Today's homework is not easy to write. I estimate that many friends are asking why the price of $BTC has dropped, although not by much. In fact, this time it is not just BTC that has fallen; at the same time, the U.S. stock market has also seen a decline. The likely reason for the drop is the escalation of geopolitical conflicts, with the U.S. Embassy in Iraq preparing for evacuation and the State Department authorizing the departure of non-essential personnel and their families from Bahrain and Kuwait.

The decline in the U.S. stock market is due to the potential geopolitical risk signals released by the Middle East evacuation operations, prompting global investors to reassess market safety margins and inflation paths, leading them to start reducing their holdings in risk assets. However, from the current situation, the declines in both the U.S. stock market and cryptocurrencies are not severe. A similar situation occurred during the U.S. withdrawal from Kabul, Afghanistan in 2021, when the stock market also experienced a short-term drop due to geopolitical turmoil.

Overall, the current geopolitical conflicts have a limited impact on the U.S. stock market and cryptocurrencies. The future will depend on whether the conflict escalates further. The main contention remains in U.S.-China trade relations and the Federal Reserve's monetary policy.

Additionally, today's weekly report discussed the mutual constraints between Trump and Musk. As a result, Musk publicly apologized to Trump this afternoon, and Trump graciously accepted. However, the relationship between them is unlikely to return to what it was before, likely due to the binding of interests.

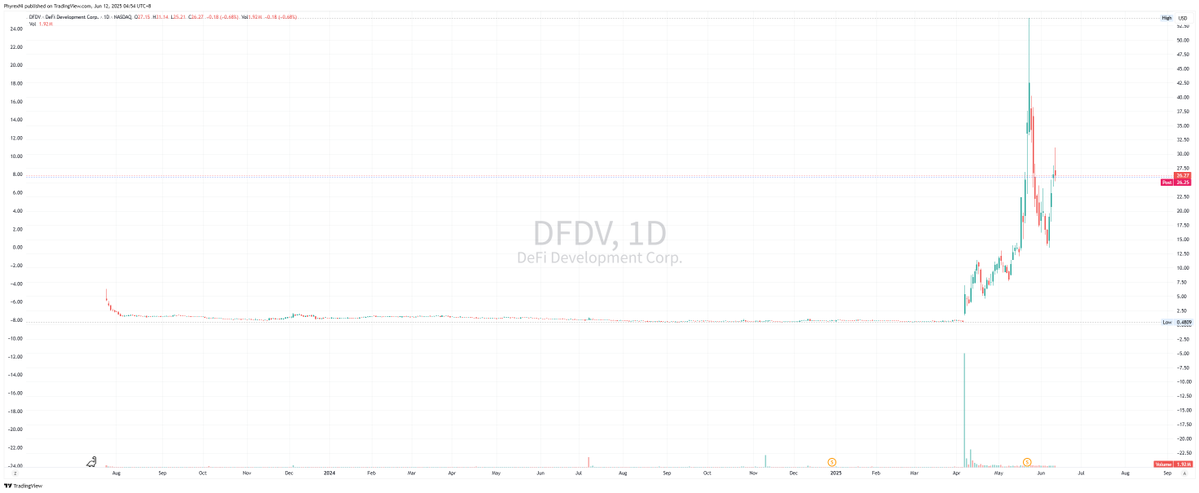

Tonight, there was also sudden news that DeFi Development (formerly known as Janover) retracted its $1 billion fundraising due to the omission of the management's internal control report in the 10-K filing. This platform, originally focused on commercial real estate loan matching, transitioned to blockchain and claimed it would purchase $1 billion of $SOL to mimic $MSTR as a strategic reserve. After the announcement, the stock price surged.

However, the retraction is expected to look bad after the market opens tomorrow. Such situations are likely to occur in the future; recently, whenever traditional companies transition to cryptocurrencies and purchase high-consensus cryptocurrencies as reserves, their stock prices soar. It is uncertain whether the companies are profiting from this, but this model may become increasingly common.

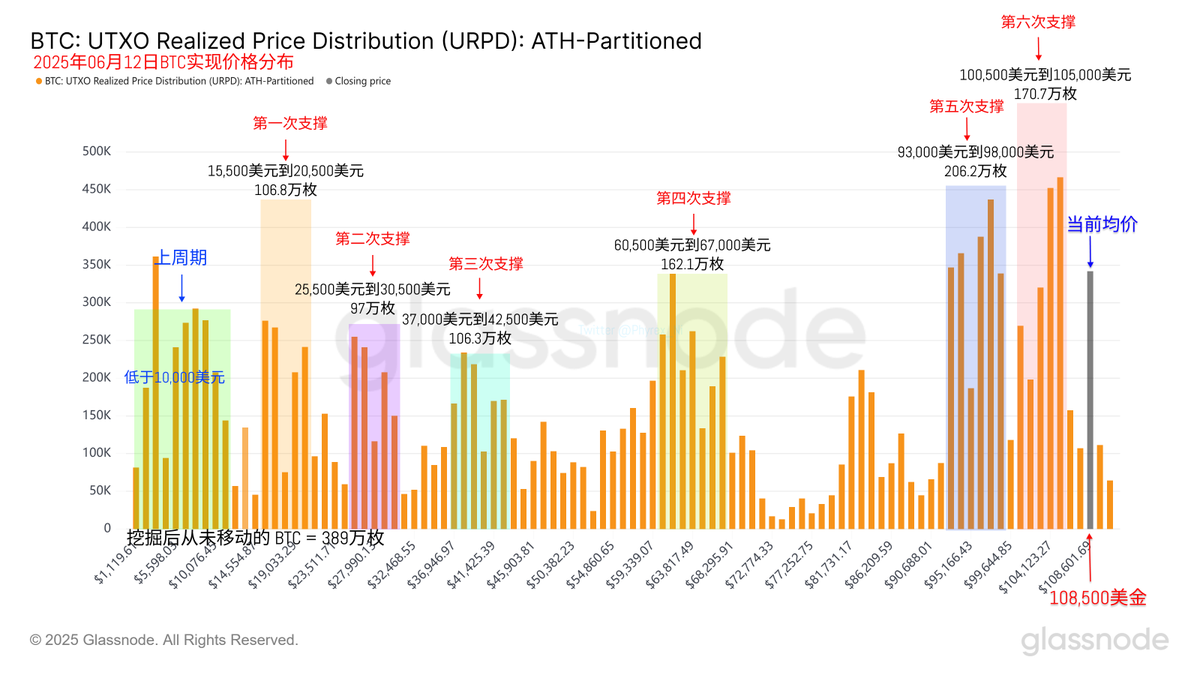

Looking back at Bitcoin's data, today's turnover continues to decrease, with short-term investors gradually reducing their holdings, but the impact is not significant. Even with today's geopolitical conflicts leading to a drop in risk markets, there is no panic. Currently, BTC investors' sentiment is very stable.

From the support data, the range of $93,000 to $98,000 remains the most stable position, with fewer investors reducing their holdings in this range, leaving mostly long-term holders. As long as this group of long-term holders does not panic, even if the price of BTC drops, the extent will be limited.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。