Important Statements and Developments by SEC Chairman Paul S. Atkins in the Cryptocurrency Field

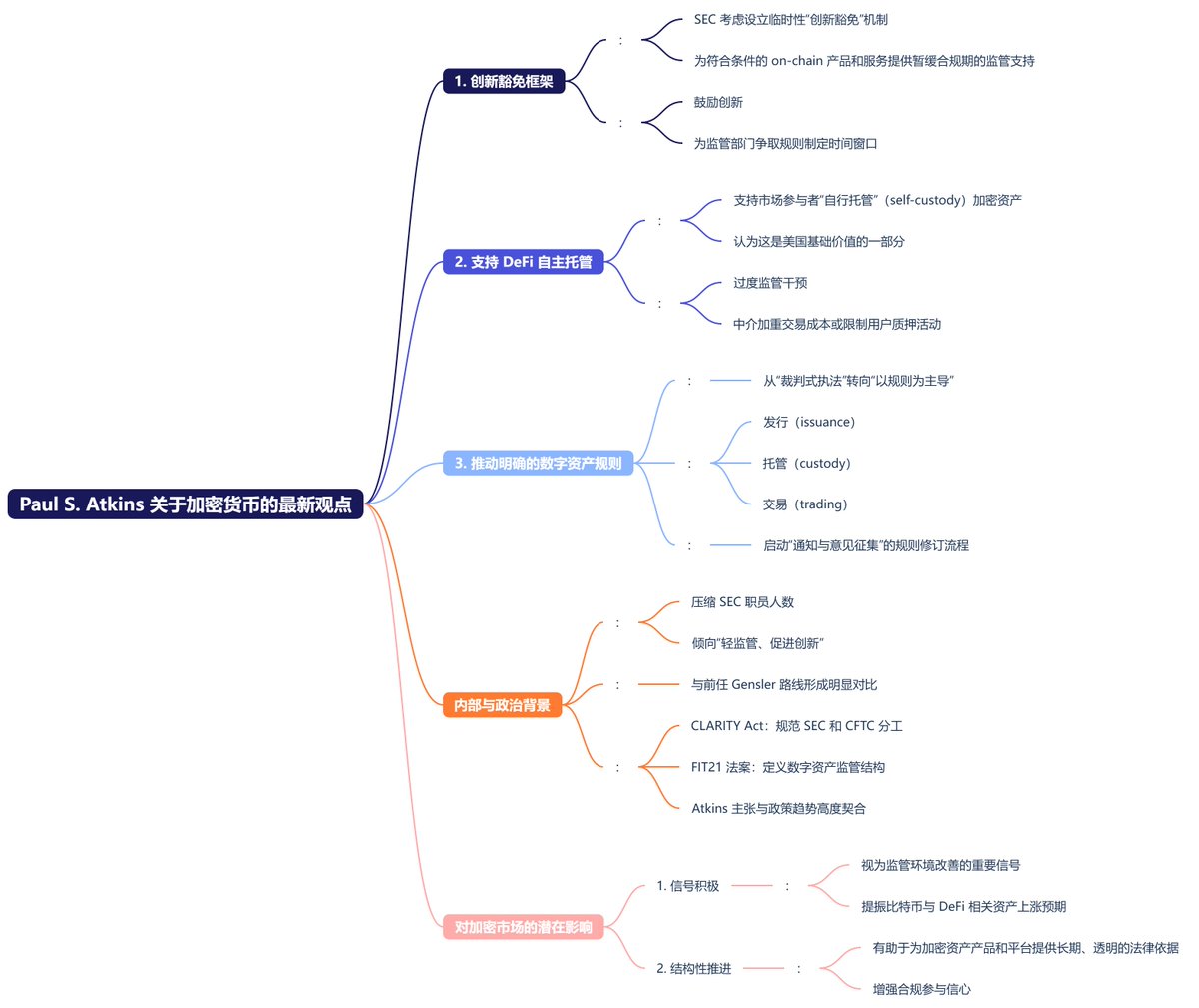

Advocating for an Innovation Exemption Framework, the SEC is considering establishing a temporary innovation exemption mechanism to provide regulatory support with a compliance grace period for eligible on-chain products and services.

Supporting the Concept of Self-Custody in DeFi, Atkins stated that self-custody of crypto assets is a fundamental American value, and excessive regulatory intervention should be avoided to reduce restrictions and interference in activities such as trading costs or user staking.

Promoting the Formulation of Clear Digital Asset Rules, the SEC will shift from a judge-led enforcement approach to a rule-based one, aiming to provide clearer and more predictable regulatory guidance in the three major areas of issuance, custody, and trading.

Since Paul S. Atkins took office, the SEC's regulatory style has undergone a substantial shift. The SEC's staff structure has been significantly reduced, making it clear that it will no longer continue the previous administration's strategy of "heavy enforcement and suppression," but will instead move towards a more "light regulation and innovation promotion" approach. The market generally views this signal as the beginning of an improved regulatory environment, especially for DeFi and on-chain financial products, releasing strong positive signals.

Even on the day Atkins announced the establishment of the "Innovation Exemption Mechanism," CZ retweeted the SEC's statement, adding that "June 9 will be remembered as Decentralized Finance Day." This not only represents a relaxation of regulatory attitudes but also symbolizes the emergence of a positive shift in mainstream compliance perspectives towards DeFi. There is significant support for innovation across the entire cryptocurrency field.

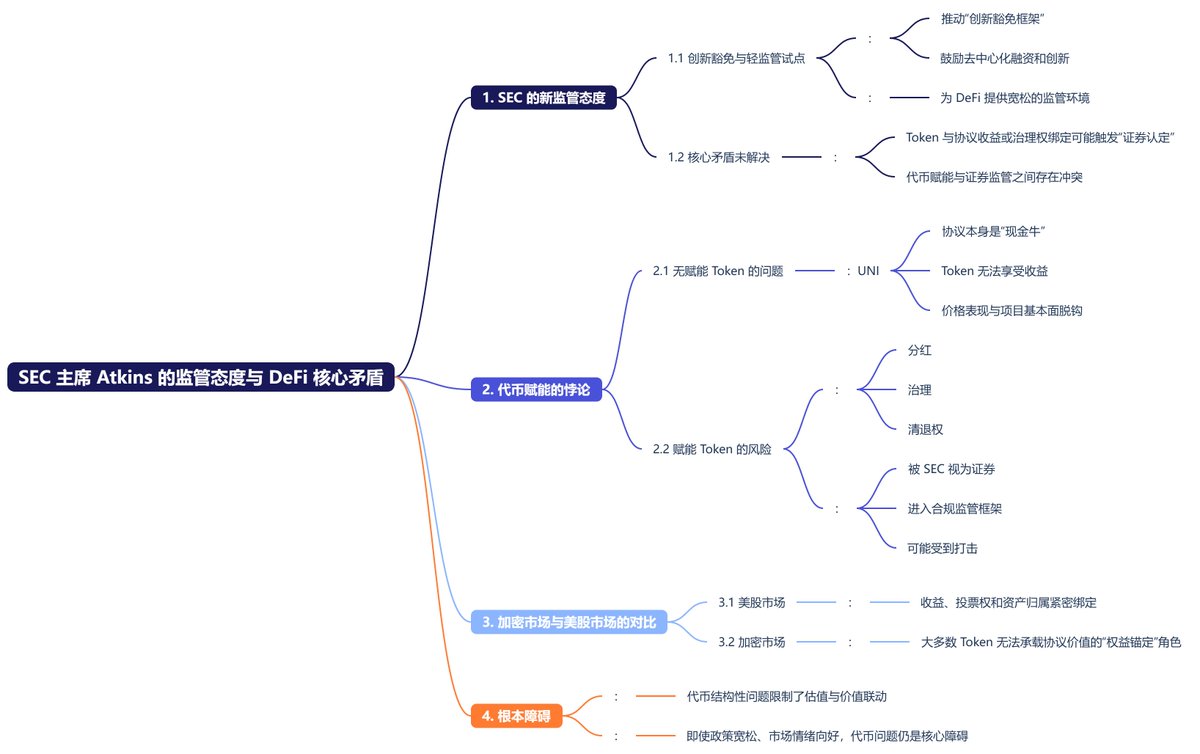

However, the core contradiction remains unresolved, as the issue of token securitization is still pending. Even if the SEC is now willing to encourage "decentralized financing and innovation," once a Token is seen as directly tied to protocol revenue or governance rights, it is very likely to trigger the "securities determination" red line. For example, Uniswap is undoubtedly a cash cow, but the UNI Token cannot be linked to Uniswap's own revenue due to its lack of empowerment, resulting in the price of UNI being unrelated to the protocol's revenue.

This stands in stark contrast to the U.S. stock market, where revenue, voting rights, and asset ownership are closely tied together, while in the crypto world, most Tokens still cannot fulfill the "equity anchoring" role of carrying protocol value. Therefore, even with relaxed policies and positive market sentiment, the structural issues of tokens remain the fundamental barrier limiting the linkage between valuation and value.

It is also worth noting that Atkins himself was appointed as SEC Chairman by Trump. This is why I repeatedly emphasize that if Trump's authority is challenged, then the crypto market, especially this round of rebound that relies on policy tailwinds, is likely to be the first to be affected.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。