The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

With the impact of tariff news, the cryptocurrency market is rising again, and Bitcoin seems to be approaching the 110,000 mark; this wave of rebound is quite clear for the coins that are rising alongside it, so choosing spot issues based on this growth shouldn't be too difficult! From Lao Cui's perspective, Bitcoin's volatility is actually a good thing. Overall, it has fallen more than 10,000 points, and as a whale falls, all things thrive. This wave returning to the 110,000 mark at least drives Ethereum to break through 2,800, and there is still a trend of continued growth! Only under the repeated fluctuations of Bitcoin will other coins experience growth. This point has been analyzed in detail in previous articles, so I won't recap today. I just hope everyone can remember this iron rule: once Bitcoin starts a new round of growth mode, other coins will only have the fate of being absorbed by funds. Do not overly trust the trends of small coins; only when Bitcoin starts to adjust and repair is when you should prepare to enter small coins.

In yesterday's article, I also gave an early warning about the growth of the rare earth and chip sectors, and Nvidia directly provided an opportunity for everyone to enter the market. Did those trading US stocks seize this opportunity? I won't discuss other markets much, let's return to the main topic. The basic framework for tariff issues has been established. The civilian sector for rare earths has also been opened up, although only three quotas were given to American car companies, which can be seen as a way to ease the antagonistic relationship between the two countries. Meanwhile, in the chip sector, the recent lifting of restrictions has also become increasingly open. This series of measures undoubtedly changes the global financial landscape. The most observable aspect reflected in the cryptocurrency market is the influx of funds; yesterday, the inflow of spot trading reached a recent high. It is important to emphasize that the current method of purchasing spot ETFs is primarily cash-based and has not involved the USDT stablecoin system. Therefore, the inflow data you see should not only focus on cryptocurrency exchanges; rather, the inflow in futures exchanges is even more intense. Do not underestimate the power of traditional capital; the new highs and bull markets in the future cannot be separated from their support. With the backing of traditional capital, Bitcoin's high point will rise at least 30,000 points or more, and the growth conditions in the cryptocurrency market also require a good overall state of the financial sector. In a situation of economic downturn, even if a bull market exists, it will not last long!

As for domestic measures, new regulations have already been established, and everyone can search to take a look. Currently, all confiscated illegal cryptocurrency assets need to be uniformly managed, no longer decided by a single unit. This is extremely important; it is the premise of legal compliance. To manage external issues, one must first stabilize internal ones. The previously concerning issue of distant ocean fishing may not be as severe in the future. Under the open status of Hong Kong, it further illustrates our change in attitude, especially after August 1, when a stablecoin bill will be implemented. This step puts us at the forefront of the world. The opening of Hong Kong is more like stabilizing the Asian economy and building new channels for other capital to flow into us. Without discussing outflow issues, at least the inflow issue has improved. This can be seen through the VIVO Group, which borrowed cryptocurrency channels from India to flow back into the domestic market; this is the key to solving the problem. In the future, when expanding overseas business, there will be no need to worry about repatriation issues. After paying taxes in Hong Kong, returning to the mainland will not pose significant problems. At the same time, this also brings a side benefit to the cryptocurrency market. This is why Lao Cui sees that Bitcoin has a space for a 10,000 to 20,000 point correction, yet still advises everyone not to short, but to focus on going long. This year will not see new lows like in the past; to profit, there is only one path for bulls to take!

Let's talk about everyone's thoughts on spot trading. Since the beginning of last year, anyone engaged in spot trading has basically been in a profitable state. It's just a matter of more or less, and many of those who entered the market last year have their thoughts centered on spot trading. Based on the current trend, as long as you enter the spot market, you can profit. However, Lao Cui needs to remind everyone that any investment market that can outpace inflation is a good market. Therefore, once you engage in spot trading, you cannot measure Bitcoin's performance by contract profits. Contracts require stage victories, while the benchmark market for spot trading can only be the current US stock market. Regardless of the coin type, all can outperform all financial markets, whether it be gold, the previously booming military sector, or even tech stocks and the current energy rare earths; these markets cannot be compared with the cryptocurrency market. As long as the yield can exceed that of these markets, it is worth trying. You must eliminate the desire for small coins to multiply. It can be said that achieving returns that meet psychological expectations is a common trait among investors. Last year, people thought Bitcoin would reach 100,000; this year, they will think it will reach 200,000. The influence of anchoring effects will only lead everyone to lose their capital. Many newcomers to spot trading, or many former gamblers transitioning to the spot market, will experience psychological issues. It is not that spot trading cannot be profitable, but that they cannot conquer themselves. Doubling a small coin, while a 50% profit in Bitcoin is the target you should consider exiting now. That's all I have to say!

For contract users, Lao Cui's advice is that if you have sufficient funds, you should still consider the returns from spot trading. Contracts, when facing tariff issues, will appear very fragile, so it is best not to engage in contracts recently. For users who are stuck in short positions, you must be resolute and have a stop-loss plan to proceed with the next actions. Although, in the face of tariff decisions, even if all tariffs are revealed, such favorable news will not create a long-term growth impact. After all, the current funding gap in the cryptocurrency market is very obvious, but if tariffs are successfully reduced, it will definitely lead to new highs in the cryptocurrency market. This new high is similar to the impact of Trump taking office; neither you nor I can predict where the high point will be. This situation entirely belongs to market sentiment judgment, and we contract users can only intervene in a wave-like manner. A simple example: Lao Cui's long position near 105,000 did not choose to exit at the high of 111,959 because at that time, Lao Cui could not judge where the high point was. It wasn't until the new round dropped to around 100,000 that Lao Cui's thinking was awakened. After breaking below, Lao Cui also saw the downward trend and communicated with everyone about the new round of decline being between 10,000 to 20,000. However, my choice was to endure this wave of decline until this round of re-increase before exiting my long position. Although I have already made a profit, if compared to previous returns, it can be considered a loss. Why does this happen? This is due to the influence of short-term public opinion, which we cannot predict. In terms of trends, this return can be considered satisfactory for Lao Cui's efforts. From Lao Cui's perspective, it is still considered normal returns, not exceeding expectations. As long as you do not compare with previous highs, being able to profit from contracts is already a victory, and being able to double is even more of a big win!

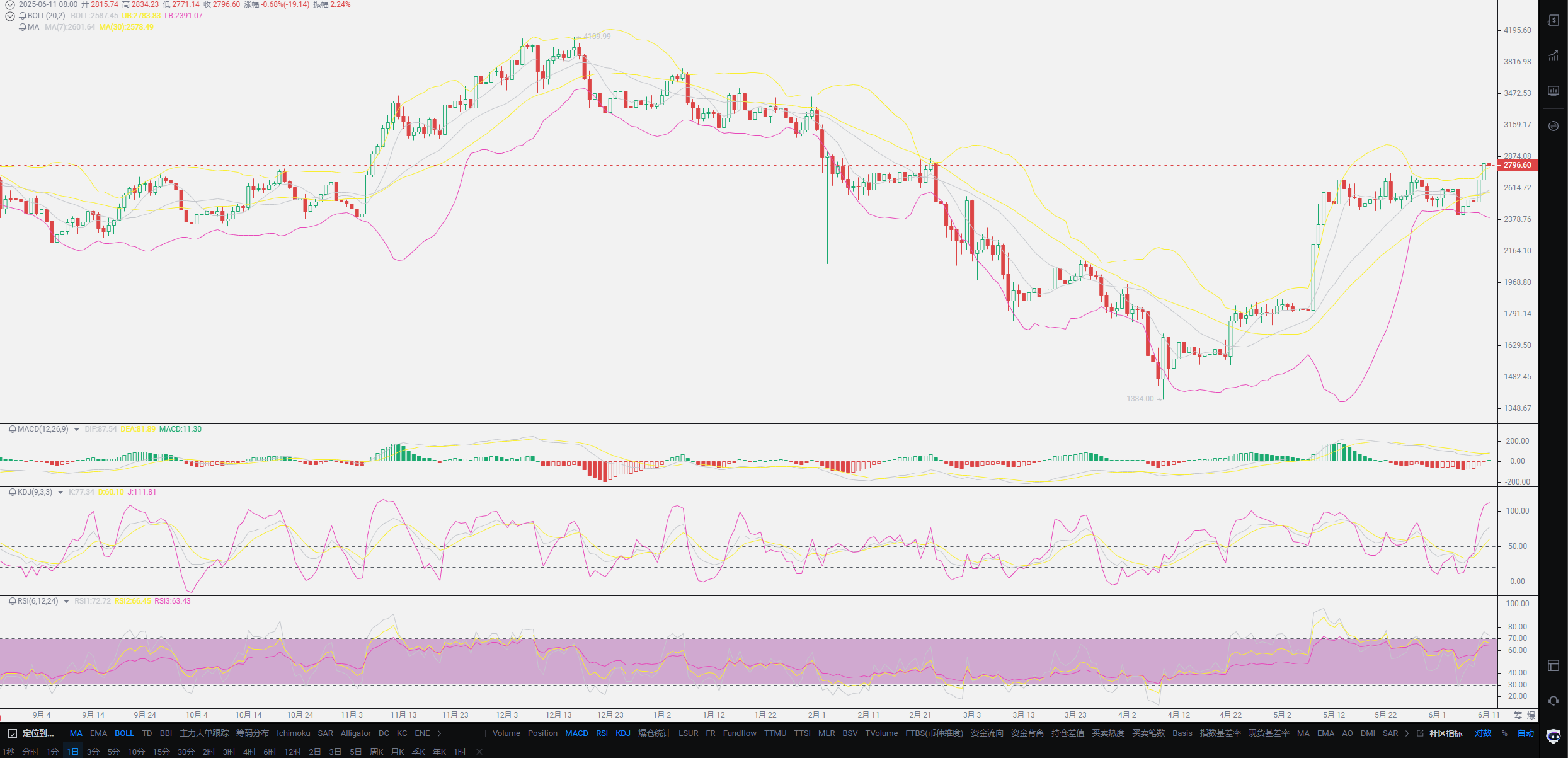

Lao Cui summarizes: Today's summary focuses more on methods. Whether for spot or contract users, the entry points and positions are very important. Among these two, the position is even more precious. From my own approach, taking ETH as an example, after reaching a new high of 4,100, it fell all the way to 3,400, creating the first wave of stabilization. At that time, Lao Cui's only thought was that Ethereum would at least be above this position by the end of the year. So I initiated the first wave of layout, directly entering 10% of the position, and continued to hold until the lowest point of 1,400, with the final average price around 2,400, and a portion of the position had not yet entered. Currently, I am only up 400 points, which is not much, but compared to many users' betting points, it is still quite considerable. If you choose to focus on spot trading, then you need to consider the position six months or a year from now. The fluctuations in between are irrelevant to you; as long as you believe that the position six months later will be higher than now, then this is your entry point. Gradually entering is also very important. For contracts, the mindset is completely different. First, when shorting, you must consider whether you can accept a new high. Does the possibility of liquidation increase for your position? And before entering, you must accept the probability of this position being liquidated! You must first develop a mindset for risk issues before considering how much profit you can make! A practical example: a user with a position of around 50,000 USDT entered the market synchronously with Lao Cui, entering the first order near 105,000. When it touched around 100,000, he became a bit anxious. In fact, at that time, Lao Cui's internal acceptance price was around 98,000; however, considering future returns, Lao Cui's advice was to add a position. Under the influence of the market trend at that time, this user did not adopt Lao Cui's suggestion. Although it seems that he has made a profit of 5,000 points now, in Lao Cui's eyes, it can even be considered a loss.

This loss is not based on your profits, but rather viewed from the perspective of future losses, because once you engage in contracts, you must consider the state of losses. No one is a perpetual winner, and if you misjudge the trend later on, the losses may not be offset by these profits. If you cannot control the ratio of losses to profits well, contracts may not be suitable for you. Simply focusing on risk or solely on profits is not an objective mindset; contracts should only serve as the first step for you to accumulate initial capital. As long as the capital is sufficient, the ultimate goal must be to consider stable financial management as the main focus. This mindset can also be applied to the entire cryptocurrency market; the crypto market can only be seen as a stepping stone for you. Currently, the most stable way is that only the essential market can outperform inflation. Once you engage with contracts, you must be prepared for losses, and you must convince yourself to accept both exiting at any time and cutting losses. If you cannot accept losses, do not engage in contracts! Once the contract reaches your psychological expectations, you must take profits in time. For Bitcoin, you should take profits at most after a 10,000-point gain; for Ethereum, it's 500 points, and for SOL, it's 50 points. Do not amplify your greed. The same goes for stop-loss positions; once you reach the stop-loss, you must exit. Even if you insist on being bullish or bearish, that is related to the next order's profit and has nothing to do with the current round. Always keep a clear mind; the cryptocurrency market operates 24 hours, which will consume more energy, and the controllability is better. Opportunities are always there; do not go against the trend. Finally, for spot trading, focus on this year's half-year returns; the main trend in this half-year will be growth. Contracts should be used to capture certain waves during the growth process, and it is best to focus on going long. After this wave of tariff turmoil passes, you should consider shorting strategies, and Lao Cui will notify you at that time. Here, I would like to inform you that users who previously went long should consider exiting in batches and try not to hold long-term!

Original text created by: Lao Cui Says Coin. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves in trouble.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。