On June 10, 2025, Deutsche Bank and Ant International announced a strategic partnership, marking a profound structural transformation in global financial infrastructure. The two parties will integrate their respective advantages in traditional banking networks and digital financial technologies to launch a new generation of cross-border payment solutions for global corporate clients.

The core of this collaboration is not merely business synergy, but rather a systematic approach to addressing the efficiency, cost, and risk pain points in traditional cross-border payment systems through the introduction of Distributed Ledger Technology (DLT), exploration of tokenized deposits, and application of AI-based foreign exchange models.

1. Infrastructure Layer: DLT Replaces Traditional Settlement, Efficiency Becomes the Core Driving Force

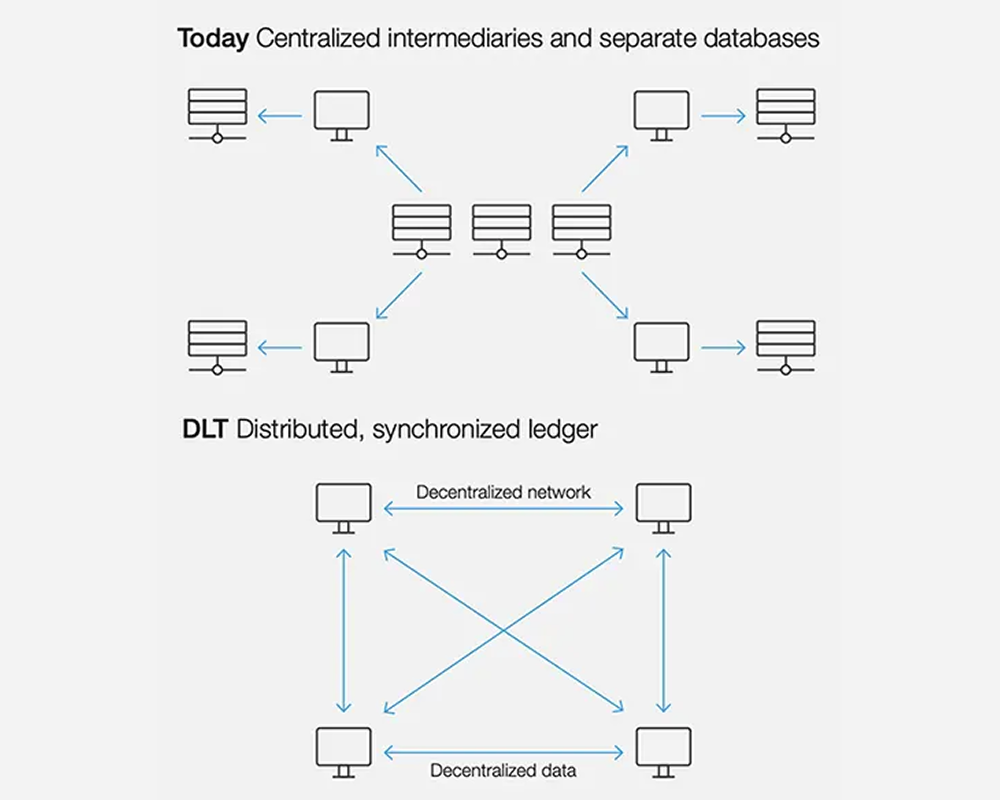

The foundation of the partnership lies in Deutsche Bank becoming the first German bank to access Ant International's blockchain technology platform. This platform, based on Distributed Ledger Technology (DLT), aims to achieve near real-time fund clearing and settlement, directly challenging the traditional multi-day settlement paradigm represented by the SWIFT system.

Compared to traditional wire transfer systems, DLT offers two core advantages: speed and transparency. Transactions can be confirmed and settled on-chain within seconds, compressing the previous multi-day fund transit time to negligible levels. At the same time, all transaction records on the shared ledger are immutable, significantly enhancing the transparency and traceability of fund flows.

For corporate treasury management, this means 24/7 uninterrupted liquidity management capabilities, especially in high-frequency, small-amount supply chain finance and e-commerce payment scenarios, where improvements in operational efficiency and reductions in friction costs will be decisive. Deutsche Bank's involvement not only serves as an authoritative endorsement of the feasibility of DLT technology in mainstream financial scenarios but also indicates that this technology will penetrate from emerging markets in Asia to mature financial systems in Europe.

2. Asset Layer: Tokenized Deposits and Stablecoins, Exploring Programmable Digital Cash

Another frontier of this collaboration is the exploration of the application of "Tokenized Deposits" and stablecoins. Tokenized deposits map traditional bank liabilities (deposits) to digital tokens on the blockchain, retaining the backing of fiat currency credit while incorporating the programmability of smart contracts.

This innovation provides corporate clients with more refined liquidity management tools. Stablecoins will serve as an efficient medium for cross-border settlement within this system, with their value pegged to fiat currencies, effectively avoiding exchange rate exposure risks and achieving synchronous transaction and settlement (PvP/DvP).

Deutsche Bank's layout in this area aligns with the macro trend of digital transformation in the European banking industry. Market information indicates that several large European banks are evaluating the feasibility of issuing stablecoins through self-built or consortium blockchains.

The collaboration with Ant International will allow Deutsche Bank to directly leverage the latter's mature stablecoin application experience in the Asian B2B payment space, thereby gaining a first-mover advantage in the Europe, Middle East, and Africa (EMEA) markets.

3. Intelligent Layer: Time Series Transformer Model, AI Empowering Foreign Exchange Risk Management

The most forward-looking technological integration is reflected in AI-driven foreign exchange risk management. The two parties will apply an AI model based on the Time Series Transformer (TST) architecture to conduct in-depth analysis of high-frequency foreign exchange market data.

Compared to traditional quantitative models, the TST architecture has significant advantages in capturing long-term dependencies and nonlinear patterns in data. It can more accurately identify the complex relationships between macroeconomic indicators and micro price fluctuations, thereby dynamically optimizing foreign exchange hedging strategies. Ant International's preliminary tests in the Asian market have proven that such models can effectively enhance prediction accuracy.

By integrating Deutsche Bank's global market data and client transaction flows, the predictive capability and applicability of this model will be further strengthened, potentially helping corporate clients avoid hundreds of millions in potential foreign exchange losses and building a new moat for Deutsche Bank in the algorithmic trading field.

4. Strategic Significance: Structural Integration of Traditional Finance and Digital Economy

The collaboration between Deutsche Bank and Ant International transcends a single technological or business level; it represents a structural integration of the traditional financial system and the digital economy ecosystem. Deutsche Bank provides a global compliance framework, a vast customer base, and deep financial market credibility; Ant International contributes market-validated digital technology, agile product iteration capabilities, and a wide emerging market payment network (such as Alipay + ecosystem).

This synergy aims to bridge the service gap of traditional banks in the digital payment field, especially in serving small and medium-sized enterprises and e-commerce clients. Against the backdrop of increasingly clear global regulatory frameworks, such as Hong Kong's "Stablecoin Regulation Draft," the compliance-first strategy of both parties also provides a model for financial innovation to operate within a controllable risk framework.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。