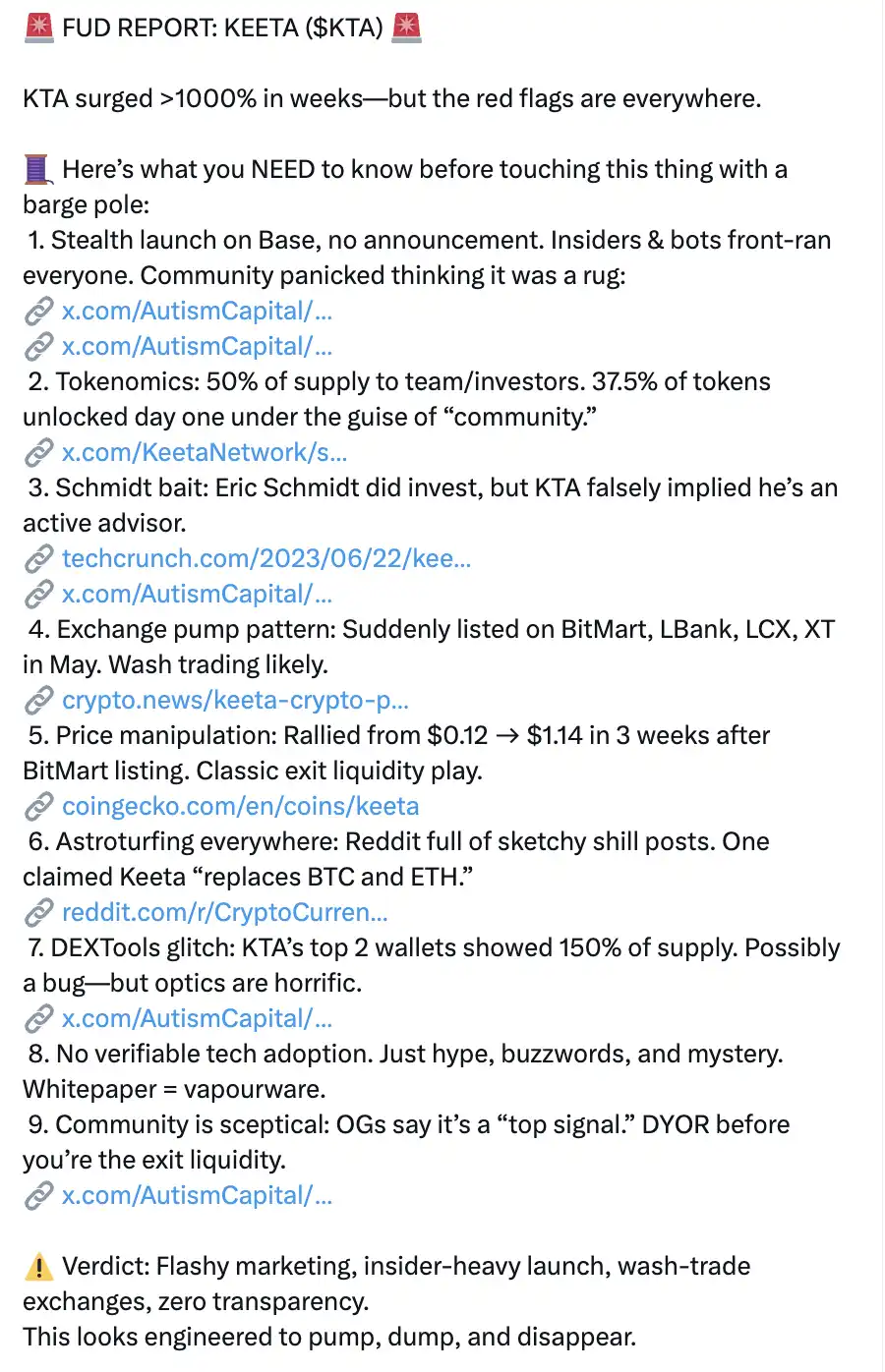

Last night, the "pump and dump" $KTA on the Base chain plummeted, with a 24-hour drop of 20% as of the time of writing. The trigger for the crash was a tweet.

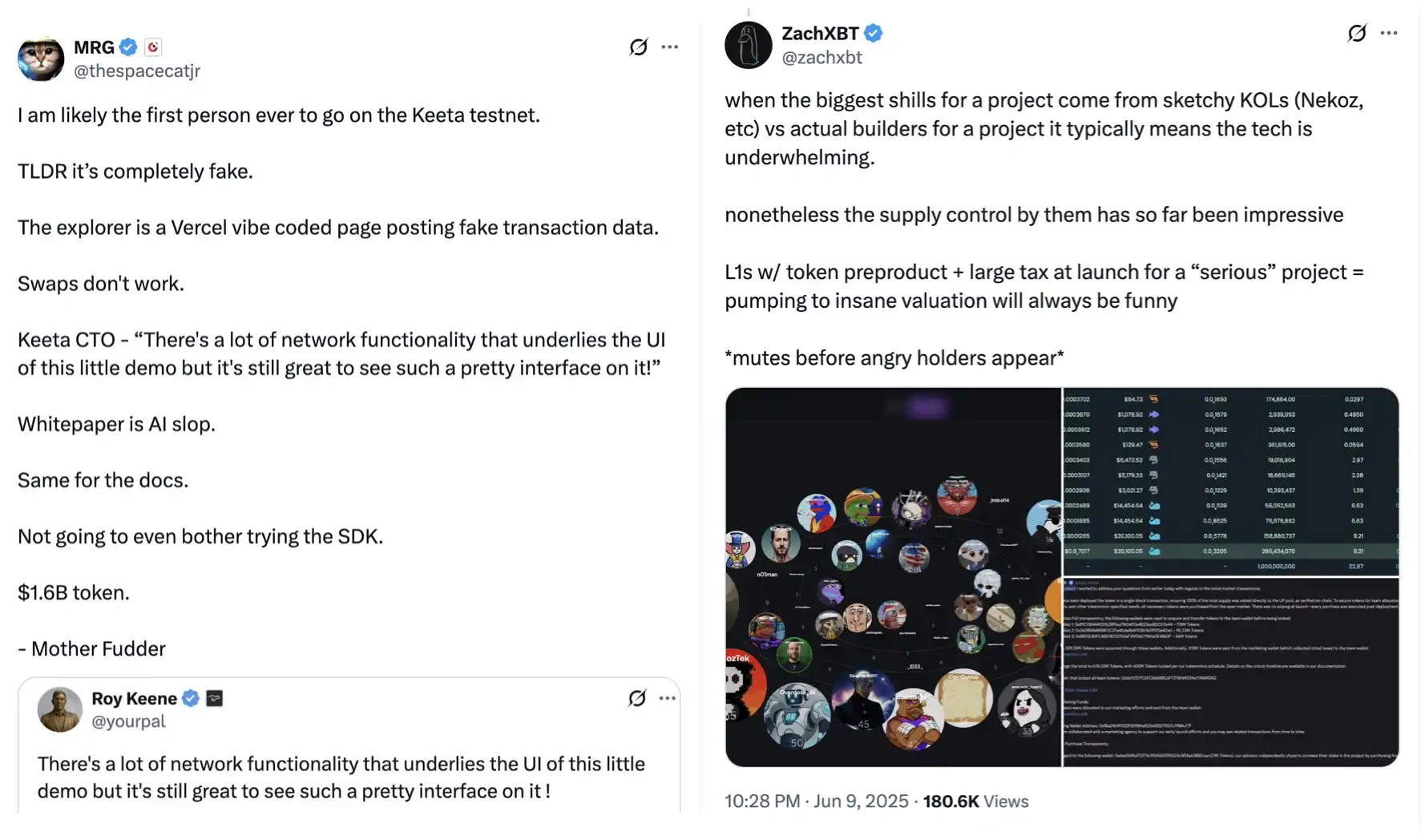

Community user MRG (@thespacecatjr) expressed that after experiencing the Keeta testnet, he believes the project is completely fake, stating, "The block explorer is a fake page built with Vercel, and the transaction data displayed is fabricated. The swap function is completely unusable. The white paper is AI-generated garbage, and the documentation is the same. I couldn't even be bothered to try their SDK."

What exacerbated the drop of $KTA was the response from on-chain detective ZachXBT, who said, "When the most enthusiastic promoters of a project are not the actual developers, but some unknown KOLs (like Nekoz), it usually means the project's technology isn't that great. It's absurd and laughable for a so-called 'serious' project's L1 chain to issue tokens and charge high taxes before launching a product, only to be inflated to sky-high valuations."

Additionally, Zach noted that Keeta's control over token supply seems quite impressive.

After public opinion fermented, the official Keeta account announced that it would conduct a live test on June 12, collaborating with the Google Spanner engineering team to verify Keeta's capability of processing 10 million transactions per second.

The former Google CEO and Keeta's investment history

Players familiar with the Base ecosystem have certainly heard frequent introductions about Keeta recently, not only due to its terrifying increase of over 600 times since launch but also because its fully diluted market cap exceeds $1.6 billion. More importantly, it has received $17 million in funding support from investors, including former Google CEO Eric Schmidt and the incubator platform he founded, Steel Perlot Management.

Eric Schmidt is one of the most influential tech giants in Silicon Valley, having served as Google CEO since 2001, leading the company's strategic transformation from a search engine to multiple key product lines, including Android, Maps, Gmail, and cloud computing, and witnessing the rise of its parent company, Alphabet. After stepping down, he gradually shifted his focus from corporate management to research, diplomacy, and early-stage tech investments, particularly in artificial intelligence, cybersecurity, and military technology.

Keeta first announced the completion of its $17 million financing through the American news media PR Newswire on June 6, 2023. The press release clearly stated: "Keeta is a new global payment platform that provides instant and secure cross-border currency transactions, officially launching today with support from investors including Eric Schmidt and Steel Perlot Management, LLC." Thus, Schmidt's name became one of the most significant talking points in the $KTA community.

Burning money to win hearts

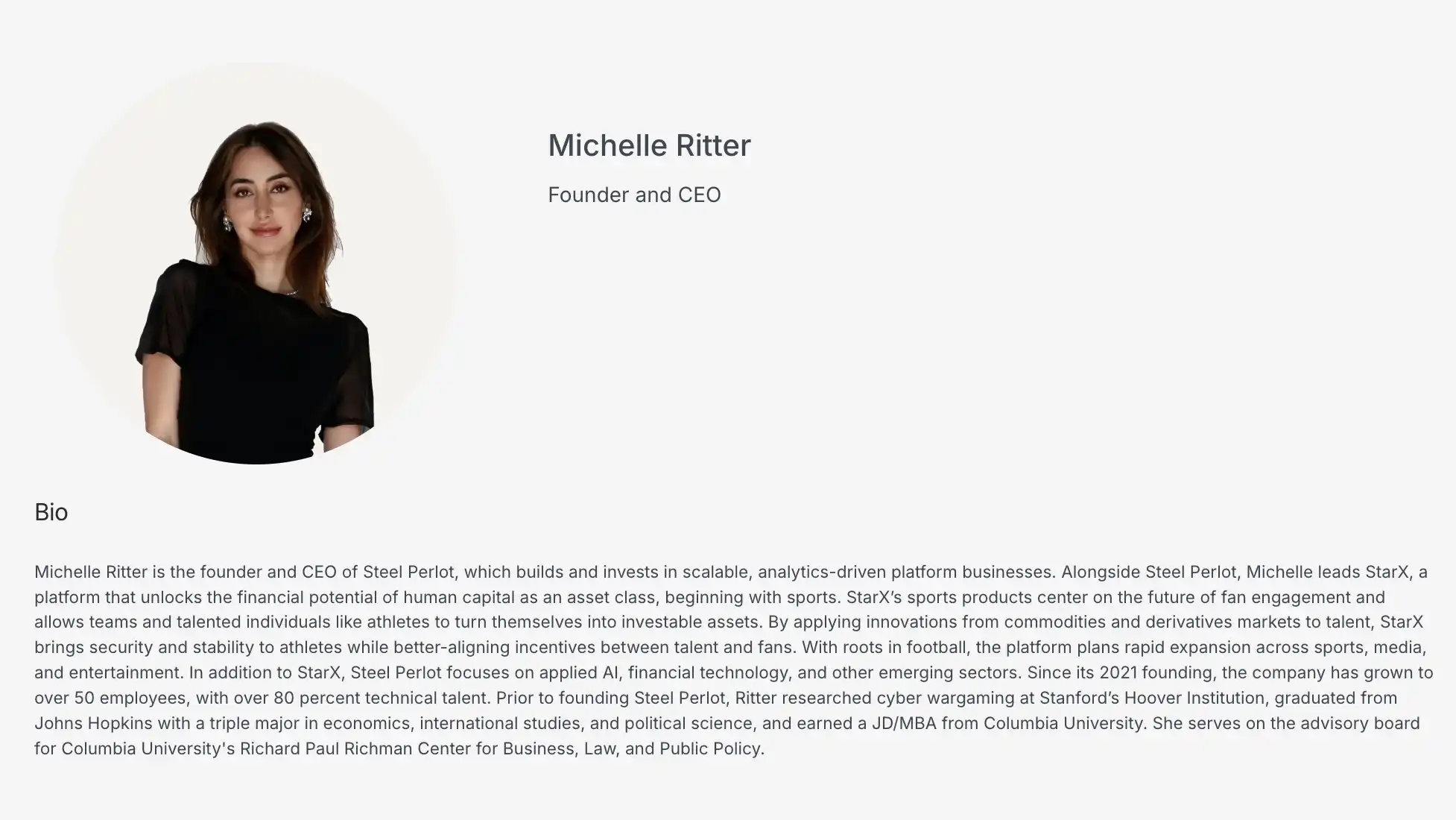

Eric Schmidt's Steel Perlot company has been seen as one of the most publicly invested entrepreneurial platforms since Schmidt retired from Google. The founder and CEO of Steel Perlot, Michelle Ritter, is also his extramarital girlfriend. The two met in 2020 when Ritter was a junior at Columbia Law School. Soon, with Schmidt's funding, connections, and influence, Ritter established Steel Perlot, claiming to incubate the next generation of companies in the "AI + blockchain + payments" space.

Ritter, who graduated from Columbia Law School in 2021, previously worked as a cybersecurity research assistant at the U.S. Department of Homeland Security and interned at the law firm Skadden. She claims to have met Schmidt through her law school connections. According to a report by the New York Post at the time, they began dating after attending a Virgin Galactic rocket launch ceremony together, and shortly thereafter, they held a party at the luxurious New York club Zero Bond to officially launch Steel Perlot.

In the years where romance and business intertwined, Schmidt not only provided about $140 million in funding for Steel Perlot but also included Ritter in his social and investment circles, attending events alongside people like Sam Altman from OpenAI and Alexandr Wang from Scale AI, and even arranged for Ritter's parents to live next to his mansion in Bel Air.

According to a report by The Information, after Ritter and Schmidt met in 2020, they began discussing big ideas about business strategy. Ultimately, Ritter proposed her vision for Steel Perlot—a new type of hedge fund using advanced trading strategies while incubating startups involved in payments, cryptocurrency, artificial intelligence, and the creator economy.

Steel Perlot regularly received funding from Hillspire, a large Silicon Valley family office that Schmidt manages for his private wealth, providing financial support for multiple projects. Even when Steel Perlot could not afford operational expenses, Hillspire directly covered $2.5 million in salaries and credit card debt.

Internal documents show that by the end of 2022, Steel Perlot had about 90 employees, with annual salary expenditures reaching $16 million, and the average annual salary of company employees exceeding $300,000. Other expenses for Steel Perlot were also continuously increasing; according to financial records, the startup rented offices near SoHo in New York and in Los Angeles, spending over $160,000 per month.

Under Ritter's leadership, Steel Perlot lavishly spent on high salaries for employees but only generated meager income. Internal documents revealed that some startups incubated by Steel Perlot, such as a company developing tools for social media creators, shut down shortly after being established. Former employees stated that Ritter often told them she had raised significant funds from new investors, but these investors never materialized.

Good times don't last long

This romantic relationship did not last long. In the second half of 2023, the romantic relationship between Schmidt and Ritter began to show cracks. Around mid-2022, Ritter accused Schmidt of sleeping with and traveling with other women, and she became increasingly frustrated with Schmidt's continued marriage to Wendy Schmidt.

A former employee said that during a company trip to France in 2022, Ritter and Schmidt argued because Schmidt did not invite her to a meeting with people in his network. She was also angry that a news report introducing Steel Perlot's startup Keeta mentioned Schmidt as an investor but did not mention her company.

At the beginning of 2024, Ritter and other executives sought additional funding from Schmidt's Hillspire company to support company operations, but the condition was that the startup must achieve business milestones and raise external funds. Hillspire rejected the request, citing lagging business progress.

As media reports covered Schmidt's interactions with his wife at different social events, rumors circulated that Schmidt had halted further funding for Steel Perlot, leading the company into operational difficulties.

In an internal letter to Steel Perlot employees, Ritter accused Schmidt of failing to fulfill his commitment to continue support, blaming the company's difficulties on the interruption of their personal relationship. Meanwhile, people close to Schmidt revealed that Ritter exaggerated fundraising progress and exaggerated project packaging in her operations to gain more support, ultimately leading him to decide to withdraw.

Is Keeta a vaporware? What is the status of other companies invested by Steel Perlot?

Currently, on Keeta's official Twitter account "@KeetaNetwork," the author did not find any statements related to Schmidt and Steel Perlot's investments.

Some community members commented on Keeta, stating, "After listening to the team's speech on Spaces for the first day and spending a few hours researching, it became very clear— the project Schmidt invested in is actually something completely different from a few years ago."

Additionally, community member @adaYen72 noted that the pump time for $KTA often coincided with weekends when liquidity was low, meaning the cost of pumping was low, and currently, $KTA has not been listed on any mainstream trading platforms with good liquidity.

While collecting public opinion materials on Keeta, the author found that some links questioning the Keeta project had been deleted, including issues related to the token economic model, trading manipulation patterns, and clear signs of price manipulation, as well as claims that Eric Schmidt was an advisor.

As mentioned earlier, besides Keeta, Steel Perlot's investment projects also include decentralized dark pool trading protocol Tristero, Web3 privacy infrastructure Socket, instant messaging tool Zo, creator economy platform Hachi, AI company Pryon, decentralized banking platform Knox Networks, and more than a dozen other startups.

Undoubtedly, as Steel Perlot's funding chain has broken, the above investment projects are no longer operational, including Michelle Ritter and Steel Perlot's official social X account, which has not posted since May 2024.

Keeta launched on Base in March this year without warning, initially even being mistaken for a hacked official project Twitter account. With three months of pump time, the market seems indifferent to whether Keeta is genuinely endorsed by the former Google CEO.

Currently, the price of $KTA remains at an extremely high valuation stage, and the community's doubts about its token liquidity control, KOL manipulation traces, and the behind-the-scenes team continue to ferment. If the so-called 10 million TPS test fails to be completed on time or truthfully, the Keeta project will face a more serious trust crisis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。