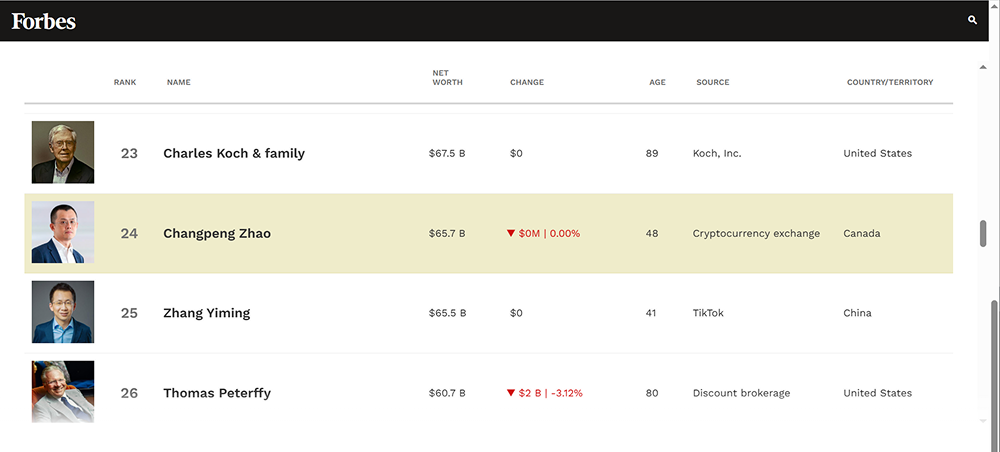

On June 10, 2025, just over a year after Zhao Changpeng (CZ) walked out of the Seattle Federal Detention Center, the latest data from Forbes placed him back on the throne of the richest Chinese with a fortune of $65.7 billion.

The founder of Binance, who once fell to the title of "the world's richest prisoner," completed a financial rebirth in less than a year after his release. The iron fist of regulation did not crush the foundation of Binance; instead, it helped the company undergo a pressure test during a global crypto bull market. CZ's wealth curve is not only a reflection of Bitcoin's price but also an ultimate affirmation of Binance's survival philosophy in the post-regulation era.

Bull Market Fuel and Compliance Restructuring: The Two Engines of CZ's Wealth Return

Data from the Hurun Research Institute in October 2024 (wealth of 135 billion RMB) had already shown signs of this trend, while Forbes' 2025 figure of $65.7 billion (approximately 475 billion RMB) pushed this trend to its extreme. The core logic behind the wealth growth is clear:

Volume Amplifier: Market enthusiasm directly translated into astronomical trading volumes for Binance. As the world's largest trading platform with over 6 million active users, supporting more than 150 mainstream cryptocurrencies and peak processing capabilities of 1.4 million transactions per second, Binance captured the largest share of industry profits during the bull market.

Equity Value Reassessment: CZ holds about 30% of Binance's shares, and his personal wealth is directly linked to Binance's valuation. Referring to the precedent of its main competitor Coinbase's market value skyrocketing from $19 billion in 2024 to $46 billion, Binance, as an unlisted absolute leader, was assigned a higher premium in valuation during the bull market.

However, if the bull market is "timing," then Binance's "compliance restructuring" after the regulatory storm is its "geographical advantage" and "human harmony" that stabilized its footing.

Post-CZ Era: Richard Teng's "De-risking" Long March

2024 was a year of "farewell and rebirth" for Binance. With CZ stepping down as CEO and serving his sentence, along with a staggering $4.32 billion settlement with the U.S. Department of Justice (DOJ), an era came to an end. His successor, Richard Teng, has a clear mission: to lead Binance on a "de-risking" long march.

This transformation is profound and effective:

Compliance Iron Fist: Engaging the renowned U.S. law firm Sullivan & Cromwell as an independent compliance monitor is Binance's most significant "letter of intent" to regulatory agencies. This move means that Binance's core operations will continue to be exposed to external supervision, and its anti-money laundering (AML) and sanctions compliance systems have undergone a complete upgrade.

Globalization 2.0: Binance is no longer seeking breakthroughs in a single market but is shifting to a multi-point blooming "judicial arbitrage" strategy. Among them, Dubai has become the most successful example. The seeds sown in 2021 bore fruit in 2025, as Binance's Dubai Virtual Asset Industry Center not only attracted a large amount of hot money and institutional investors from the Middle East but also became a compliance model for its global operations, effectively hedging against regulatory pressures from traditional financial centers like the U.S.

It is this series of "amputation for survival" transformations that solidified user and market confidence, allowing Binance to absorb the massive liquidity when the bull market arrived without distraction.

BNB Flywheel and Wealth Cornerstone: An Indispensable Value Hub

In CZ's wealth landscape, in addition to Binance's equity, the value of its native token BNB also constitutes an important support. BNB is not just a "platform token"; it is the value flywheel driving the operation of the Binance ecosystem.

In the 2025 bull market, BNB's performance was particularly outstanding. Its value logic lies in:

Trading Fee Discounts: Attracting users to hold and use BNB.

Launchpad/Launchpool: Becoming the "golden shovel" for participating in new project launches, locking in substantial liquidity.

BNB Chain Ecosystem: Serving as fuel for public chains, supporting the increasingly prosperous DeFi and GameFi applications.

The massive trading volume creates continuous demand and a destruction-deflation model for BNB, while BNB's strong performance, in turn, enhances Binance's brand value and market influence, forming a positive cycle. The growth of BNB's market capitalization is undoubtedly an important component of Binance's overall valuation surge.

The Next Stop for the Richest Chinese: Pardon, New Narrative, and Eternal Regulatory Game

Now, CZ has returned quietly. His statement in a May 2025 podcast—having applied for a pardon from the Trump administration—has been interpreted as his latest attempt to completely eliminate legal obstacles and seek "full freedom."

Reclaiming the title of the richest Chinese, alongside ByteDance's Zhang Yiming, also symbolizes a direct confrontation between two wealth paradigms: one based on a crypto economy built on the Web3 value network, and the other rooted in an attention empire based on the Web2 traffic black hole.

In Conclusion

CZ's wealth story is a contemporary epic interwoven with technological faith, business laws, and political games. From a gambler who sold his house to go all-in on Bitcoin in 2014 to reclaiming the peak as the richest Chinese in 2025, he has always walked on the edge of a knife.

The valuation of $65.7 billion is the highest reward the market can give for Binance's demonstrated resilience and adaptability amid turbulent waves.

The road ahead is not smooth. The SEC's lawsuit is still ongoing, the cyclical fluctuations of the crypto market hang like the sword of Damocles, and the global regulatory "tightening spell" could be invoked at any time.

CZ and his Binance empire are still engaged in a never-ending game, trying to find the best balance between the ideals of decentralization and centralized power.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。