On May 12, the China-U.S. Geneva trade talks exceeded expectations, leading to a rise in U.S. stocks and cryptocurrencies under favorable policies and market expectations. However, at the end of the month, the ruling by the U.S. International Trade Court weakened the "legitimacy basis" of the tariff war, triggering a policy game and entering a "judicial-administrative struggle" phase in the reconstruction of global trade rules, raising concerns about the long-term impact of tariffs. The decentralized and cross-sovereign nature of crypto assets, resistant to policy intervention, is increasingly favored by investors.

On May 12, the China-U.S. Geneva trade talks exceeded expectations, leading to a rise in U.S. stocks and cryptocurrencies under favorable policies and market expectations. However, at the end of the month, the ruling by the U.S. International Trade Court weakened the "legitimacy basis" of the tariff war, triggering a policy game and entering a "judicial-administrative struggle" phase in the reconstruction of global trade rules, raising concerns about the long-term impact of tariffs. The decentralized and cross-sovereign nature of crypto assets, resistant to policy intervention, is increasingly favored by investors.

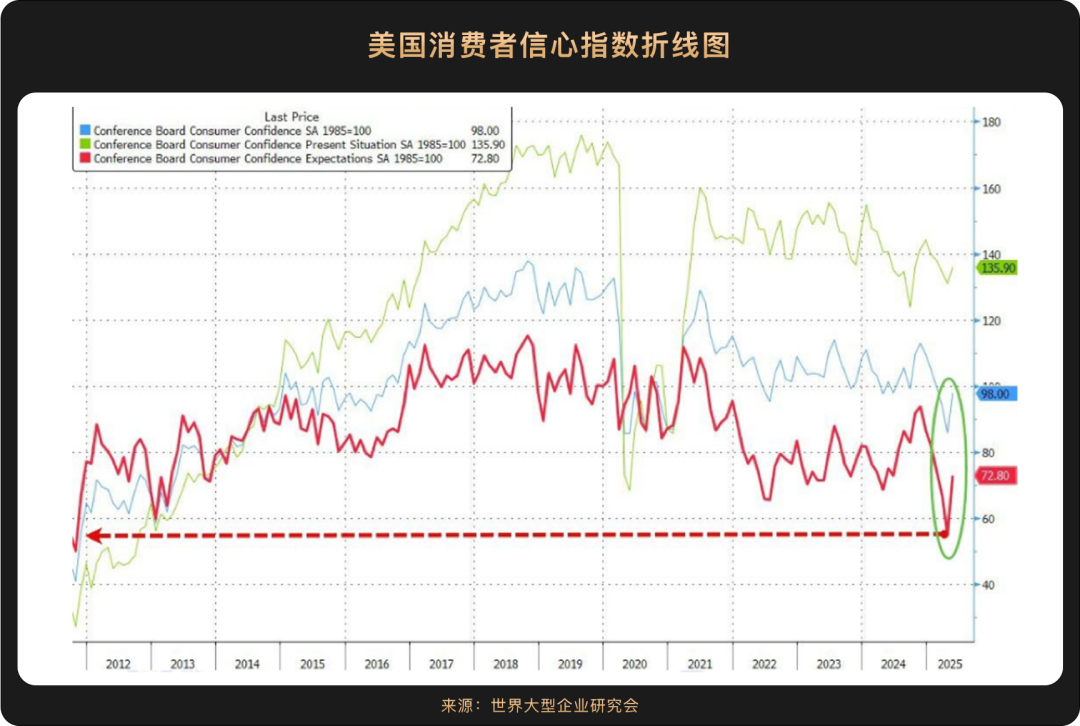

In May, the U.S. government enjoyed the sweet taste of economic data: the latest non-farm payroll data for April showed an increase of 177,000 jobs, better than expected, indicating that the labor market remains robust. The China-U.S. Geneva trade talks reached an agreement on a "tariff suspension period," alleviating market concerns about global supply chain disruptions, leading to a decrease in consumer inflation expectations for imported goods (such as electronics and daily necessities), and boosting retail consumption willingness. This also brought about a brighter confidence index: data released on the 27th by The Conference Board showed that the U.S. consumer confidence index unexpectedly soared to 98 in May, a significant rebound of 12.3 points from April's 85.7, marking the largest single-month increase in four years, reflecting the positive transmission of tariff easing to the consumer side.

However, "good fortune does not come in pairs," and the bitterness of U.S. debt has also arrived. With the curtain rising on "Trump 2.0," the massive tremors in the U.S. debt market have become commonplace. In late May, the yield on 30-year U.S. Treasuries soared above 5.1%, nearing a 20-year high. A series of factors, including Japanese bonds and trade negotiation progress, influence U.S. debt trends, but we all know that the U.S. fiscal outlook is the most critical factor, and new variables have emerged: at the end of May, the Trump administration's "One Big Beautiful Bill Act" passed the House of Representatives, proposing to raise the U.S. debt ceiling from the current $10 trillion to $40 trillion. Predictions cited by The New York Times indicate that this bill will push the U.S. debt-to-GDP ratio from the current approximately 98% to 125%, and the bill is currently awaiting Senate review.

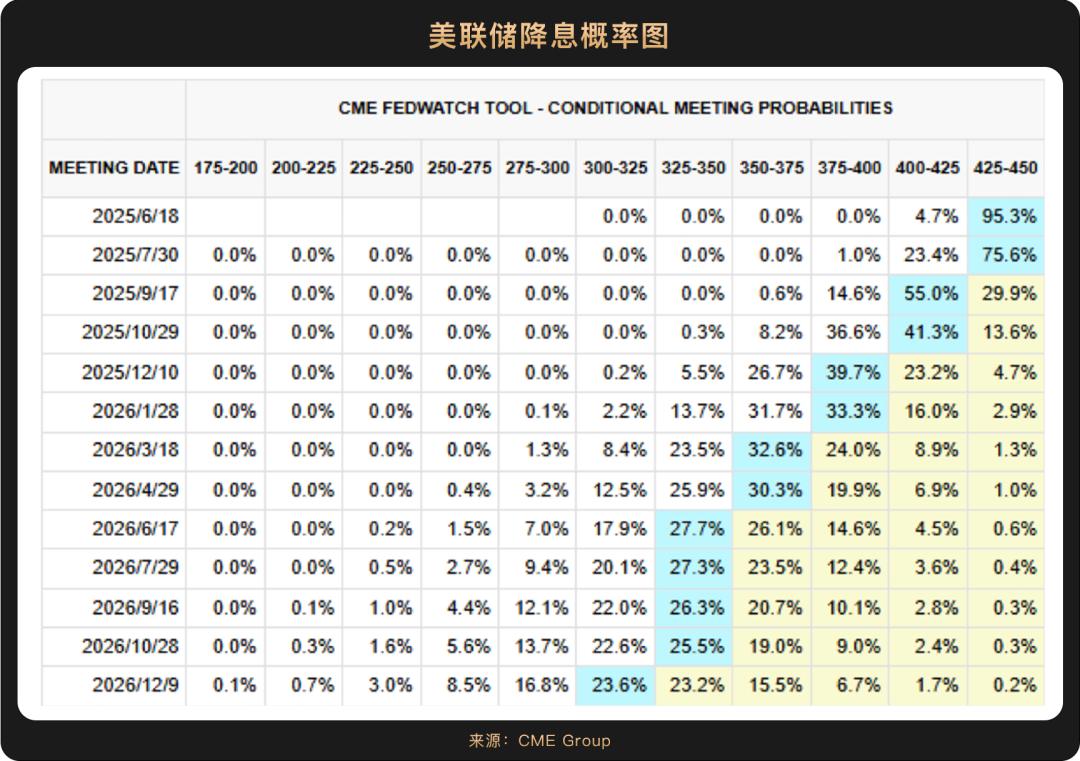

Additionally, the Federal Reserve's interest rate cuts remain unclear. The minutes from the Federal Reserve's May meeting, released on May 28, 2025, show that nearly all of the 19 officials participating in the policy meeting believe that "inflation may be more persistent than expected," leading the Federal Reserve to maintain its pause on interest rate cuts.

Overall, the current U.S. economy is in a "steady yet risky" phase: short-term growth resilience supports the market and is favorable for the dollar, but a broader fiscal and monetary policy backdrop may suppress its upward potential. Subsequently, how the Senate revises the "One Big Beautiful Bill" (such as the scale of tax cuts and the extent of spending reductions) and other conditions during the signing process will impact the U.S. economic structure and global financial markets. Whether the contradiction of U.S. policy "stimulating short-term growth while over-drafting long-term credit" can be alleviated remains a suspense.

There is a Wall Street saying, "Sell in May," but the easing of tariffs in early April broke this curse. U.S. stocks and the crypto market quickly eliminated the negative pricing of the "tariff war," with the speed and magnitude exceeding expectations. The S&P 500 index rose approximately 6.15% for the month, the Nasdaq increased by about 9.56%, and the Dow Jones rose about 3.94%. The S&P 500 and Nasdaq recorded their strongest May performances since 1990 and 1997, respectively, directly reflecting the market's optimistic expectations for supply chain recovery and corporate profit improvement:

The phased agreement between China and the U.S. on May 12 directly boosted market risk appetite. On that day, all three major U.S. stock indices surged, with the Dow soaring 1,160 points (2.81%), the S&P 500 rising 3.26%, and the Nasdaq increasing by 4%, marking the largest single-day gain since 2024. Tech giants became the biggest beneficiaries, with Amazon (AMZN) and Meta (META) rising over 7% in a single day, and Nvidia (NVDA) and Apple (AAPL) rising over 6%. Institutions like Goldman Sachs raised their expectations for U.S. stocks after the tariff easing, increasing the S&P 500's target level for the next 12 months to 6,500 points, emphasizing the increased possibility of a "soft landing." However, another viewpoint suggests that rising U.S. debt yields may squeeze corporate profit margins, especially for tech companies reliant on a low-interest environment. This tug-of-war between bulls and bears has led to a market characterized by "high volatility and high differentiation."

More controversially, the "One Big Beautiful Bill" strongly pushed by the Trump administration involves multiple areas such as taxation and immigration, proposing to push the U.S. debt-to-GDP ratio from the current approximately 98% to 125%, far exceeding the international warning line (generally considered that 90% is the critical point for debt risk), intensifying market concerns about U.S. debt credit risk. Moody's also downgraded the U.S. sovereign credit rating from Aaa to Aa1 this month.

The bill claims to "cover the debt increment through tax reform," temporarily boosting expectations for a "soft landing" in the economy, but the market generally questions the sustainability of U.S. fiscal policy—over the first five months of fiscal year 2025, the U.S. federal budget deficit reached $1.147 trillion, expanding by 38% year-on-year, with tax revenue growth facing resistance, and the "snowball" effect of debt is likely difficult to curb. Musk publicly expressed disappointment over the bill's increase in the deficit during an interview with CBS, while Democrats accused it of "undermining government efficiency." In the subsequent Senate review process, potential revisions (such as scaling back tax cuts) and uncertainties regarding presidential signing will become potential core factors suppressing market risk appetite.

In short, the current core issue in the market has shifted from liquidity and interest rate cuts to U.S. debt, and the "Trump risk" is always online.

As a barometer of digital assets, Bitcoin staged a remarkable comeback in May after breaking through $100,000 in April—soaring from a fluctuation range of $95,000 at the beginning of the month to $105,000 by the end, with a monthly increase of 12%. It even reached $112,000 at one point, refreshing the high since April 2024, significantly reversing the market's inherent perception of it as a "high-volatility risk asset." In the context of the tariff war entering a new phase, this resonance effect with U.S. stocks (the Nasdaq index rose 9.56% during the same period) indicates that investors are re-anchoring assets amid policy uncertainty.

In such a market atmosphere, Bitcoin's fundamentals also welcomed key catalysts, with a particularly significant "siphoning effect" on funds: according to data compiled by Bloomberg, over the past five weeks, U.S. Bitcoin ETFs attracted more than $9 billion in inflows, while gold funds faced outflows exceeding $2.8 billion, indicating that some investors are abandoning traditional gold in favor of Bitcoin, dubbed "digital gold," viewing it as a new store of value and hedging tool, with a significant shift in investment trends.

Among them, BlackRock's internal investment portfolio, the BlackRock Strategic Income Opportunities Portfolio, has continuously increased its holdings in Bitcoin ETF (IBIT). Currently, IBIT has assets under management exceeding $72 billion, and despite being launched only last year, it has already entered the list of the 25 largest Bitcoin ETFs globally. From a more macro perspective, the rapid development of IBIT reflects that cryptocurrencies are accelerating their integration into the mainstream financial system. On the 19th, JPMorgan announced that it would begin allowing clients to invest in Bitcoin, although its CEO Jamie Dimon remains skeptical. "We will allow clients to purchase Bitcoin," Dimon stated during the bank's annual investor day event on Monday, "We will not provide custody services but will reflect relevant transactions on clients' statements." This decision is a significant move for the largest bank in the U.S. and also marks Bitcoin's further integration into the mainstream investment field, potentially prompting institutions like Goldman Sachs to follow suit.

The current trend of loosening cryptocurrency regulations in the U.S. has also brought about a positive new climate. On May 12, the new chairman of the U.S. Securities and Exchange Commission (SEC), Paul S. Atkins, delivered a keynote speech at the crypto task force's tokenization roundtable, proposing the goal of making the U.S. the "global cryptocurrency capital" and announcing that the SEC would shift its regulatory approach from "enforcement-led" to "rules-led." More specifically, the SEC is considering three key reforms—clarifying the identification standards for security tokens, updating custody rules to allow self-custody under specific conditions, and establishing a conditional exemption mechanism for new products, which means providing clearer legal frameworks for crypto market participants, reducing uncertainty, and promoting innovation.

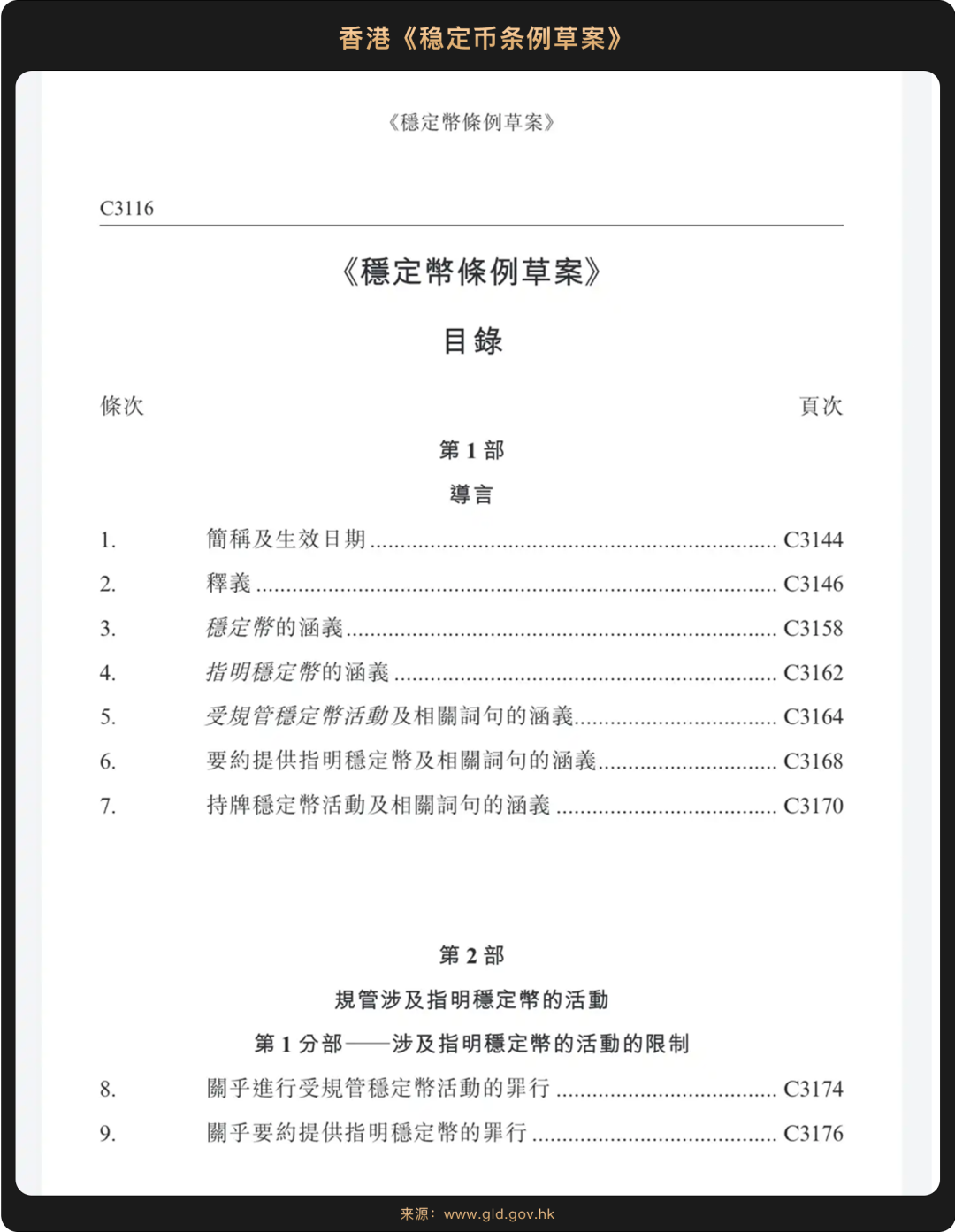

In addition to the direct impetus from funding and regulation, the policy breakthroughs in the stablecoin sector have injected new momentum into the pricing logic of Bitcoin. On May 19, the U.S. Senate passed the "Guidance and Establishment of the U.S. Stablecoin National Innovation Act" (referred to as the "GENIUS Act") with a procedural vote of 66 in favor and 32 against, marking the imminent establishment of the first federal regulatory framework for stablecoins in the U.S., which will reshape the U.S. crypto asset market and impact the global financial system. Just two days later, on May 21, the Hong Kong Legislative Council passed the "Stablecoin Regulation Bill," expected to take effect within the year, showcasing Hong Kong's breakthrough progress in stablecoin regulation. The two bills create a synergistic effect, jointly promoting the standardization of the global stablecoin market, bringing new funding channels to the digital currency market on one hand, and providing institutional support for the development of the Web3 ecosystem on the other. With the dual entry of "traditional financial institutions + regulatory systems," the narrative of real-world assets (RWA) on-chain is accelerating, and the market consensus on Bitcoin as a "store of value" will further strengthen, highlighting its unique position in global asset allocation.

What is also worth looking forward to in the future is that the volatility of traditional financial markets will not exert a one-way pressure on cryptocurrencies; rather, at certain stages, it may become a driving force for their rise: in the short term, the rise in U.S. Treasury yields has raised market concerns about the U.S. fiscal situation, prompting safe-haven funds to flow into the crypto market; from a long-term perspective, the deterioration of the U.S. fiscal situation may enhance the safe-haven appeal of crypto assets, as this fiscal pressure could weaken confidence in the dollar and Treasury bonds, prompting investors to turn to decentralized assets like Bitcoin to hedge against credit risk.

The cryptocurrency frenzy in May signifies that as the traditional financial system struggles amid tariff frictions, debt crises, and monetary policy dilemmas, Bitcoin is becoming a new choice for capital to hedge against the "uncertainties of the old order." As regulatory loosening transitions from expectation to reality, this reconstruction process may accelerate. Of course, the mid-term pressure from U.S. Treasury yields and the fluctuations in regulatory policies may test this round of upward momentum. Nevertheless, the narrative of Bitcoin as "digital gold" has entered the mainstream discourse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。