Original Title: "BTC Surges to $110,000, Can ETH Seize the Opportunity for a Rally?"

Original Source: Bitpush

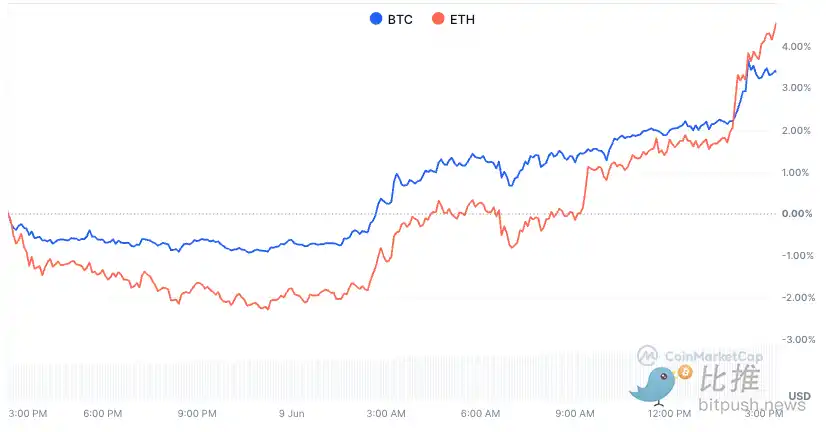

In the past 24 hours, Bitcoin (BTC) has surged by 3.7%, reclaiming the $110,000 mark, just a step away from the historical high set in May. Meanwhile, Ethereum (ETH) also rose by 3.8%, bouncing back above $2,620, demonstrating its correlation with Bitcoin.

But the key question is: As Bitcoin approaches its historical high, is Ethereum's rise merely a passive follow-up? Or is it brewing a more independent ETH market?

Analyst: ETH Will Reach $10,000 Within the Next Year

Well-known crypto market analyst DCinvestor boldly predicts on social media that ETH will reach $10,000 or even higher within the next year.

He believes that the real driving force will no longer be the return of retail investors, as they may have been "brainwashed" and developed biases against ETH's true value, making it difficult for them to buy again. DCinvestor stated, "Retail investors will not return to ETH; they have been completely brainwashed by 'psychological warfare' into believing ETH is worthless. But they will be forced to watch ETH rise to $10,000, as corporations, governments, and Wall Street are injecting trillions of dollars into this chain."

DCinvestor compares this phenomenon to Bitcoin's cycle in 2017, pointing out that ETH's development is two cycles behind BTC but is progressing steadily. He emphasizes that the new batch of market buyers will not care about the doubts or "concerns" in the market, as they may not even be aware of the existence of those "old-school" critics.

Continued Inflows into ETH ETFs: A Clear Signal of Institutional Interest

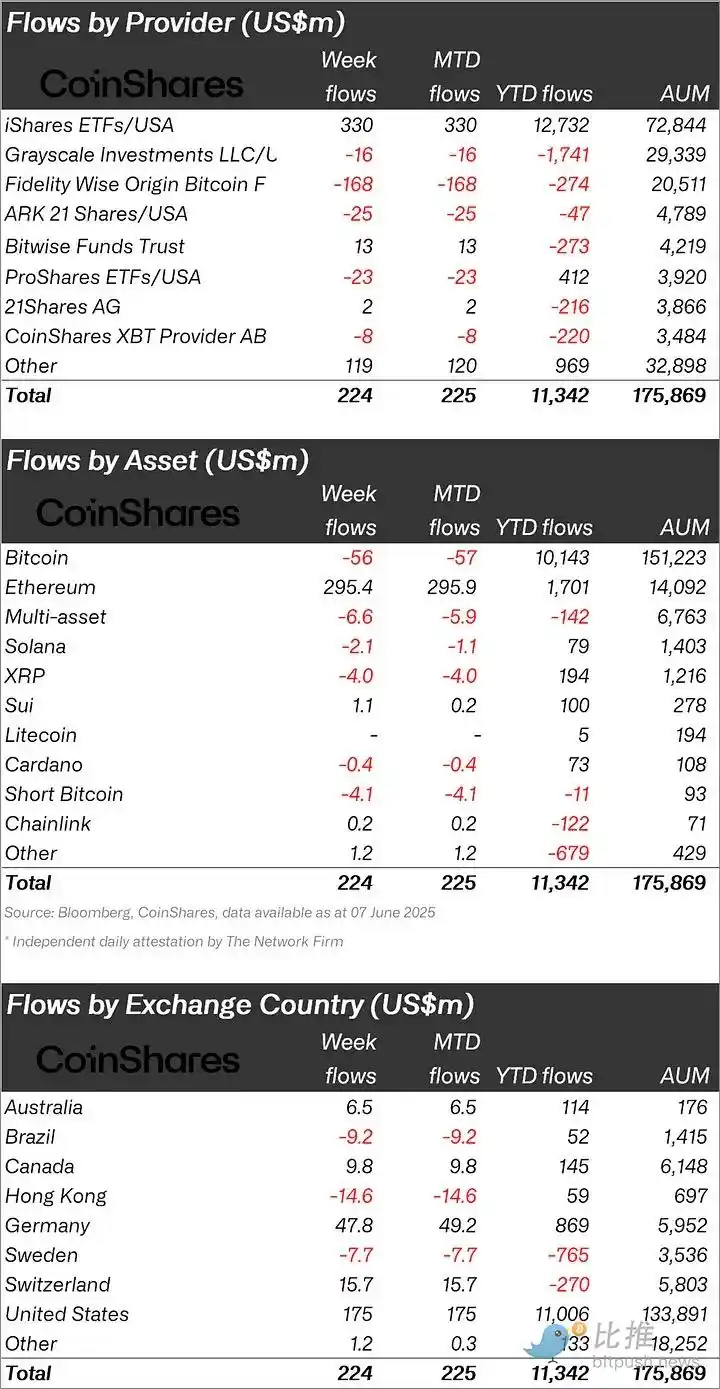

Data does not lie. CoinShares' latest report shows that since May 16, Ethereum-related investment products have led digital asset inflows for the second consecutive week, attracting $296.4 million in funds, bringing the total inflow over seven weeks to $1.5 billion.

CoinShares' Head of Research James Butterfill wrote, "This is the strongest inflow since the U.S. elections," adding that this figure currently accounts for 10.5% of the total assets under management for Ethereum.

Marcin Kazmierczak, co-founder and COO of Redstone, pointed out that the upward momentum of ETH seems to be driven by several factors: institutional ETF fund flows showing renewed interest in ETH products, and the growing market expectations for Ethereum's roadmap upgrades.

At the same time, the ETH/BTC market cap ratio has risen above 0.14, seen as a potential signal for a renewed shift towards "risk-on" altcoins, which could be an early "signal" of a broader altcoin season.

Pectra Upgrade Boost

Despite the relatively "dull" price movement of ETH recently, its fundamentals remain strong. Market expectations for Ethereum's roadmap upgrades are high, with the Pectra upgrade completed last month (May 7) playing a significant role.

Luke Nolan, a senior Ethereum researcher at CoinShares, stated that while the Pectra upgrade did not bring about any major single change, it includes multiple improvements to the Ethereum protocol that lay the groundwork for further scalability, which has long been a major bottleneck for Ethereum.

One of the key features of the Pectra upgrade is the ability to expand Ethereum's blockchain to handle "blobs" (temporary data storage units), which helps retain more data at the consensus layer. Nolan believes that sometimes a small narrative is enough to drive positive sentiment.

Positive Technical Trends

From the Tradingview technical chart, Ethereum's current trend also shows positive signals. As of the writing of this article, the price has strongly rebounded from the May low to around $2,665 and is firmly standing above the weekly pivot point (PP, around $2,400-$2,500).

On the downside, $2,483-$2,485 serves as immediate support, while the weekly pivot point and deeper Fibonacci support provide a solid foundation. Notably, the chart shows a potential "bullish flag" pattern, and a key "golden cross" has formed between the 50-day moving average and the 200-day moving average, all of which are strong bullish signals.

ETH's sustained momentum above $2,520 indicates that short-term buying power is dominant. Key resistance above looks towards R1 (around $2,900-$3,000) and historical highs, so bulls are expected to continue pushing towards higher resistance levels in the near term. However, investors still need to closely monitor market volume and breakthroughs at key levels to confirm the sustainability of the upward trend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。