Original Title: "SEC Chairman: DeFi is Free for All, If Something Goes Wrong, I'm Exempt!"

Original Source: C Labs Crypto Observation

On June 9, 2025, Eastern Time (midnight Beijing time), Paul S. Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), delivered a speech at the "DeFi and the American Spirit" roundtable held in Washington, D.C.

The content of the speech was quite explosive, so let me extract some key quotes for you to feel: Decentralized Finance (DeFi) embodies America's economic freedom, property rights, and spirit of innovation.

The individual's right to self-custody of their private property is a "fundamental American value" and should not be restricted by the use of the internet or blockchain technology. Engineers should not be subjected to federal securities law regulation simply for publishing such (DeFi) software code. As a court ruling stated, it is absurd to hold developers of autonomous vehicles responsible for third-party misuse or bank robberies.

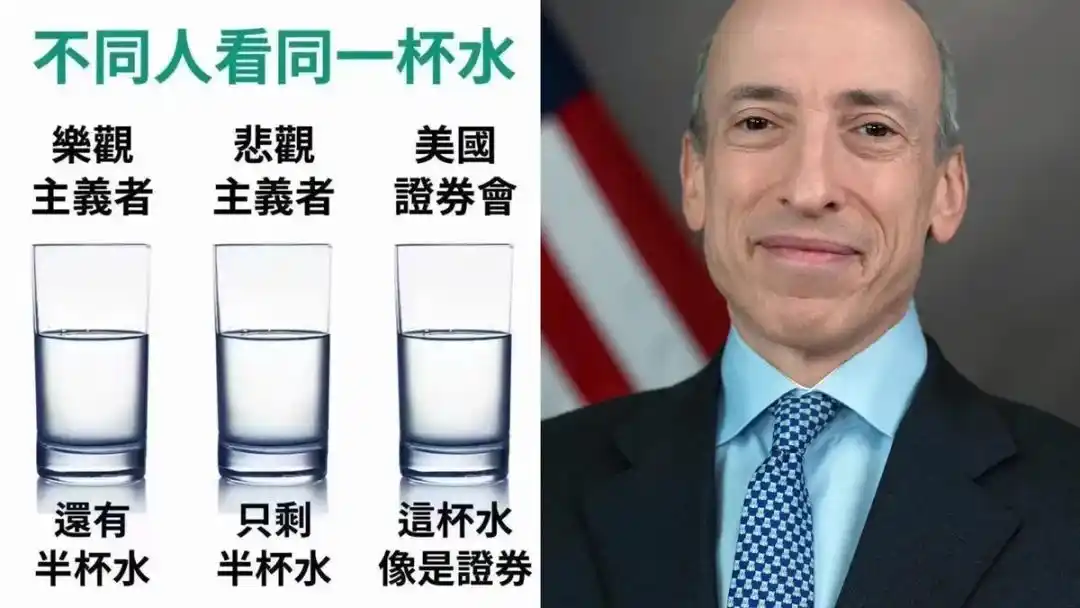

It currently seems that the SEC's regulation of DeFi is on a path to be fully relaxed. Big Brother's fines were paid too early; if only they could have dragged it out like Sun, they wouldn't have to pay at all~ Below is the full text of Atkins' speech (the original English text can be viewed at the end, with my comments in parentheses):

The theme of this roundtable is "DeFi and the American Spirit." This title is very apt because economic freedom, property rights, and innovation—these core American values—are precisely the genes of the decentralized finance (DeFi) movement.

Blockchain is undoubtedly a creative and potentially revolutionary innovation that prompts us to rethink ownership and the transfer of intellectual and economic property rights. Blockchain is a shared database that allows people to own a type of digital property called "crypto assets" without relying on intermediaries or central authorities.

In contrast, these peer-to-peer networks adopt an economic incentive mechanism that encourages participants to verify and maintain the database according to network rules. This is a free market system where users pay network participants fees based on demand so that their transactions are included in data "blocks" with limited capacity. (Recognition of blockchain technology)

The previous U.S. government obstructed Americans' participation in these market-driven systems through lawsuits, speeches, regulations, and threats of regulation, claiming that participants and "staking-as-a-service" providers might be involved in securities trading. (Criticism of the previous government, consistent with Trump)

I am grateful that the staff of the company's financing department clearly stated that they believe that voluntarily participating as "miners," "validators," or "staking service providers" in proof-of-work (PoW) or proof-of-stake (PoS) networks does not fall under the purview of federal securities law.

While I am pleased with this progress, it is not a formally enacted rule with legal effect, so we cannot stop here. The SEC must formulate relevant regulations based on the powers granted to us by Congress. (Limiting the SEC's rights, not regulating what shouldn't be regulated)

Another core feature of blockchain technology is that individuals can self-manage crypto assets through digital wallets. The right to self-custody of personal property is a fundamental American value, and this right should not disappear simply because one is connected to the internet.

I support providing greater flexibility for market participants to self-manage crypto assets, especially when intermediaries bring unnecessary transaction costs or restrict their participation in staking and on-chain activities. (Major intermediaries are significant beneficiaries in today's market, just sitting there and eating)

The previous presidential administration also took regulatory actions to crack down on innovations in self-custody digital wallets and other on-chain technologies, claiming that developers of such software might be engaging in brokerage activities. Engineers should not be subjected to federal securities law regulation simply for publishing such software code.

As a court ruling stated, it is absurd to hold developers of autonomous vehicles responsible for third-party misuse or bank robberies. The ruling stated: "In such cases, the target of the lawsuit should be the individuals committing the illegal acts, not the companies manufacturing the cars." (Similar to not restricting residents from owning guns)

Many entrepreneurs are developing software applications that can operate without management by an operator. These accessible, ungoverned, and automatically executed codes that enable private peer-to-peer transactions may sound like science fiction.

But blockchain technology indeed makes it possible for this new category of software to operate without intermediaries. I do not believe we should allow century-old regulatory frameworks to hinder these technological innovations that could fundamentally change, and most importantly, enhance and advance our existing financial intermediary models.

We should not instinctively fear the future. (Traditional financial intermediaries are in for trouble; by the way, banks are the biggest financial intermediaries! No wonder Buffett is liquidating his bank stocks)

These on-chain automated execution systems have shown resilience in crises. In contrast, under recent market pressures, some centralized platforms have faltered or even collapsed, while many on-chain systems continue to operate normally according to open-source code. Most existing securities regulations are based on the regulation of issuers and intermediaries (such as brokers, advisors, trading platforms, and clearing agencies).

The drafters of these regulations likely did not foresee that automated execution software code could replace these issuers and intermediaries. (Currently, the main regulatory role over financial intermediaries is knowing who to send to jail)

I have asked the committee staff to assess whether further guidance or rules need to be issued to help registered entities comply with these software systems in legal transactions. (We will see how to catch people in the future)

I am also excited about issuers and intermediaries using on-chain software systems to eliminate economic friction, improve capital efficiency, promote new financial products, and enhance liquidity. (The market can save a lot on intermediary fees)

Although existing securities regulations have considered the possibility of issuers and intermediaries using new technologies, I have still asked the staff to assess whether SEC rules need to be revised to better meet the actual needs of issuers and intermediaries wishing to build on-chain financial systems. (Who to catch in the future is a question)

In the process of the committee and its staff formulating special rules applicable to on-chain financial markets, I have instructed the staff to consider a conditional exemption mechanism, known as the "innovation exemption." This exemption mechanism could accelerate the pace at which registered and non-registered entities launch on-chain products and services in the U.S. market. (But no immediate consideration for catching people)

The innovation exemption will help realize President Trump's vision of "making America the global crypto capital," encouraging developers, entrepreneurs, and businesses willing to operate in compliance under specific conditions to carry out on-chain technological innovations within the United States. (Everyone, hurry up and get to work!)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。