Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

The highly anticipated "stablecoin public chain" Plasma will officially open public fundraising deposits tonight at 21:00 Beijing time. After a deposit phase lasting several weeks (the specific duration is yet to be determined), participating users will receive corresponding public fundraising shares based on their time-weighted deposit ratio, thus participating in the project’s public fundraising at a fully diluted valuation (FDV) of $500 million.

Plasma: A stablecoin public chain backed by Bitfinex, Tether, Peter Thiel, and others

Plasma is positioned as a high-performance blockchain specifically built for stablecoins, with core features including: support for thousands of transactions per second; zero-fee USDT transfers; reliance on the Bitcoin network for settlement (understood as a Bitcoin sidechain); 100% EVM compatible; customizable gas tokens (such as USDT, BTC); and support for privacy transactions without compromising compliance.

From a market perspective, the reason Plasma has garnered such high attention is primarily due to its rapid fundraising progress and the impressive endorsements from investors.

In October 2024, Plasma announced it had completed a $3.5 million fundraising round at its debut, led by Bitfinex, with participation from Christian Angermayer and venture capital firms Split Capital, Anthos Capital, Karatage, and Manifold Trading. Bitfinex's CTO and Tether's CEO Paolo Ardoino also supported the project.

In February 2025, Plasma announced it had completed a $24 million fundraising round (including $20 million in Series A and $4 million in seed funding), led by Framework Ventures, with Bitfinex and Paolo Ardoino participating again. The name of Silicon Valley venture capital giant and PayPal co-founder Peter Thiel also appeared on the investment list.

In May 2025, Plasma announced it received strategic investment from Founders Fund, owned by Peter Thiel. Although the specific amount was not disclosed, it emphasized that this investment would help Plasma expand its team and ecosystem, accelerating adoption in Latin America, the Middle East, and other regions.

Public fundraising details

On May 27, the well-known KOL Cobie's angel investment platform Echo announced the launch of a new public fundraising platform called Sonar, with Plasma being the first public fundraising project on this platform.

For this public fundraising, Plasma plans to sell a total of 10% of its tokens, XPL, at a fully diluted valuation (FDV) of $500 million, aiming to raise $50 million. Although some concerned users questioned the $500 million valuation as being too high, Plasma stated that this is consistent with the valuation from the recent equity financing led by Founders Fund.

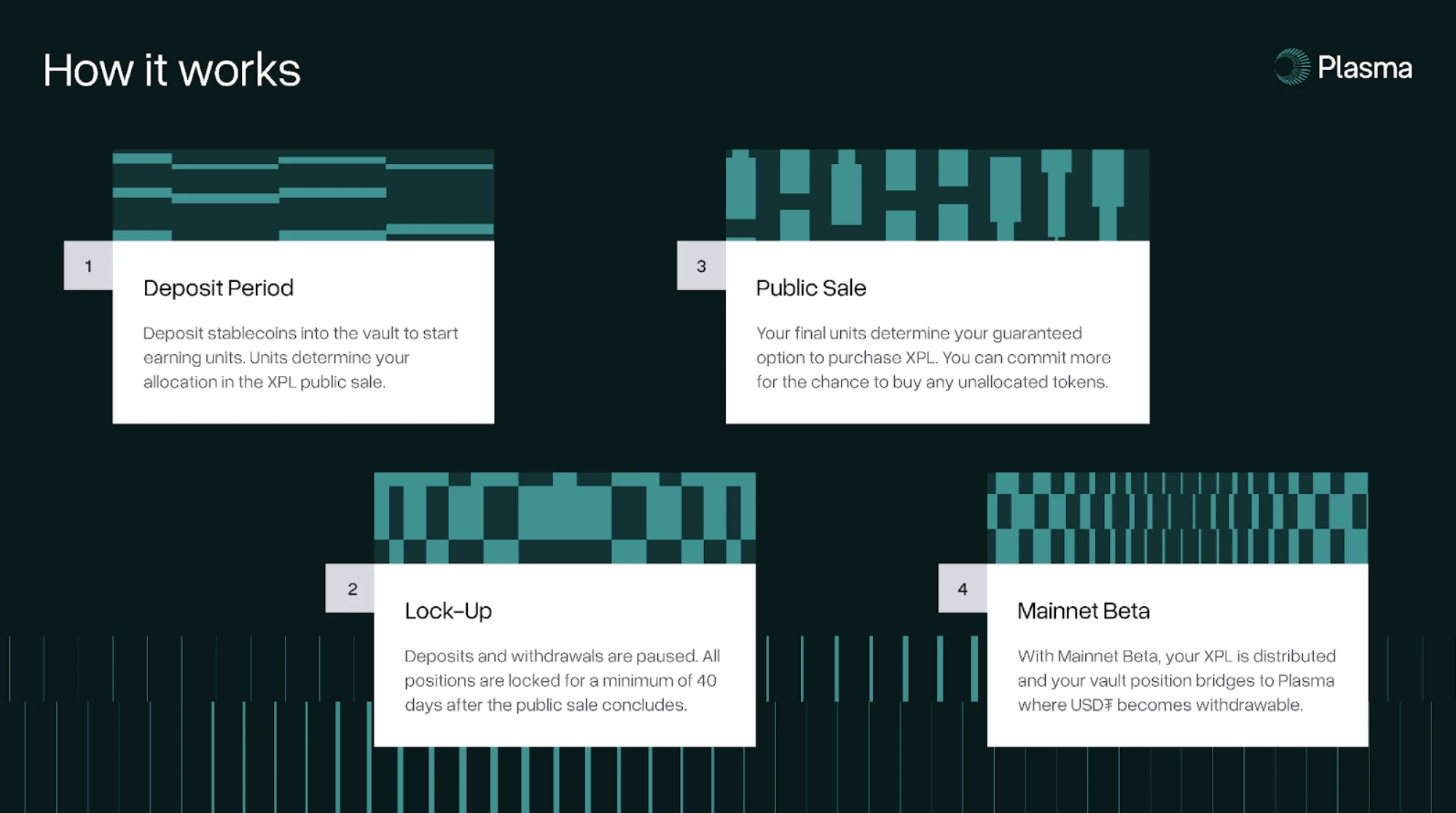

According to Plasma's disclosure, this public fundraising will be divided into four phases.

Deposit Phase

The first phase is the deposit phase, where participants can deposit USDT, USDC, USDS, or DAI into the Plasma treasury on the Ethereum mainnet. The funds will be deployed to Aave and Maker protocols through Veda's audited custody contract (users can receive earnings when withdrawing from the Plasma mainnet test version). After depositing, users will start accumulating points (units), which reflect their time-weighted share of the total deposits in the treasury, ultimately determining their guaranteed allocation in the XPL public fundraising.

During the deposit phase, users can withdraw their deposits at any time, but their points will decrease accordingly after withdrawal.

The deposit phase is expected to last several weeks, with an initial deposit cap of $250 million, which will gradually increase. The maximum deposit limit for a single user is $50 million — surely everyone has $50 million, right?

Lock-up Phase

After the deposit channel closes, the treasury will enter a lock-up state, prohibiting new deposits or withdrawals.

This lock-up period will last at least 40 days (calculated from the end of the public sale), during which all stablecoin deposits will be uniformly converted to USDT in preparation for cross-chain transfer to the Plasma mainnet test version.

Sale Phase

Then, the sale phase will begin, where users can participate in the sale using their deposit addresses on the Plasma official website. Sonar will handle KYC identity verification, jurisdiction screening, and other review processes on behalf of Plasma — participation is prohibited for users from the UK, China, Cuba, Iran, Russia, Syria, North Korea, and Ukraine; US participants must verify their accredited investor status and will need to lock their funds for 12 months after the public sale ends.

Users' points determine their guaranteed allocation in the XPL sale, and subscriptions can be supported using stablecoins such as USDT, USDC, USDS, and DAI. If other depositors do not fully subscribe, the remaining XPL shares will be proportionally allocated to oversubscribers.

Mainnet Phase

After the public fundraising is completed, Plasma will launch the mainnet test version.

As the network goes live, the XPL tokens subscribed by users will be distributed, and the treasury assets will be cross-chained to the Plasma network, allowing users to choose to withdraw USDT directly on the Plasma chain.

Mixed Reviews

As the public fundraising opening approaches, discussions about Plasma in the market are increasing, showing a clear divide in opinions.

Supporters believe that with stablecoins making legislative breakthroughs and the recent market heat from Circle's IPO, Plasma, backed by the "king of stablecoins" Tether, has a promising development outlook. From this perspective, the $500 million valuation is not considered expensive, and it is expected that the $250 million hard cap will be quickly filled after the opening tonight.

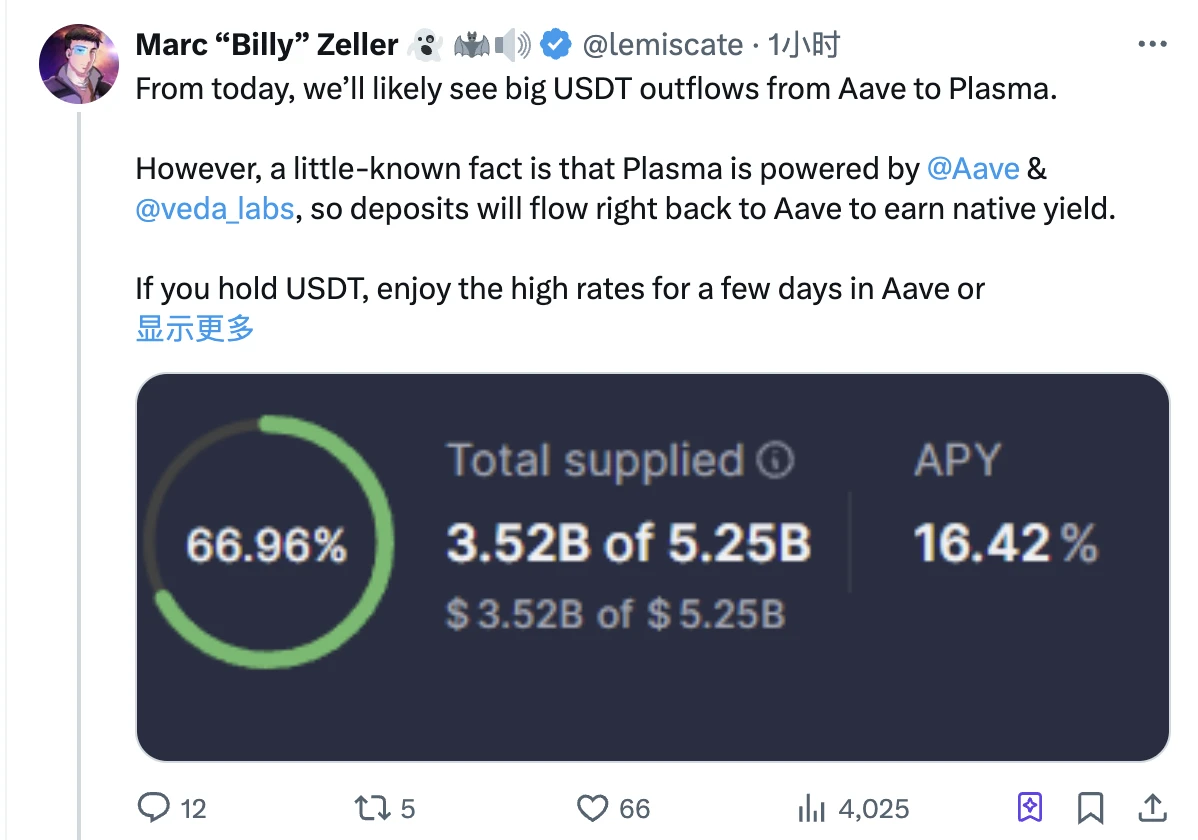

Marc Zeller, a core member of Aave, also noted the fund flow of the protocol, stating: “Starting today, we may see a large amount of USDT flowing from Aave to Plasma. After users complete their deposits, it will flow back to Aave via Veda.”

Opponents argue that in the current cycle, new projects generally open at low valuations, and Plasma's $500 million does not offer good value for money… Some even bluntly state that Plasma and another hot project about to go public, pump.fun, may "harvest" the last liquidity of this cycle…

Personally, while I am currently taking a wait-and-see approach regarding participation in Plasma's public fundraising, given that Plasma has mentioned it will deposit the funds received during the public fundraising into Aave and Maker for interest, I would prefer to secure a position first for qualification reasons. This way, even if I ultimately decide not to participate, I will still earn some interest, and if Plasma and its ecosystem projects intend to airdrop in the future, early deposit users will likely be prioritized. Therefore, I am inclined to make a deposit right after the opening tonight.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。