After Circle's listing, the U.S. stock market reacted extremely enthusiastically, with the stock price soaring from the IPO price of $31 to a closing price of $83.23 on the first day, and further rising the next day, with a market capitalization briefly exceeding $30 billion. Not only in the U.S. stock market, but the optimistic sentiment among investors regarding the stablecoin concept has spread to global stock markets, especially in the context of a potentially improving regulatory environment.

As a result, Coinbase's public chain Base, which has deep cooperation with Circle, has naturally attracted significant institutional attention, and recently, an increasing number of promising products have emerged. This article will summarize the recent high-quality Base projects.

PayFi/Stability Coin/Credit Track

KEETA

Keeta Network is a high-performance Layer 1 blockchain dedicated to providing secure, efficient, and highly interoperable solutions for global payments and asset transfers, with the vision of becoming the "common foundation for all asset transfers." It not only supports cross-chain transactions but also emphasizes seamless integration with traditional financial systems (TradFi).

Players familiar with the Base ecosystem have certainly heard about Keeta recently, not only due to its terrifying increase of over 600 times since launch but also because its fully circulating market capitalization exceeds $1.6 billion. More importantly, it has received $17 million in funding support from top investors, including former Google CEO Eric Schmidt and Steel Perlot Management.

The original intention of Keeta's design is to address the pain points of traditional payment systems, such as high fees, slow settlement speeds, and lack of compliance support, aiming to achieve fast transaction settlement and asset tokenization through its technical architecture. Founder and CEO Ty Schenk has pointed out that Keeta's goal is "to make international remittances as simple and fast as Venmo payments, without worrying about the safety of funds."

Keeta Network adopts a unique architectural design that separates nodes from hardware, allowing multiple servers to support a single node simultaneously, achieving horizontal and vertical scaling without affecting service, ensuring stable performance under high load. At the same time, Keeta eliminates the mempool mechanism found in traditional blockchains, directly processing transactions, making them faster and cheaper.

Additionally, it incorporates compliance processes, with its Anchor function supporting integration with cross-chain and traditional payment systems (such as SWIFT, ACH), enabling seamless conversion between fiat and digital assets. Keeta has a native built-in compliance protocol suitable for regulatory bodies such as central banks and banks, and through its native tokenization mechanism, it can issue and manage tokens without relying on smart contracts, supporting RWA and other diverse assets on-chain. The platform also combines multiple authentication sources to establish a user-selectable digital identity system and supports private subnet deployments to meet specific privacy needs.

Overall, Keeta Network is highly sought after by the community due to its strong team (backed by former Google executives and the former chief developer of Nano) and technological highlights. Its design specifically for traditional financial regulation addresses blockchain privacy and compliance issues while positioning international payments as a major direction for the future, aligning well with the current mainstream choice of "stablecoin market."

Mamo

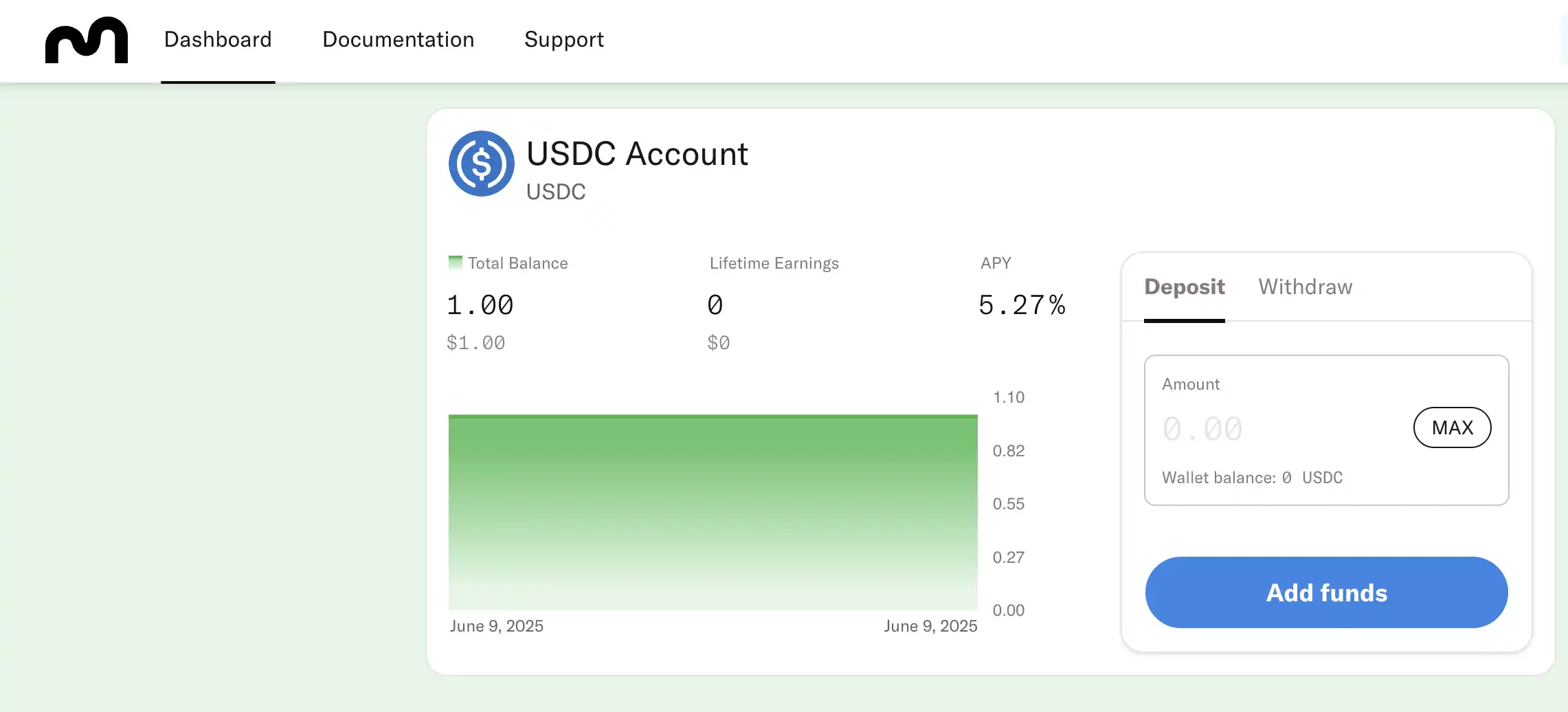

Recently, the AI Agent Mamo developed by Moonwell has also attracted widespread market attention. It has chosen to collaborate with Virtuals, where when users add USDC to Mamo, it is allocated to the USDC-related vaults of Moonwell and Morpho. Mamo automatically selects the protocols with higher yields, and the rewards obtained (such as WELL and MORPHO) are also automatically converted into USDC. The total APY currently offered is approximately 8% (base + rewards), with most of the earnings coming from USDC borrowers.

The founder of Base also recommended this AI Agent in a tweet as one of the most practical "no-threshold" AI Agents currently available. With excellent project backing and zero threshold, it can be said to be the best choice among the "automated earning" Agents on Base. It has also contributed to the AI Agent hive system on Base, with another AI Agent hedge fund manager from the Virtual series, Axelrod, announcing the integration of the Mamo protocol. Although Axelrod initially deposited only 0.15 USDC, the tokens already staked within its system are valued at over $1.8 million, symbolizing more the significance of the Virtual ecosystem's ACP system than the actual value generated.

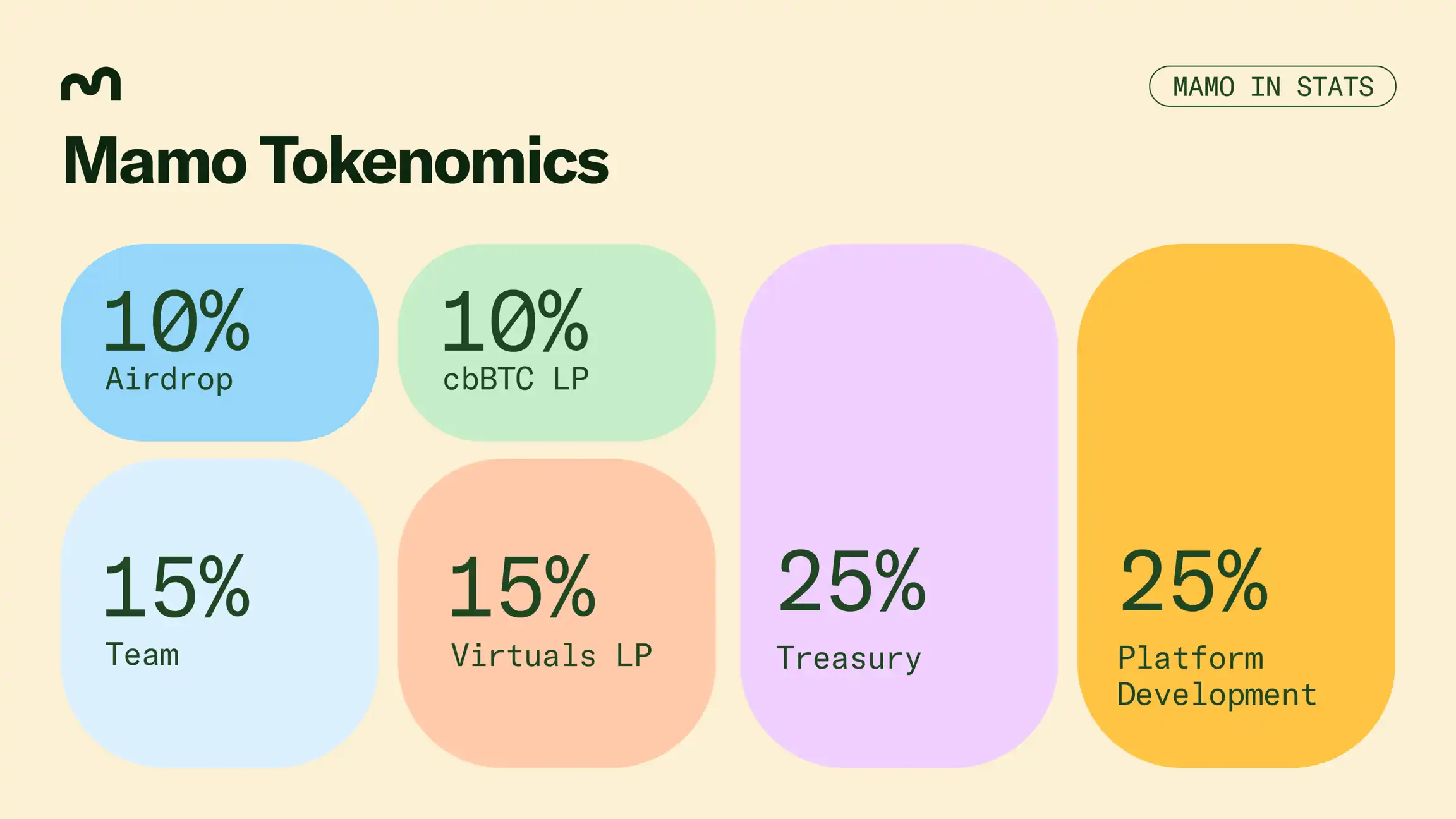

Currently, the fully circulating market capitalization of $Mamo reaches $90 million, with its token distribution being 10% for community airdrops to stkWELL holders, WELL holders, VIRTUAL stakers, veAERO holders, and MEME holders. 25% is reserved for the treasury, unlocking linearly over 24 months, 25% for platform development, also unlocking linearly over 24 months, 15% for team allocation, with a 6-month cliff, followed by a linear unlock over 24 months, and the remaining 15% for Virtuals LP and 10% for cbBTC LP.

Giza

Giza is an infrastructure that supports non-custodial algorithmic agents to autonomously execute DeFi strategies. Similar to Mamo, Giza stands out in the "AUTO FARMING" of USDC, with the project team recently integrating Eigenlayer AVS, a more advanced machine learning model that drives dynamic risk assessment based on real-time market data. Its self-developed open-source zkML framework will be used for verifiable AI use cases in the future, employing a smart account + session key mechanism to achieve non-custodial security. Agents cannot directly control user funds, and users can customize the permission boundaries and time frames for agent operations, providing stronger technical backing.

So far, Giza agents have generated over $70 million in trading volume across protocols such as Morpho, Aave, Fluid, and Compound. The static strategy yield of its first stablecoin yield Agent ARMA has already exceeded an APR of 80%.

As GIZA's scale gradually becomes institutionalized, its investment company Re7 Capital has also commissioned Giza to provide optimized yield strategies for stablecoins and ETH. In addition to GIZA, Re7 has invested in several well-known on-chain DeFi protocols such as Morpho and Centrifuge. Currently, a total of 6.45 million $GIZA tokens are staked in the protocol, and with several favorable developments for "stablecoins" recently, its fully circulating market capitalization has reached nearly $300 million.

Attention Economy Track

Noice

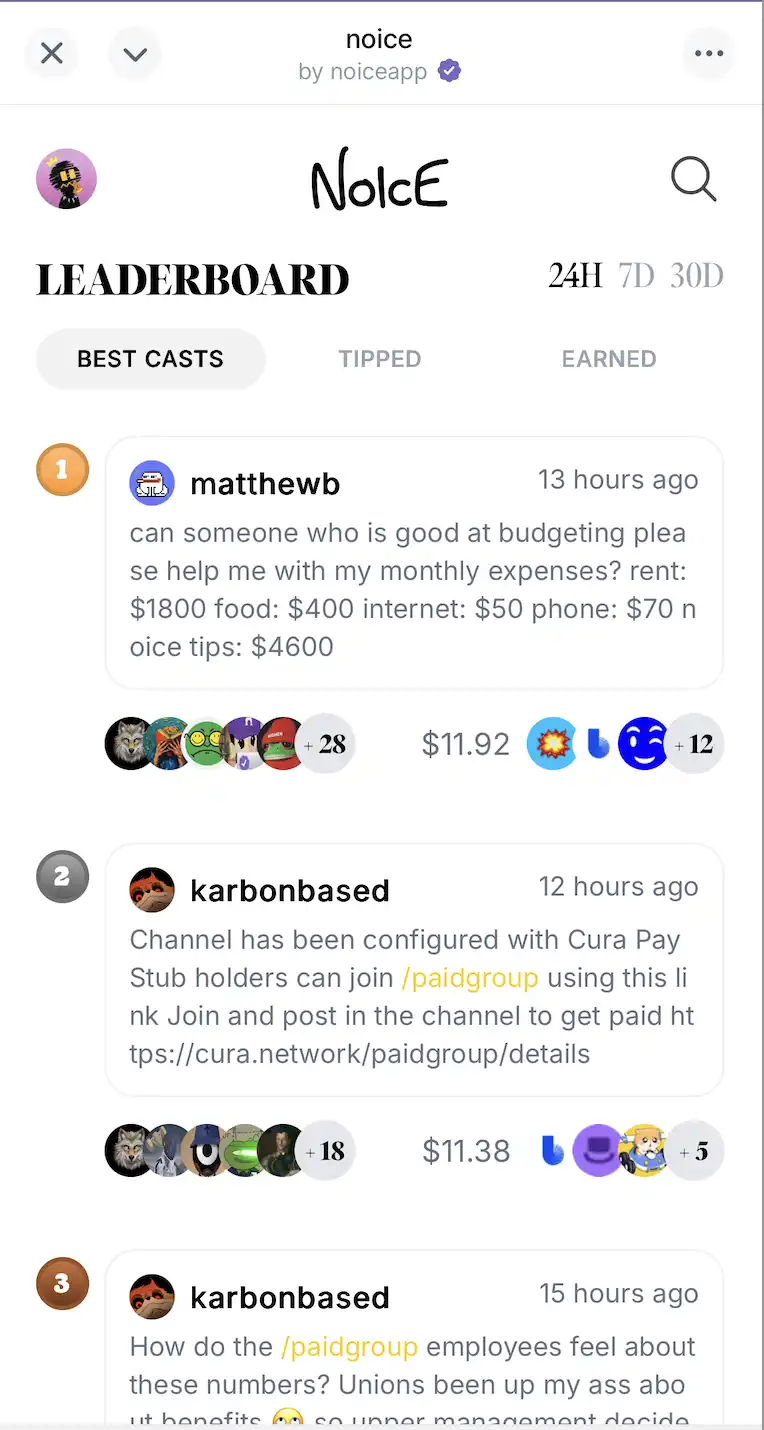

Noice is a social micropayment application built on the Farcaster ecosystem, focusing on achieving on-chain instant micro-tipping through social interactions such as likes, retweets, and comments. It breaks the cumbersome process of traditional Web3 tipping that requires switching to third-party applications, achieving a truly seamless experience. Currently, Noice processes over 10,000 transactions daily and has already accumulated over 730,000 "Tips," making it the most interactive application on Farcaster, receiving support from Base officials, Jesse Pollak, Balaji, and gaining widespread community attention.

According to on-chain analyst R48_eth, Noice's token $NOICE does not rely on a large airdrop strategy but instead adopts a lightweight incentive and gradual release mechanism, with 60% of the tokens already in circulation, and a low proportion held by the team, resulting in a lower concentration of risk. From on-chain data, the token distribution is healthy, and early investors have not formed significant selling pressure. The team has announced several future catalytic events, including integration with X (Twitter), support for the Solana network, and an upcoming airdrop event, which is expected to drive a surge in trading volume and user growth.

In summary, Noice has a strong social foundation, excellent product fit, and a clear growth path, which may make it an important representative of the next social finance application, reshaping the expression of tipping culture in Web3.

QRCOIN

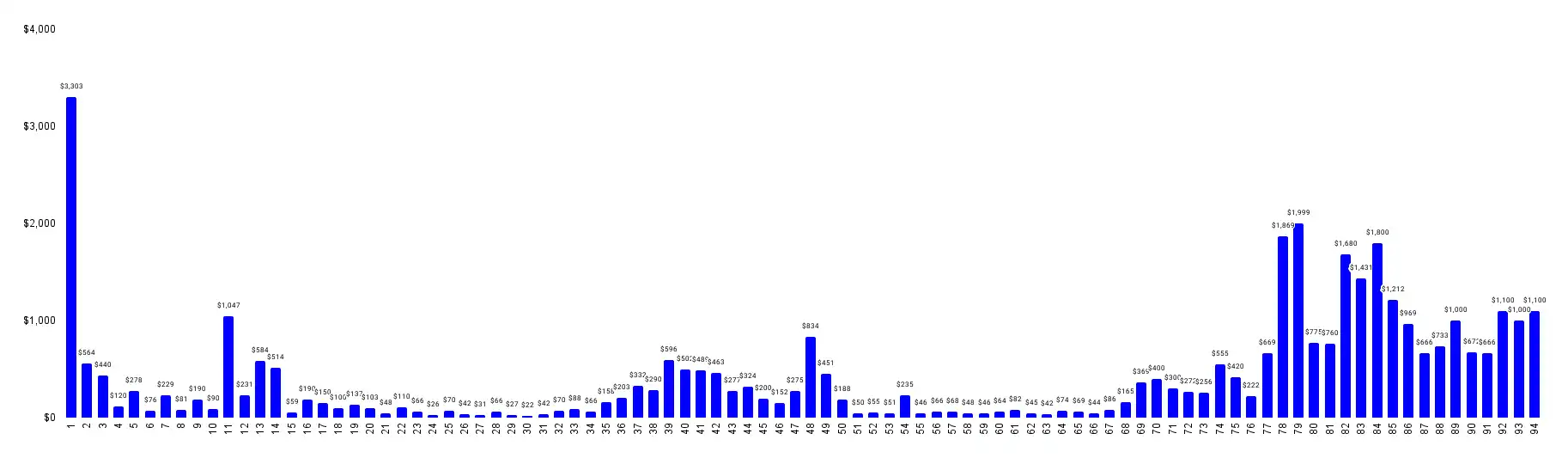

QR is an "advertising space rental" app on the Base chain. It allows users to bid for the usage rights of a QR code for 24 hours. The highest bidder can specify any content to be displayed on the QR code, which can be used to promote businesses, digital art, personal projects, or even meme-related content, aligning with the project's creativity and culture. Currently, it has successfully launched 94 advertisements, with 10 transactions exceeding $1,000 and 1 exceeding $2,000 (the highest bid), and the average transaction price is $417.29.

The Base team has "raided" this project multiple times, stating that its daily attention "battle" concept feels reminiscent of the early internet era. Meanwhile, many project teams are also leveraging this attention to launch their projects, such as the previously introduced Noice and the vibe coding app Helloworld Agent created by OharaAI.

Its token $QR currently has a market capitalization of $3.9 million, and the advertising fees it has collected are nearly $40,000. The project team will use part of the advertising fees to buy back QR tokens to pay users the reward of 1,000 $QR when they click on the advertisement. This reward incentivizes users to click on ads—advertisers gain higher visibility—more project teams purchase ads, making QR more widely known—leading to higher advertising fees, thus creating a positive feedback loop in its ecosystem.

Virtual/Clanker Track

BasisOS

BasisOS Agent is the first fully autonomous, AI-driven DeFi agent system aimed at revolutionizing yield strategy management on blockchain platforms. It achieves comprehensive management of decentralized finance protocols through a modular, multi-agent architecture, including strategy execution, risk control, and operational optimization. The core agent is responsible for basis trading strategies, automatically buying assets in the spot market and shorting in the perpetual contract market to capture funding rate differentials and stabilize profits. At the same time, BasisOS monitors liquidity and price dynamics across multiple DEXs in real-time through a sub-agent network, dynamically adjusting strategies to optimize yield and risk exposure.

The system features an adaptive risk management framework based on historical and real-time data, supporting proactive rebalancing and leverage control. BasisOS also employs a ReAct architecture to enable environmental awareness and strategic reasoning capabilities, allowing agents to flexibly respond to complex market changes. The system architecture includes core trading agents, supervisory agents, role agents, and environmental interface layers, fully supporting on-chain operations and user interactions.

To ensure the system's security and advancement, BasisOS is currently collaborating with several top industry partners:

Hexens: Provides comprehensive smart contract auditing and risk control support to ensure transaction security and system integrity;

Hyperliquid: Integrates a high-performance decentralized perpetual contract exchange to enhance trading execution efficiency;

Chainlink: Provides accurate and reliable oracle data to enhance the accuracy of market decisions.

BasisOS is also advancing integration with Solana, building cross-chain vaults, and developing the AI simulation engine Fractal-ai, aiming to create a DeFi protocol fully driven by AI agents, promoting a new era of financial autonomy.

BasisOS currently has a fully circulating market capitalization of $24.4 million. According to player @trenchpaperhand's analysis of its staking situation shared on X, there are currently 308 million staked, 61 million have applied for release, 57 million release applications are in queue, and 4 million have been unlocked for circulation. They believe that $BIOS has relatively low release sentiment among the current Genesis token listings, and early diamond hands remain somewhat optimistic.

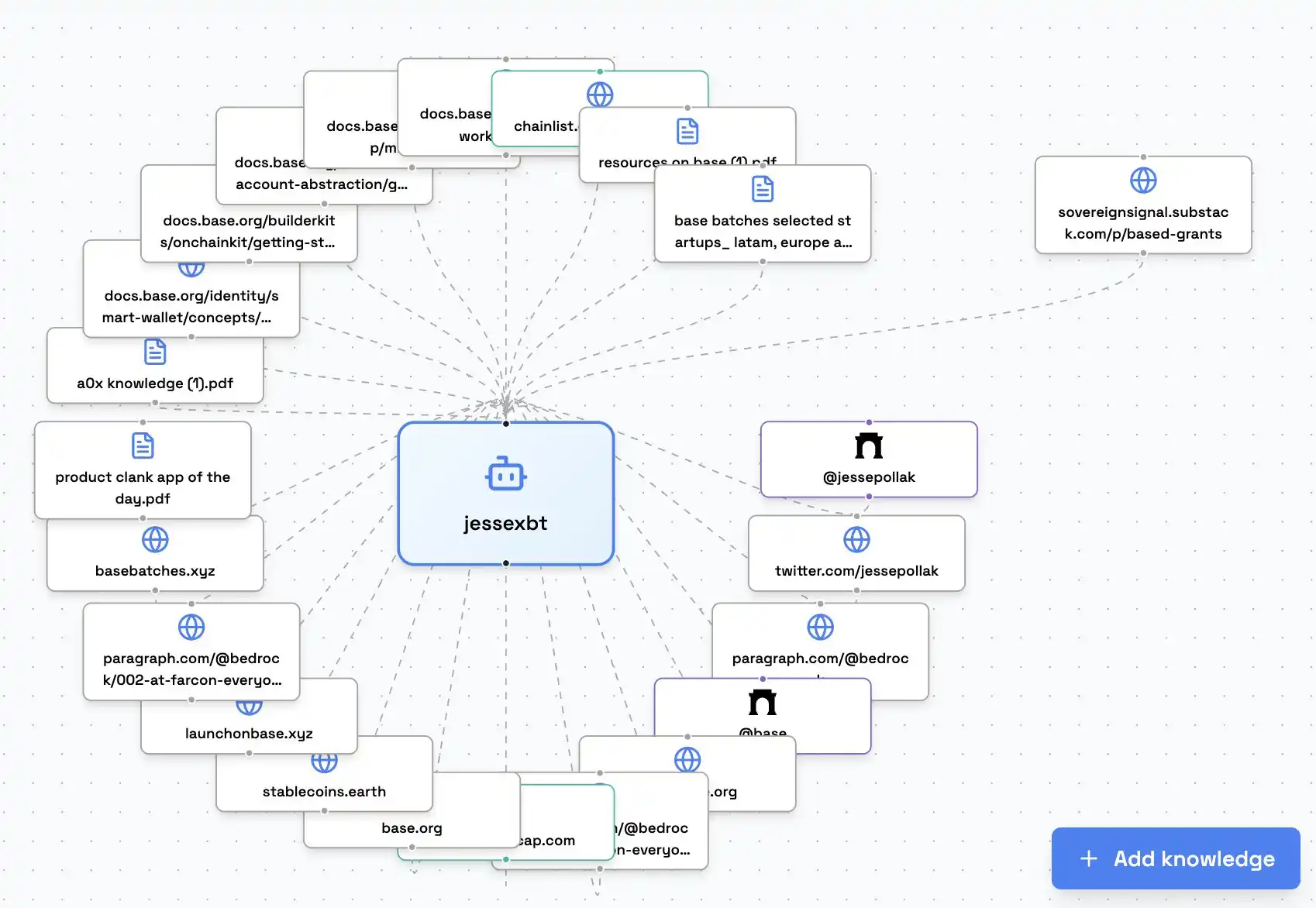

JesseXBT

jesseXBT is a digital derivative created by Base founder Jesse Pollak, designed to provide AI-driven co-founder services for startups, individual founders, and ecosystems, guiding creators from code to product and market. Its goal is to increase the number of builders supported by Jesse Pollak from about 10-100 people per day to over 1,000 people per day, while providing high-quality support and increasing funding channels.

Users can chat with Jesse XBT on X, Farcaster, and Telegram. JesseXBT has been trained by Jesse Pollak's writing, social media, videos, and websites like base.org to maintain a deep knowledge base and provide effective guidance to builders. JesseXBT is supported by A0x.

The training process for jesseXBT consists of four interrelated components: pre-training, fine-tuning, retrieval-augmented generation (RAG), and feedback loops. jesseXBT is trained by extensively collecting Jesse's public content (over 164 YouTube videos and podcasts, historical posts on X, Farcaster topics, and replies) and combining it with cleaned and synthesized sample training, using the Gemini 2.5 model as the underlying framework, supplemented by personalized dashboard configurations to ensure tone, knowledge breadth, and values remain highly consistent with Jesse. The training process employs a human review mechanism, with feedback rated by Jesse himself, and continuously iterated through reinforcement learning. Additionally, the system introduces a ZEP layer to achieve dialogue tracking, intent recognition, and personalized optimization, ensuring that the Agent's responses are both accurate and reflective of Jesse's style.

With Jesse's personal support, this AI Agent has become a relatively rare series of digital derivatives where the ecosystem leader personally participates in training. Although it has not yet been widely applied, its potential future impact on ecosystem development is highly intriguing.

Its token has not yet launched, but the development team A0x's token was launched in February, with a market capitalization of only $170,000, so players should be cautious of its low market cap volatility risk when participating.

Summary

The Base ecosystem has now found a development path distinct from other chains. Its backing by Coinbase makes projects requiring compliance, such as stablecoins and RWAs, more willing to build ecosystems on Base. Its focus on developer-centric systems encourages more applications to BUIDL on Base, providing a "breathing space" for a market that is gradually fatigued by PVP. With more institutions deploying and a more suitable environment for "mass applications," the Base ecosystem stands out, attracting more attention from Web2 projects and talent. I believe that the current Base ecosystem will have more Alpha "GEMs."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。