Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risk can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Past Records

New Opportunities

Huma 2.0 Reopens Deposits

Huma Finance officially announced last week that Huma 2.0 will reopen deposits at 10:00 UTC on June 10 (18:00 Beijing time). HUMA staking users will be able to deposit 24 hours in advance, with the deposit amount being the number of HUMA staked divided by 25 — that is, for every 1 HUMA staked, you can deposit 0.04 USD.

In the article on May 27, we mentioned that Huma's official team confirmed that a snapshot for the second phase airdrop would be taken three months after the TGE, distributing 2.1% of the total supply (the first phase was 5%), so there is still significant participation value.

However, at that time, some readers reported that due to the limit issue, it was basically impossible to deposit. The temporary solution we provided was to buy PST directly in the secondary market (the yield deposit certificate obtained after depositing stablecoins in Huma), but doing so would limit the scale of funds and incur some wear and tear, so this reopening will allow users to deposit more directly.

Additionally, the RateX LP strategy mentioned in the previous article is still valid, as double earning is indeed more appealing.

Huma Portal: https://app.huma.finance

RateX Portal: https://app.rate-x.io

BounceBit USD1 Incentive

Last week, BounceBit announced that USD1 has gone live on the network, and to celebrate, it will launch a 30-day incentive activity, offering a 15% APR to deposit users during the event, but there will be a limit of 1 million USD for deposits.

The deposit window will open today at 19:00 Beijing time, and interested users can set an alarm in advance.

Cove Mining

Cove, a one-click on-chain investment portfolio management protocol that received a $3 million investment from Electric Capital, Accomplice, Robot Ventures, Daedalus, and others last year, has recently launched and opened for deposits.

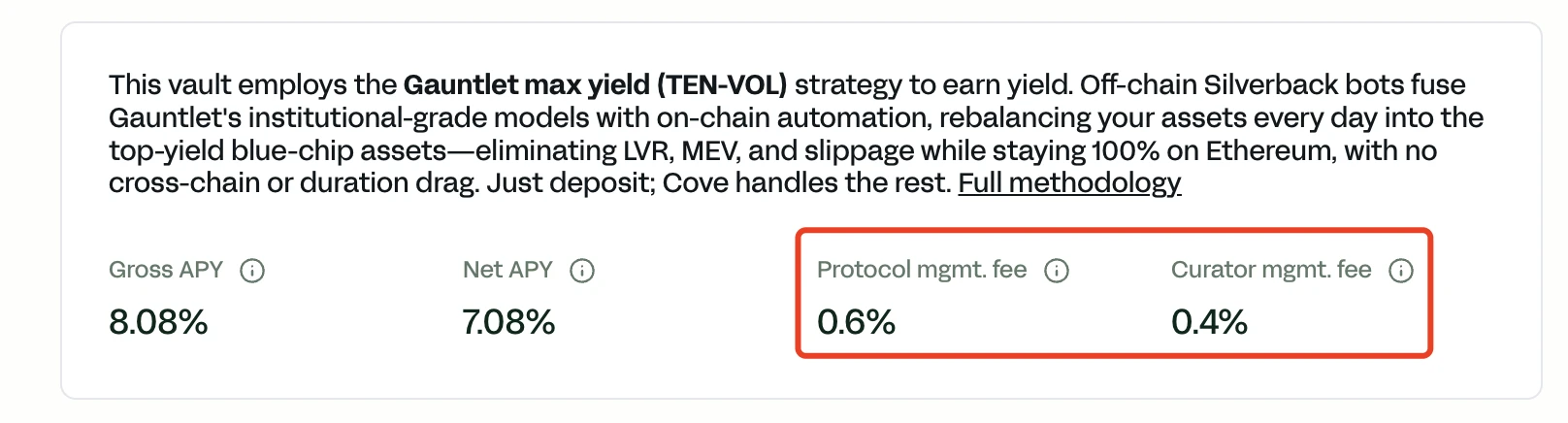

Currently, directly depositing into the coveUSD pool can yield an 8.08% APY, and the team has clearly stated that "depositing into the pool will earn COVE rewards," indicating a clear expectation of double earning.

However, Cove will charge a 1% management fee for deposits, so it is only recommended for users willing to make long-term deposits; otherwise, it may not be cost-effective.

- Portal: https://app.cove.finance/vaults

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。