Original | Odaily Planet Daily (@OdailyChina_)

_

Recently, the keywords "cryptocurrency" and "US stocks" have been frequently associated with each other. On one hand, US-listed companies are flocking to purchase crypto assets, with companies like SharpLink and GameStop seeing significant stock price increases in a short period due to this strategy; on the other hand, crypto companies are embarking on the path of US stock IPOs, with USDC stablecoin issuer Circle closing its first week of trading on June 6 at $107.7, a 247.4% increase compared to its IPO price of $31. BitMEX co-founder Arthur Hayes also wrote that Circle's listing could mark the beginning of a crypto IPO frenzy.

Such a fervent scene has left many in the crypto community feeling envious, but if this is indeed a new liquidity feast, how could they be willing to miss out? Thus, under this trend, on-chain trading of US stocks has also become a hot topic.

Securities tokenization (STO) actually existed before the emergence of RWA (real-world assets). During 2020-2021, platforms like FTX and Binance launched US stock tokenization trading services, but the regulatory environment for crypto at that time was not friendly, and the securities tokenization trading business could not be sustained. However, with the current improvement in the US crypto regulatory environment and the increasing integration of crypto and traditional finance, Citigroup, JPMorgan, Robinhood, and others have also begun to explore US stock tokenization business.

With favorable timing, location, and people, on-chain securities trading platforms in the market may become the next trend. Odaily Planet Daily will review the trading platforms available for purchasing US stocks with crypto assets in this article for readers' reference.

Bybit

The centralized exchange Bybit launched USDT-based stock contracts for difference (CFD) trading on its TradFi platform on May 19. The Bybit TradFi platform is a multi-asset trading platform that allows traders to access global financial markets with a single account. Users can create an MT5 account to directly trade US stocks using USDT as collateral. Currently, there are 78 stocks available, including Apple (AAPL), Tesla (TSLA), Nvidia (NVDA), Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOG). A complete list of stocks can be found in the official announcement.

Unlike stock spot trading, CFD trading does not involve the actual purchase of stocks but rather trading based on price movements. When users open a CFD position on the Bybit TradFi platform, they are essentially entering into a contract with the platform, settling the difference between the stock prices at the opening and closing of the position, with a maximum leverage of 5 times.

Bybit charges a fee of 0.04 USDT per share, with a minimum trading size of 5 USDT.

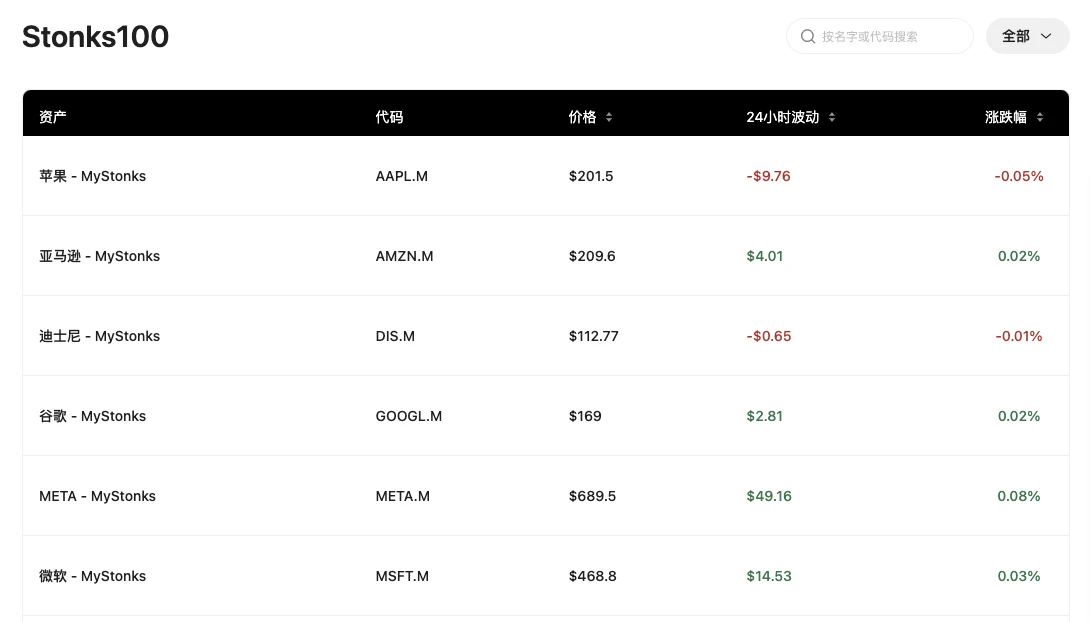

MyStonks

MyStonks is a decentralized crypto asset trading platform created based on the Meme coin Stonks community's CTO, where users can also purchase US stocks in the Stonks100 section, which includes 95 US stocks such as AAPL, AMZN, DIS, GOOGL, META, MSFT, NFLX, NVDA, and 5 crypto and stock ETFs listed in the US.

When users purchase US stocks on the MyStonks platform, MyStonks will mint corresponding shares of US stock tokens on the Base chain at a 1:1 ratio and distribute them to the user's on-chain wallet address. When users sell US stock tokens, the MyStonks platform will perform the reverse operation, converting the US stock tokens into stablecoins and transferring them to the user's account, while simultaneously burning the corresponding US stock tokens at a 1:1 ratio. The buying and selling process uses ChainLink oracles as the price provider. The platform charges a 0.3% trading fee for US stock tokens.

MyStonks is not just a simple on-chain data platform; when users buy and sell US stock tokens on the platform, MyStonks also buys and sells the corresponding US stocks off-chain at a 1:1 ratio, with custody provided by global asset management giant Fidelity, which has a total of $50 million in assets under custody for MyStonks.

Ondo Finance

Ondo Finance is a decentralized institutional-grade financial protocol that has partnered with the Trump family project WLFI and is a popular target for the "American coin" concept. As early as February 5, Ondo Finance announced the launch of its RWA tokenization trading platform Ondo Global Markets (Ondo GM), allowing users to buy and sell stocks, bonds, and ETF tokens backed 1:1 by real assets. However, this service is not available to US users.

All RWA tokens on Ondo Global Markets will be natively issued on the Ondo Chain, and users can also interact with other chains through the built-in cross-chain functionality of Ondo Chain. Ondo Global Markets is planned to launch later this year, but the specific date has not been announced.

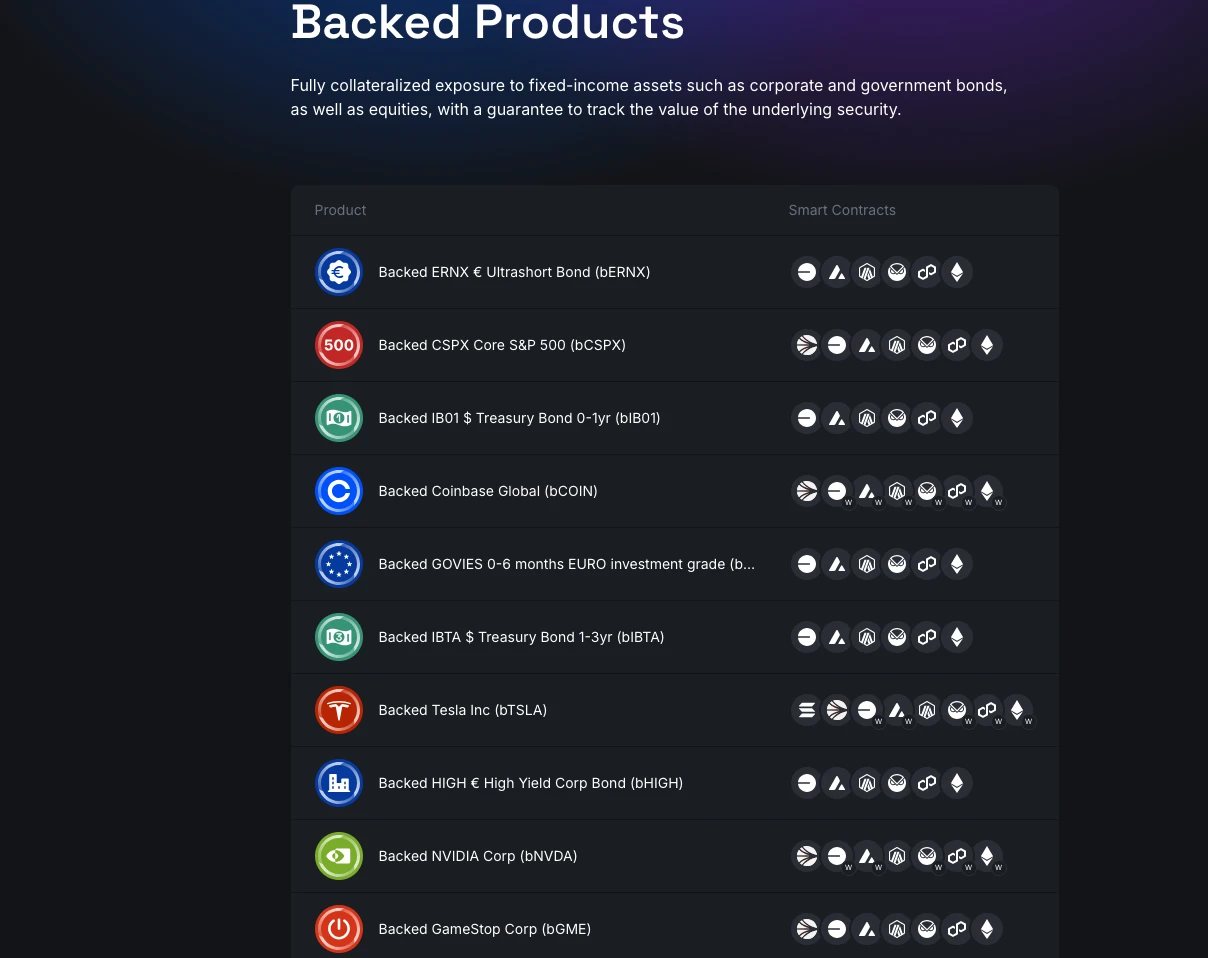

Backed

Backed is a Swiss asset tokenization issuer focused on tokenizing stocks and ETFs. Backed has launched 10 types of US stock tokens, including bCOIN, bCSPX, bTSLA, bNVDA, and bMSTR on multiple chains, but Backed itself does not operate a US stock token trading platform. Users can trade the US stock tokens it has launched directly through on-chain DEXs like CoW swap and 1inch.

Backed complies with the regulatory framework of the Swiss DLT Act and is one of the few US stock tokenization platforms with compliance qualifications. Backed employs a 1:1 collateral system, meaning that for every US stock token minted on-chain, the corresponding US stock is purchased in the secondary market. The US stock assets are managed by a Swiss custodian bank, which also regularly publishes reserve proofs.

Backed completed a $9.5 million financing round on April 30, 2024, led by Gnosis VC, with participation from cyber Fund, Blockchain Founders Fund, Stake Capital, and others. Recently, Backed has partnered with centralized exchange Kraken to launch a new stock tokenization trading platform xStocks, with the specific launch date yet to be determined.

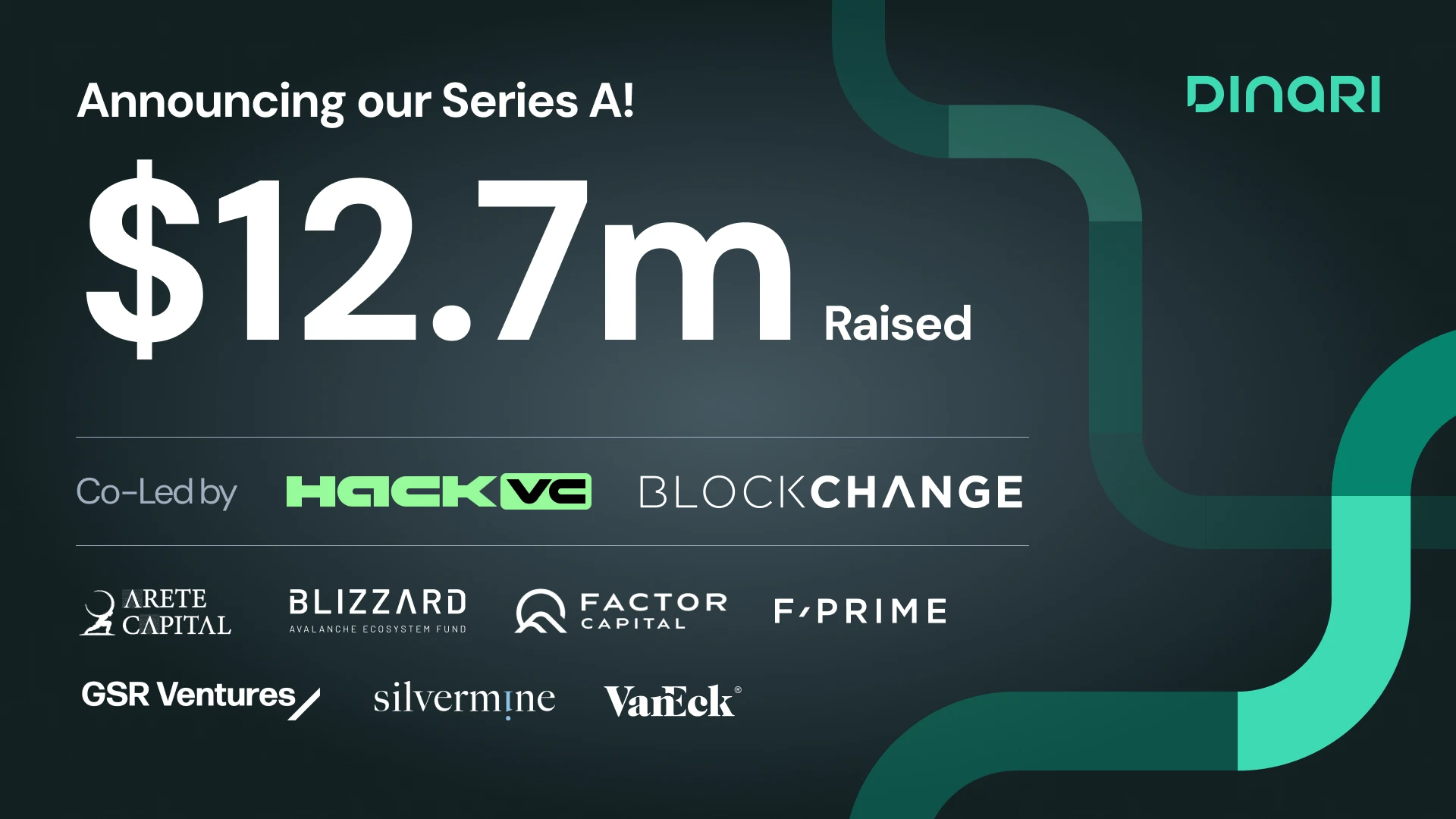

Dinari

Dinari is a compliance infrastructure platform focused on tokenizing traditional securities assets (such as stocks, bonds, ETFs), where users can trade nearly a hundred US stocks, including Apple, Amazon, Microsoft, Nvidia, and Coinbase, on its US stock token trading platform dShare. However, users must complete KYC to trade, and currently, the platform only supports KYC for users in the US and Canada, requiring government-issued identification (driver's license, passport, etc.) and proof of residence (current utility bill, bank statement showing address, etc.).

On Dinari, US stocks exist in the form of dShares, which are ERC-20 tokens on Arbitrum One, minted only when stocks are purchased from the exchange, implementing a 1:1 collateral system. Dinari is a registered compliance stock transfer agent with the SEC in the US, so the US stock assets backed by dShares are managed by it.

Users can trade US stock tokens on-chain using stablecoins like USDT, and holding the tokens also entitles them to dividend payouts. Dividends are distributed by Dinari to users, and US stock token holders will receive dividends in the form of USD+ on Arbitrum One, with USD+ being a stablecoin asset issued by Dinari. Additionally, a fixed fee of $10 will be charged for each order traded on the Ethereum mainnet, while a fixed fee of $0.20 will be charged for each order traded on L2.

Dinari has clearly stated that it will not launch the Dinari token. On May 1, 2025, Dinari completed a $12.7 million Series A financing round, led by Blockchange and Hack VC, with participation from Blizzard Fund, VanEck, F-Prime Capital, Factor Capital, Arete Capital, GSR Ventures, and Silvermine Capital.

Helix

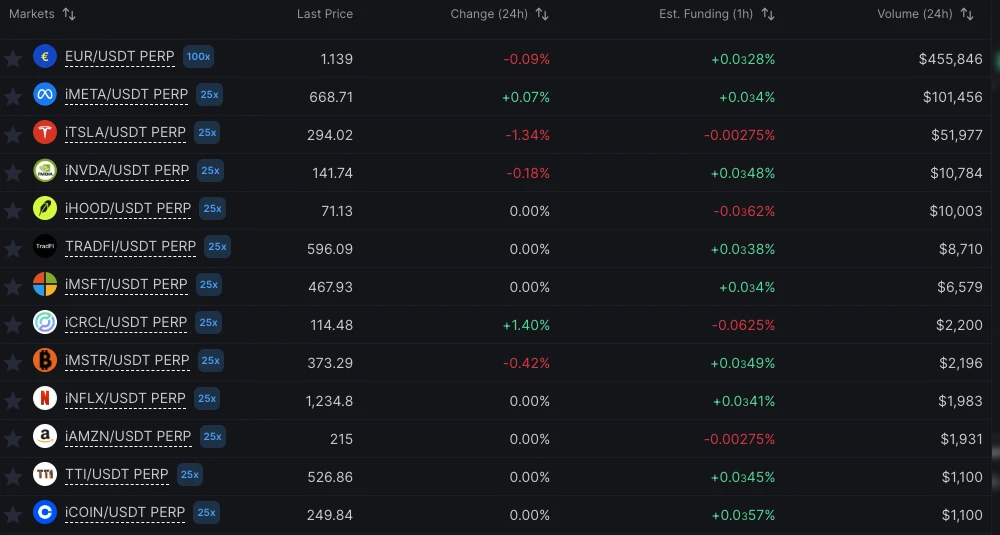

Helix is a decentralized cryptocurrency exchange built on Injective, primarily used for trading cross-chain spot and perpetual contract markets. It also supports trading some US stocks using USDT, including 13 US stocks such as META, TSLA, NVDA, MSTR, and COIN.

US stocks on Helix exist in the form of iAssets, which are derivatives of real-world assets (RWA) that bring traditional markets (such as stocks, commodities, and foreign exchange) to Injective in a fully on-chain, composable, and capital-efficient manner. iAssets do not require pre-funding or wrapping of the underlying assets; instead, they exist purely as synthetic derivatives without any underlying custodial US stock assets.

Therefore, trading iAssets is identical to trading other on-chain perpetual contract tokens, available 24/7. Users can use USDT or other stablecoins as margin, with a leverage of up to 25 times for US stocks, and positions are settled in USDT rather than physical delivery. The contract order fee and taker fee are 0.005% and 0.05%, respectively.

Currently, Helix has launched a trading points program, but the rebate rewards are still in the testing phase.

Swarm

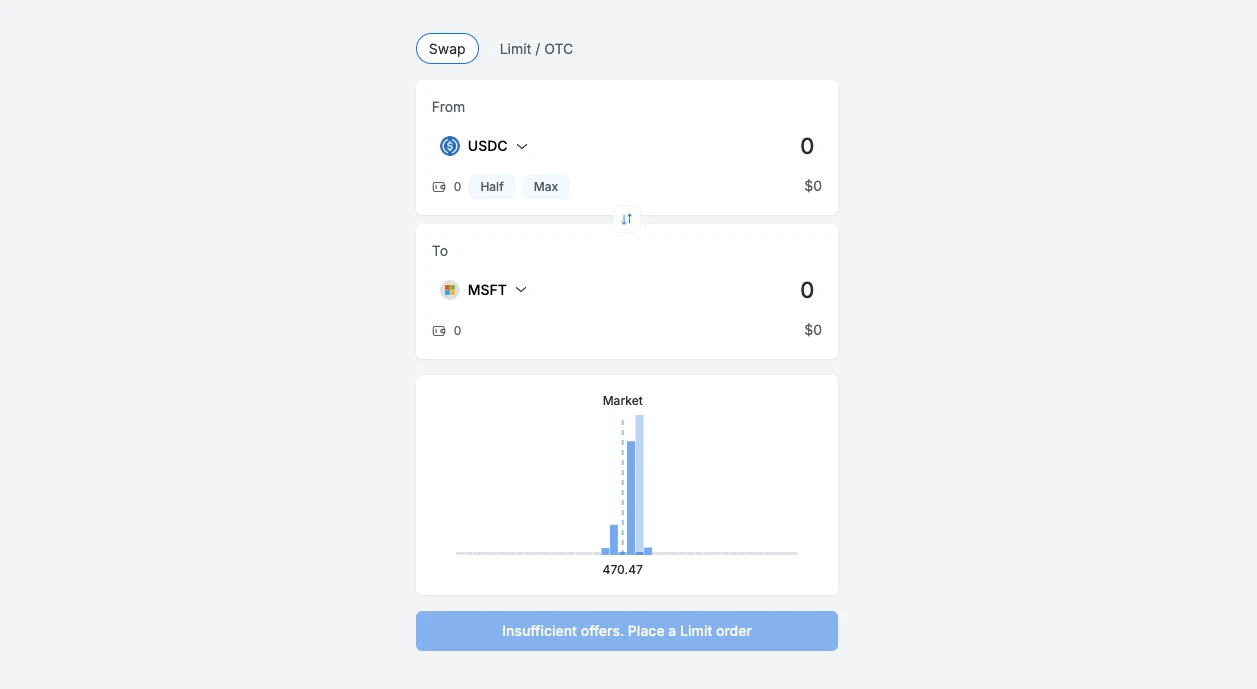

Swarm is a compliant DeFi infrastructure that provides token issuance, liquidity, and trading, allowing users to trade US stock tokens and gold through its launched DEX dOTC, including 12 US stock tokens such as AAPL, NVDA, MSFT, COIN, and TSLA. Swarm supports users in purchasing US stock tokens using stablecoins like USDC on the Ethereum mainnet, Polygon, and Base, with a trading fee set at 0.25%.

The US stock tokens on Swarm are issued by SwarmX GmbH, a subsidiary of Swarm. The US stock tokens on Swarm are also 100% backed by physical stocks, with the underlying US stock assets held by institutional custodians and verified by token trustees, with reserve asset information publicly disclosed monthly.

DigiFT

DigiFT is a compliant RWA crypto exchange based in Singapore, licensed as a Recognized Market Operator (RMO) and Capital Markets Services (CMS) provider by the Monetary Authority of Singapore (MAS). On February 28, 2023, DigiFT completed a $10.5 million Pre-A financing round, led by Shengda Group, with participation from HashKey Capital, Hash Global, Xin Enterprise, and Beituo Capital.

DigiFT currently offers two products: the structured note iSNR linked to the performance of Invesco US Senior Loan Strategy and the UBS-USD money market investment fund token UMINT. Users who have completed KYC can purchase these two products using stablecoins like USDC on the Ethereum mainnet.

Although DigiFT has not yet launched tokenized US stock products, primarily focusing on RWA assets like funds and bonds, it may open the US stock tokenization market in the future.

The true explosion of the US stock tokenization market requires finding new PMF fit points

US stock tokenization indeed has multiple advantages, such as breaking geographical and KYC restrictions, supporting 24/7 trading, allowing non-US users to hold US assets at low costs, and avoiding high cross-border fees. However, despite predictions that US stock tokenization would lead to a trillion-dollar RWA market, according to data from RWA.xyz, the entire RWA market is currently only about $23 billion, with tokenized stocks accounting for just $313 million, far from the anticipated scale.

The root cause lies in the fact that the compliance models of most US stock tokenization trading platforms are still immature, with issues such as "data platforms," lack of transparency, and even potential lack of qualifications. Meanwhile, platforms that have established complete compliance qualifications impose KYC/AML restrictions on users that are close to or exceed those of traditional brokerages, resulting in many crypto users not experiencing substantial convenience.

On the other hand, the US stock market already has a mature, transparent, and compliant secondary market globally. For users who genuinely want to trade US stocks, the entry barriers are not significantly different from those of traditional brokerages, and in some aspects, they may even be more cumbersome, failing to provide users with substantial convenience. More critically, for crypto-native users seeking high-frequency and high-volatility arbitrage, the volatility range of US stock targets is still too narrow, far less stimulating than the excitement brought by crypto contracts or on-chain meme coins. James and Liangxi can only emerge in the crypto market and not in the US stock market.

Therefore, simply "moving US stocks on-chain" is not enough to trigger a collective influx of crypto funds. To truly ignite the US stock tokenization market, platforms and project parties need to find new PMF fit points.

Nevertheless, looking ahead, US stock tokenization still has vast imaginative space. Once the core needs of crypto users are captured and true PMF is found in product design, on-chain US stock trading will no longer be just a gimmick but will become a bridge for the organic integration of global capital markets and the Web3 world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。