The "divorce battle" between Musk and Trump over "landing first and then cutting ties" is still ongoing.

A few days ago, Shayne Coplan, the founder of Polymarket, announced that Polymarket has become the "official prediction market partner" of social media giant X and its artificial intelligence team xAI. The collaboration will combine data from the X platform with Grok's analytical capabilities, providing millions of Polymarket users worldwide with more contextual and data-supported insights in real-time.

Currently, Grok is using Polymarket's data to predict events with uncertainties in the real world. However, it remains unclear how this collaboration will change the user experience for X users.

The announcement of this collaboration coincidentally occurred the day after Musk and Trump publicly clashed on social media. Just two weeks prior, the X platform had also engaged in discussions with Kalshi regarding a similar partnership—it's worth noting that Trump's eldest son, Donald Trump Jr., is a senior advisor at Kalshi.

Given Kalshi's ties to the Trump family, this collaboration not only has product-level significance but is also interpreted as Musk's deep exploration into restructuring political relationships, expanding financial infrastructure, and promoting the vision of a "super app."

According to a press release from Polymarket, both parties will launch a series of jointly developed integrated features and unique experiences.

The agreement indicates that X will provide data-driven insights to Polymarket, while Polymarket's prediction results will be fed back to the X platform, combined with real-time interpretations from Grok and related X posts, achieving an "explainable prediction data flow."

X CEO Linda Yaccarino stated that this collaboration will bring more value to X users who are already using Polymarket: "Polymarket has achieved a high level of transparency through prediction markets and has become an important source for many X users to obtain real-time information. We are excited to partner with Polymarket and integrate our data and technology into a series of innovative products for their users."

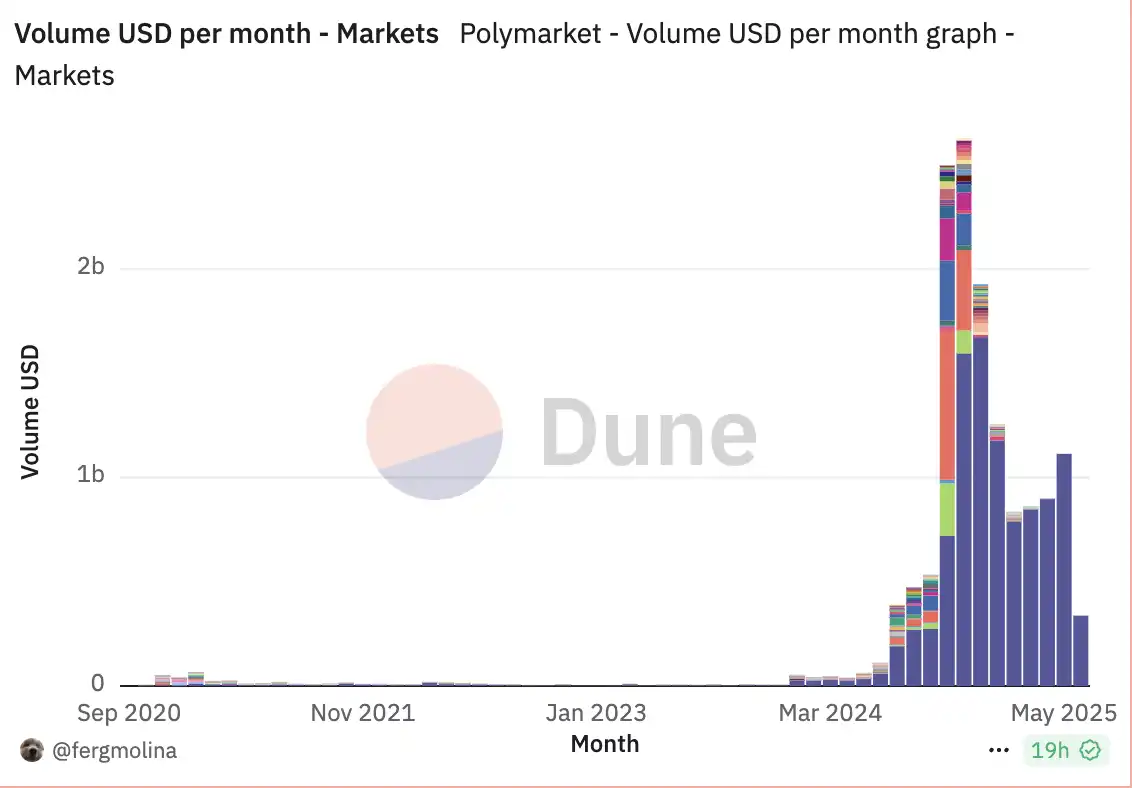

Currently, Polymarket's monthly trading volume has gradually increased after the election.

Why Polymarket?

Although Polymarket is currently one of the most popular prediction market platforms, it remains banned in the United States. In January 2022, the CFTC determined that it was illegally operating an unregistered trading platform and fined it $1.4 million.

At that time, CFTC enforcement division acting director Vincent McGonagle stated, "Market participants (like Polymarket) should proactively communicate with regulators to ensure that markets remain sound, transparent, and provide protections under the Commodity Exchange Act and related regulations." The CFTC also issued a "cease and desist" letter to Polymarket, making it unable to operate legally in the U.S. market. This makes the collaboration between X and Polymarket particularly noteworthy—especially considering that Kalshi has now been approved to operate prediction markets legally within the U.S.

The Breakup Continues

The current conflict between Musk and Trump is clearly difficult to separate from this new collaboration. As mentioned earlier, Trump's eldest son Donald Trump Jr. is a senior advisor at Kalshi, which had previously discussed similar partnerships with X.

However, such large-scale collaborations typically cannot be finalized in just a day or two, but the potential collaboration between Kalshi and X did indeed go from "official announcement to cancellation" in a single day.

In May of this year, Bloomberg reported that Kalshi was in talks with xAI regarding a partnership that included utilizing xAI's capabilities to provide "customized AI insights" for Kalshi. At that time, Kalshi CEO Tarek Mansour expressed on social media, "I am very excited to announce that Kalshi is about to partner with xAI to accelerate the mainstream adoption of prediction markets."

But this joy was short-lived, as the related statement was deleted the same day, and there has been no follow-up since.

This has led X to decisively turn to Polymarket, which has not yet obtained compliance approval in the U.S., carrying significant symbolic meaning in both public opinion and political context. In this backdrop, why did Musk choose to collaborate with Polymarket, which is in an "illegal" status?

In the short term, this may simply be a counterattack against Kalshi's "turning to Trump"; from a long-term perspective, it may be Musk's strategy to challenge the existing regulatory paradigm and build "borderless financial tools" for X. He clearly does not want his super app journey to be constrained by the pace of traditional financial compliance.

X's Financial Ambitions: From Payment Systems to Prediction Markets

In fact, X has a long-standing connection to financial services. As early as 1999, Musk founded X.com, attempting to create an online hub for global financial transactions. The company later merged with Peter Thiel's Confinity, giving birth to PayPal. Although Musk was ousted from the board, PayPal ultimately became the main brand, but he never abandoned the concept of "X." In 2017, he bought back the X.com domain from PayPal, calling it "emotionally valuable." Five years later, he acquired Twitter and integrated it into X Corp, reviving his former vision.

"If you just want to be a niche payment system, PayPal is more suitable; but if you want to take over the global financial system, then X is the only option." This is a statement Musk left in "Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic Future." He has never hidden his ambition to turn X into "the WeChat of the West"—a super platform that integrates social, payment, content, information, and identity.

Prediction markets are a new piece of the puzzle for X in moving towards this goal. The data structure and user behavior of Polymarket are highly complementary to X's real-time public sentiment, AI analysis engine Grok, and the future XPay payment system that may be launched. Musk clearly hopes that by incorporating Polymarket into the ecosystem, he can capture social trends, public opinion tendencies, and even market sentiment from user-generated data, forming commercializable and actionable financial products.

The collaboration press release explicitly states that Polymarket's prediction results will be combined with Grok AI's semantic understanding capabilities to generate "explainable prediction data flows," providing X users with data insights that have real-time context. This provides a practical example for the long-term narrative of "AI × Finance × Social."

At the same time, X is also accelerating its expansion at the product level. On June 1, Musk announced the launch of the XChat system, featuring end-to-end encryption, automatic message destruction, file transfer in any format, and cross-platform audio and video calls, claiming it uses a "Bitcoin-style encryption" architecture developed in Rust. Evolving from a social messaging tool to a comprehensive platform, X is rapidly approaching the structural prototype of WeChat.

Combined with previously launched content creator revenue-sharing mechanisms, protests against Apple's in-app purchase commission policy, and advertising rebates for Twitter Blue users, it is evident that Musk is building a closed ecosystem "from content to payment." Prediction markets are expected to become one of the earliest data product lines to achieve profitability within this ecosystem.

Musk has stated that he "will never issue a cryptocurrency for X," but this does not prevent him from continuing to test on-chain financial functions. From a payment logic perspective, the combination of prediction markets and crypto assets has inherent advantages—trustless, quantifiable, and composable, aligning with the Web3 toolchain. If X launches a system similar to XPay in the future, Polymarket could also become part of an embedded functional module, which aligns with the macro environment's gradually crypto-friendly trend.

Polymarket as a Speculative Target

As a blockchain-based prediction market platform, Polymarket has yet to issue a native token, leading many users in the crypto community to anticipate its future token launch and airdrop.

UMA

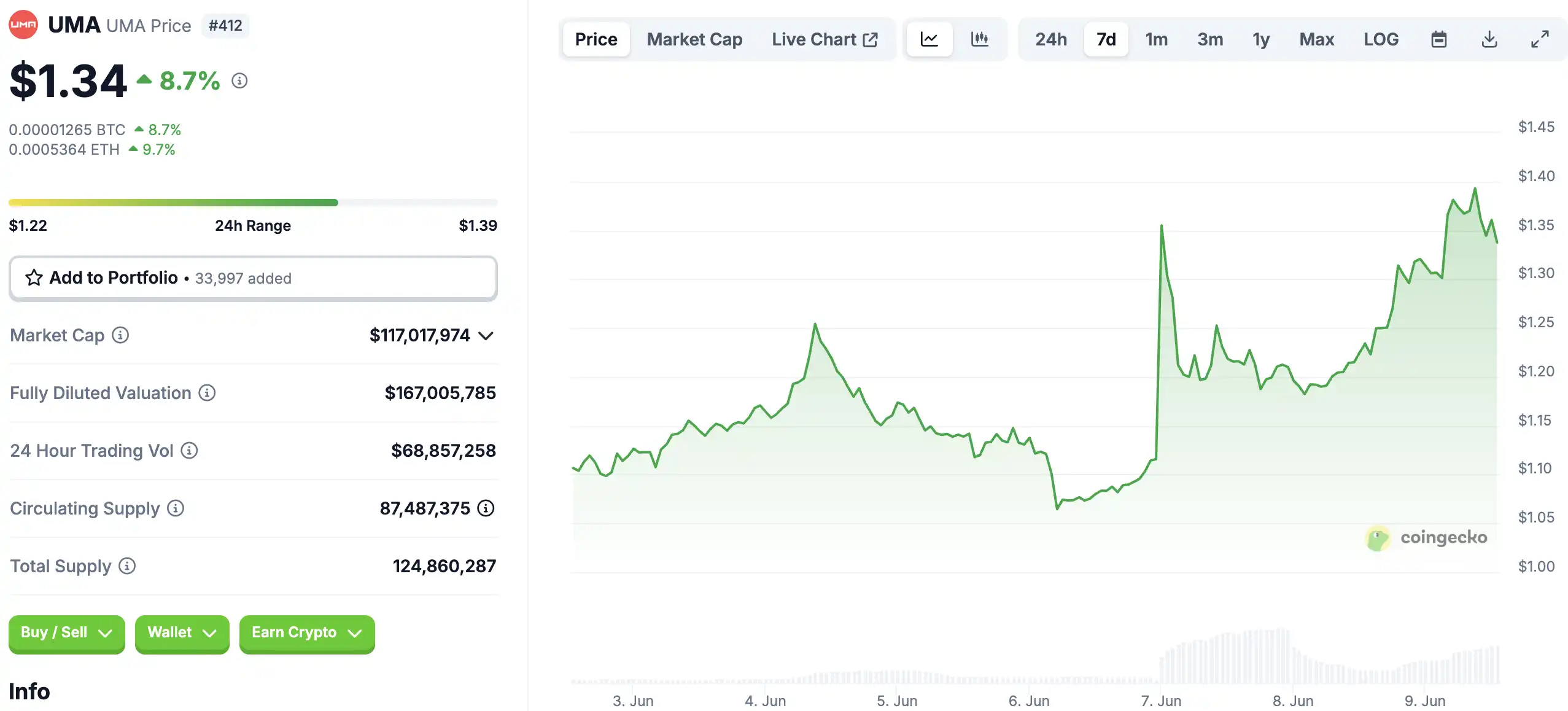

Meanwhile, the market is also looking for direct speculative targets related to this. UMA is the core oracle for Polymarket, used to settle the results of prediction markets. Polymarket relies on UMA's Optimistic Oracle to ensure the fairness and reliability of market outcomes.

The collaboration between X and Polymarket could significantly increase Polymarket's trading volume and user base, thereby raising the usage and demand for UMA. As trading volume on Polymarket grows, the demand for the UMA oracle will increase, potentially driving up the staking and governance demand for UMA tokens, further boosting their price.

Polycule

After the revival of Polymarket's trading volume, derivative projects surrounding its development have also emerged.

Polycule is a streamlined Telegram trading bot designed to simplify trading on the Polymarket prediction market platform. On June 8, Polycule's founder krish announced on the X platform that they had secured a $560,000 investment from Alliance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。