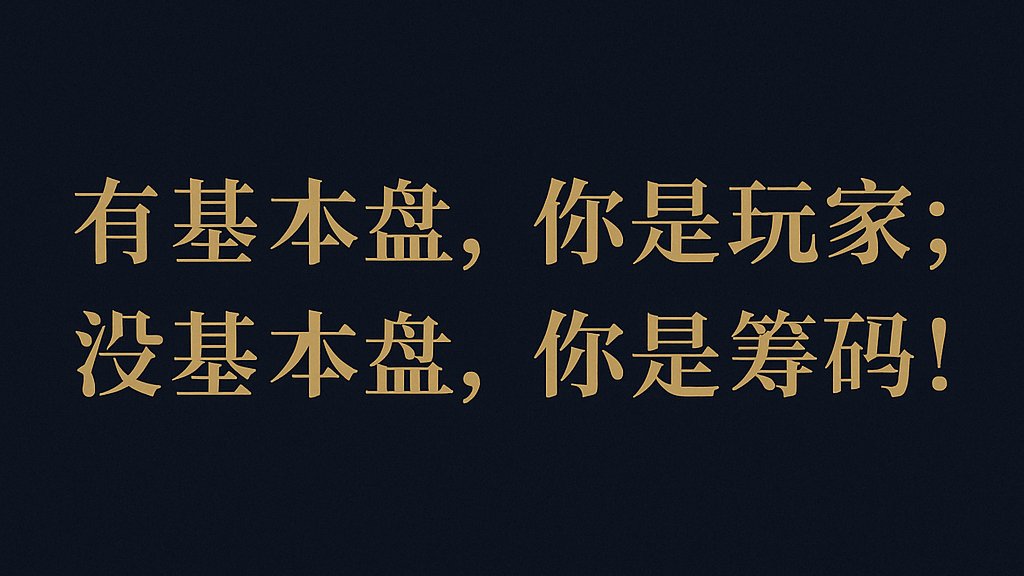

🚨Must-Read Article: What is the Confidence in Investment? | With a Basic Foundation, We Are Players; Without a Basic Foundation, We Are Just Chips——

Yesterday, the tweet from Sister Doll @MyHongKongDoll reminded me again of the thoughts about cash flow and basic foundation;

One cannot understand the importance of this matter without experiencing bankruptcy once or twice;

1️⃣ Investment Requires a Basic Foundation First

Many people ask, why is it easy to lose money in investments?

The root cause often lies not in vision, but in the lack of a basic foundation, which means—lacking the underlying ability supported by stable cash flow.

Without cash flow, unrealized losses can cause anxiety and helplessness, and when emotions take over, it disrupts our cognition and plans.

I realized this issue in the last cycle:

The major pullback after the last bull market caught me off guard; the lack of a basic foundation led to a significant shrinkage of funds, but expenses remained, and family obligations were still there, which can throw you off balance, causing losses to grow larger.

2️⃣ What is a Basic Foundation?

In one sentence: Cash flow that can withstand cycles, provides stable support, and allows you to make decisions with peace of mind.

So just as @MyHongKongDoll said:

There is no such thing as a small gain; without accumulating small steps, one cannot reach a thousand miles. You should be clear about where your basic foundation lies; one cannot understand the importance of this matter without experiencing bankruptcy once or twice;

A basic foundation is not a high salary, not a one-time windfall, and not relying on hitting a certain skyrocketing asset. It is the money you can continuously obtain, which can cover living costs and even provide a surplus.

There can be many forms:

Main job income (the most common basic foundation);

Side business cash flow;

Stable rental income;

Dividends from stocks and bonds;

Stable financial management interest;

Profit sharing from long-term trusted partnerships;

Negative examples:

Living off selling coins/stocks/assets (too volatile, not considered a basic foundation);

Relying on high leverage for high returns (risk of liquidation at any time);

Relying on one-time speculative arbitrage (can be encountered but not sustainable);

3️⃣ Why is a Basic Foundation Important?

Investment is essentially a game of mindset;

With a basic foundation, you do not need to rely on investments for survival; your investment can have the right mindset—“profits and losses are in the game, life is outside the game.”

Most importantly, you can withstand cycles and accumulate compound interest. When others are forced to cut losses due to interrupted cash flow, you can hold on, afford to buy, and catch the bottom.

This way, you can think independently in the long term and not let short-term market conditions sway your mindset.

4️⃣ How to Build Your Basic Foundation?

1) Prioritize understanding your living expense needs:

Your basic foundation should cover your "necessary expenses + security expenses";

2) Prioritize engaging in cash flow businesses with strong certainty:

Quality main job (for those with strong professional skills);

Stable side business (media, consulting, training, services);

Asset income (investing in bonds, real estate, dividend-paying stocks);

Long-term clients/partners;

3) Reduce dependence on high-volatility assets

Do not call "selling coins to pay the mortgage" cash flow

Do not call "living off trading coins" cash flow (this is a typical negative example; many people mistakenly believe they have cash flow during a bull market, but face problems in a bear market)

4) Set reasonable ratios

Ideally:

50-70% cash flow = sources of certainty;

30-50% cash flow = low-volatility controllable sources;

Speculative funds = completely using spare money, not affecting the basic foundation.

You need to have a cash flow ability that can withstand bull and bear markets; 99% of the mindset and confidence on the investment journey comes from this ability.

Money earned by luck will eventually be lost back due to lack of understanding.

And understanding and confidence are slowly accumulated through a basic foundation.

In summary:

You need to have a cash flow ability that can withstand bull and bear markets; 99% of the mindset and confidence on the investment journey comes from this ability.

The confidence in investment does not come from account balances but from stable cash flow. Money earned by luck will ultimately be lost back due to lack of understanding;

And understanding + confidence are slowly accumulated through a basic foundation. Once you understand this logic, you will realize: why some people can thrive at the poker table for a long time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。