Sunday's homework was much simpler, I just lay flat all day. Today, I was quite disappointed to see that Robinhood couldn't join the S&P 500 in the second quarter. I had prepared funds but couldn't buy $CRCL, and my plan to switch to $HOOD also didn't succeed. Should I chase $MSTR on Monday? If that doesn't work, maybe I'll buy some Tesla? I'll decide tomorrow.

Next week, the focus should be on the trade talks between China and the U.S. If we consider Beijing time, it should be on Tuesday. I expect that market sentiment will start to react when the market opens on Monday. I hope there will be a definite outcome this time; currently, the main issue with tariffs is also with the EU and China.

Additionally, we have the CPI and PPI data coming out next Wednesday and Thursday. The current market expectations are not good, with predicted data exceeding previous values. If the data turns out to be as predicted, it could negatively impact expectations for interest rate cuts and market sentiment, so we need to pay attention next week.

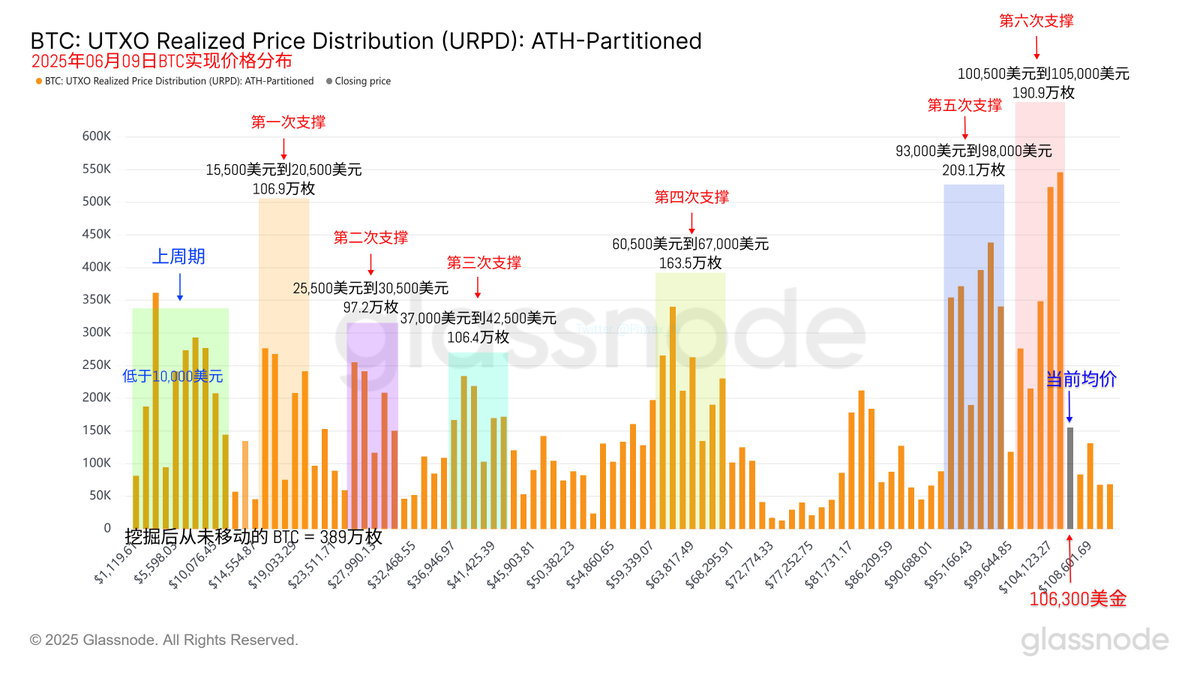

Looking at Bitcoin's data, everything seems normal; it remains a classic weekend market with very low turnover. Investor sentiment is very stable, and those who were selling at a loss during the weekdays have stopped selling. Only the investors who bought the dip yesterday have a slightly higher turnover, while most others are enjoying the weekend.

With low turnover, support hasn't changed. More chips are accumulating between $104,000 and $105,000, and the positions at these two levels already hold nearly 1.07 million $BTC. The market's urgency in choosing a direction has started to become apparent.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。