Original Title: "Circle's Strong IPO, Two Circuit Breakers, Who Are the Beneficiaries Behind It?"

Original Author: Fairy, ChainCatcher

After seven years of hard work, the bell has finally rung. The "compliance narrative" of USDC has finally received its Wall Street certification. Since 2018, Circle has been knocking on the door of the capital markets, experiencing cycles of bull and bear markets, policy games, and even a failed SPAC listing. Now, this long journey to IPO has finally reached its destination, opening a new chapter for the stablecoin narrative.

Circle's IPO Begins

On its first day of trading, Circle (CRCL) performed strongly, opening significantly higher and triggering circuit breakers twice, with the stock price soaring to $103 per share at one point. Within just 40 minutes of opening, the trading volume exceeded 20 million shares, and the market capitalization surged to over $20 billion. Circle completed its IPO on the New York Stock Exchange at $31 per share, raising $1.1 billion and achieving a valuation of $6.2 billion. This impressive performance exceeded the initial expected pricing range of $24-26.

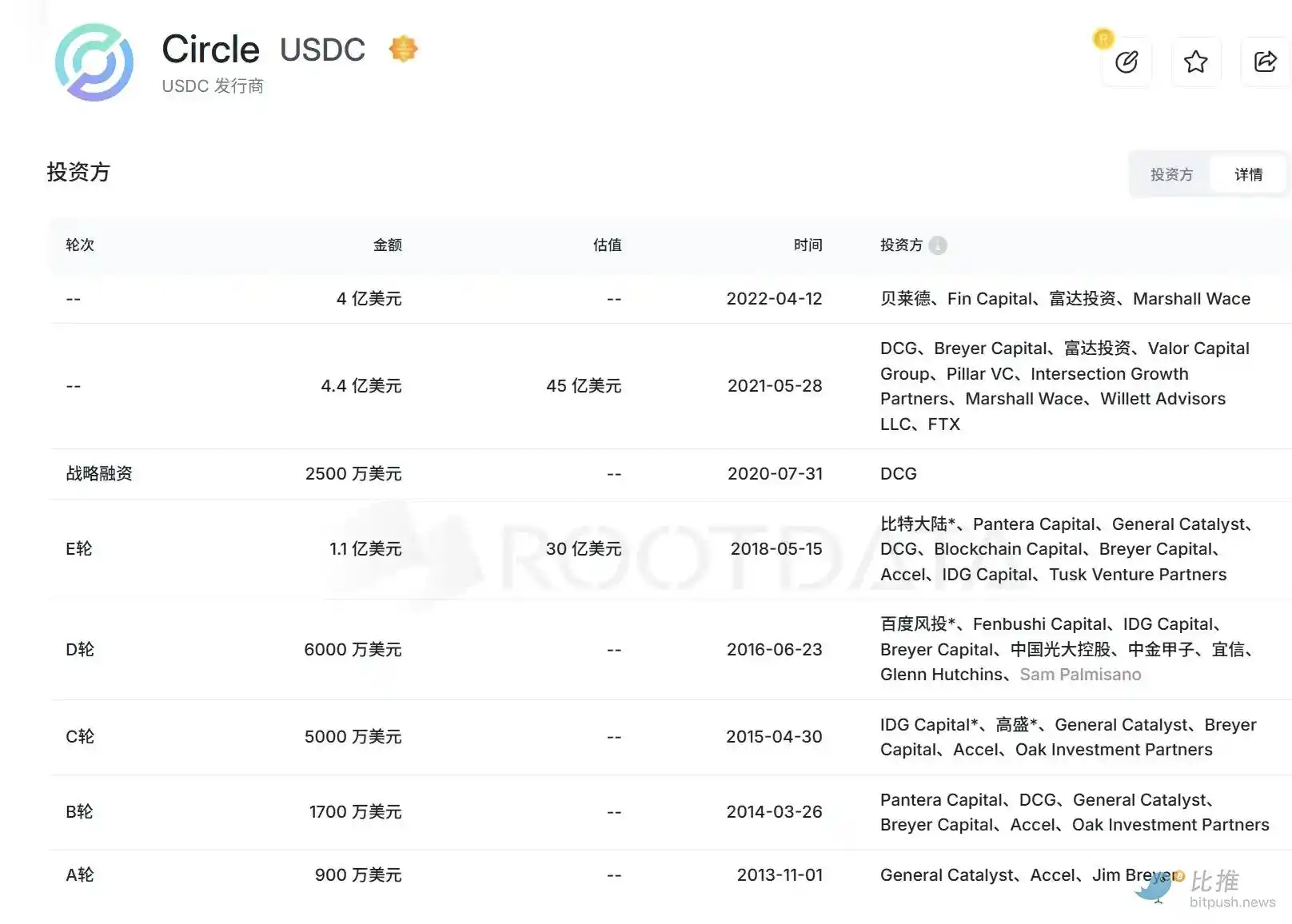

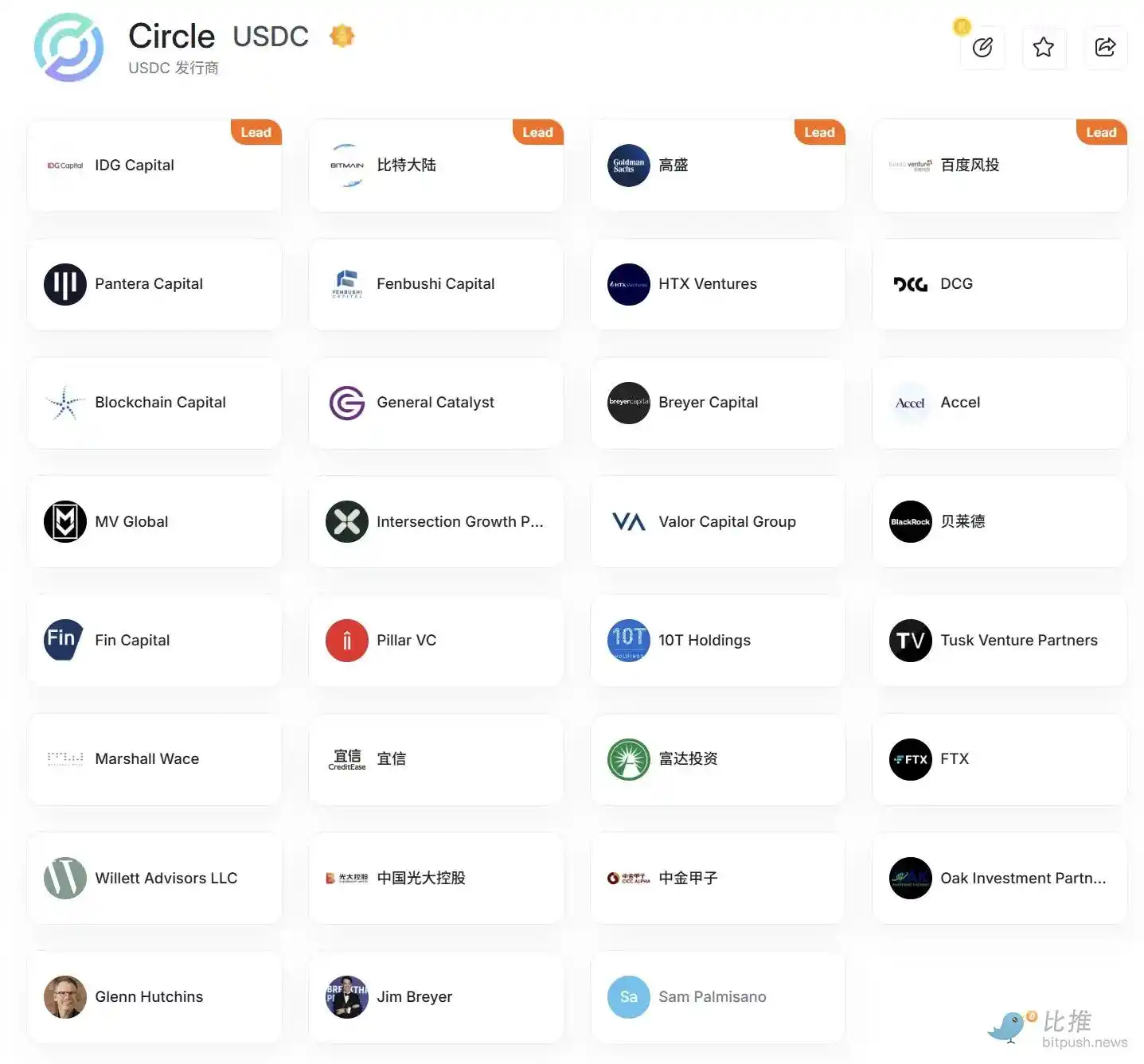

In fact, this IPO feels more like a concentrated explosion after twelve years of accumulation. According to RootData, since its establishment in 2013, Circle has completed eight rounds of financing, with a total amount raised reaching $1.111 billion. Its backers include top-tier institutions such as Goldman Sachs, Accel, General Catalyst, and Fidelity. Now, the IPO is not only an exit for capital but also an upgrade and affirmation of its identity narrative.

Why Did Circle Accelerate Its IPO Now?

With the GENIUS Act stablecoin bill achieving a key procedural breakthrough and the U.S. compliance framework gradually becoming clearer, Circle decisively pressed the accelerator for its IPO. It may seem like "riding the wave," but in reality, it is about "securing a position."

The Trump family's crypto project WLFI has issued the stablecoin USD1, Wyoming plans to launch the first state-level stablecoin in the U.S. in July, and traditional financial giants like JPMorgan, Citigroup, and Wells Fargo are frequently making moves in the stablecoin space. Circle's carefully cultivated compliance moat may lose its significance overnight once the "national team" enters the arena. The IPO may not be about adding to the cycle but about "stamping" its own positioning and striving for the last first-mover advantage amid regulatory tides.

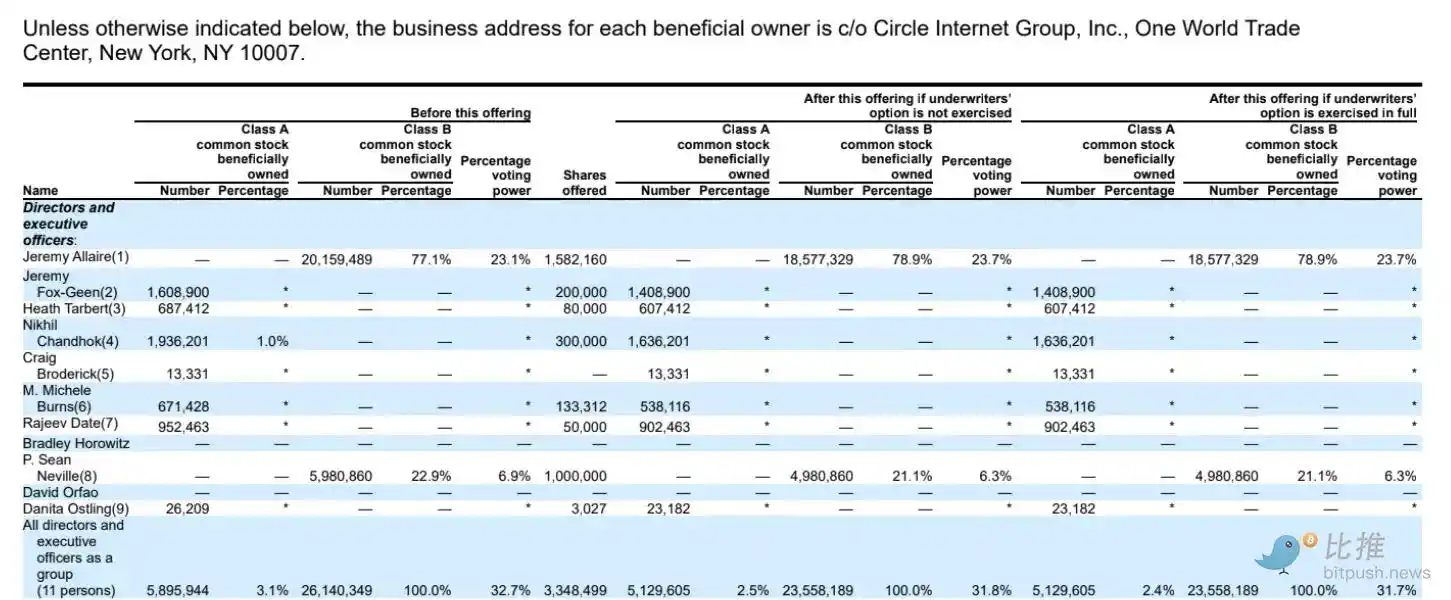

Moreover, details disclosed in the prospectus reveal another side of the IPO: in this IPO, existing shareholders are selling a staggering 60% of their shares, far exceeding the typical IPO level for tech companies. CEO Jeremy Allaire plans to reduce his stake by 8%, while top investment firms like Accel, Fidelity, and General Catalyst also plan to reduce their stakes by about 10%. For many early investors, the current window may represent a better "exit opportunity."

Fortunately, the market response has been quite enthusiastic. After the IPO announcement, Ark Invest stated it would subscribe for $150 million, and BlackRock also plans to acquire 10% of Circle's total IPO issuance. Due to strong investor demand, Circle's issuance scale was raised from 24 million shares to 32 million shares, with the final public offering being oversubscribed by more than 25 times.

Who Will Soar Alongside?

Circle's successful IPO is not only a highlight for itself but also signifies that the global stablecoin sector is entering a new round of mainstream capital catalysis. Against this backdrop, a number of early investors in the stablecoin ecosystem, focusing on core technology and compliance capabilities, are now facing a "value reassessment" window. So, in this new trend, which assets are most likely to benefit first?

Early Shareholders

As early as 2016, Chinese giants such as Baidu, Everbright Holdings, CICC, and Yixin placed strategic bets on Circle as early supporters. Now, with the acceleration of mainstream adoption, early shareholders are being refocused. Among them, Everbright Holdings has seen a rise of 38.8% in the past week, with the market already responding to this potential dividend. Here are Circle's investors:

In addition, we have compiled a list of some Hong Kong-listed companies related to stablecoins:

ZhongAn Online: Its joint venture ZA Bank is the first local digital bank to provide reserve services for Hong Kong stablecoin issuers.

OSL Group: A licensed compliant exchange that has partnered with Ethena to launch stablecoin interest products.

Standard Chartered Group, HKT: Collaborating with Animoca to issue stablecoins and has applied for a Hong Kong stablecoin license.

LianLian Digital: Engaging in cross-border stablecoin payments through LianLian International, with its subsidiary DFX Labs having previously obtained a Hong Kong VATP license.

Coinbase, Base

In 2018, Coinbase and Circle jointly launched the CENTRE alliance, introducing the USDC stablecoin. Although CENTRE was dissolved in 2023, Circle became the sole issuer of USDC, while Coinbase retained a 50% revenue share from USDC and some equity, keeping their relationship close.

Therefore, Circle's IPO may not only directly benefit Coinbase (COIN) stock prices, but its Ethereum Layer 2 network Base is also worth paying close attention to. Base is a Layer 2 blockchain developed by Coinbase, where USDC accounts for as much as 90% of the stablecoin market share on its network.

Related Tokens

In addition to the equity and industry chain reactions, some related tokens may also rise in tandem with market sentiment. For example, MKR, as the core token of MakerDAO (now renamed Sky), has a high proportion of USDC among its underlying collateral assets, and Circle's positive news is expected to drive its price up. Overall, the stablecoin sector and leading DeFi projects are likely to become beneficiaries in this round of market activity.

Additionally, the following tokens are also worth noting:

ENA: A popular target under the stablecoin narrative.

ONDO: BlackRock announced it would subscribe for 10% of Circle's IPO shares, and the U.S. Treasury token OUSG issued by Ondo is based on BlackRock's BUIDL fund as its core underlying asset.

CRV: Curve is a major venue for trading various stablecoins, with USDC being one of the core assets in Curve's liquidity pools.

USDC has gained a new value metric, and Circle has resonated with the capital markets. Circle's IPO is not only a milestone for the "first stablecoin stock" but also opens up a real and visible imaginative space for the future of stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。