The world's second-largest stablecoin giant, Circle, is set to go public on the New York Stock Exchange tonight, marking the second native U.S. stock listing in the cryptocurrency industry after the largest U.S. cryptocurrency exchange, Coinbase, in 2021. Four years ago, Coinbase's listing heralded the peak moment for Bitcoin, and now, four years later, coinciding with a new bull-bear cycle in cryptocurrency, Circle's listing presents a fresh narrative for the industry—stablecoins.

In simple terms, a stablecoin is a tokenized version of the U.S. dollar, pegged to the dollar at a 1:1 ratio. For a detailed interpretation of stablecoins, refer to “The Federal Reserve Understood Stablecoins Three Years Ago.”

Stablecoins, along with the concept of RWA (Real World Assets on-chain) that has emerged from them, have shown a marked difference from previous years since the beginning of this year. The favorable U.S. stablecoin policy and Hong Kong's stablecoin policy, combined with Wall Street's focus on RWA projects represented by giants like BlackRock, and the influx of traditional money into stablecoins, have rapidly brought the concepts of RWA and stablecoins into the mainstream. Circle, which was not previously viewed as favorably, has seen its IPO valuation soar from $5.4 billion to around $7 billion, bolstered by BlackRock and Cathie Wood's rush to purchase IPO shares.

The Bitcoin white paper defines Bitcoin as "a peer-to-peer electronic cash system." However, Bitcoin has long since become a financial commodity, and no one uses Bitcoin for payments anymore. The only asset that can currently function as a peer-to-peer electronic cash system is stablecoins, which is where the true potential of stablecoins lies.

Jeremy Allaire, the founder of Circle, recognized all of this seven years ago.

Below is a summary of Jeremy's narrative as organized by Rhythm BlockBeats.

The "Shovel Seller" of the Web 1.0 Era

In 1990, I began to engage with the internet, and what truly sparked my interest was experiencing the power of open networks, distributed systems, decentralized architectures, open protocols, and open-source software firsthand. I often refer to these as the "DNA of the internet."

During that time, I was also following the dissolution of the Soviet Union, deeply shocked by this structural transformation, and began to delve into technology, increasingly convinced that the internet would change the world.

By 1994, the first graphical web browser technology was born. At that moment, I realized we finally had software that could display content, applications, and various things on web pages, giving rise to the concept of "the web as an application platform."

Thus, my brother and I, along with some partners, founded Allaire Corporation and launched ColdFusion, the first commercial web programming language.

At that time, although there was Perl and some people were writing dynamic page logic in C on web servers, ColdFusion truly made web application development simple and user-friendly—if you had an idea and about a thousand dollars, you could create an interactive web application that could be used in a browser.

In 1995, this was already a significant breakthrough. With the rise of websites, e-commerce, and online content, we rode this wave. Allaire also developed a complete set of tools, and millions of developers worldwide were using our software.

As the market matured, we successfully went public in early 1999.

We were somewhat "alternative" at that time because we were a profitable public company—most companies were in a loss state when they went public during the internet bubble. But we were more like the "shovel sellers" of the Web 1.0 era, providing foundational tools for the entire industry.

After going public, we merged with Macromedia, which was also a giant in creating internet and content development tools. I became the CTO of the new company after the merger and began to promote the development of Flash applications. It was a powerful software that allowed web pages to achieve more complex multimedia presentations and interactive experiences.

The "Couch Economist" Falls into the Crypto Rabbit Hole

Returning to the initial moment I engaged with the internet, I was originally studying international political economy, focusing on the comparison of various economic systems and political institutions, and was very interested in macro issues related to the international economic system. Then I became excited about the internet, deeply attracted by the transformation in information transmission and software distribution brought about by these open networks.

During my time at Macromedia, as early as March 2002 (yes, 2002, not 2022), we integrated seamless video playback capabilities into Flash Player, making video playback ubiquitous on the internet.

For the first time, anyone could easily embed videos in their browsers. The explosion of YouTube was built on this technology—it was initially implemented based on Flash Player.

Later, I founded a company called Brightcove. The philosophy of Brightcove was still based on the underlying genes of the internet: open networks, open protocols, and distributed systems.

My idea at that time was—could we enable any company or media organization to publish video and television content directly on the internet? Keep in mind that it was 2004, when broadband was just starting to emerge, Wi-Fi was just beginning, and smartphones did not yet exist, but people were already talking about the future of "connected devices."

One clear point was that I could see a future with a large number of connected devices, with Wi-Fi and mobile broadband, and video dissemination would be completely liberated.

So we built an online video distribution system—understandable as an "online television platform."

This was an extension of the capabilities of the internet: increasingly rich and more authentically realizing what people envisioned in Web 1.0, finally coming true in the Web 2.0 era, and Brightcove's business was also very successful, ultimately going public in early 2012.

Why Found Circle?

The 2008 financial crisis sparked reflections from my academic years, turning me into a "couch economist," voraciously reading various materials on the nature of money, central banking, the international monetary system, and fractional reserve systems. I pondered, "What is going on here?" and began to think about whether there could be a better monetary system. Is there a better way to construct the international financial system?

Of course, this wasn't something where you wake up one day and say, "I want to start a company that disrupts the global monetary system." It was 2009 and 2010, and there were no realistic paths to achieve these ideas; I was just continuously researching.

But by 2012, shortly after Brightcove went public, I encountered cryptocurrency and dove headfirst into this rabbit hole.

Jeremy Allaire during the Brightcove era

I came from a technical and product background, and after entering this field from a technical perspective, I saw some astonishing things: this was a true technological breakthrough.

Some computer science problems were solved, and these solutions were incredibly powerful. For the first time, I synchronized the Bitcoin blockchain on my laptop and completed a peer-to-peer transaction—directly on the internet, entirely relying on open protocols. That moment felt like the first time the Mosaic browser opened a web page—I thought, "My God, this is the missing internet infrastructure!"

Next, my co-founders and I delved deeper into our research, especially in the tech community at the time, where we encountered many discussions about:

Besides Bitcoin, could other types of digital assets be issued on such networks? Today we refer to these as "tokens" or "digital assets." Given my previous work in virtual machines and programming language development, it was natural for me to participate in the discussions:

How can we make these digital assets "programmable"?

How can we achieve "programmable money"?

How can we build smart contracts?

At that time, these ideas were still just concepts on napkins, and some white papers had just emerged, but we were very clear that these would be realized; it was just a matter of time.

So we combined all these ideas with another question: how to build a more secure and open financial system? These thoughts converged into the only thing I could think about, and I became almost obsessed, ultimately deciding to found Circle.

Our original intention was to create a protocol for "money" similar to HTTP. Could we build an open internet protocol suitable for the U.S. dollar? This protocol would be open, programmable, and so on.

This was our vision ten years ago, and it has now come true, becoming a true "killer application" in the crypto space. Although building this system took a long time, it has now reached a considerable scale, even though it is still in its early stages.

The Rise of USDC

In the spring of 2018, the crypto market experienced a significant correction, and the entire industry fell into a severe winter, with almost the entire market declining sharply. Our products, which were originally capable of generating revenue and profit, either barely broke even or began to incur losses, leading us to burn cash at an alarming rate.

By 2019, at the depth of that winter, financing became exceptionally difficult. Meanwhile, our operating costs had spiraled out of control, and we were running out of cash—if we did not take action, we would face bankruptcy.

It was at this time that we officially launched USDC in October 2018.

A Gamble

In 2019, DeFi protocols began to widely adopt USDC, and the market saw early signs of product-market fit (PMF). Although the market was still highly volatile at that time, from a technical perspective, Ethereum had matured enough to truly support these use cases, with MetaMask and other related products available, allowing developers to finally start using these tools effectively.

Despite the trading volume being small at that time, the developer community's acceptance of USDC was very high. We recognized this and realized that this was our company's original vision, this was our core, and this was what we truly wanted to do.

Thus, in a very short time, we rapidly sold three business units—we sold the Poloniex exchange, the Circle Trade OTC trading business, and the Circle Invest product aimed at retail investors, while also shutting down and liquidating our previously launched payment application.

By selling these assets, we obtained the urgently needed funds and undertook a complete restructuring of the company. Some employees were transferred to these divested businesses, and the company underwent significant adjustments overall.

By the fall of 2019, we were once again on the brink of bankruptcy, but at the same time, USDC began to show early signs of vitality in the market. So we made a decision—to fully bet on USDC. We decided to invest all our energy into it, building a complete platform around it to promote its widespread adoption.

This was essentially a "gamble on the company." At that time, USDC itself had not yet generated any revenue, and the entire company was barely making any income. But I firmly believed that the era of stablecoins had arrived, and they would ultimately become a core component of the global monetary system. Stablecoins were the most suitable monetary structure for the internet age.

We had the right product, and as long as we persevered, we would find the right path and create something valuable. So we pushed ourselves to advance it.

This was the first real major challenge in the development of USDC. Although we had faced many difficulties before, this moment was critical for the survival of the entire company. While USDC had already gained early momentum, it was not enough to support a scaled company.

We redirected all company resources to USDC, betting all our funds on it. I remember clearly that we officially announced this strategy in January 2020, when the homepage of Circle's official website was completely revamped into a massive billboard promoting "Stablecoins are the future of the international financial system." The only action button on the page was: "Get USDC." All other functions were removed.

Then, on March 10, 2020, we launched an upgrade to the Circle platform, completely overhauling the USDC account system and introducing a new set of APIs to facilitate developers in seamlessly integrating payment systems like banks and credit cards for USDC deposits and withdrawals. The entire platform was built around USDC.

Just three days later, on March 13, the world entered lockdown due to the COVID-19 pandemic. Interestingly, USDC had already begun to grow in February 2020, before our official launch. I believe this was because users in the Asian market had already recognized the severity of the pandemic and began to react in advance.

During that time, a very complex intertwining phenomenon occurred: many people, due to distrust in their national financial systems, began to transfer funds into digital dollars; at the same time, governments around the world began to roll out large-scale emergency stimulus policies, attempting to inject liquidity into the market to prevent the economy from falling into a "Great Depression."

Thus, we saw a highly coordinated super-loose monetary policy emerge globally, leading to a massive influx of funds into the market. People sat at home with government-issued stimulus checks, pondering, "How should I use this money?"

During that period, the world also experienced a significant turning point—the digitalization process of society suddenly accelerated.

The concept of the metaverse began to gain popularity from that point, as people transitioned online overnight. All digital products experienced explosive growth. From Zoom (which became a representative company of that period) to home fitness platform Peloton, to e-commerce, online retail, digital payments, and online marketplaces—almost every digital industry saw a five-year level of growth acceleration during that phase.

At the same time, the adoption of blockchain technology and the digital asset market also entered an explosive phase.

The summer of 2020 was dubbed the "Summer of DeFi," and USDC skyrocketed from a circulation of $400 million at the beginning of 2020 to $40 billion within a year, representing a dramatic and explosive growth.

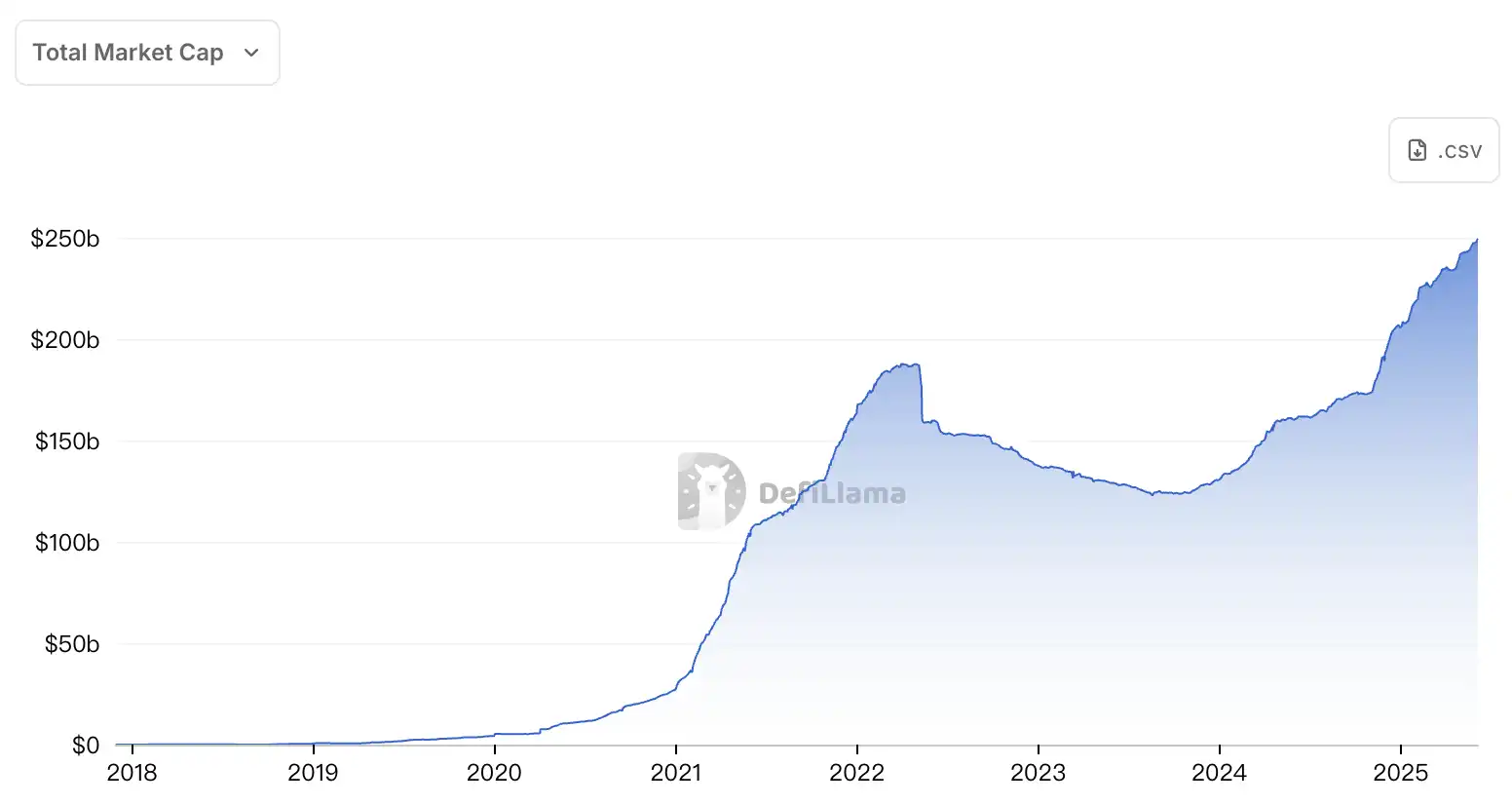

Stablecoin Market Capitalization Growth Curve

Preconditions for the Popularization of Stablecoins

Over the years, and even just a year or two ago, people often asked, "How can this thing achieve true mass adoption?" My consistent answer has been: we need to solve three key issues. Of course, "we" here does not just refer to Circle, but to the entire industry, requiring collective efforts to drive progress.

The first issue is infrastructure, which refers to the blockchain networks themselves.

My thinking model for blockchain networks is that they are like "the operating systems of the internet." What we need are higher-performance, higher-throughput operating system-like blockchain networks. Significant progress has been made in this area over the past few years. We have now entered the era of "third-generation blockchain networks"—that is, high-performance Layer 1 public chains and Layer 2 scaling networks.

This means achieving higher transaction throughput, with the cost of a single transaction being extremely low, possibly less than a penny, even less than a cent.

Coinbase CEO Brian Armstrong previously stated, "Transaction times under one second, costs under one cent," and we have indeed largely achieved this state now. The advancements in these high-performance networks are also driving the growth of the entire ecosystem. By lowering unit costs and marginal costs while increasing transaction speed—it's like transitioning from dial-up internet to broadband, from Web 1.0 to Web 2.0.

The second issue is network effects. Stablecoins like USDC are essentially network-type product platforms, where developers build applications based on them. The more applications that connect, the stronger the overall network's utility becomes; the more users that hold stablecoins, the greater the network's utility, creating a positive feedback loop.

At a certain stage, developers will even realize that if their products do not support USDC, they may fall behind in competition. So when the infrastructure upgrade is complete, this network effect between users and developers truly begins to take effect.

Next is the third issue, which is the so-called improvement in "usability," which is closely related to infrastructure upgrades. Remember two or three years ago, if you wanted to use stablecoins, you had to first purchase them on a platform, then install a browser extension wallet, and to use the wallet, you had to buy Ethereum, pay high transaction fees, and then transfer ETH to your self-custody wallet. The entire process took seven to eight minutes and was particularly cumbersome, making it completely unreasonable.

At that time, if someone asked, "Who would want to use this thing?" it was entirely understandable.

But now you can directly access the wallet system through a web interface or mobile app, and the entire experience is like registering for WhatsApp, possibly requiring just a phone number, facial recognition, or biometric code, without needing to remember a seed phrase or deal with a bunch of complicated settings.

All these changes combined are creating a favorable usage environment, making stablecoins easier to accept and use.

The final ultimate hurdle is government regulation.

The most exciting thing is that now, globally, from Japan, Hong Kong, and Singapore to all of Europe, the UK, the UAE, and the United States, almost all major jurisdictions are gradually introducing relevant laws that explicitly recognize stablecoins as legal electronic currency and incorporate them into the formal financial system.

Once these laws are implemented, the use of stablecoins will expand from early crypto natives to a broader general population. Therefore, we believe that by the end of 2025, stablecoins are likely to become a widely legally integrated part of the global financial system.

Of course, we must also recognize that all of this is still in a very early stage. You can view the current state through Geoffrey Moore's "Crossing the Chasm" theory: we are like the process of leaping over that "chasm" in mid-air, not yet having truly landed, and still at risk of failure or falling. But I believe we will make it across.

We are seeing more and more institutions that I call "FinTech-friendly banks," or "emerging digital banks (neobanks)," beginning to natively support the use of stablecoins. For example, NuBank in Latin America, Revolut in Europe, or brokerage applications like Robinhood.

This also includes large crypto companies like Coinbase and Binance, which together have over 400 million users. In a sense, they have already transformed into "financial super apps": you can store balances, receive salaries, link cards for spending, and the process of obtaining and using USDC has become very smooth.

We are indeed witnessing a trend—people are starting to view the "dollar" as a unit of value storage, but its underlying form is actually USDC.

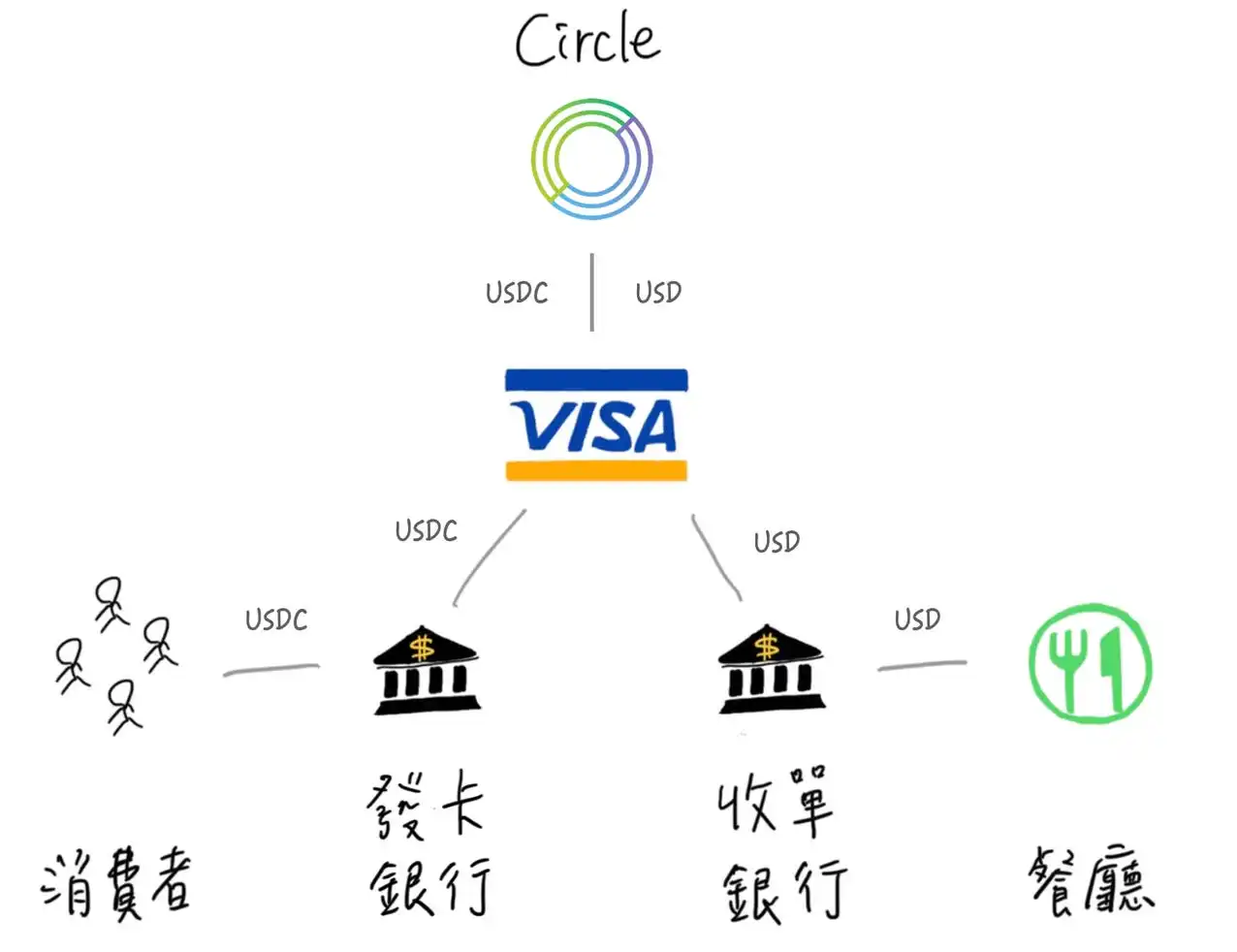

Moreover, we are now collaborating with Visa and MasterCard, both of which have projects allowing card issuers to issue such cards: on the surface, they are Visa or MasterCard, but in actual transactions, stablecoins like USDC are used.

This model has emerged in large numbers in emerging markets, where users obtain a physical or virtual card through new bank-style digital wallet apps, and this card is linked to their stablecoin balance. Many people wish to hold dollars, and these cards allow them to continue spending within traditional card networks, with the backend settlement process using USDC.

Even for these card issuers, the settlement funds they pay to Visa or MasterCard can now also be completed directly through USDC. This means that USDC is effectively being used as a settlement channel between financial institutions and card networks, which is quite interesting in itself.

At the same time, we are also seeing changes on the merchant acquiring side, with companies like Worldpay, Checkout.com, Nuvei, and Stripe beginning to offer merchants the option to settle in USDC.

Earlier this year, we saw a very cool example: Stripe co-founder John Collison, at their annual conference, made a "grand reveal" as he had in previous years, stating something like, "Crypto is back, but this time it's not Bitcoin; it's USDC, it's stablecoins."

He demonstrated a new feature in the Stripe Checkout product—this product allows merchants to directly embed Stripe's payment gateway into their own websites or apps. In the demonstration, USDC was displayed alongside credit cards as a payment option, allowing merchants to choose to accept USDC.

Collison excitedly showcased the entire process on stage, saying, "This is how payments should be." In the demonstration, they used the Solana network, with real-time settlement and very low fees.

As the legal status of stablecoins becomes clearer, more and more financial institutions will view them as a foundational settlement layer.

For example, a merchant might say, "I want to accept USDC because I can receive money instantly and save on fees; it's a better choice for me."

On the user side, an increasing variety of terminal products are emerging—whether traditional banks, emerging digital banks, or crypto super apps, they are all creating a seamless experience that allows users to complete payments with just a scan of a QR code.

Another significant event I mentioned earlier this year on Twitter: iOS has begun to open NFC for use by third-party wallets. This means that Web3 wallets may support "Tap to Pay" in the future, allowing users to make payments at physical merchant terminals directly with their wallets containing USDC.

Of course, achieving this requires collaboration from multiple parties, such as payment processors and acquirers supporting on-chain transactions, wallet developers integrating NFC functionality into their products, and obtaining approval from Apple.

However, these plans are already in place, and we expect to see larger-scale implementations by 2025, which is indeed an exciting development.

Favorable Policy Environment

From the very first day Circle was founded, our philosophy has been to stand at the intersection of the traditional financial system and the new world of blockchain. To achieve this, the U.S. government clarified its legal stance as early as March 2013:

If you are a company that connects both the banking system and the virtual currency world, you fall under the category of "money transmitter," and you must register with the federal government, have a complete anti-money laundering program, and apply for licenses in every state where there are legal requirements.

We were the first company in the crypto industry to obtain a full set of compliance licenses from the ground up. We were the first crypto company to receive an Electronic Money Institution (EMI) license in Europe and the first to obtain the so-called "BitLicense" in New York—this was the first regulatory license specifically established for the crypto industry. For nearly a year after that, we were the only company holding this license.

We have always adhered to the principle of "regulation first," consistently choosing to take the "front door" approach to ensure we have a sound and robust compliance system. It is worth mentioning that it is precisely because of this compliance foundation that we can achieve another key goal: liquidity.

What is liquidity? It means you can truly create and redeem stablecoins, connect to real bank accounts, and use fiat currency to buy and redeem stablecoins. If you are a suspicious offshore company, no one is willing to open a bank account for you, and you simply cannot do any of this. You might not even know where your bank is.

We were the first to establish high-quality banking partnerships and brought in strategic partners like Coinbase to distribute USDC on a large scale at the retail level, allowing any ordinary user with a bank account to easily buy and redeem USDC. We also provide institutional-level services. In other words, from transparency, compliance, and regulatory framework to actual liquidity, we have achieved it all.

On the technological innovation front, we have also been exploring what else the protocol itself can do. We view USDC as a stablecoin network protocol and have been thinking about how to collaborate with developers to promote its integration and application. These fundamental principles are the root reason we have come this far, and we are still continuously building, not just for the U.S. market.

In terms of payment stablecoins, significant work has already been done in the U.S. The "Payment Stablecoin Act" is, in my view, quite mature, with bipartisan support in the House of Representatives and active participation from the Senate leadership. We have also seen high-level attention from the government, including the White House, the Treasury Department, and the Federal Reserve. This topic has been prioritized by the government for several years.

(Keynote: On May 19, the U.S. Senate passed the procedural vote for the "2025 U.S. Stablecoin Innovation Guidance and Establishment Act" (GENIUS Act) with a vote of 66 to 32, attempting to provide federal regulation for dollar-pegged stablecoins.)

Many key issues, such as how to ensure financial safety and soundness while supporting private innovation, the core role the Federal Reserve should play (establishing standards for dollar stablecoins), and how to provide pathways for state issuers and regulators, similar to the current "dual banking system"—where you can be a state-chartered bank or a federally-chartered bank—are all being advanced.

The financial system itself is a highly regulated industry; the energy system is highly regulated, the transportation system is highly regulated, the aerospace system is highly regulated, and pharmaceutical production is also highly regulated. In fact, most critical technologies or infrastructures in society are under intensive regulation.

The software industry has been an exception over the past thirty years, with almost no regulation. But now, if you are doing something particularly large and cutting-edge, such as artificial intelligence, hardware combined with autonomous driving, or building a global digital currency system—these areas have begun to intersect with those traditional highly regulated industries, and they have a tremendous potential impact on society, making regulation reasonable.

I do not believe that "as long as it is innovation, it should not be regulated." If something becomes extremely important to society as a whole, it needs a corresponding spirit of contract and framework of social responsibility, which is a reality of existing systems. Regulation varies in intensity—global systemically important banks (G-SIBs) are subject to far more regulation than a local community bank.

So if what we are doing becomes systemically important in the future, not only will our relationship with the U.S. government change, but our relationships with other countries' governments will also change accordingly. Of course, these are all matters for the distant future, and we are not there yet.

What we are truly focused on now is how to realize our vision for the internet financial system, how to make "open, programmable, composable money" a reality. We hope this innovation can truly take root rather than be stifled. Achieving this also requires policymakers and governments to provide more space for innovation—just as the internet once gained in other fields.

Circle's Business Model

I believe Circle is one of the most transparent financial institutions in history. If you observe a bank, an insurance company, or other types of financial institutions, you will find that they do not publicly disclose the operational status of their products in real-time, nor do they disclose basic data from their balance sheets daily, which is exactly what we have been doing.

How do we achieve this? First, when we receive U.S. dollars, these dollars are pre-deposited into reserve accounts before minting USDC. These reserve funds are set up as segregated accounts for the benefit of customers, as required by law. Legal and regulatory requirements mandate that we must keep these funds segregated, and only after this segregation can we issue electronic currency instruments, with ownership of the funds belonging to the customers. Therefore, we strictly comply with all legal, regulatory, and operational requirements.

How to Ensure Reserve Safety

So, what do these reserves consist of? Currently, the reserves are mainly divided into two parts:

About 90% of the reserves are held in an account called the Circle Reserve Fund. This is very important. We want anyone interested in understanding USDC to clearly see the composition of these reserves within a regulated structure. Therefore, we partnered with BlackRock, the world's largest asset management company, to establish the Circle Reserve Fund.

This fund is essentially a government bond fund, which can also be understood as a government money market fund, with the sole purpose of holding the reserve assets for USDC. It is issued in the form of securities, regulated by the U.S. Securities and Exchange Commission, and has independent audits and an independent board of directors.

The entire asset of the fund is completely transparent to the public and updated daily. If you search for "USDC" online, you can visit BlackRock's official website and clearly see the face value, purchase date, and maturity date of each treasury bond. All treasury bonds have maturities within 90 days, representing extremely liquid and price-stable U.S. dollar assets.

Additionally, there are assets existing in the form of "overnight treasury repurchase agreements," guaranteed by the world's largest systemically important banks (G-SIBs), which are essentially equivalent to treasury bond assets.

Therefore, every component of this reserve structure is visible and transparent. Anyone familiar with market liquidity and financial assets will tell you: if we need to redeem all assets within 24 hours, it is entirely feasible.

About 10% of the reserves are basically held in cash at several global systemically important banks, commonly referred to as "too big to fail" banks. Currently, there are about 50 such banks globally, including institutions like JPMorgan. We have publicly disclosed some of these partner banks. These banks, due to their large size and solid reputation, effectively enjoy implicit government backing.

Furthermore, we have established a global infrastructure to support institutional clients in creating and redeeming USDC. The reason we can conduct these operations is that we are a regulated company. Banks and regulatory agencies around the world are therefore willing to allow us to operate in local markets.

We have currently obtained regulatory licenses in Singapore and Europe and are working with places like Japan to establish compliant distribution channels, meaning institutions can open accounts in the Singapore banking system, Hong Kong banking system, Brazilian banking system, U.S. banking system, and European banking system to create or redeem USDC.

In other words, as long as you have a bank account in these countries or regions, whether as an individual or an institution, you can create and redeem USDC, and the funds will flow directly into the aforementioned reserve structure.

So, from the operational perspective of local banking systems, you have the liquidity to create and redeem; from the perspective of underlying reserve assets, you have the most liquid and robust asset support globally; and there is also a publicly registered reserve fund structure that is disclosed daily, combined with the regulatory mechanisms of global regulatory agencies.

Circle's Future Plans

You may remember that before the iPhone appeared, there were about 17 different mobile operating systems on the market: Symbian, Windows Phone, Palm, BlackBerry, and those systems from NTT Docomo—various systems, with each company trying to attract developers to join, competing to get their own phone systems distributed.

To be honest, those systems had terrible experiences and were simply inadequate. You would go to the Mobile World Congress and see a bunch of people showcasing their products based on Symbian, only to find a pile of junk.

So what I want to say is that, to some extent, ensuring reserve safety—while these systems may seem advanced in architecture, the actual user experience is quite poor.

They are more like a set of operating systems competing for ecosystems, developer resources, user-friendliness, and so on. But I want to be very clear: we have not yet arrived at the "iPhone moment" for blockchain.

What we truly need is a blockchain network that does not just support financial transactions.

It should also support social interactions, gaming, content, intellectual property, traceability of AI data, transaction flows of AI agents, retail-scale applications, and digital tokens for mass use—none of which can be achieved right now. The throughput is insufficient, the systems cannot handle it, and the infrastructure lacks scalability.

In the long term, we need a network capable of processing millions of transactions per second, which is an achievable goal. At the same time, the development experience for software engineers and user experience aspects are still in their early stages.

Reflecting on my past experiences in platform software, developer tools, and user experience, I feel that we are not fully prepared yet. Of course, I agree on one point—we are very close.

But even if we do have a "click-to-connect" blockchain platform, I believe that new layers and more networks will continue to emerge on top of it.

You can foresee a period where a situation like this exists: for example, you are a large internet company in Asia with 500 million users, and you now want to introduce digital tokens, stablecoins, and smart contracts for these users. Once you open it up for use, all existing infrastructure on the market will directly collapse—it simply cannot handle such a large volume of traffic.

But you can imagine that one day, this model will evolve like AWS's "Virtual Private Cloud" (VPC), giving rise to a type of "dedicated blockchain" that forms a network model of interconnected chains to support large-scale expansion. This will essentially lead to more "fragmentation," but it also means more development of infrastructure.

As Circle, our goal is to ensure that stablecoin network protocols like USDC, EURC, CCTP (Cross-Chain Transfer Protocol), and gas fee abstraction can be easily invoked in these environments—so that users and developers do not have to worry about the underlying complexities.

So whether the future supports 15 chains or 50 chains, I can't tell you the exact number, but what I can confirm is that we will continue to expand, deploy, and release stablecoin infrastructure to support more blockchain networks.

As for when the "iPhone moment" will truly arrive, or when we will enter a phase of diminishing marginal returns, I don't know either.

Speaking of currency, we have already launched USDC and EURC. I can't say for certain that we will issue more currencies in the future, but what I can confirm is that globally, whether in emerging markets or developed countries, regulations for stablecoins are gradually being implemented, and we are seeing more and more high-quality stablecoin projects coming online.

I believe that by 2025, you will see an increasing number of fiat stablecoins like the Mexican peso, Japanese yen, Australian dollar, and British pound. And we at Circle do not need to be the issuers of all these currencies; what is truly needed are compliant, high-quality local teams to issue these stablecoins using the infrastructure we have built, thereby achieving good cross-currency interoperability, allowing applications to easily access and use different currencies.

The issuance of each currency is complex, involving a lot of legal and regulatory issues, as well as considerations of local central bank preferences, market acceptance, and so on.

We will also assess market size, such as how large the market for this currency actually is, which is also a key point we mentioned earlier.

We genuinely believe that in this "era of internet financial systems," the status of the U.S. dollar will only become more important, and the U.S. dollar stablecoin (USDC) will be at the core of it. Therefore, our main focus will certainly remain on this.

At the same time, we certainly want to open up entry and exit points in different global markets and establish interconnectivity, and we will continue to promote this while also welcoming the development of other projects.

However, from a business or ecosystem perspective, we do not believe that we must do all these non-U.S. dollar currencies ourselves.

From the perspective of monetary theory—whether from the central bank's perspective or the commercial bank's perspective—there is actually a concept called "neutral interest rate." This interest rate is neither accommodative nor restrictive.

After the 2008 financial crisis, we experienced a long period of "zero lower bound" interest rates, during which the crisis was countered with the monetization of government debt. Later, due to soaring inflation, central banks made strong tightening responses. Interest rate policy is essentially a cyclical cycle.

But whether it is "nominal interest rates" or "neutral interest rates," they essentially fluctuate around a target range. Some economists now believe that the neutral interest rate may be around 2.75% to 3%—this level neither suppresses the economy nor overly stimulates it.

So, whether you are a central bank or a bank, high interest rates do not necessarily mean "good." Of course, banks or institutions like ours may benefit somewhat from increased interest income on reserve assets, but overall, this environment is restrictive—economic activity decreases, the velocity of money slows down, capital investment slows, and risk appetite decreases.

When interest rates decline, indeed, the interest income from our reserve assets will also decrease, which is an objective fact. But at the same time, money becomes cheaper, liquidity increases, capital investment rises, and economic activity accelerates—this is good for the venture capital market, the real economy, and entrepreneurial activities. And all of this will, in turn, promote the use and growth of stablecoins.

We have experienced both expansionary and contractionary cycles. The next phase may be a more moderate cycle, which we cannot predict yet. But we always believe:

On one hand, there are macroeconomic forces at play that we cannot control, such as the direction of the global economy and central bank decisions;

On the other hand, we have built a platform network with user growth flywheels and developer ecosystem flywheels. We are creating a highly practical form of digital currency and a powerful development platform—this system itself has an inherent growth logic.

Today, the total market size of "legitimate electronic currency" globally exceeds $100 trillion. I believe that one subset of this—represented by U.S. dollar stablecoins and euro stablecoins—will continue to expand, regardless of whether interest rates are high or low.

What we currently see is that the total size of stablecoins is only about $160 billion (now over $200 billion), accounting for just 0.16%. This is clearly still a very early stage.

If you agree that "internet-level utility" has reshaped media, communication, transportation, and software distribution, then you will also believe that this new form of internet currency may have the same transformative potential in the future.

If all goes well, perhaps in the next 10 to 20 years, we could see 10% of the world's currency transformed into a form like stablecoins. This does not sound exaggerated—because achieving a 10% penetration rate for internet products indeed takes years or even decades, but it will certainly change the world.

We hope Circle can become an important participant in this transformation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。