Today's homework is not very difficult. Both the US stock market and $BTC are maintaining slight fluctuations, with the overall market sentiment being neutral. However, despite the small price movements, the density of events is unusually rich, and the underlying structural signals are worth digging into.

In the crypto space, the first milestone event compliant with the repeal of the SAB 121 Act has finally emerged. JPMorgan has officially launched a compliant lending business backed by Bitcoin and cryptocurrency ETFs. As one of the largest financial institutions in the world, this move marks the first formal acknowledgment of crypto assets as "fully financial products" by traditional finance. Although KYC/AML processes still need to be fulfilled, this pathway has been opened, laying a compliant foundation for more flexible crypto financing in the future.

Meanwhile, Circle's IPO has also brought good news, with oversubscription reaching 25 times. As the first company to issue a compliant US dollar stablecoin as its core business and move towards an IPO, Circle's listing signifies the formal integration of crypto dollar infrastructure into the Wall Street system. The market generally expects USDC to be the first stablecoin that meets the requirements of the US stablecoin legislation and hopes to become an industry template for achieving hard redemption of stablecoins.

In the traditional market, the tremors are stronger. Trump has once again called on the Federal Reserve and Powell to lower interest rates in response to the ADP report, but in reality, the current expectations for rate cuts are not even in the third quarter. Musk, who strongly supported Trump's rise, has also publicly expressed a break with Trump, openly criticizing Trump's spending bill as "disgusting" and labeling the lawmakers supporting it as "shameful." Today, he also called for the repeal of the bill.

Musk pointed out that the bill would cause the US federal government deficit to surge to $2.5 trillion, increasing the burden on citizens, while Trump continues to push his policy agenda without making a significant response to Musk's criticism.

In terms of geopolitics, Trump stated today that he has had a long conversation with Putin, but also indicated that Putin would retaliate against Ukraine. A ceasefire in the Russia-Ukraine conflict seems unlikely to be achieved in the short term. Although these events have not had a significant impact on the market so far, they ultimately point to Trump's leadership over the US. Whether in the crypto industry, macro markets, or geopolitical landscape, the core logic is tightening around Trump's policy focus. Both the cryptocurrency industry and the US political economy have been tied to Trump's belt.

Looking back at Bitcoin's data, loss-making investors are still the main force in the current trading turnover. Although the turnover rate has decreased compared to yesterday, it remains at a relatively high level. The market is paying more attention to Friday's non-farm payroll data, especially the unemployment rate, which is still one of the most closely watched data points by the Federal Reserve. However, given the current environment, unless there is a significant economic downturn, the probability of the Federal Reserve cutting rates before the end of the third quarter remains low.

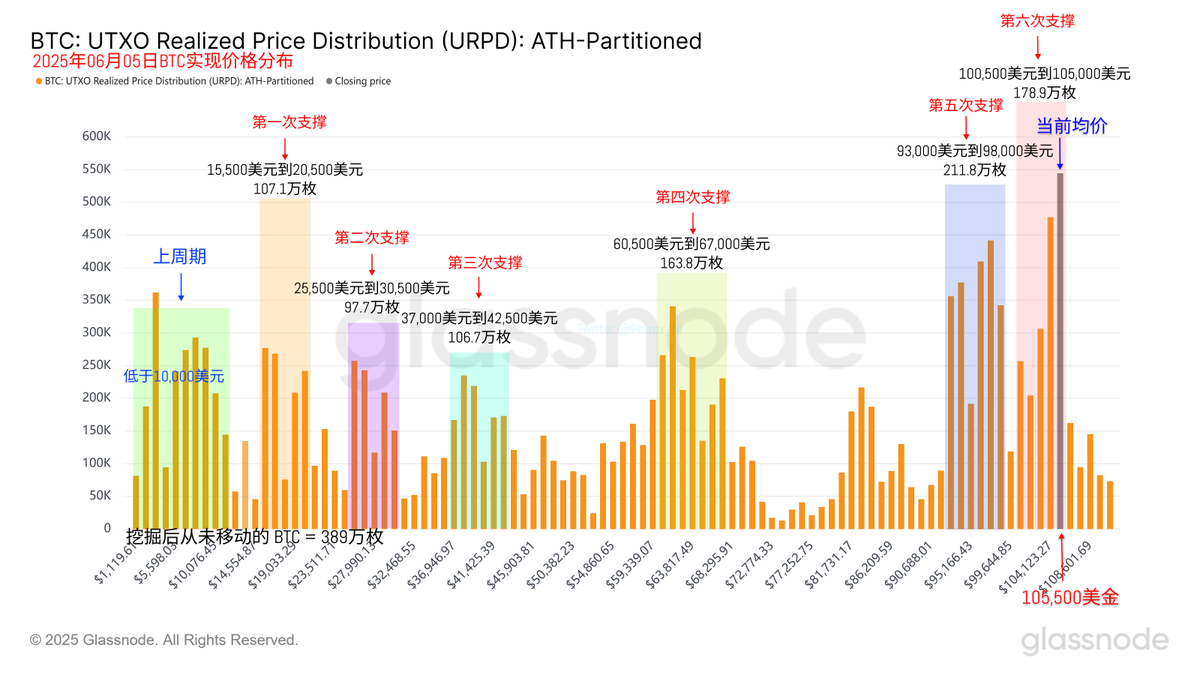

In terms of support, the range between $93,000 and $98,000 remains the most stable support level. Although more chips are shifting towards the range of $100,000 to $105,000, this group of investors is still primarily focused on short-term investments and is significantly affected by short-term price movements.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。