Original|Odaily Planet Daily (@OdailyChina)

Whether the imitation season has arrived remains controversial, but the contract season has undoubtedly arrived ahead of schedule. With BTC breaking new highs and entering a period of volatility again, on-chain Perp platforms represented by Hyperliquid have once again become the focus of the market, with their trading volume reaching historical highs as market sentiment heats up. Meanwhile, a number of emerging popular platforms have gradually surfaced, with some projects already achieving billion-level liquidity. In light of this, Odaily Planet Daily will summarize relevant information on 6 popular on-chain Perp platforms in this article for readers' reference.

Note: The following content does not constitute investment advice. Odaily Planet Daily does not endorse any project and is for learning and sharing purposes only.

Ethereal: Rising Star of the Ethena Ecosystem

As early as last December, Odaily Planet Daily senior author Azuma detailed this platform in the article “Ethereal, the first airdrop project of the Ethena ecosystem, can it replicate the miracle of Hyperliquid?”, where its main concept was “Hyperliquid of the Ethena ecosystem,” primarily expecting to launch its mainnet in Q1 of this year and airdrop 15% of tokens to ENA token stakers.

Official account: https://x.com/etherealdex

In February this year, it launched the Season Zero deposit event, allowing users to deposit USDe in Ethereal to earn Ethereal points and Ethena points (30x multiplier), and also gain priority access to the testnet and future platform plans;

At the beginning of May, the official announced that USDe pre-deposits had exceeded $1 billion, and Season Zero was nearing its end. Currently, the community has 25,000 independent users.

On May 28, the official stated that the amount of USDe pre-deposits had surpassed $1.2 billion.

On one hand, the hot data highlights the popularity of this project; on the other hand, for users, it is undoubtedly a highly competitive "ranking game."

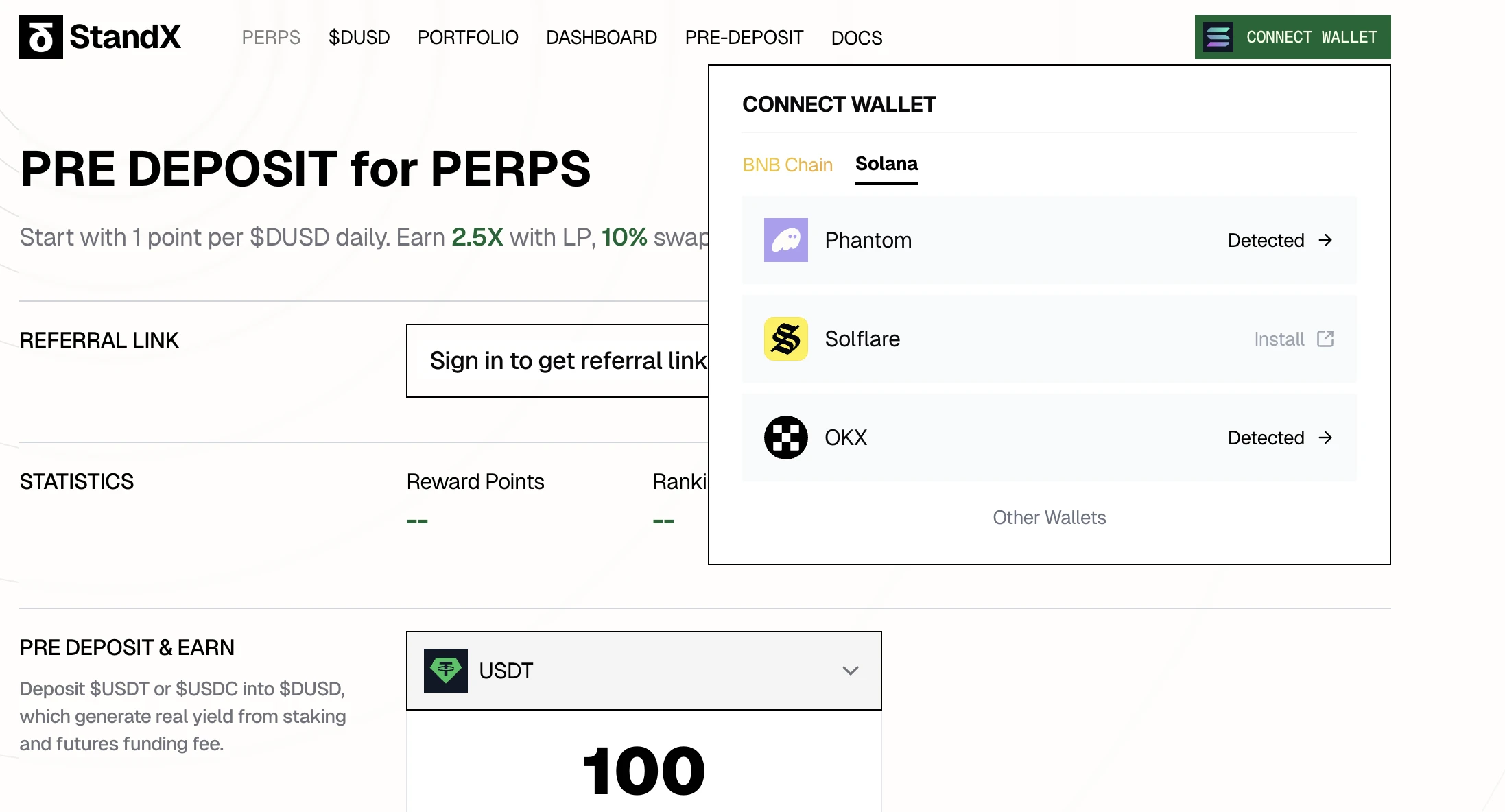

StandX: The Version Answer Supported by the Solana Ecosystem, Founded by Former Binance Contract Team Members

This platform was initially established based on the Solana ecosystem and previously received support from the Solana Foundation. Additionally, according to its official website, it now also supports the BNB Chain ecosystem.

Founded by the former head of Binance's contract department and a notable former Goldman Sachs investment banker, the platform has launched a pre-deposit reward program. Users can mint DUSD by pre-depositing USDC/USDT or earn platform points through LP, holding YT tokens, referral invitations, and Swap interactions. The official announcement stated that the Perp DEX is expected to be officially launched in July.

Official account: https://x.com/StandX_Official

According to the latest official news, the StandX platform has nearly 10,000 users. The benefit is that users can withdraw funds at any time without locking them.

StandX official explanation regarding fund locking

StandX official website interface

Aster: The "Favorite Project" of the BNB Chain Ecosystem

As a decentralized Perp DEX favored by Binance founder CZ, Aster (formerly known as Astherus) has also gained considerable attention, previously receiving investment from Yzi Labs (formerly Binance Labs).

Additionally, with the launch of USD1 by WLFI attracting significant attention in the crypto market, Aster's official team has provided a deposit and contract trading channel for USD1. They also supported a month-long ($1 million) USD1 DeFi liquidity event initiated by WLFI in collaboration with BuildON, PancakeSwap, and Four.meme from June 4 to July 4. Currently, Aster supports both the BNB Chain and Arbitrum ecosystems.

Official account: https://x.com/Aster_DEX

In May, the cryptocurrency data platform CoinMarketCap (CMC) announced the launch of CMC Launch, a platform designed for Pre-TGE projects, aimed at connecting high-quality crypto projects with over 50 million monthly active users globally. The first project to join CMC Launch is Aster (AST).

At the beginning of June, Aster officially launched the Aster Reward Hub event, which includes a series of tasks where users can earn Rh and Au points through trading, which can be converted into AST tokens at TGE.

Aster Rewards Hub event

Levana Protocol: Cosmos Ecosystem Perp DEX Spanning Osmosis, Injective, and Neutron

This is a somewhat niche multi-chain Perp DEX. According to the official introduction of Levana Protocol, the platform offers decentralized perpetual contracts across more than 40 markets, including cryptocurrencies, commodities, and foreign exchange, supporting up to 50x leverage, deployed on ecosystems such as Osmosis, Injective, and Neutron.

Official account: https://x.com/Levana_protocol

In May, according to official news, the platform's trading volume exceeded $4 billion, primarily distributing trading rewards through the LVN token, and users can also participate in governance activities through the token.

DeriW: On-chain Perp Platform Launched by Exchange CoinW

The explosive popularity of Hyperliquid has also provided exchanges with a new platform-building idea, and DeriW is the latest attempt by the crypto exchange CoinW.

In March of this year, in the article “In the Name of Security, DeriW Rewrites the On-chain Perp DEX Experience”, CoinW officially introduced this platform, mentioning that DeriW is a decentralized perpetual exchange offering zero gas fee trading, up to 80,000 TPS, and enhanced security features (such as the UBPK system), supported by CoinW, aiming to provide a trading experience comparable to centralized exchanges.

Official account: https://x.com/DeriWOfficial

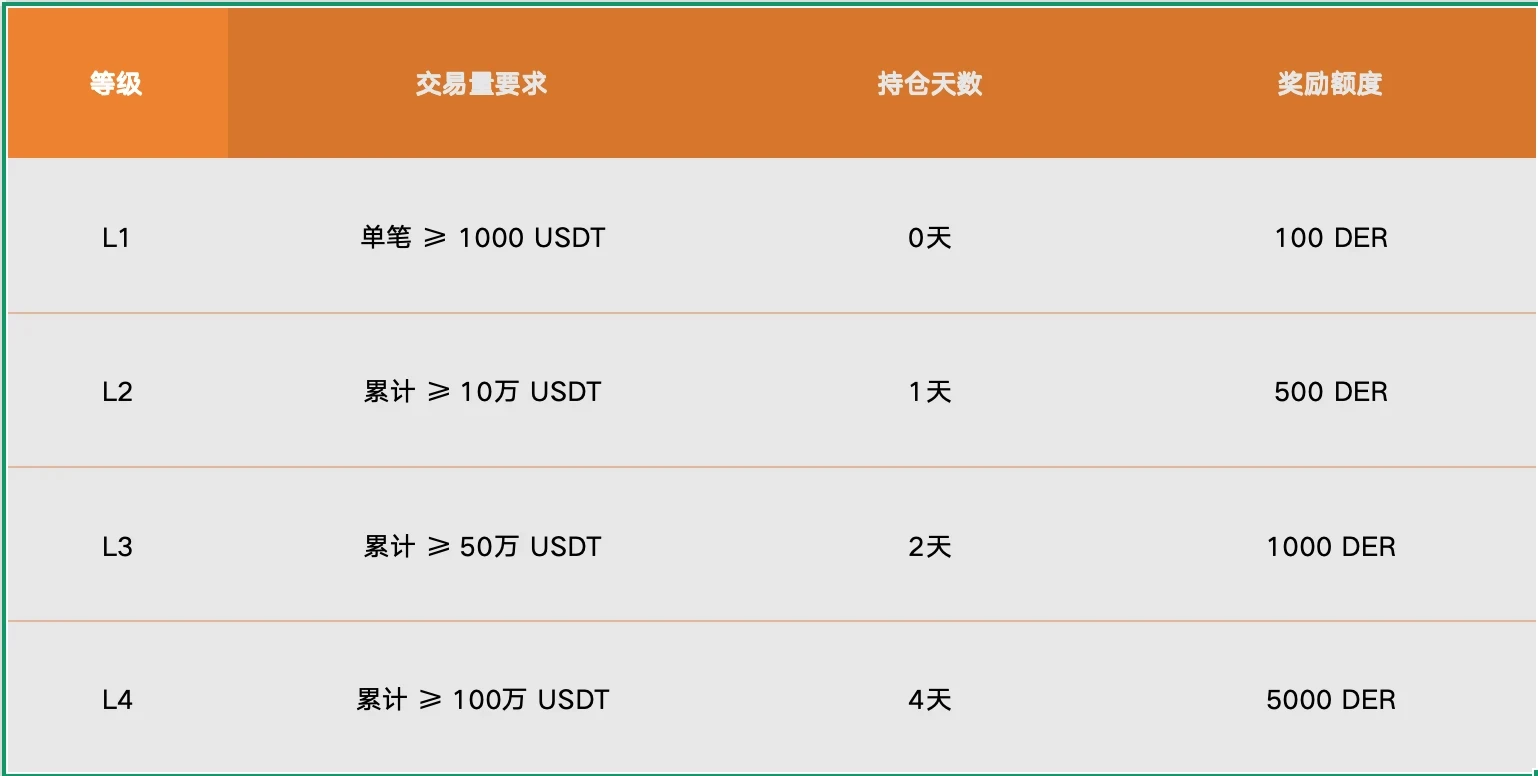

In June, the Supernova trading event initiated by DeriW is still ongoing, where users can participate in the testnet to win DER points. Additionally, users can join the global ambassador program to earn more incentives by inviting new users.

Slightly Strict Trading Conditions

Ostium: On-chain Perp Trading Platform for RWA Assets

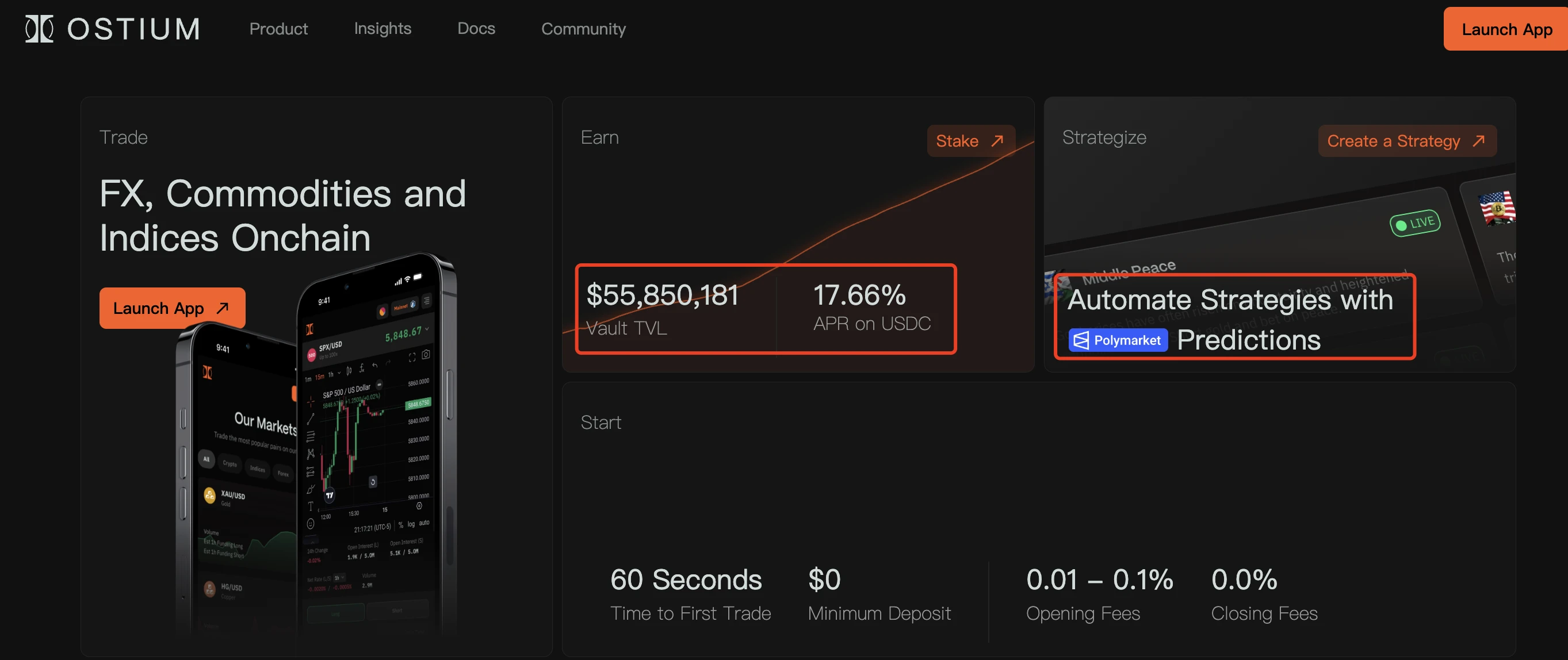

The platform's official introduction states, “Go long or short on forex, stocks, indices, commodities, and cryptocurrencies from your wallet.” This single sentence highlights the uniqueness of the project, which not only supports conventional cryptocurrency trading but also forex, stocks, index funds, and other assets. According to its official tweet released in May, the MAG7 stock long/short leverage trading feature has been launched.

It is understood that Ostium, built on the Arbitrum ecosystem, primarily provides price exposure to traditional financial assets (such as forex, commodities, indices, etc.) through synthetic assets, without the need to actually hold these assets. The platform employs a Shared Liquidity Layer (SLL) design, combining a Liquidity Buffer and a market-making treasury to minimize the risks for liquidity providers and enhance trading efficiency. Its main goal is to bridge TradFi and DeFi, offering a transparent, non-custodial, and high-leverage (up to 200x) trading experience. Notably, the platform also supports event monitoring from the Polymarket platform, triggering long/short contract trades. According to media reports, on April 16, Ostium's single-day trading volume peaked at $938 million, with the asset distribution being cryptocurrencies (53%), forex (22%), commodities (18%), and indices (7%).

As early as October 2023, Ostium Labs completed a $3.5 million funding round, led by General Catalyst and LocalGlobe, with participation from individuals and institutions such as former Coinbase CTO Balaji Srinivasan, Susquehanna International Group, and AllianceDAO. Currently, according to official website information, the platform's treasury TVL is approximately $55.85 million, with a USDC APR of about 17.66%.

Official account: https://x.com/OstiumLabs

Dune Data** shows that Ostium, which focuses on the concept of “going long or short on any asset,” has currently surpassed a total trading volume of $8.888 billion, with total trading revenue fees of $3.655 million and a total user count of 8,796.**

Platform Information

Summary: On-chain Perp has become a battleground, and users need to upgrade and iterate

With Trump also launching his official meme coin, on-chain has become the hottest territory for crypto exchanges, project parties, and traders. Naturally, Perp DEX, which aligns with the inherent “gambling demand” of the cryptocurrency crowd, has become a popular track.

These projects represent either new attempts within mature ecosystems, version iterations from OG teams, on-chain transformations of traditional finance, or DEX attempts by exchanges. Regardless, the on-chain “land grab” is relentless, and what users can do, perhaps beyond deposits and interactions, is to be agile, discerning, and, while guarding against risks, seek potential excess returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。