If traders cannot see each other's positions, they cannot engage in liquidation hunting.

Written by: David C, Bankless

Translated by: Shan Ouba, Golden Finance

Last week, trader James Wynn lost $100 million on Hyperliquid due to liquidation.

The loss included 949 bitcoins (approximately $99.3 million) and 982.5 million kPEPE (approximately $11.6 million), triggered when his 40x leveraged position was liquidated after Bitcoin fell below $105,000. But the interesting part is: Wynn claims he was not just "unlucky," but rather "hunted."

Wynn wrote on social media: "At least I exposed how corrupt these markets are." He believes someone deliberately orchestrated a "liquidation hunt" by pushing the price down just enough to trigger his high-leverage position, then quickly allowing the market to rebound.

Whether this accusation is true or not, the incident indeed exposed a significant flaw in decentralized trading: everyone's positions are public. It's like showing your hole cards to everyone while playing poker.

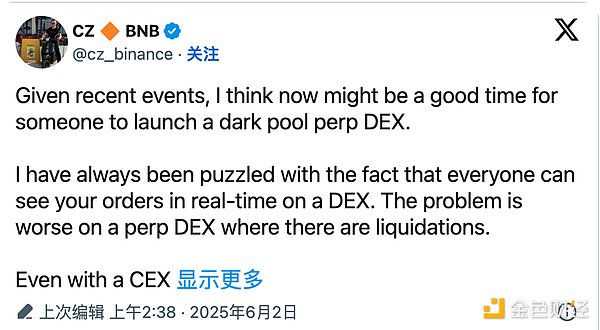

This incident prompted Binance founder CZ to propose a solution on June 1: the launch of a "dark pool perpetual contract DEX."

His logic is simple: if traders cannot see each other's positions, they cannot engage in liquidation hunting. Using zero-knowledge proofs to hide the order book can protect large players from being precisely targeted while maintaining decentralization.

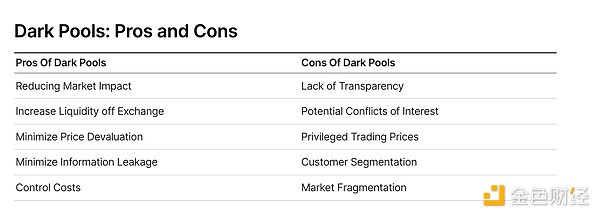

Let's quickly understand the origins, advantages, and disadvantages of dark pools, as well as existing related projects in the current crypto industry.

Origins of Dark Pools

Dark pools are not a new concept; despite the mysterious name, they are not illegal.

Dark pools first appeared in traditional finance in the 1980s, addressing the core issue: how to trade large blocks of stocks without affecting market prices?

For example, if a pension fund needs to sell 10 million shares of Apple, selling directly on the open market would cause the price to collapse quickly; others would see the large order and rush to exit, resulting in not only an incomplete sale but also greater losses.

The U.S. Securities and Exchange Commission (SEC) officially approved alternative trading systems (ATS) in 1979, allowing institutions to trade anonymously through "dark pools," with details only disclosed after the trade was executed. In the spring of 2017, dark pools accounted for as much as 40% of trading volume in the U.S. stock market, far exceeding 16% in 2010.

The basic mechanisms of dark pools include:

- Hidden order books, private matching of orders

- Trading at negotiated or midpoint prices

- Disclosure only after execution

- Typically open only to institutions

Why Dark Pools Are More Needed in the Crypto World

If dark pools are important in traditional finance, they may be essential in the blockchain world.

In DeFi, extreme transparency has become a flaw—every transaction, every position, every address is completely public.

In traditional finance, at least your trades are not visible to the entire world in real-time; in DeFi, your wallet is your own "billboard." This leads to several frequent "predatory" behaviors:

- MEV (Maximum Extractable Value): Bots monitor transactions in the mempool to engage in front-running arbitrage. It's like someone peeking at your hole cards before betting.

- Copy trading: Simply copying the wallet actions of successful traders can yield profits, undermining the advantage of strategy developers.

- Liquidation hunting: Wynn's case is a classic example, as public leverage positions are easy to calculate and attack.

- Quote withdrawal: Market makers withdraw liquidity when they sense a large order is about to execute, widening slippage.

Dark pools address these issues through the following privacy technologies:

- ZKPs (Zero-Knowledge Proofs): Verifying transaction validity without disclosing details.

- MPC (Multi-Party Computation): No single party can see all information during the order matching process.

- TEE (Trusted Execution Environment): Executing transactions in a hardware-isolated secure environment. For example, Uniswap's new L2 chain "Unichain" uses TEEs to hide transaction information and avoid MEV extraction.

These technologies enable transactions to be both private and verifiable, anonymous yet auditable—while retaining the blockchain's "trustless" characteristics, they protect traders' privacy.

Existing Dark Pool Projects

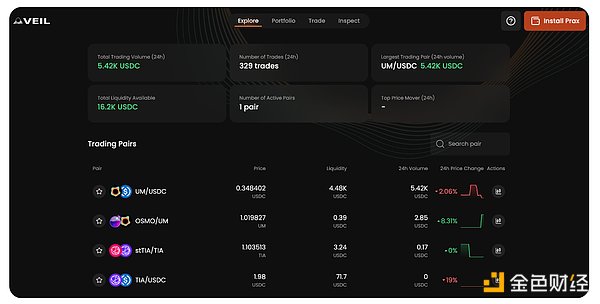

The following projects have implemented or are developing dark pool-related features:

Renegade is an on-chain dark pool based on multi-party computation (MPC) on the Arbitrum platform, ensuring transaction privacy and no slippage. The platform matches its supported token trades directly at Binance's midpoint price among peers, eliminating front-running and price manipulation. This means large trades can be conducted privately without impacting market prices.

Silhouette, on the other hand, adds privacy to trading by hiding transaction matching, based on the deep liquidity and fast trading of the Hyperliquid exchange. Although the platform is still in development with no specific launch timeline, it does not require any special wallets, making it easy to use while enjoying enhanced privacy.

Penumbra offers dark pool spot market functionality by creating a new privacy-centric blockchain within the Cosmos ecosystem. It uses zero-knowledge proofs (ZKP) to hide all transactions, balances, staking, and even governance. Its decentralized exchange (DEX) protects trades through batch auctions to prevent front-running and employs cryptographic techniques to ensure complete privacy.

sFOX is a U.S.-based company dedicated to helping large investors (primarily institutional investors) acquire and trade cryptocurrencies, providing dark pool services regulated by the Financial Crimes Enforcement Network (FinCEN) and the state of Wyoming. Through its services, sFOX allows institutional investors to use hidden orders and combine liquidity from over 30 exchanges to execute large trades cautiously.

Why Dark Pools Are Not Yet Widespread?

Despite the many advantages of dark pools—such as preventing maximum extractable value (MEV), liquidation hunting, and front-running—they have not yet become widespread due to significant technical and practical challenges in building dark pools, especially for perpetual contract markets.

The fundamental challenge lies in achieving both privacy and verifiability simultaneously. You need to prove that transactions are fair without revealing the content of the transactions. While the aforementioned technologies, such as zero-knowledge proofs (ZKPs), multi-party computation (MPCs), and trusted execution environments (TEEs), provide feasible paths, applying these technologies effectively is extremely complex—merely hiding data is not enough; it must also ensure that information cannot be inferred through other means. In other words, if the price of a so-called "private automated market maker" can be queried at any time, it is no longer private.

Dark pools also face a classic "chicken or egg" problem: they need sufficient trading volume to operate well, but if there is no existing liquidity, traders will not come to use them. This is particularly severe in perpetual contract markets, as these markets require continuous funding and active liquidation mechanisms, relying on highly active liquidity.

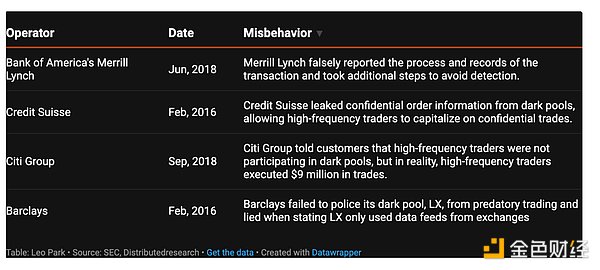

Next is the trust paradox. The lack of transparency is precisely the value of dark pools, but it can also raise suspicion. When we cannot see the trades, how do we know the prices are fair? This issue is more pronounced in the cryptocurrency industry, as "trust but verify" is a core tenet. Dark pools could theoretically become tools for market manipulation rather than prevention mechanisms. For example, by removing large trading volumes from the open market, dark pools could distort the price discovery process, creating a dual market structure: institutional investors get better prices in private markets, while retail investors can only trade in thinly liquid and more volatile public markets.

There are already similar cautionary tales in traditional financial markets. For instance, Barclays was fined $70 million for lying in its dark pool operations, and other institutions like Credit Suisse were penalized for giving certain traders unfair advantages.

Finally, launching an on-chain dark pool, especially for perpetual contracts, faces complex regulatory hurdles. The intersection of derivatives, privacy technologies, and cross-border trading creates a regulatory maze, and few projects have successfully navigated it.

Overall, whether or not James Wynn's incident truly constitutes "hunting," it reveals a fundamental tension in the crypto industry: we have built highly transparent mechanisms to achieve a "trustless" system, but this transparency itself can also become a weapon for attack.

Dark pools offer a solution, but the path is not easy. The challenge lies in how to provide the necessary privacy for transactions while maintaining the "verifiable and fair" nature of cryptocurrencies, making certain behaviors genuinely fair. Projects like Renegade have already proven this can be achieved in spot markets—demonstrating the fairness of transactions without disclosing details through cryptographic means. However, the "perpetual contract dark pool DEX" envisioned by CZ has yet to be realized, with only Silhouette working towards this direction.

As the crypto industry matures and institutional capital continues to flow into the on-chain world, infrastructure must evolve continuously to protect the interests of large players without sacrificing those of smaller players. These technical challenges are real but not insurmountable. Dark pools are not perfect, but they are becoming increasingly necessary.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。