Original | Odaily Planet Daily (@OdailyChina_)

_

According to Blockworks, pump.fun plans to raise $1 billion through an ICO, with a valuation of $4 billion. Sources added that the token sale will be divided into private and public rounds, but it is unclear when the tokens will go live or if they will be issued on the pump.fun platform.

Velocity Capital investor DeFi Cheetah stated that through an unverified private channel, he heard rumors about pump.fun's financing, including: no airdrop, but a whitelist will be set for the public sale; the financing target for the public sale is $800 million, with a valuation of $5 billion; VCs will also have a $200 million quota, with the same valuation of $5 billion; the public sale will take place on most mainstream CEXs, which are preparing for it.

As one of the engines of last year's Meme bull market and one of the most profitable protocols, there have been multiple rumors about pump.fun issuing tokens. However, each time it has been a "wolf is coming" scenario, and pump.fun co-founder Alon has denied the rumors about the pump.fun token.

But times have changed; the changing environment of the Meme market and intensified competition among token issuance platforms have forced pump.fun to make a choice, and the wolf may really be here this time.

Solana Meme trend declines, pump.fun issues tokens for self-rescue

In January of this year, the personal Meme coin TRUMP issued by U.S. President Trump saw its market cap exceed $10 billion in a single day, not only creating many on-chain leaders but also attracting outside capital into the crypto space. When Argentine President issued his own token LIBRA in February, harvesting the market and causing this wave of celebrity token issuance to fade, people naively thought this was just a short-term correction in the Meme market. However, in hindsight, this "money-grabbing market" has become the last carnival before the decline of the Solana Meme trend.

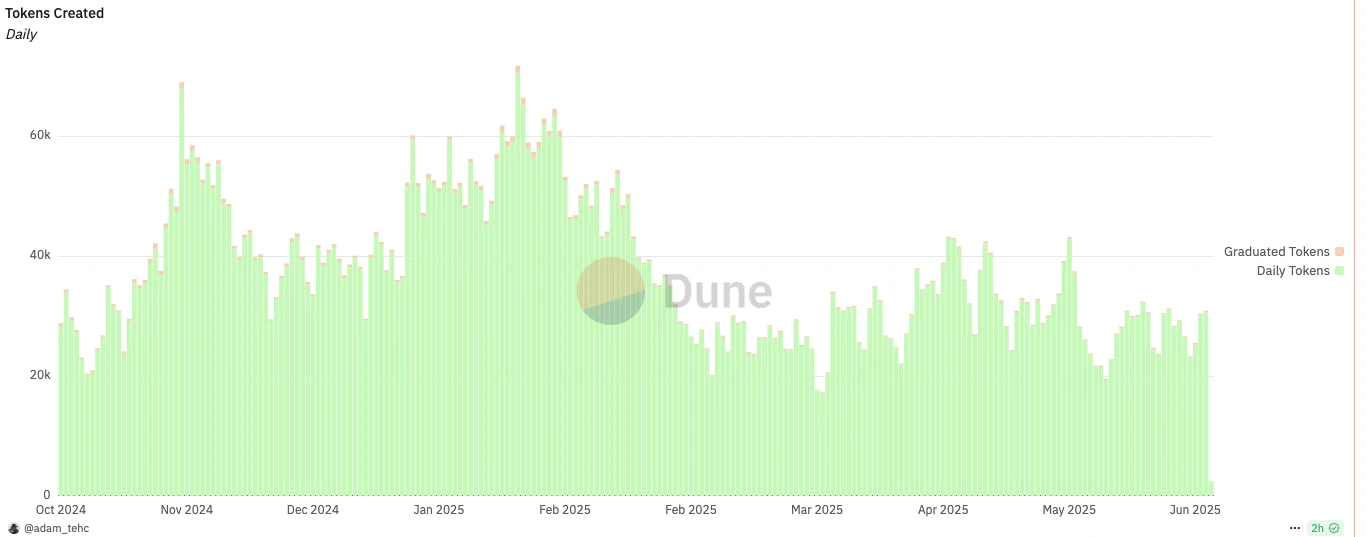

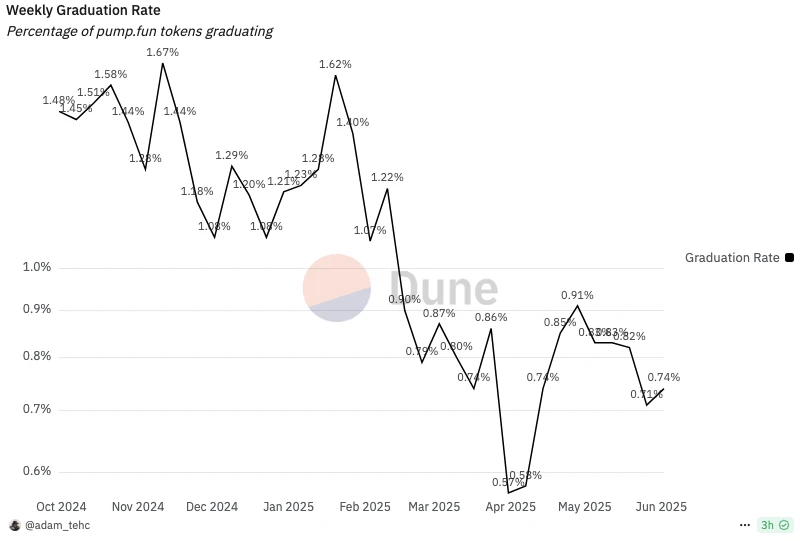

According to Dune data, the number of tokens created on the pump.fun platform and the graduation rate (the ratio of successfully launched tokens to total created tokens) have plummeted since February, with the number of tokens created dropping from a peak of 50,000-70,000 per day to 20,000-30,000 per day, and the weekly graduation rate for tokens falling below 1%.

Daily token creation on pump.fun

Weekly token graduation rate on pump.fun

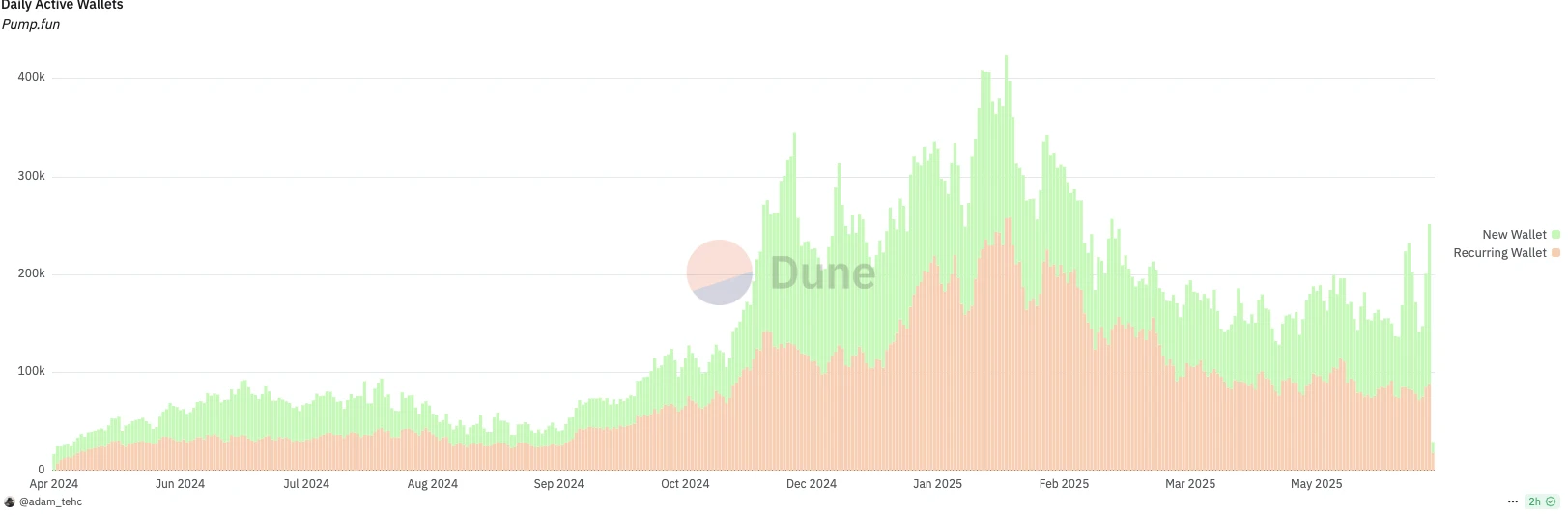

At the same time, the number of active users on pump.fun is also decreasing. According to Dune data, from December 2024 to February 2025, the daily active wallets on the pump.fun platform reached 150,000-200,000, but since February, the number of daily active wallets has decreased by about 50%, leaving only 70,000-100,000.

Daily active wallets on pump.fun

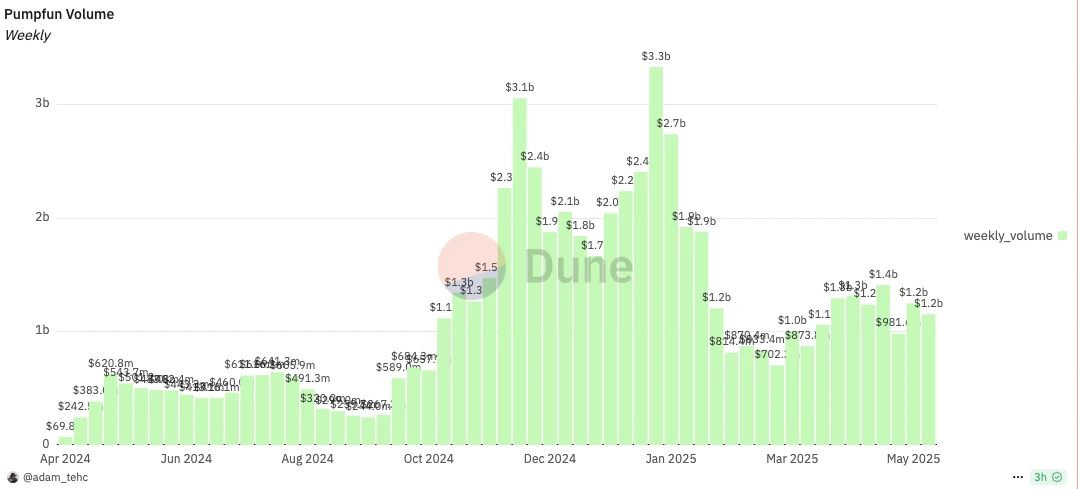

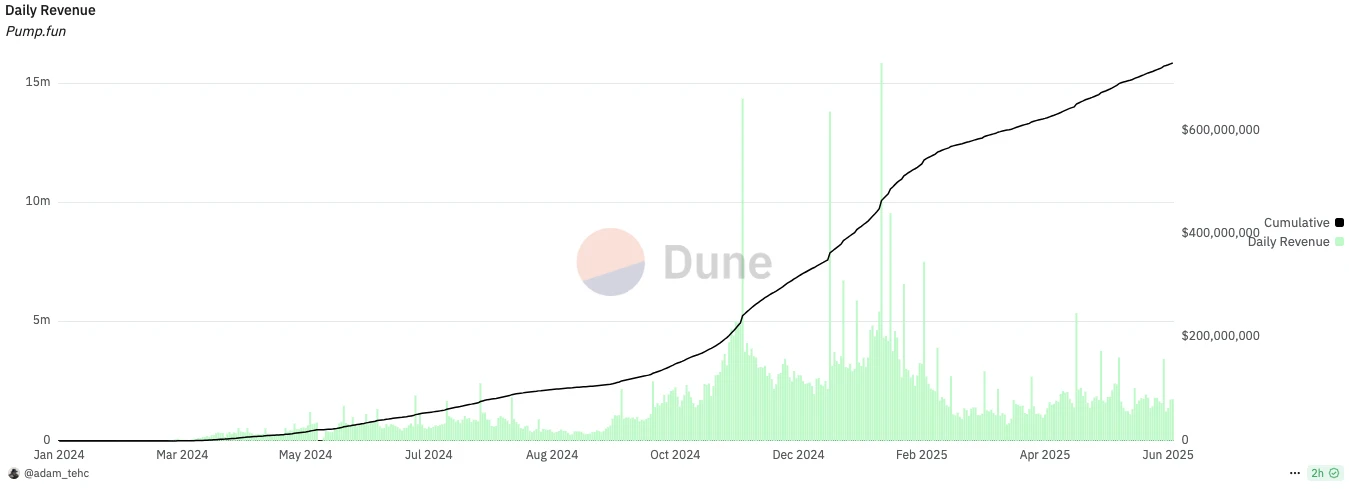

As the token issuance groups and user activities decline, the accompanying result is a drop in trading volume and revenue on the pump.fun platform. According to Dune data, from November 2024 to early February 2025, the weekly trading volume on the pump.fun platform could reach $2-3 billion, while after mid-February 2025 (after the Argentine president issued his token), the weekly trading volume dropped to between $700 million and $1.5 billion, a decrease of about 50%.

Weekly trading volume on pump.fun

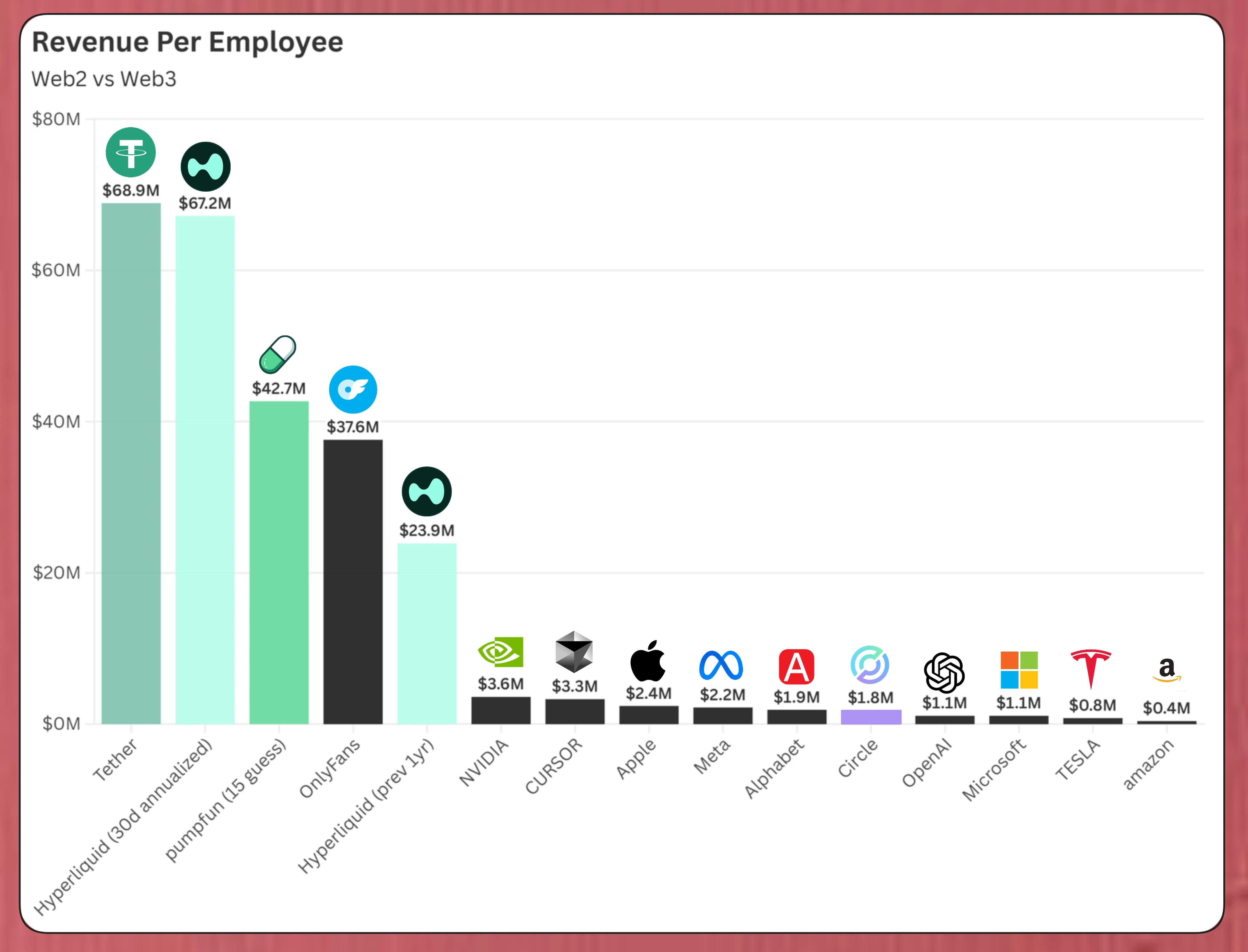

The cumulative fee income of the pump.fun platform is about $700 million, and according to overseas KOL BREAD, its human efficiency ratio has already surpassed top Web2 tech companies like Nvidia and Apple.

Web2 vs Web3 company human efficiency ratios, source: BREAD

But no one complains about the speed of making money being slow; they worry that they are not making enough. During the peak of the Solana Meme trend (from November 2024 to February 2025), the daily fee income on the pump.fun platform was between $2 million and $5 million, but after the decline of the Solana Meme trend, even with the launch of pumpswap, the daily fee income has decreased to between $1 million and $2 million.

Daily fee income on pump.fun

Many times, the success of a project may simply depend on seizing the trend and making few mistakes or even doing less; however, when the trend is gone, a project must do more and must do it right to survive. The success of pump.fun is attributed to the rise of the Solana Meme trend and the upgrade of the Meme market's narrative ability, but it cannot stop the decline of the trend and the exhaustion of market narratives.

In this final moment of sunset, issuing tokens has naturally become the last means of self-rescue. For tool-type or "selling shovels" projects, if there is a solid business model and continuous cash flow, they will not easily issue tokens, as the regulatory risks and operational pressures brought by token issuance are not as favorable as existing profits; but when a project is in trouble or when the supply of "shovels" in the market exceeds demand, reassembling the situation, expanding the project's narrative perspective, and taking the traditional path of going public to issue tokens can also allow the project to last longer.

Meme issuance platforms are rampant, pump.fun may issue tokens to transform and resolve the situation

"Afraid of my brother suffering, but also afraid of my brother driving a Land Rover," a good business that is too profitable will naturally attract competition and backstabbing, even from once good brothers; pump.fun is in such a situation. With the explosion of the Meme market, various chains have started a launchpad war, with Solana being the most intense, such as LetsBonk.fun, Boop, Believe, Moonshot, and even pump.fun's former good brother Raydium wants to get a piece of the pie.

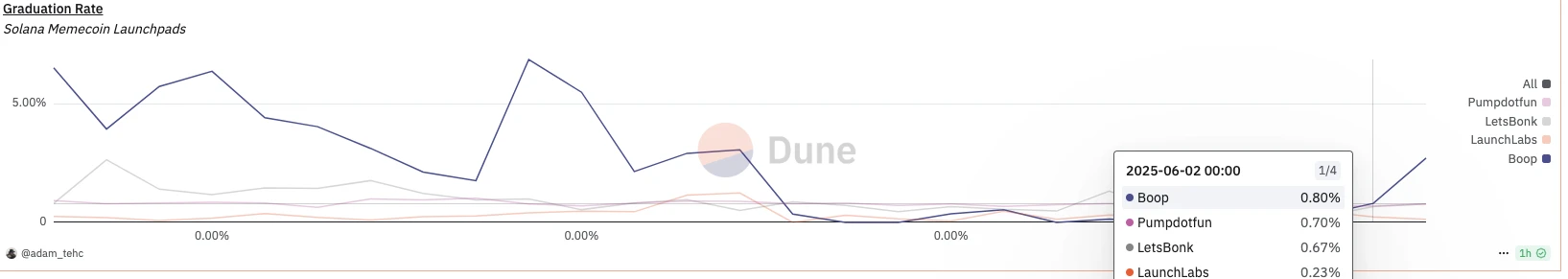

However, even though these new Meme issuance platforms each have their own characteristics and were once famous at their inception, in the context of the decline of the Solana Meme trend, they are all struggling to survive. According to Dune data, in May, the daily token graduation rates of mainstream Solana launch platforms (Pump.fun, Boop, LaunchLabs, LetsBonk) were all below 1%. Boop and LetsBonk had daily graduation rates above 1% in early May, but the heat did not last long.

Mainstream Solana launch platforms

With the trend of Memes fading and the proliferation of issuance platforms, it is not an exaggeration to say that pump.fun is already in deep trouble. If pump.fun wants to resolve the situation, issuing tokens and transforming may be a good choice.

As a tool-type product, pump.fun's moat is quite weak; essentially, it is just a Web2 tool serving Web3 assets, and its business model of charging platform service fees is highly replicable. If it chooses to issue tokens, it also means that pump.fun will transition to a pure Web3 business model. Although pump.fun has not personally disclosed its plans for token issuance and future project roadmap, it can be imagined that in the future, pump.fun may focus on building a large Meme ecosystem, transitioning from a tool to a platform or even infrastructure.

Even if issuing tokens for profit, at least it is better than OpenSea

However, some people question whether pump.fun's $4 billion valuation is too high, undermining the valuation system of Web3 projects. Independent researcher Haotian stated that a MEME launch platform's valuation surpassing most DeFi blue-chip protocols may not be reasonable, as pump.fun's ability to monetize its business model is entirely a product of the short-term spotlight effect of the market, rather than a sustainable, normalized profit logic. Once the MEME craze fades or the market returns to rationality, pump.fun's revenue model could collapse instantly.

From a profitability perspective, pump.fun is indeed worth this valuation. Once one of the four kings of L2 and the king of ZK technology, StarkNet was valued at $8 billion in its final Series D funding round. According to DeFiLlama data, its peak daily network fee income was only $760,000, and now its daily network fee income is just over $1,000, with a cumulative network fee income of $43.61 million, which is not on the same level as pump.fun's profitability.

However, from the product and narrative perspective, as a tool-type product, pump.fun is indeed not as strong as StarkNet, so its valuation is inflated. Nevertheless, Haotian also mentioned that the key may lie in whether pump.fun can truly build a sustainable business moat after obtaining substantial capital. Ultimately, it circles back to the question: if the existing business model is profitable enough, why would a tool-type product need to issue tokens…

To take a step back, if pump.fun chooses to issue tokens now, although it may not be as effective as during the peak of the Solana Meme trend, the timing has not yet passed. The overall market remains strong, global crypto regulation continues to improve, and there is still a group of users for Meme coins. In short, there are still people willing to buy in if tokens are issued now.

Otherwise, the neighboring example of OpenSea serves as a counterexample; it did not choose to issue tokens during the peak of the NFT trend and the highest platform valuation, and now it can only realize that things have changed. Whether pump.fun can seize this last opportunity to complete its token issuance will be continuously tracked and reported by Odaily Planet Daily.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。