Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risk can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Past Records

New Opportunities

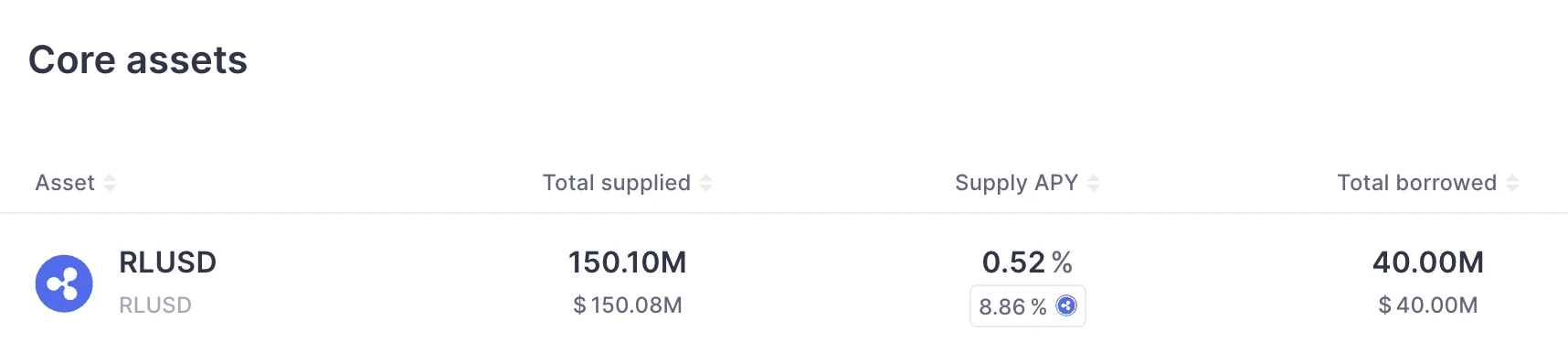

Ripple Throws RLUSD Incentives

With the mainstreaming of stablecoins, major players have clearly set their sights on this cake.

Ripple is currently throwing incentives for its stablecoin RLUSD, currently using RLUSD for deposits on Aave can earn an incentive increase of 8.86% APY (plus a base yield of 0.52% APY), and the incentives are distributed in the form of the stablecoin RLUSD itself.

This is almost the simplest stablecoin mining pool available right now, with relatively considerable returns, and the security backing of Aave and Ripple itself is also good, making it suitable for users with a lower risk appetite.

- Portal: https://app.aave.com/markets/

infiniFi Launches

This morning, the stablecoin yield protocol infiniFi announced its official launch. infiniFi completed a $3 million Pre-Seed round of financing in February this year, led by Electric Capital, with participation from New Form Capital, Kraynos Capital, BaboonVC, and others.

Currently, depositing stablecoins in infiniFi offers a real-time APY of 11.25%, which can be increased to a maximum of 22.64% if locked for 8 weeks, and a points program has also been launched, providing certain expectations for dual airdrops.

It is worth mentioning that infiniFi currently requires a whitelist or invitation code to deposit. Interested users can choose to use my invitation code (DWKBY1GN) or directly access through the link below.

Avantis Raises $8 Million

Last night, the Base ecosystem derivative exchange Avantis announced the completion of an $8 million Series A financing, led by Founders Fund (VC under Silicon Valley giant Peter Thiel) and Pantera Capital, with participation from Symbolic Capital, SALT Fund, and Flowdesk. Valuation information has not yet been disclosed.

Avantis is not a new project, but it's not too late to engage now — Avantis is currently conducting a second season points activity, where trading or forming LP can earn corresponding points.

Avantis' LPs are divided into high-risk and low-risk categories. High-risk LPs bear higher market-making losses but can also earn higher fee income; low-risk LPs bear lower market-making losses but also earn lower fee income — 65% and 35%, respectively. However, due to more funds currently choosing high-risk LPs, the actual yield for low-risk options is even higher.

Currently, the base yield for choosing low-risk Vaults is 5.73% APR, and if LP is locked, it can be increased to a maximum of 20.5%, making the combined airdrop expectations quite appealing.

- Portal: https://www.avantisfi.com

Sky Staking Introduces Stablecoin Rewards

Sky (formerly Maker) has begun offering stablecoin incentives for staking SKY tokens, with incentives distributed in the form of USDS, and the current APY for SKY staking is 15.96%.

Although it is not a stablecoin yield strategy, it can actually achieve a neutral mining strategy through "spot-futures hedging," that is, buying spot SKY for staking while shorting MKR in equal amounts (MKR and SKY have a fixed exchange ratio, and MKR has better liquidity on major exchanges). Just be sure to maintain a low leverage — theoretically, any token with a high yield and sufficient liquidity for short hedging can adopt this strategy. For example, B2 currently reports a staking yield of 98.6%, which can also be earned through a similar strategy while maintaining a neutral position.

- Portal: https://info.sky.money/rewards

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。