Introduction

The tokenization of Real World Assets (RWA) is reshaping the global financial landscape.

By converting traditional assets such as real estate, bonds, and commodities into digital tokens on the blockchain, RWA significantly enhances asset liquidity, lowers investment thresholds, and provides unprecedented opportunities for global investors.

The rise of RWA is not only a breakthrough in blockchain technology but also a milestone in the integration of traditional finance and the crypto economy. From MakerDAO collateralizing U.S. Treasury bonds to issue the DAI stablecoin, to BlackRock tokenizing fund shares, this movement is evolving into an experiment in the value integration of institutional capital and crypto-native protocols.

This report systematically reviews the differentiated landscape of the RWA ecosystem as of 2025, focusing on its main categories and representative projects, helping readers understand the current state of industry development and quickly find reference projects.

The report is approximately 10,000 words long, with an estimated reading time of 10 minutes (This report is produced by DePINOne Labs; please contact us for reprints).

RWA: On-chain Reconstruction of Value Flow in Traditional Assets

By the end of 2024, the total assets in the RWA tokenization market (excluding stablecoins) have surpassed $50 billion, growing nearly 67% from about $30 billion at the beginning of the year. This growth reflects widespread interest from both institutional and retail investors.

Reports on the security token market indicate that over 1,200 unique security tokens are traded across various platforms, covering debt, equity, real estate, and commodities. The tokenized trading volume has steadily increased each month, reaching a market cap peak of $14 billion in December alone.

Real estate dominates the market. Issuers have announced tokenization projects worth $24 billion, with $5.4 billion already launched on-chain. Platforms like RealT and RedSwan CRE are leading in the residential and commercial real estate sectors. In 2024, the secondary market trading volume for tokenized real estate grew by 40% year-on-year, indicating increasing liquidity.

Tokenized bonds have also gained attention. The total issuance in Germany (59.8%), China (13.1%), Hong Kong (7.5%), and other European markets reached $12.8 billion. Notable examples include Germany's digital bond issuance platform and the Hong Kong Monetary Authority's green bond pilot program. Bond tokenization reduces settlement time from T+2 days to nearly instantaneous on-chain settlement, attracting banks like Deutsche Börse and JPMorgan to explore this model.

The adoption of liquidity funds is rapid. Franklin Templeton's Franklin On-chain U.S. Government Money Fund (BENJI) accumulated $375 million in assets under management within six weeks of launch, exceeding $709 million by April 2025. Shortly thereafter, Hashnote's USYC surpassed BENJI, leading the year-end with $648.5 million in assets under management. These tokenized money market products meet the market's demand for safe, yield-generating assets, which can also serve as collateral on platforms like FalconX and Hidden Road.

These data highlight the rapid proliferation of RWA tokenization. They underscore an increasingly mature market where tokenized assets can provide real-world liquidity, reduce costs, and create new investment opportunities.

RWA Ecosystem Classification and Representative Projects

Government Bonds and Securities

Government bonds and securities are the core areas of RWA tokenization, with underlying assets primarily consisting of bonds issued by sovereign nations (mainly U.S. Treasury bonds) and standardized financial securities. The current market coverage is concentrated in the U.S. Treasury market (over 90% share) and is gradually expanding to European sovereign bonds, with representative projects including Ondo Finance (tokenization of U.S. Treasury ETFs). This category features low volatility and stable income cash flows, reducing the traditional $100,000 investment threshold through fragmented tokens, enabling 24/7 on-chain settlement, and providing compliant dollar yield exposure for global investors.

- Ondo Finance

🔗 https://ondo.finance/

Ondo Finance focuses on tokenizing U.S. Treasury bonds and fixed-income products, with its OUSG fund (Ondo Short-Term U.S. Government Bond Fund) providing investors with a blockchain-based entry to Treasury yields.

In 2024, Ondo's assets under management surpassed $1 billion and integrated with multiple DeFi protocols (such as Aave) to enable on-chain reinvestment of yields.

In 2025, Ondo Finance further expanded the bridging capabilities of its USDY token to the Solana blockchain, achieving cross-ecosystem liquidity through LayerZero. This development enhances its competitiveness in the institutional RWA market.

- BUIDL by BlackRock

🔗 https://www.blackrock.com/

BlackRock's BUIDL fund is a tokenized money market fund operating on Ethereum, managing nearly $2 billion in assets. The fund offers a transparent and efficient investment method through blockchain technology, attracting widespread attention from institutional investors.

BUIDL ensures compliance and security through a partnership with Securitize, becoming a benchmark project for the integration of traditional finance and blockchain.

- Matrixdock

🔗 https://www.matrixdock.com/

Matrixdock is a multi-chain RWA platform focused on tokenizing traditional financial assets.

Through collaboration with Chainlink, Matrixdock ensures the accuracy and reliability of asset pricing, providing a secure investment environment for investors. The Matrixdock platform supports various asset classes, including government bonds and ETFs, and is expected to further expand its market coverage in 2025.

- Other Projects

Backed Finance, Compound (COMP), OUSG, Midas, Dusk Network, Finteum, OpenEden

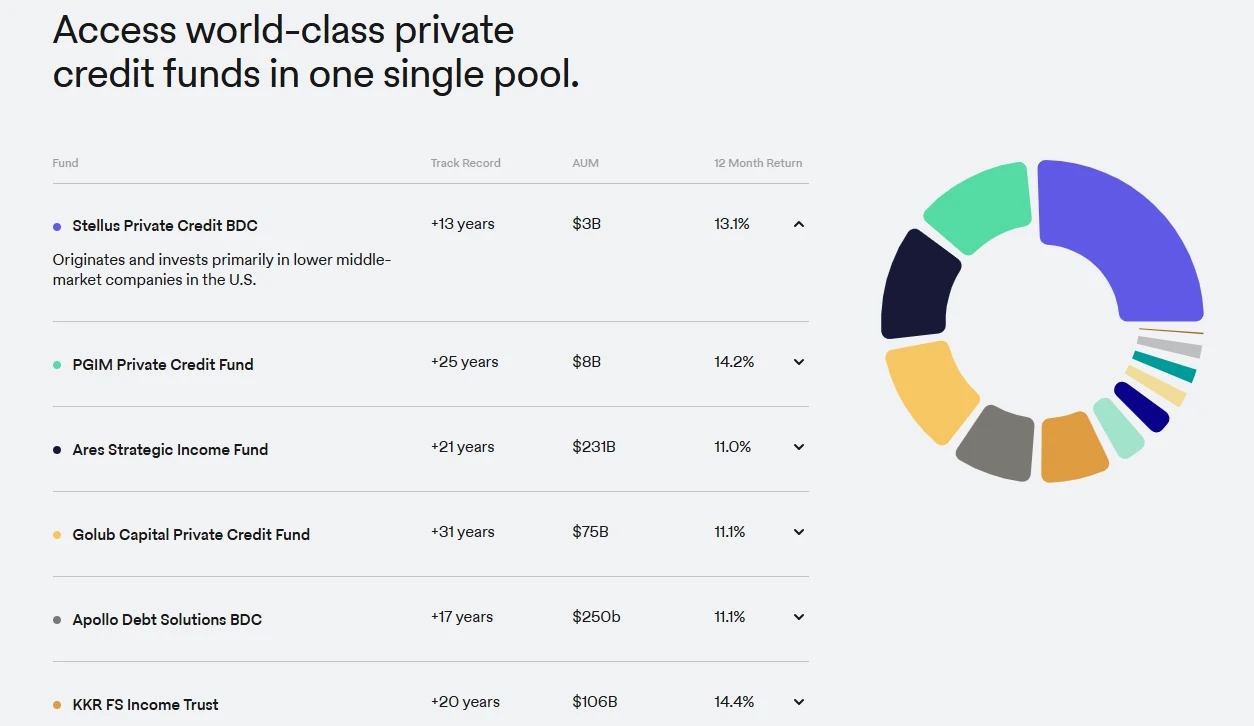

Private Credit

RWA private credit focuses on commercial real estate mortgages, small and medium-sized enterprise receivables, and supply chain financial assets, addressing the financing needs of emerging market enterprises (e.g., Southeast Asian supply chain finance accounts for 35% of Centrifuge protocol's asset scale). Its advantages lie in the automatic cash flow distribution enabled by smart contracts, addressing pain points such as redundancy in traditional credit markets and inefficiencies in cross-border settlements. Representative projects like the Goldfinch protocol maintain a bad debt rate below 1.2%, showcasing the innovative capabilities of blockchain technology in credit risk assessment.

- Maple

🔗 https://maple.finance/

Maple is a decentralized credit platform focused on providing on-chain credit services for institutions and enterprises. Through its governance token MPL, Maple achieves community governance and risk management, with significant growth in its loan pool size in 2024.

In 2025, Maple launched a BTC yield strategy, offering an annualized yield of 5.1%, attracting the attention of traditional financial players.

- Goldfinch

🔗 https://www.goldfinch.finance/

Goldfinch focuses on private credit in emerging markets, providing loans to borrowers without credit history through blockchain. Investors can participate in the loan pool via the GOLD token, earning an annualized yield of 8-15%.

In 2024, Goldfinch's active loan value reached $446 million, with plans to expand into African and Southeast Asian markets in 2025, further promoting financial inclusion.

- Centrifuge

🔗 https://centrifuge.io/

Centrifuge tokenizes invoices, loans, and other real-world assets through its Tinlake protocol, providing low-cost financing for small and medium-sized enterprises. In 2024, Centrifuge's tokenized asset pool exceeded $500 million and collaborated with MakerDAO to bring private credit into DeFi. In 2025, Centrifuge released version 3, further optimizing the efficiency and scalability of on-chain finance.

- Other Projects

Defactor ($FACTR), TrueFi ($TRU), Clearpool ($CPOOL), Credix Finance, Intain, FortunaFi, Credefi Finance, KKR, Dinari, Creditcoin (CTC)

Real Estate

The underlying assets of real estate RWA include commercial properties (58%), residential properties (32%), and land development projects (10%), primarily active in the U.S. REITs market, Dubai Free Trade Zone, and Southeast Asian tourism real estate sectors. By implementing a tiered token structure (such as RealT's property equity NFTs), fractional investments in million-dollar properties are achieved, combined with an automatic on-chain distribution mechanism for rental income, addressing core pain points of traditional real estate investment, such as poor liquidity (average exit cycle of 6-8 months) and high management costs (annual management fees of 3-5%). The Propy platform pioneered an on-chain property registration system, completing over 23,000 cross-border real estate transactions.

- Propy

🔗 https://propy.com/

Propy utilizes blockchain technology to simplify real estate transactions, providing decentralized land registration and online home purchasing services. In 2024, Propy's transaction volume in the U.S. and European markets grew by 50%, supporting investors in purchasing fractional shares of properties. Propy's platform ensures transaction transparency and security through smart contracts, with plans to further expand into the Asian market in 2025.

- RealT

🔗 https://propy.com/

RealT focuses on the tokenization of residential properties in the U.S., allowing investors to purchase property tokens for as low as $50. Token holders can receive rental dividends and property appreciation benefits. In 2024, RealT's tokenized real estate assets accounted for 60% of the market's total value, with plans to expand into commercial real estate in 2025 to attract more institutional investors.

- Other Projects

LABS Group ($LABS), Tangible ($TNGBL), Parcl, Realio Network ($RIO), PropChain, Homebase, LandX Finance, PlayEstates

Stablecoins

Stablecoins serve as on-chain representations of fiat assets, with underlying reserves in sovereign currencies such as the U.S. dollar and euro (USDC, USDT have over 96% dollar reserves), achieving value stability through a 1:1 peg mechanism. The current market size has reached $140 billion, covering cross-border payment scenarios in over 200 countries/regions, with an average daily settlement volume exceeding $10 billion. Its core advantage lies in combining the stability of traditional finance with the 24/7 global liquidity of blockchain. USDC issuer Circle holds a New York BitLicense and a UK electronic money institution license, with reserve assets subject to monthly third-party audits to ensure compliance and transparency.

- Tether (USDT)

🔗 https://tether.to/

As the largest stablecoin by market capitalization, USDT is backed by U.S. dollar reserves and short-term bonds, widely used in crypto trading and DeFi protocols. In 2024, USDT's on-chain trading volume accounted for over 60% of the stablecoin market. Tether generates revenue by investing in highly liquid assets (such as U.S. Treasury bonds) while ensuring the 1:1 dollar peg of the token.

- Circle (USDC)

🔗 https://www.circle.com/

USDC is known for its transparent reserve management and compliance, with reserve assets including cash and short-term government bonds. Circle collaborates with Coinbase to provide seamless fiat-crypto conversion for institutional and retail users. In 2025, the application of USDC in cross-border payments and DeFi lending is expected to further grow, solidifying its market position.

- Other Projects

MakerDAO($MKR), Reserve Rights (RSR), OpenEden OpenDollar (USDO), Compounding OpenDollar (CUSDO)

Precious Metals

Precious metals RWA is based on physical gold (82% share), silver (15%), and platinum group metals (3%) certified by the London Bullion Market Association (LBMA), enabling divisible investments starting from 1 gram of gold (approximately $65) through on-chain certificates. Representative projects like PAX Gold (PAXG) and Tether Gold (XAUT) store physical gold bars in top custodians like Brink's, with audit frequencies at quarterly levels. These assets have an annualized volatility of less than 8% and a correlation of only 0.2 with Bitcoin, making them an important hedge in crypto portfolios, with on-chain gold trading volume surging 340% year-on-year in 2023.

- Paxos

🔗 https://paxos.com/

Paxos issues PAXG (PAX Gold), where each token corresponds to one ounce of London Good Delivery gold bars, providing investors with a convenient gold investment channel. Paxos also issues other stablecoins, such as USDP, committed to providing secure and compliant digital assets, with its market share steadily growing in 2024.

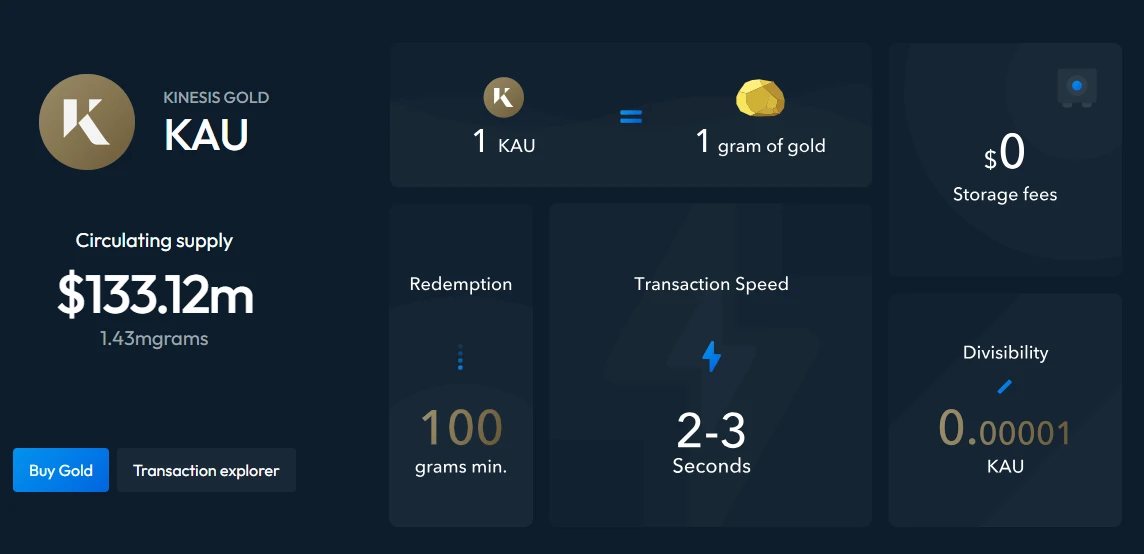

- Kinesis Gold

🔗 https://kinesis.money/gold/

Kinesis Gold (KAU) is a digital currency. Each KAU is backed by one gram of pure gold, which is stored in fully insured and audited vaults in your name. KAU allows you to spend, trade, send, and earn physical gold anywhere in the world.

As a true stablecoin, KAU enables cryptocurrency traders to easily exit volatile markets and enter the enduring value of physical gold while earning monthly yields on precious metals through transaction fee income redistributed among users. Yields are earned by holding assets on the Kinesis platform, and spending KAU on the Kinesis virtual card also generates yields. This card allows users to spend gold and cryptocurrency through real-time, instant conversion at over 80 million locations worldwide.

- Uranium308

🔗 https://u3o8.co/

Uranium308 (U3O8) is a tokenized precious metals project.

According to a report by Canaccord Genuity in September 2021, the total global supply of uranium mines is approximately 150 million pounds, equating to about $6.7 billion annually at the current price of $45 per pound. It is expected that by 2035, uranium mine supply will increase to about 250 million pounds, but demand will still exceed supply.

- Other Projects

LODE, Project 79, Ethena, Cache Gold, Meld Gold, Aurus, Tether Gold (XAUT), Quorium (QGOLD)

Carbon Assets / Regenerative Finance (ReFi)

RWA carbon assets refer to carbon credits, carbon allowances, and other carbon emission rights recorded in digital token form through blockchain technology on RWA (Real World Assets) platforms, achieving asset digitization and fragmentation to increase their liquidity and trading efficiency.

On-chain regenerative finance projects are also a relatively new field in traditional finance, aiming to address real-world social and environmental issues through the use of blockchain.

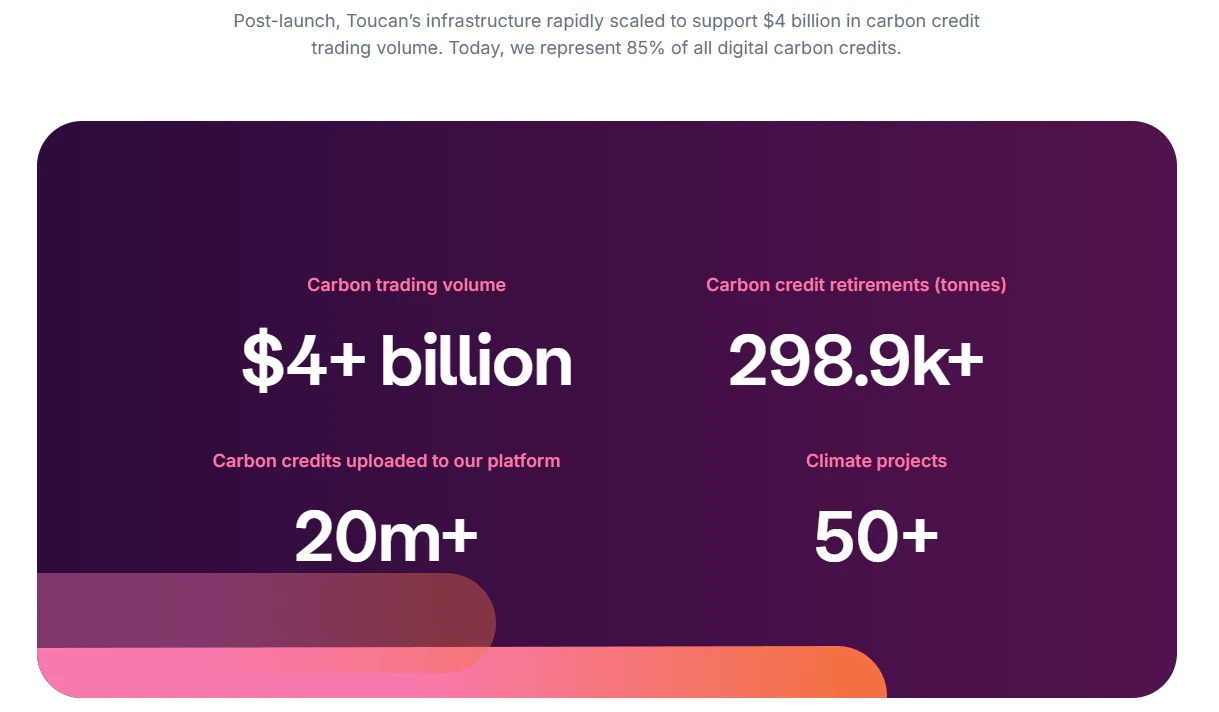

- Toucan Protocol

🔗 https://toucan.earth/

Toucan tokenizes carbon credits, creating an on-chain carbon market that allows businesses and individuals to purchase carbon offset tokens. In 2024, Toucan's carbon token trading volume exceeded 100 million tons of CO2 equivalent. In 2025, Toucan continues to play a significant role in building carbon market infrastructure, promoting transparency and efficiency in the carbon removal sector.

- Flowcarbon

🔗 https://www.flowcarbon.com/

Flowcarbon focuses on the on-chain trading and management of carbon credits, collaborating with traditional energy companies to promote the development of carbon markets. Flowcarbon's platform provides investors with transparent and efficient carbon credit investment opportunities, with plans to further expand its market influence in 2025.

- KlimaDAO

🔗 https://www.klimadao.finance/

KlimaDAO promotes climate financing through the tokenization of carbon credits, allowing KLIMA token holders to participate in the governance of the carbon market. In 2025, KlimaDAO collaborates with traditional energy companies to expand the application of carbon credit tokenization, becoming a leading project in the ReFi field.

- Other Projects

Regen Network ($REGEN), Agro Global Token

Art and Collectibles

Art RWA encompasses museum-quality collections (such as Picasso paintings), luxury goods (Patek Philippe watches), and cultural IP (NBA player cards), currently primarily focused on the auction markets in Europe and the U.S. (Sotheby's NFT auction revenue reached $120 million in 2023). By solving the liquidity dilemma of the $1 billion art market through ownership fractionalization tokens, and utilizing the immutable characteristics of NFTs to establish digital twin certificates, the provenance verification time for Christie's auction items has been reduced from an average of 14 days to instant on-chain verification. However, it is important to note that the valuation of non-standard assets relies on compliance costs brought by third-party certification agencies (such as ARTFRAME's AI appraisal system).

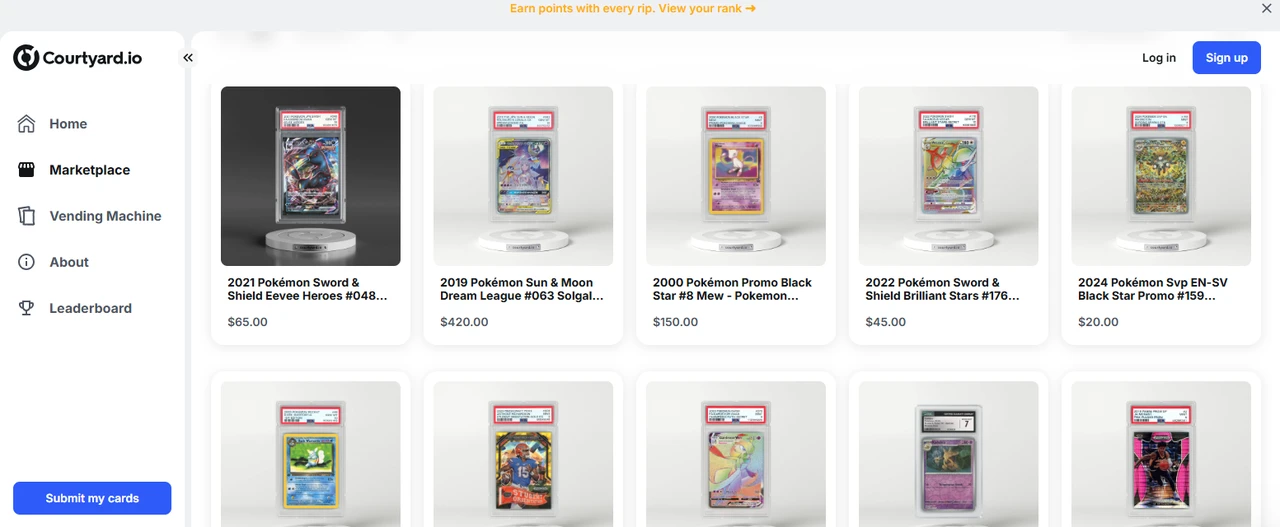

- Courtyard.io

🔗 https://courtyard.io/

Courtyard.io is a platform for the tokenization of art, allowing investors to hold partial ownership of artworks by purchasing NFTs. The platform supports secondary market trading of artworks, enhancing their liquidity, with significant growth in trading volume expected in 2024.

- Freeport

🔗 https://www.freeport.art/

Freeport is a storage and management platform focused on high-value artworks and collectibles, providing secure and transparent ownership records through blockchain technology, allowing users to invest in fractionalized artworks using tokens on Ethereum.

Freeport's platform offers convenient on-chain trading services for art owners, with expectations to attract more high-end collectors by 2025.

- Other Projects

Curio ($CUR), Galileo Protocol, Lingo, Golteum, ClubRare, Artrade (ATR), Keeta

RWA Infrastructure

The RWA infrastructure layer is centered around compliance frameworks (security token standards), cross-chain protocols (such as Circle CCTP), and legal entity structures (SPV special purpose vehicles). Securitize's DS protocol has completed compliant issuance of over 400 types of RWA assets. The technology stack in this field shows a modular trend, with Chainlink's proof of reserve pricing service adopted by 85% of RWA projects. The infrastructure market size is expected to reach $4.7 billion by 2025 (according to Traceni report data), and its development will directly determine the construction of compliant channels for trillion-dollar traditional assets on-chain.

- Plume

🔗 https://plume.org/

Plume is an EVM-compatible public chain built for the next generation of real-world asset (RWA) development. We not only tokenize assets but also aim to create a seamless way to use assets like cryptocurrencies: staking, exchanging, lending, borrowing, and more.

Plume is building a permissionless, transparent, and demand-driven financial system where anyone can access high-quality assets, trade freely, and innovate with new financial tools.

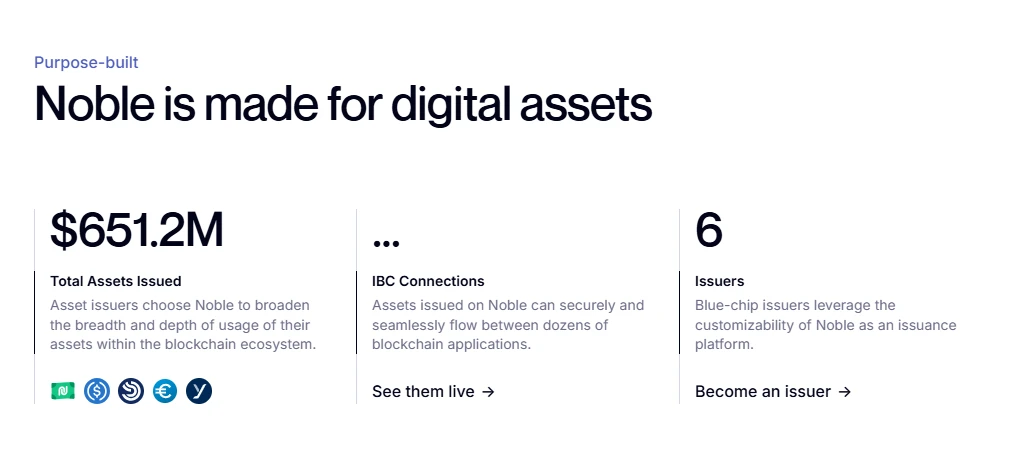

- Noble

🔗 https://www.noble.xyz/

Noble is a Cosmos application-specific blockchain designed for the issuance of native assets. Noble brings the efficiency and interoperability of native assets into the broader Cosmos ecosystem, starting with USDC.

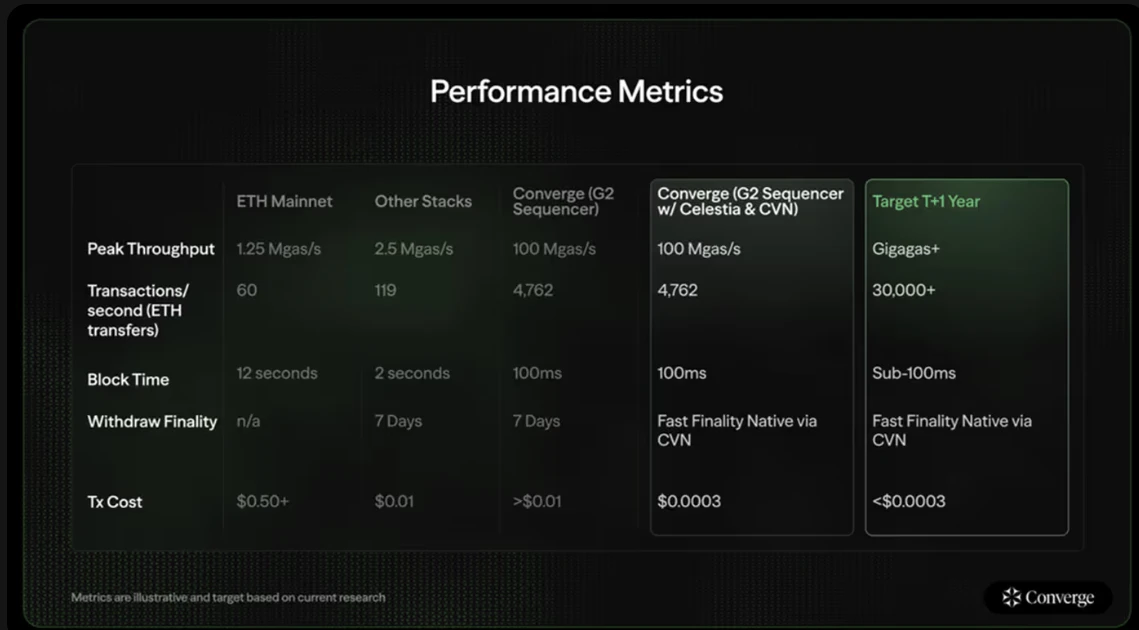

- Converge

🔗 https://www.convergeonchain.xyz/

Converge is pursuing one of the most ambitious goals in today's cryptocurrency space: bringing billions of dollars of institutional capital on-chain to integrate risk-weighted assets (RWA) with DeFi.

Converge is building various financial applications based on Ethena and Securitize. The total asset under management (TVL/AUM) of Ethena and Securitize is close to $10 billion, positioning Converge to become one of the largest blockchain networks currently.

- Securitize

🔗 https://securitize.io/

Securitize is a leader in the tokenization of real-world assets, having issued over $1 billion in assets on-chain and collaborating with top issuers such as BlackRock, KKR, and Hamilton Lane.

- Other Projects

ELYSIA ($ELFI), Tokeny Solutions, StrikeX ($STRX), INX ($INX), Polytrade, Sologenic, Polymesh Network, MANTRAO ($OM), Provenance ($HASH), SpruceID, Quadrata, Swarm Markets ($SMT)

RWA Tokenization Trends to Watch in 2025

Deepening Institutional Participation

The deep involvement of traditional financial institutions is a core driving force for the development of the RWA ecosystem. In 2024, giants like BlackRock, JPMorgan, and Goldman Sachs are reshaping financial markets through tokenization projects. For example, BlackRock's BUIDL fund manages nearly $2 billion in assets on Ethereum, becoming a benchmark for institutional-level tokenization. JPMorgan's Kinexys platform has processed over $15 trillion in transactions, with an average daily trading volume exceeding $2 billion. Franklin Templeton's OnChain US Government Money Fund manages fund shares through blockchain, showcasing the potential of tokenized funds. In 2025, as more traditional financial institutions enter the RWA space, the market size and credibility are expected to significantly increase.

Improvement of Regulatory Frameworks

The improvement of the regulatory environment provides crucial support for the maturation of the RWA ecosystem. The EU's Markets in Crypto-Assets Regulation (MiCA) is expected to come into full effect in the second quarter of 2025, providing a unified compliance framework for RWA tokenization and reducing legal risks. The UK's Electronic Trade Documents Bill was passed in 2023, legalizing electronic trade documents and paving the way for their tokenization. Additionally, regions like Singapore and Hong Kong are formulating RWA-related regulations, with clearer regulatory pathways expected by 2025. These regulatory measures will enhance investor confidence and attract more institutional and retail investors into the RWA market.

Market Size Expansion

According to the Ozean report, the RWA tokenization market (excluding stablecoins) is expected to reach $5 billion by 2025, growing approximately 230% from $1.52 billion in 2024 (Coingeek). In the long term, predictions compiled by Tren Finance indicate that the market size could range between $4 trillion and $30 trillion by 2030, with a median of about $10 trillion, representing over a 54-fold increase from the current market size of $18.5 billion (including stablecoins).

Diversification of Asset Classes

RWA tokenization is expanding from traditional financial assets to emerging fields, with expectations to cover more asset classes by 2025. Real estate tokenization lowers investment barriers through fractional ownership, accounting for 60% of the market's total value in 2024, and is expected to continue dominating in 2025. Private credit tokenization provides financing for small and medium-sized enterprises through blockchain, with active loan values from Centrifuge and Goldfinch reaching $446 million in 2024, and further growth expected in 2025. Carbon credit tokenization is becoming a highlight in the ReFi field, with trading volumes from Toucan Protocol and KlimaDAO exceeding 100 million tons of CO2 equivalent in 2024, and the market size expected to double in 2025. Additionally, the tokenization of artworks, collectibles, supply chain finance, and intellectual property is also showing growth trends, injecting new vitality into the RWA ecosystem.

Conclusion

The above outlines the development blueprint for real-world assets (RWA) in 2025. Through an in-depth analysis of the definition, development, market review of 2024, trends to watch in 2025, and representative projects in key areas of the ecosystem, we can clearly see the diversity and potential of the RWA ecosystem.

In 2024, the total assets of the RWA market (excluding stablecoins) reached approximately $1.52 billion, an 85% increase from the previous year, covering a wide range of asset classes from real estate to bonds, from funds to artworks. This growth not only reflects the market's demand for liquidity and transparency but also marks the increasing importance of institutional investors in RWA. Looking ahead to 2025, the RWA ecosystem will continue to expand, driven by the deep participation of traditional financial institutions, the improvement of regulatory frameworks, and the diversification of asset classes.

The rise of RWA not only reconstructs the value flow model of traditional assets but also provides investors with unprecedented opportunities. Through blockchain technology, RWA achieves fractional ownership of assets, enhances liquidity, and lowers investment barriers. However, for investors, technology developers, and policymakers, the future presents both challenges and opportunities.

References

BlackRock Launches Its First Tokenized Fund, BUIDL, on the Ethereum Network

https://www.binance.com/zh-CN/square/post/17324425199913

https://foresightnews.pro/article/detail/30855

https://www.chaincatcher.com/article/2096718

https://web3caff.com/archives/58122

https://www.techflowpost.com/article/detail_11880.html

https://www.hellobtc.com/kp/du/07/4360.html

Special Statement: All articles from DePINone Labs are for informational and educational purposes only and do not constitute any investment advice.

End

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。