Master Discusses Hot Topics:

Last night, U.S. stocks soared, with the Nasdaq and S&P pushing against key resistance, seemingly on the verge of entering a bull market. However, looking at Bitcoin, it took a dive after the close, dropping sharply and showing no respect for the U.S. stock market. This divergence feels awkward; where does the problem lie?

The Master believes the first possibility is that U.S. stocks are currently absolutely attractive. With tariffs easing and limited liquidity, funds are flowing that way. To put it bluntly, there’s only so much money in the market; if U.S. stocks are rebounding, the crypto market will naturally cool off and lose funding.

The second possibility is even more painful: there hasn’t been anything fresh in the crypto space lately, not even a compelling narrative. The market doesn’t even know where it’s headed, and the stories being told are stuck in the past few months. The momentum and gains are indeed hard to describe; relying on talk and air won’t work.

Looking at the broader environment, June saw a major overhaul of U.S. debt, with new and old bonds being managed together, directly sucking a large chunk of liquidity out of the market by the Federal Reserve. This is no joke, even if there doesn’t seem to be any negative news on the surface.

However, this blood-sucking transfer of funds is enough to leave Bitcoin without the strength to move. If it can’t break through key levels, and if the non-farm payroll data doesn’t show strength, a pullback to daily support is highly probable.

Returning to the Bitcoin market, comparing the contract market today with yesterday reveals some clues. First, there are still a lot of short liquidation zones below 108k, but the long orders around 102k have actually decreased. This indicates that the pull from below isn’t strong, while the upper area is a concentration of short positions.

Second, the funding rates have dropped across the board, indicating that shorts have started to enter the market. This means that the current market is no longer solely supported by longs; shorts are also getting involved, making the price feel like it’s being pulled in both directions, with potential for sudden movements.

In simpler terms, the current market is very sensitive; it could either continue to oscillate upwards and gradually clear out the shorts below 108k, or if the long structure breaks and new lows are set, it could plunge directly down into the long liquidation zone, possibly resulting in a large bearish candle.

While it’s true that the absence of negative news for Bitcoin is the biggest positive, don’t think that guarantees stability. The market is too sensitive to sentiment, liquidity, and policy; whether the longs have strength is key. If there are no surprises in Friday’s non-farm payroll, don’t be surprised if it drops again.

Master Looks at Trends:

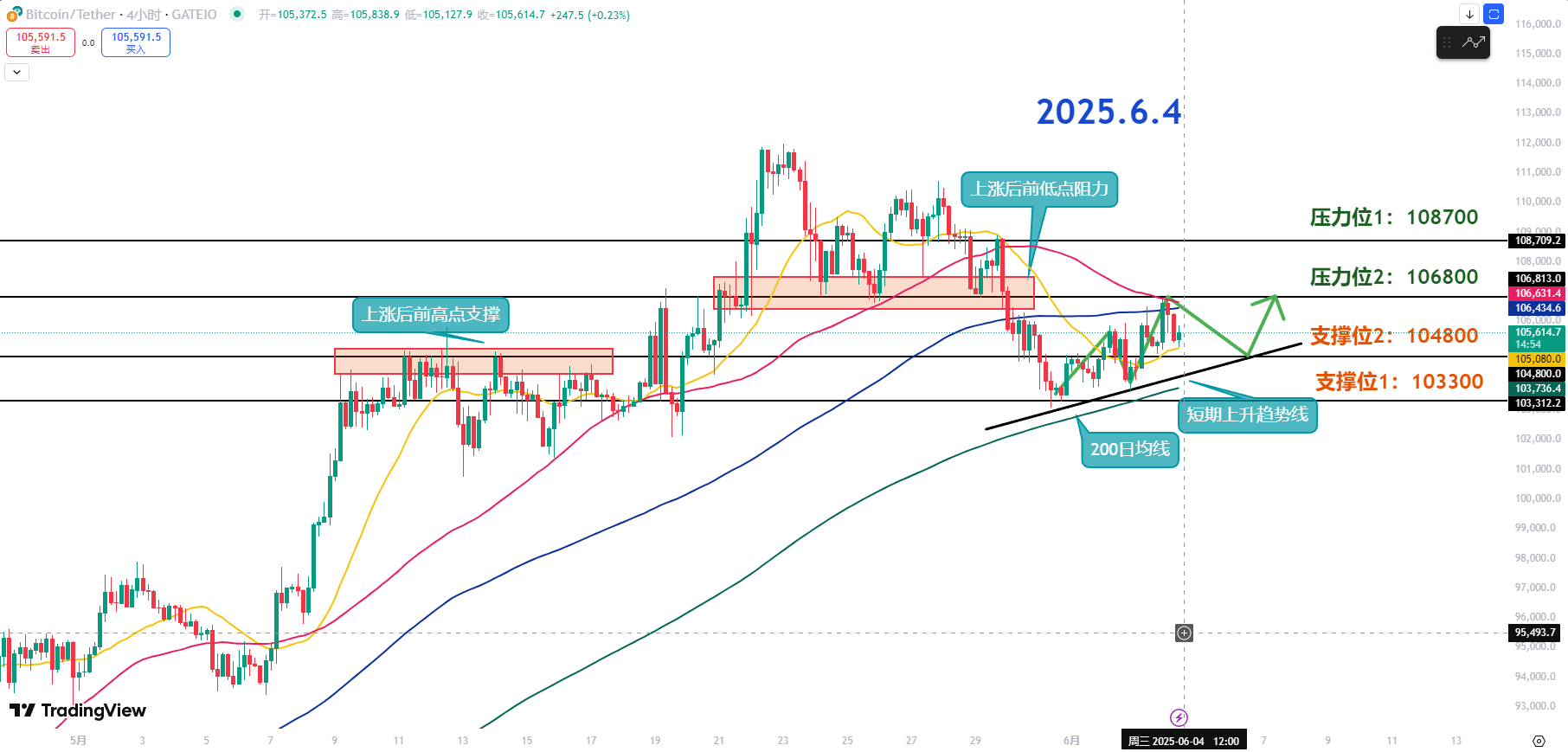

Resistance Levels Reference:

Second Resistance Level: 108700

First Resistance Level: 106800

Support Levels Reference:

Second Support Level: 104800

First Support Level: 103300

Today's Suggestions:

Bitcoin briefly broke through 106K yesterday but quickly fell back to the 105K area and couldn’t continue to rise, currently still oscillating within the range. From a technical perspective, a sideways range has formed, with 103.3K–104.8K serving as short-term support, while maintaining a long position approach; attention should also be paid to the 200-day moving average trend.

The first resistance level is a recent high point; if it can rebound around 106.3K with accompanying volume, the probability of reaching the second resistance at 108.7K will significantly increase.

In the short term, as long as the 104.3K–104.8K range can hold, the long position approach can continue. The key is whether the short-term upward trend line can hold. If a pullback occurs, opportunities to enter the market can be seized near this range.

If a rapid decline occurs, the area of 103.3K–103.5K must hold. Also, monitor the 200-day moving average and volume conditions; if entering a short position, the average opening cost should be controlled at a favorable position.

6.4 Master’s Wave Strategy:

Long Entry Reference: Buy in batches in the 101500-103300 range, Target: 104800-106800

Short Entry Reference: Sell in batches in the 106800-107600 range, Target: 104800-103300

If you truly want to learn something from a blogger, you need to keep following them, rather than making hasty conclusions after just a few market observations. This market is filled with performers; today they screenshot long positions, tomorrow they summarize short positions, making it seem like they "always catch the tops and bottoms," but in reality, it’s all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don’t be blinded by exaggerated data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This content is exclusively planned and published by Master Chen (WeChat: Coin Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans and community live broadcasts are now available!

Warm Reminder: This article is only written by Master Chen on the official account (as shown above); other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in discerning authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。