The homework from the past two days hasn't been too difficult, mainly because Trump hasn't intervened in the market much these days. Aside from the tariff adjustments on steel announced last Friday, he has continued to communicate with China. The market is already very familiar with Trump's TACO.

As long as Trump uses tariffs to threaten the market, it's time to short the S&P 500. The impact of the tariffs will gradually fade, quickly within a day or slowly within a week. Generally, the harsher the words, the more likely there will be a temporary pause in such tariff plans. Currently, it seems that Trump has set the final adjustment period for reciprocal tariffs on July 8.

In the coming month, tariff information is likely to remain one of the factors influencing market trends, while another factor will be the Federal Reserve's monetary policy. Although job vacancy data was released today, this data does not equate to non-farm payrolls and unemployment rates, so its impact on the market is not significant. The focus should still be on Friday's unemployment, employment, and wage data.

However, regarding cryptocurrencies, it seems that Trump is serious. After announcing last week that he raised $2.3 billion to purchase $BTC and other cryptocurrencies, today there are rumors that the Trump organization is preparing to develop a crypto wallet and decentralized trading application. The president's involvement can be seen as the U.S. indeed paying attention to the development of the cryptocurrency field, and it may also indicate the focus of U.S. cryptocurrency development.

Looking back at Bitcoin's data, today's turnover rate has significantly increased. Upon checking the data, it appears that two transactions involving a total of over 230,000 BTC have occurred, likely due to the reorganization of exchange wallets. This situation typically occurs once every quarter and does not impact prices, so in reality, BTC's price is still maintaining a narrow range of fluctuations today.

Recently, both Trump and the Federal Reserve's influence on the market has been decreasing. Although several Federal Reserve officials have expressed concern about tariffs in their speeches over the past week, they have also informed the market that as long as tariffs are not confirmed, the Federal Reserve will not provide a clear response. Therefore, the market has adjusted its expectations for interest rate cuts, and currently, the probability of a rate cut in the third quarter is less than 28%.

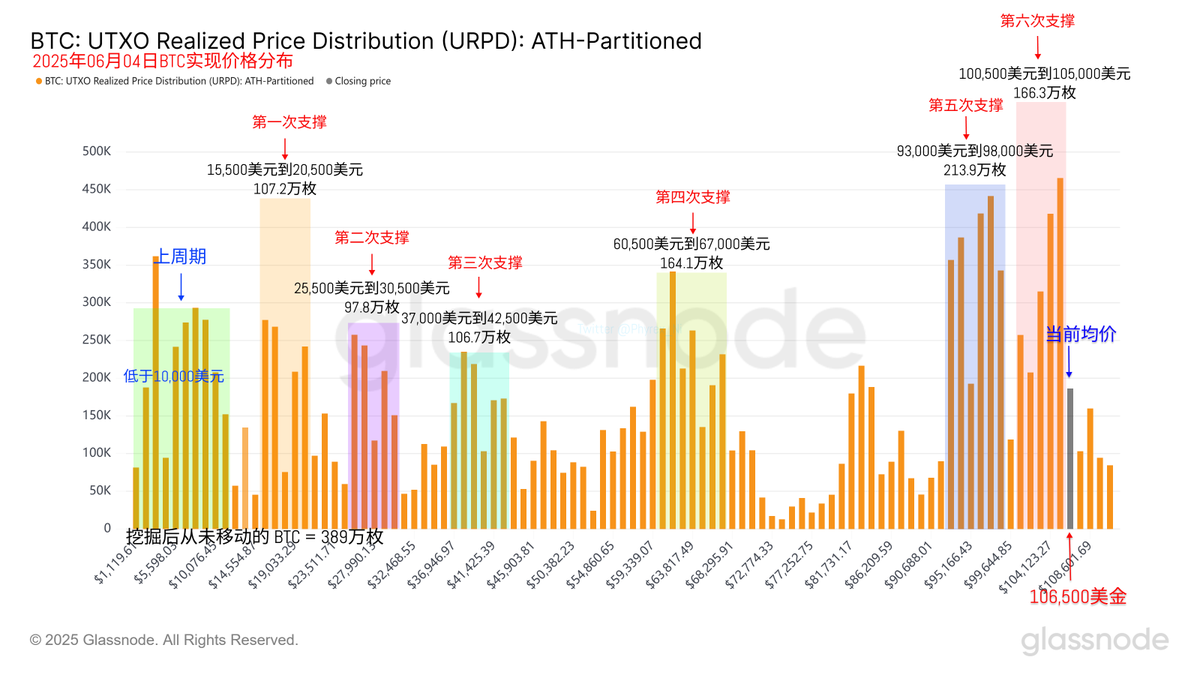

Although turnover has increased significantly, the range of $93,000 to $98,000 remains the most solid support. As long as investors at this level do not exit significantly, the impact on prices will not be substantial.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。