Recently, JP Morgan and Morgan Stanley both released their mid-term investment strategy outlook for 2025, which is worth a look. Overall, they discussed a few points:

1️⃣ Trump 2.0: A risk and an opportunity

• Risk aspect: Tariffs are likely to increase, potentially reaching nearly 1% of GDP, marking the largest trade reversal since the Cold War and a global supply chain restructuring.

• Opportunity aspect: Tax reform plans and relaxed financial regulations may stimulate mergers and acquisitions, loans, and bank stock performance.

In the next 12 months, we are likely to face high volatility and high risk in financial markets, but it is not purely bearish. This could be beneficial for sectors like energy and defense that are part of the "local economy."

2️⃣ Global perspective: Weakening dollar, rebound in Europe, Japan, and Hong Kong

• The strong dollar cycle may have peaked, and global funds are beginning to "rebalance."

• European fiscal expansion and de-industrialization policies, along with Japan's policy stability, are expected to create long-awaited opportunities for "relative performance improvement."

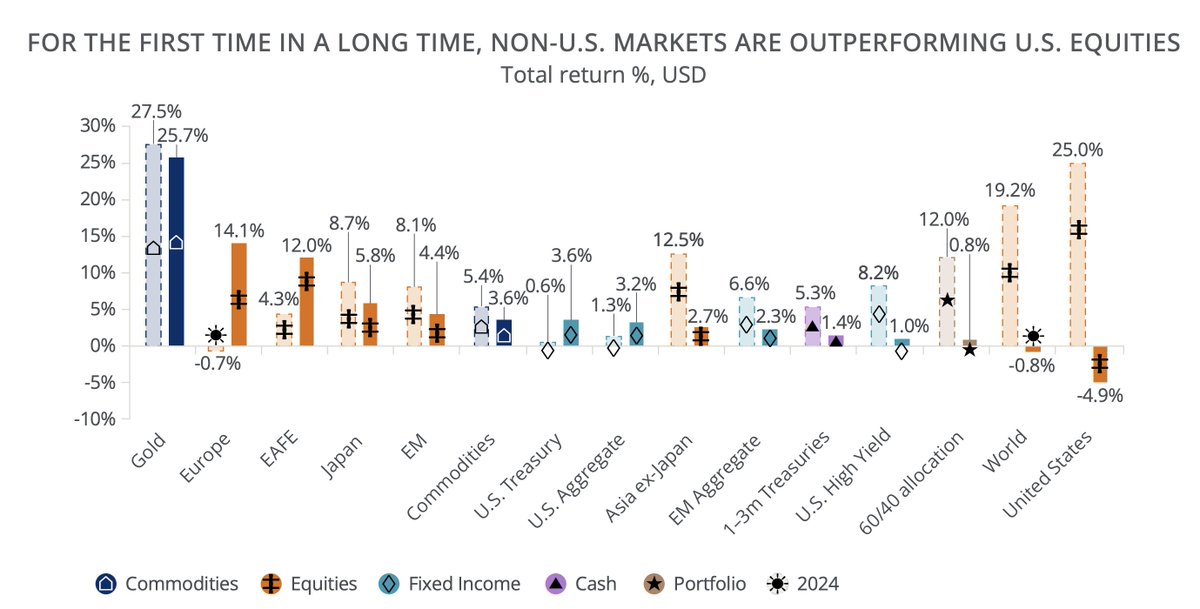

This year is a rare year where non-US markets have overall investment returns higher than the US market (as shown in Figure 2). Therefore, in terms of investment, do not go all in on US stocks; global allocation is a major trend, especially as Japan, Europe, and Hong Kong have valuation advantages and policy drivers.

3️⃣ Optimization of investment logic

• This year is a year of high volatility, and investment portfolios need "resilience": it is not about betting on the explosive potential of a single asset, but rather on structural pressure resistance.

• Both inflation and growth risks coexist: asset portfolios need to balance downside protection and upside opportunities.

• Types of opportunity assets:

Core defense: Gold, hedge funds, infrastructure

Offensive support: Structured equity notes, private credit

Have you noticed a remarkable phenomenon? The optimization of this investment portfolio is quite similar to the "all-weather strategy" we wrote in our pinned tweet on January 1st.

4️⃣ #AI still full of opportunities, focus on the application side

• Is no one talking about AI? It's just an illusion: The trend of AI reducing costs and increasing efficiency continues, benefiting the tech sector, especially infrastructure and AI enterprise application products.

• As an emerging industrial revolution, AI transforms the industrial and technology sectors comprehensively and multidimensionally. Almost all existing mid-to-high-end industries can be reformed and upgraded, especially in finance and biotechnology.

Focus on high value-added areas; the penetration and optimization of AI in industries, along with improvements in talent and efficiency, present the greatest opportunities and industrial revolutions brought by AI.

5️⃣ About crypto, Bitcoin, and gold

• JP Morgan's attitude is neutral to conservative: They believe that the volatility of crypto assets is too high, and in the short term, they still cannot serve as a "stabilizer for investment portfolios." They are more optimistic about gold's risk-hedging effect in the context of a weak dollar.

• It is recommended to allocate more to gold than to crypto; if including crypto, keep the proportion controlled (within 5%).

6️⃣ US economic growth slows + inflation intensifies

• After a growth of 2.8% in 2024 (2.5% in the fourth quarter), the US economy is expected to slow down in 2025 due to immigration restrictions and tariff policy uncertainties, potentially slowing to 1.5% for the year (1% in the fourth quarter), and possibly down to 1% in 2026.

• As companies pass some tariff-related costs onto consumers, inflation may accelerate, peaking at 3% to 3.5% in the third quarter of 2025. Additionally, immigration restrictions may lead to labor shortages and trigger inflation in the service sector.

Overall, 2025 is bound to be a turbulent and highly volatile year, filled with both opportunities and crises. High volatility inevitably brings peaks and troughs; 'patience' is the biggest investment theme this year. Avoid impatience, leverage, and contracts. This year's core theme is simply 'stability.' It is better to go out and enjoy nature than to make heavy bets in high volatility. Remember!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。