Key Points

● The total market capitalization of global cryptocurrencies is $3.43 trillion, down from $3.54 trillion last week, with a decrease of 3.2% this week. As of the time of writing, the cumulative net inflow of Bitcoin spot ETFs in the U.S. is approximately $44.37 billion, with a net outflow of $157 million this week; the cumulative net inflow of Ethereum spot ETFs in the U.S. is approximately $3.05 billion, with a net inflow of $285 million this week.

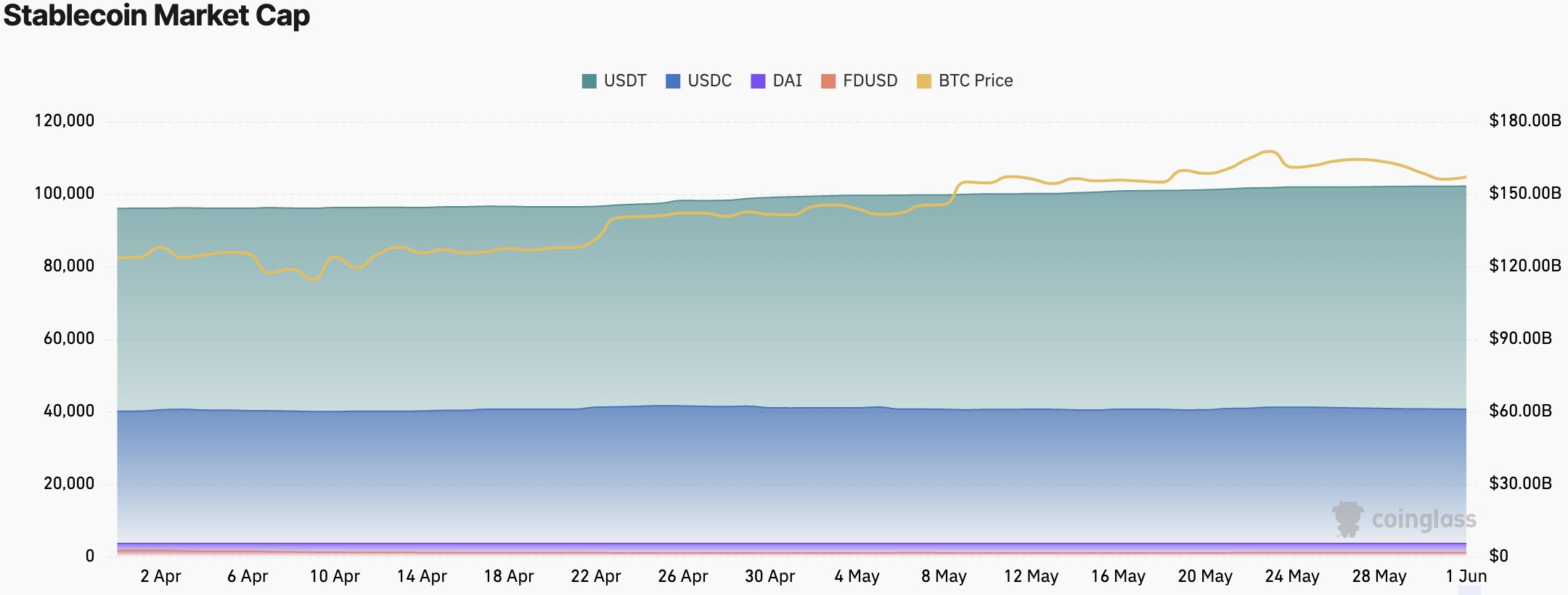

● The total market capitalization of stablecoins is $246.6 billion, with USDT having a market cap of $153.1 billion, accounting for 62.08% of the total stablecoin market cap; followed by USDC with a market cap of $60.9 billion, accounting for 24.69%; and DAI with a market cap of $5.36 billion, accounting for 2.17%.

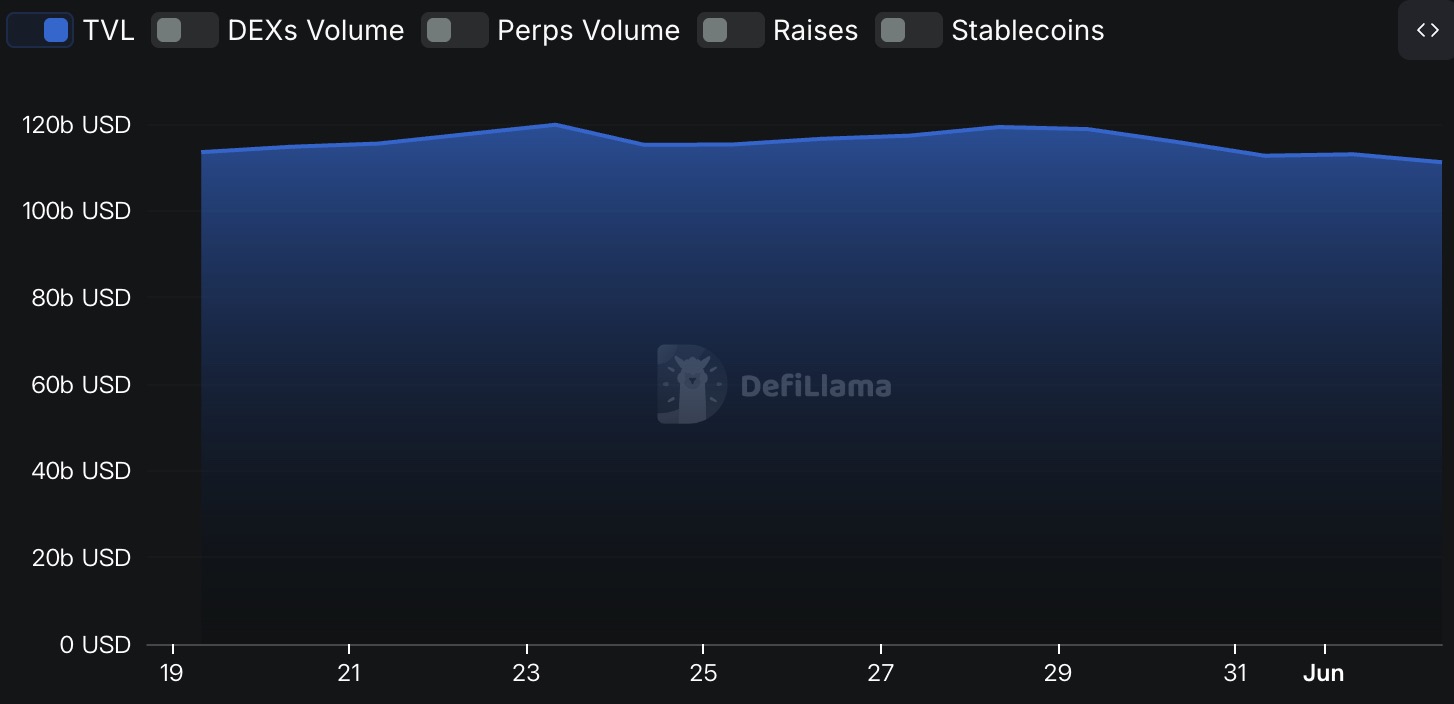

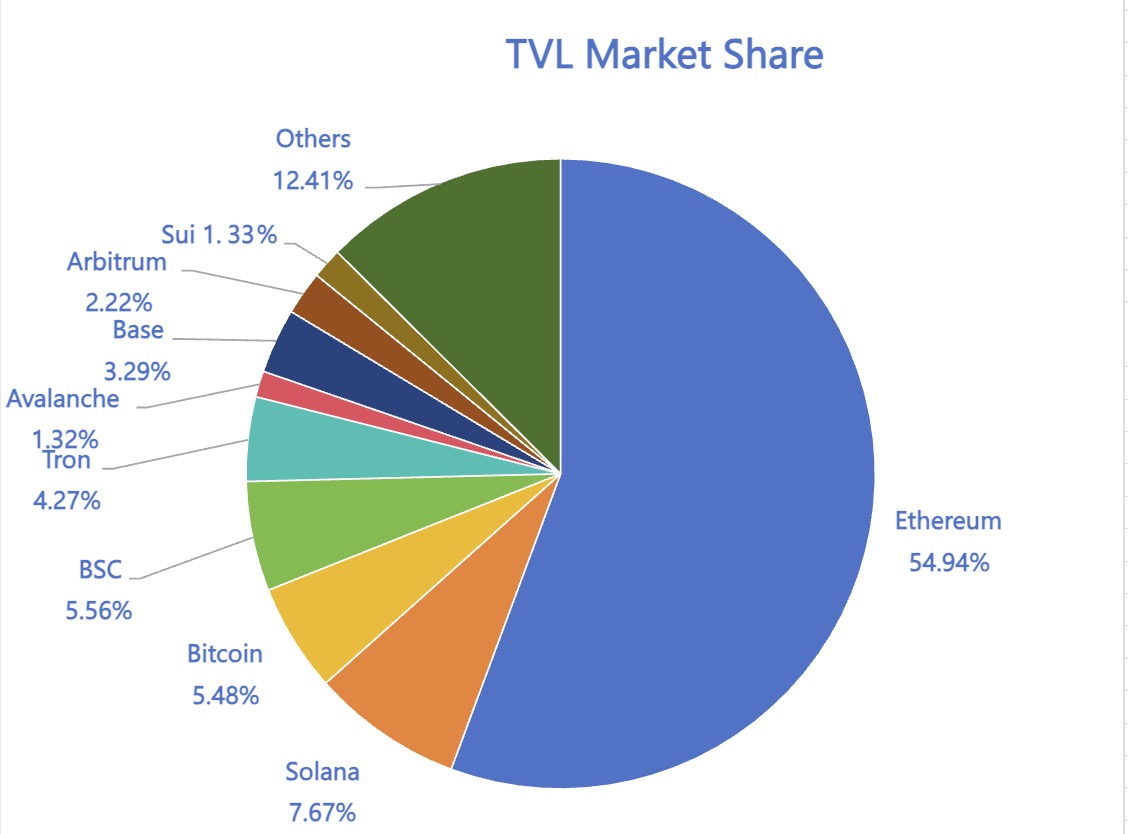

● According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $111.1 billion, down approximately 5.4% from last week ($117.1 billion). By public chain, the top three chains by TVL are Ethereum, accounting for 54.94%; Solana, accounting for 7.67%; and BNB Chain, accounting for 5.56%.

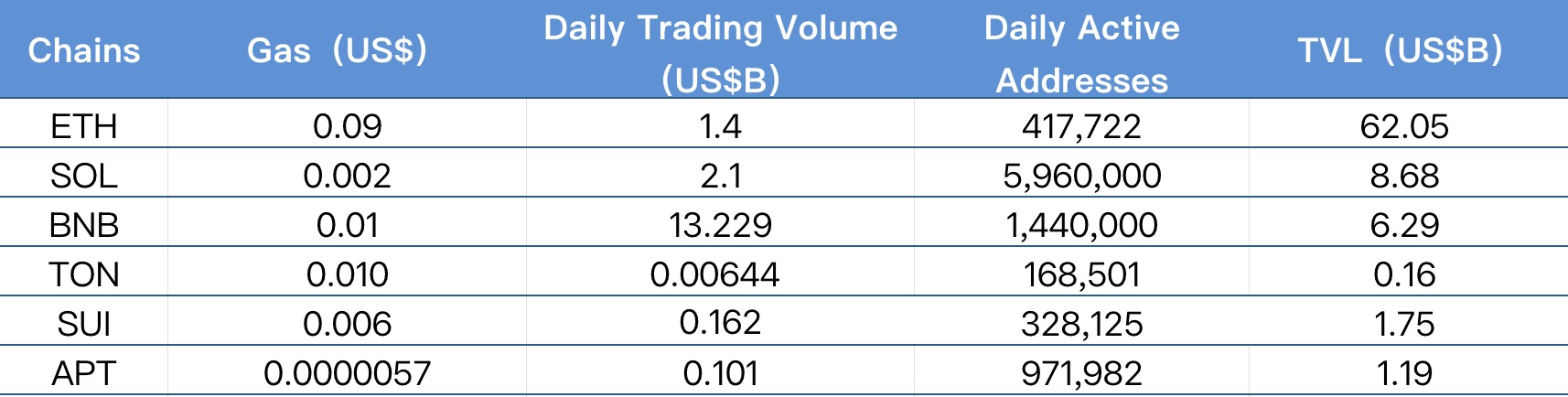

● From on-chain data, the daily transaction volume of TON and BNB Chain increased by 114% and 27%, respectively, while Solana and Aptos remained roughly flat. ETH and SUI decreased by 18% and 10%, respectively. In terms of transaction fees, ETH increased by approximately 350%, while Solana and SUI decreased by 42% and 29%, respectively, with other chains remaining nearly flat compared to last week. In terms of daily active addresses, all chains except BNB, which decreased by 17%, saw growth, with Solana increasing by 39%, Aptos, ETH, and TON increasing by about 20%, and SUI increasing by 13%. In terms of TVL, SUI increased by 7.5%, while TON and Aptos increased by 4.6% and 4.5%, respectively, while ETH, Solana, and BNB saw slight declines.

● New project highlights: Oncade is a decentralized game distribution platform aimed at helping game developers bypass traditional platform fees and sell games directly to players. Donut is a crypto browser with autonomous intelligent features, dedicated to providing users with a one-stop decentralized tool and crypto service integration experience. Cooking.City is a token fair issuance platform based on Solana, aimed at ensuring that every participant has an equal opportunity in the value creation process. Rumi Labs is a Web3 platform that rewards users for watching media content through a "watch-to-earn" mechanism.

Table of Contents

Key Points………………………………………………………………………………………. 1

Table of Contents…………………………………………………………………………….. 2

1. Market Overview…………………………………………………………………………. 2

1. Total Cryptocurrency Market Cap/Bitcoin Market Cap Proportion…….. 2

2. Fear Index………………………………………………………………………………… 3

3. ETF Inflow and Outflow Data………………………………………………………. 4

4. ETH/BTC and ETH/USD Exchange Rates………………………………………… 4

5. Decentralized Finance (DeFi)………………………………………………………. 5

6. On-Chain Data………………………………………………………………………….. 6

7. Stablecoin Market Cap and Issuance Status……………………………………. 8

2. This Week's Hot Money Trends………………………………………………………. 9

1. Top Five VC Coins and Meme Coins This Week………………………………. 10

2. New Project Insights………………………………………………………………… 10

3. Industry News Updates……………………………………………………………… 11

1. Major Industry Events This Week…………………………………………………. 11

2. Upcoming Major Events Next Week………………………………………………. 12

3. Important Investments and Financing from Last Week…………………….. 13

4. Reference Links………………………………………………………………………… 14

1. Market Overview

1. Total Cryptocurrency Market Cap/Bitcoin Market Cap Proportion

The total market capitalization of global cryptocurrencies is $3.43 trillion, down from $3.54 trillion last week, with a decrease of 3.2% this week.

Data Source: cryptorank

Data as of June 1, 2025

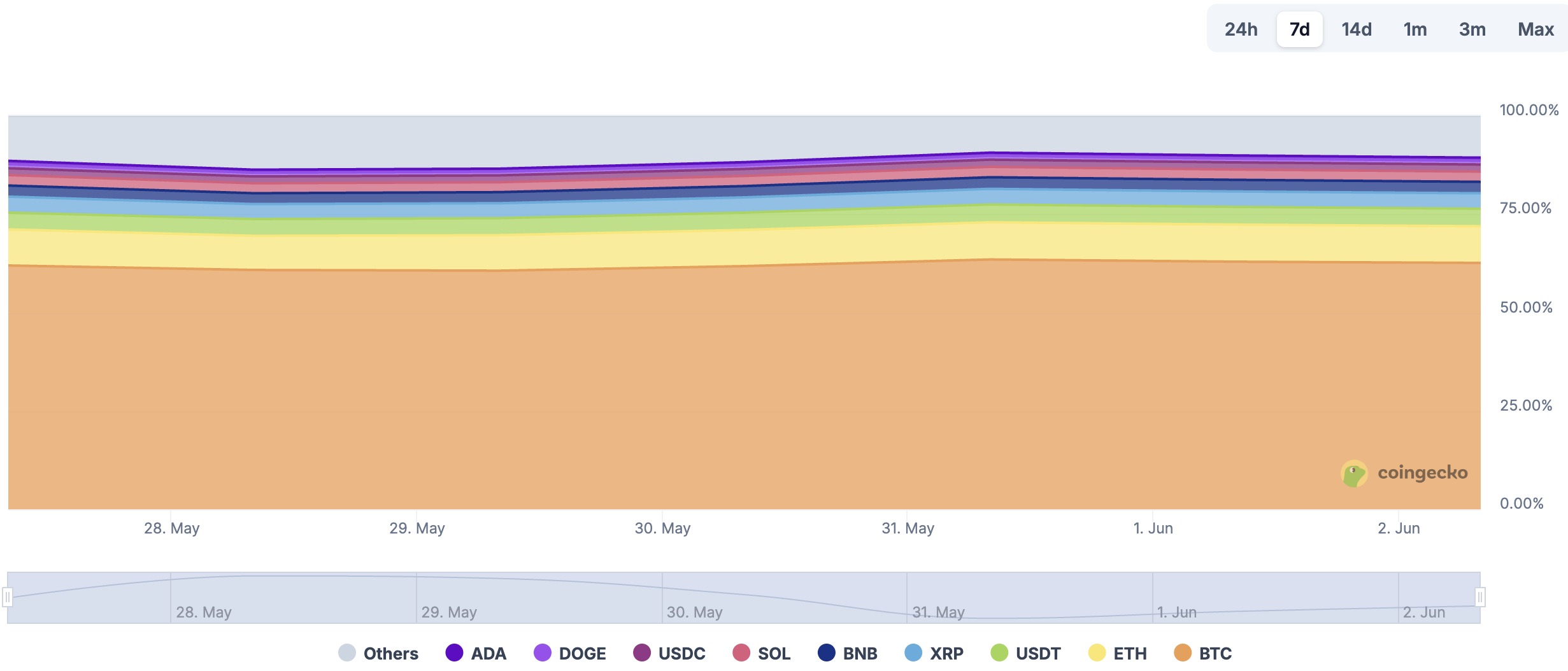

As of the time of writing, Bitcoin's market cap is $2.07 trillion, accounting for 60.3% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $246.6 billion, accounting for 7.18% of the total cryptocurrency market cap.

Data Source: coingeck

Data as of June 1, 2025

2. Fear Index

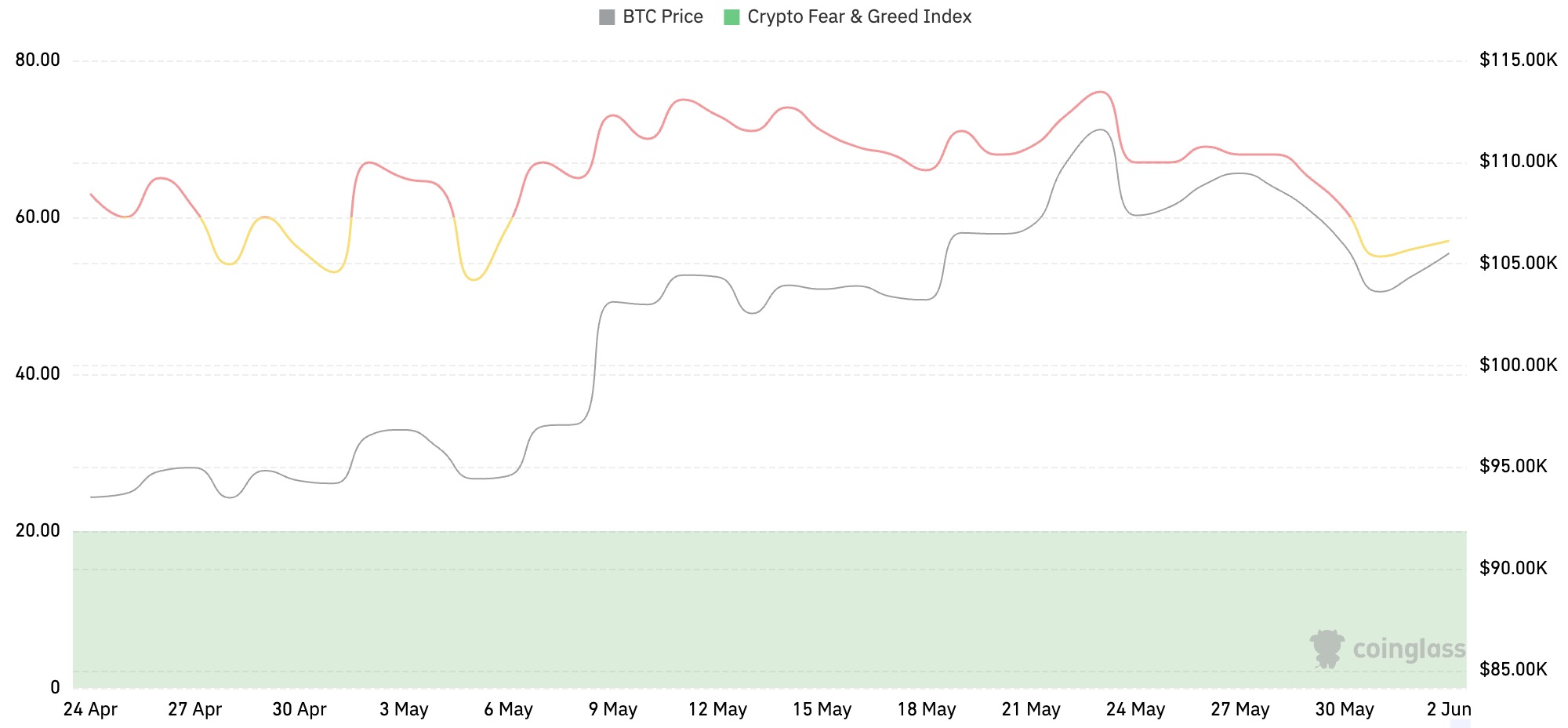

The cryptocurrency fear index is 57, indicating a neutral sentiment.

Data Source: coinglass

Data as of June 1, 2025

3. ETF Inflow and Outflow Data

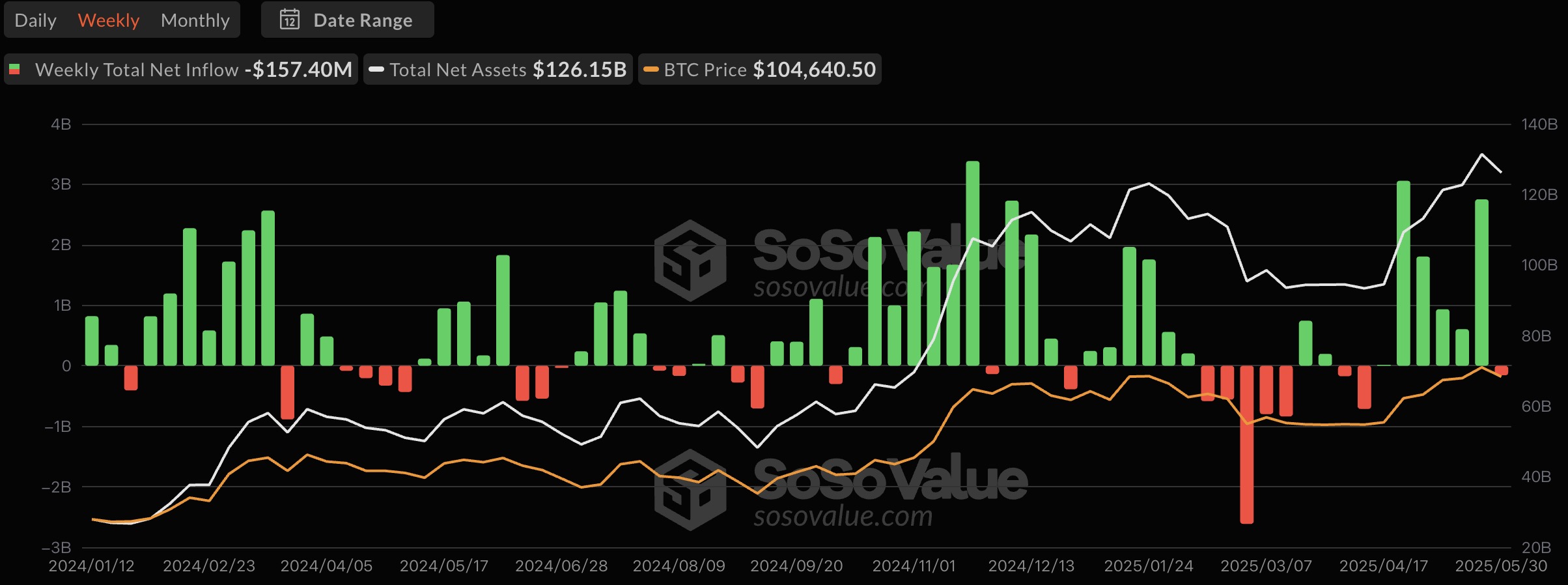

As of the time of writing, the cumulative net inflow of Bitcoin spot ETFs in the U.S. is approximately $44.37 billion, with a net outflow of $157 million this week; the cumulative net inflow of Ethereum spot ETFs in the U.S. is approximately $3.05 billion, with a net inflow of $285 million this week.

Data Source: sosovalue

Data as of June 1, 2025

4. ETH/BTC and ETH/USD Exchange Rates

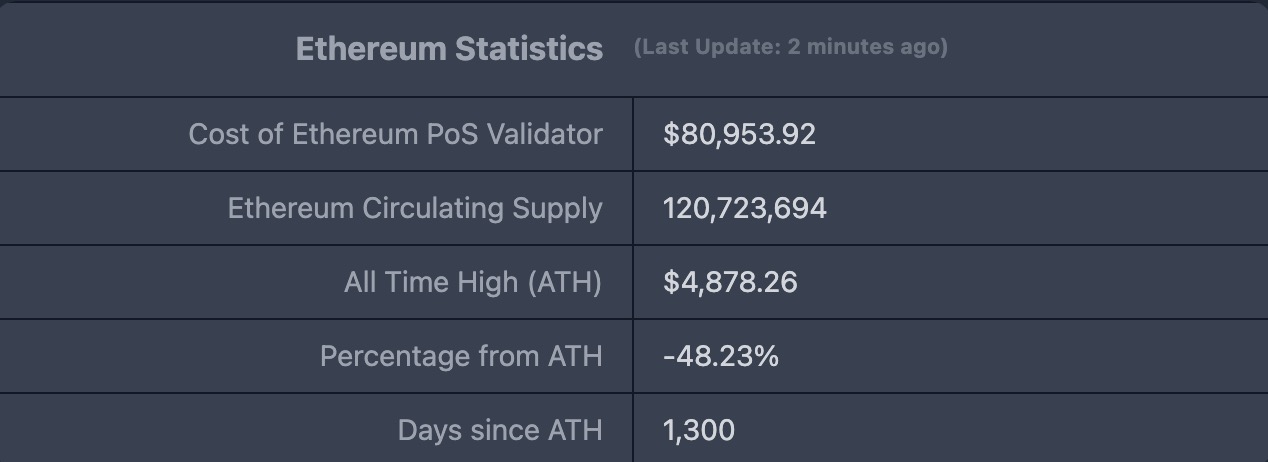

ETHUSD: Current price $2,530.89, all-time high $4,878, down approximately 48.12% from the all-time high.

ETHBTC: Currently at 0.024298, all-time high 0.1238.

Data Source: ratiogang

Data as of June 1, 2025

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $111.1 billion, down approximately 5.4% from last week ($117.1 billion).

Data Source: defillama

Data as of June 1, 2025

By public chain, the top three chains by TVL are Ethereum, accounting for 54.94%; Solana, accounting for 7.67%; and BNB Chain, accounting for 5.56%.

Data Source: CoinW Research Institute, defillama

Data as of June 1, 2025

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily transaction volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of June 1, 2025

Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. In terms of daily transaction volume, Solana and Aptos remained roughly flat compared to last week, while BNB Chain and TON Chain increased by 27% and 114%, respectively; ETH and SUI decreased by 18% and 10%, respectively. Regarding transaction fees, BNB, TON, and Aptos remained nearly flat compared to last week, while Solana and SUI decreased by 42% and 29%, respectively, and ETH increased by 350%.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects the level of trust users have in the platform. In terms of daily active addresses, only BNB Chain saw a decrease of 17% this week, while the others increased, with Solana up 39%, Aptos, ETH, and TON up about 20%, and SUI up 13%. In terms of TVL, ETH, SOL, and BNB decreased by 0.96%, 6.6%, and 1.3%, respectively, compared to last week; the other chains saw increases, with SUI Chain up 7.5%, and TON and Aptos up 4.6% and 4.5%, respectively.

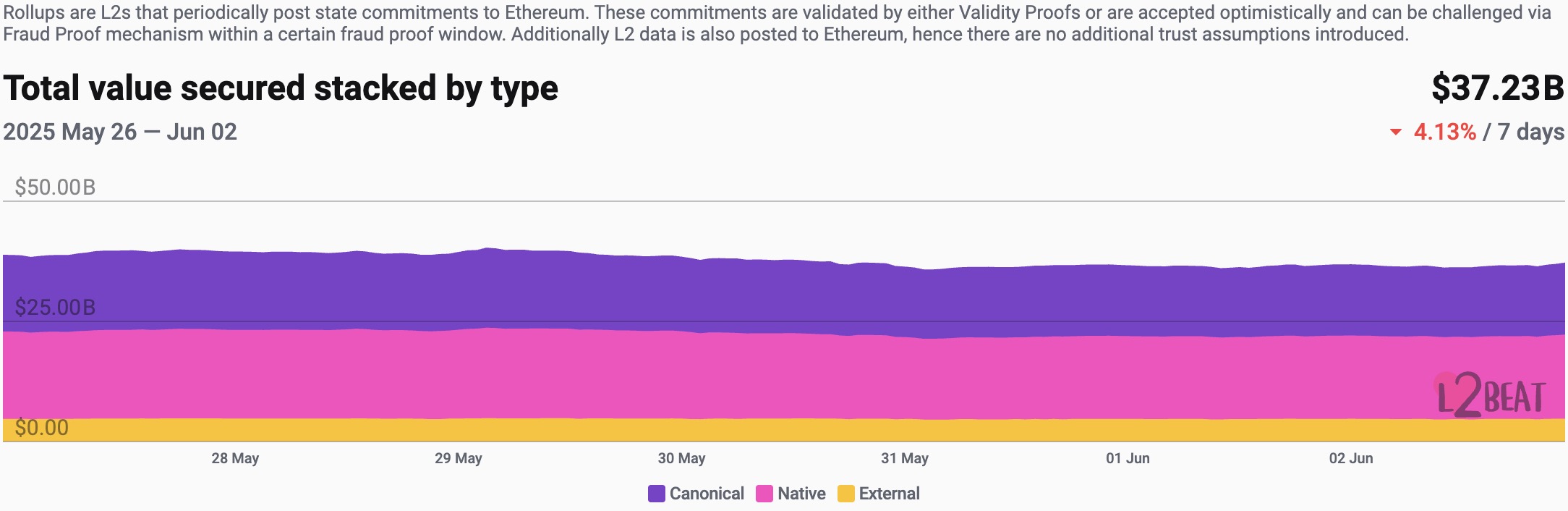

Layer 2 Related Data

According to L2Beat, the total TVL of Ethereum Layer 2 is $37.23 billion, down 3.46% from last week ($38.52 billion).

Data Source: L2Beat

Data as of June 1, 2025

Base and Arbitrum occupy the top positions with market shares of 40.71% and 32.33%, respectively, with an overall decrease in market share.

Data Source: footprint

Data as of June 1, 2025

7. Stablecoin Market Cap and Issuance Status

According to Coinglass, the total market capitalization of stablecoins is $246.6 billion, with USDT having a market cap of $153.1 billion, accounting for 62.08% of the total stablecoin market cap; followed by USDC with a market cap of $60.9 billion, accounting for 24.69%; and DAI with a market cap of $5.36 billion, accounting for 2.17%.

Data Source: CoinW Research Institute, Coinglass

Data as of June 1, 2025

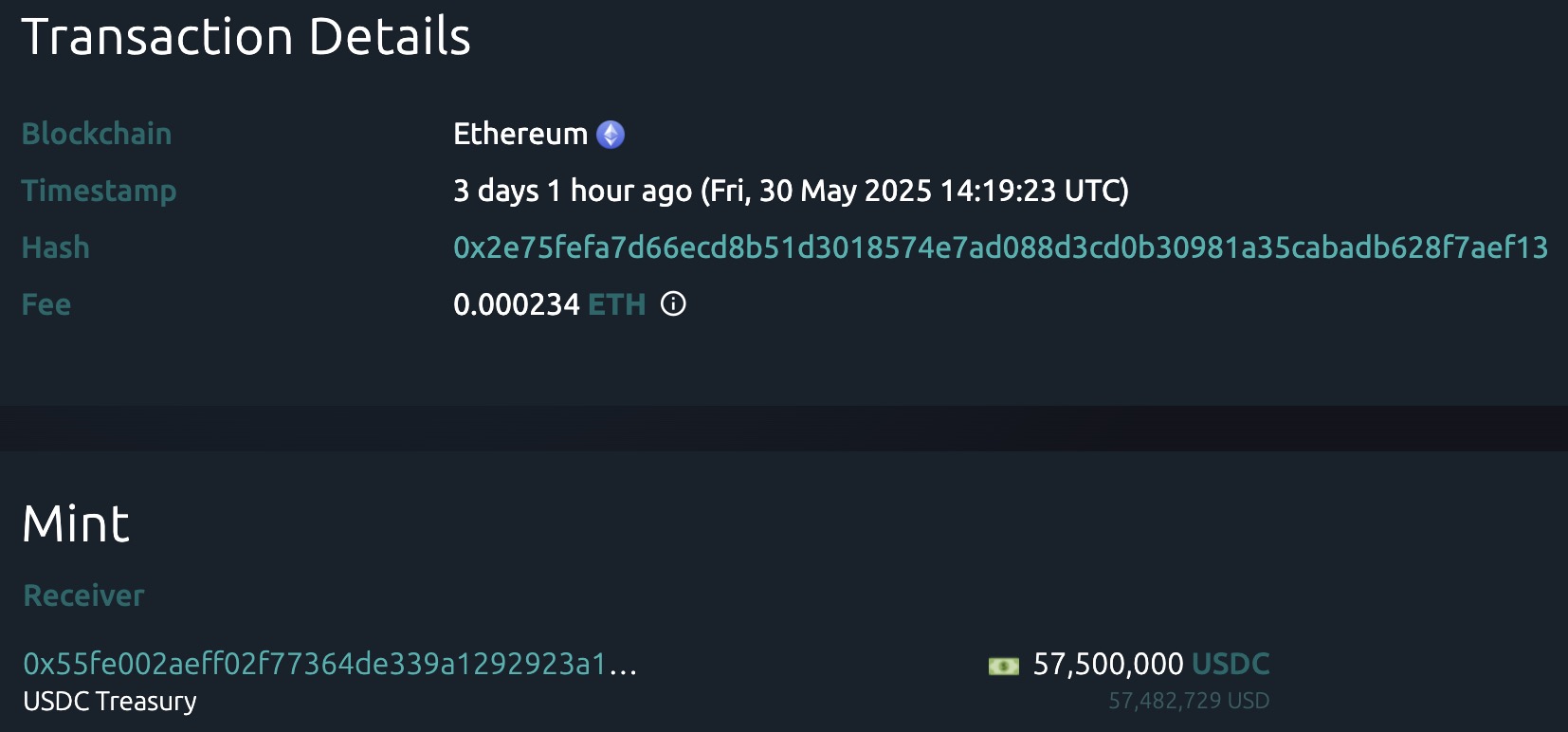

According to Whale Alert, this week the USDC Treasury issued a total of 57.5 million USDC, while Tether Treasury had no issuance of USDT this week. The total issuance of stablecoins this week was 57.5 million, a decrease of approximately 99.73% compared to last week's total issuance of 2.2 billion stablecoins.

Data Source: Whale Alert

Data as of June 1, 2025

2. This Week's Hot Money Trends

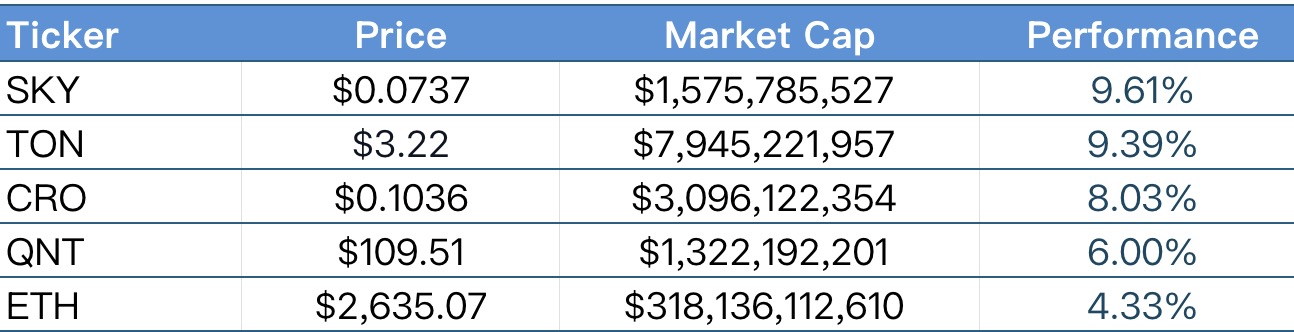

1. Top Five VC Coins and Meme Coins This Week

The top five VC coins with the highest increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of June 1, 2025

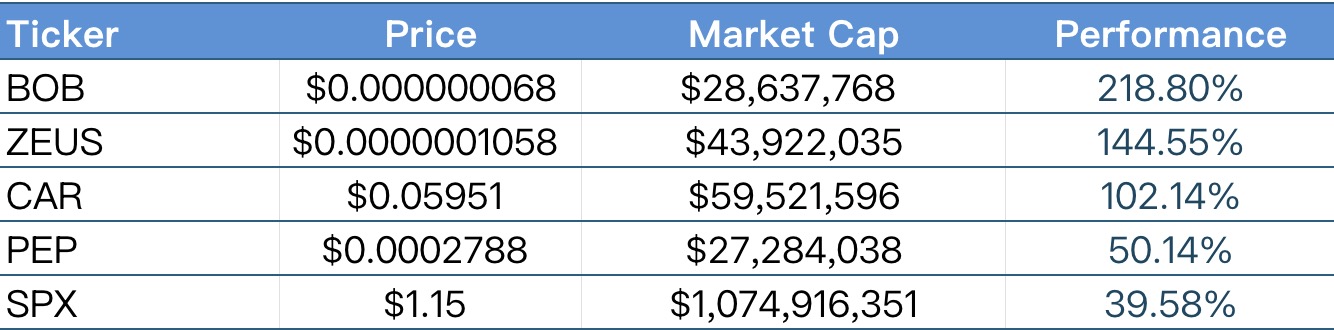

The top five Meme coins with the highest increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of June 1, 2025

2. New Project Insights

Oncade is a decentralized game distribution platform aimed at helping game developers bypass traditional platform fees and sell games directly to players. The platform supports stablecoin payments, a community-driven distribution rebate mechanism, and introduces the $ONCADE token to enhance user participation and distribution efficiency.

Donut is a crypto browser with autonomous intelligent features, dedicated to providing users with a one-stop decentralized tool and crypto service integration experience. Through its smart interface, users can trade digital assets more securely and conveniently.

Cooking.City is a token fair issuance platform based on Solana, aimed at ensuring that every participant has an equal opportunity in the value creation process. It is committed to reshaping the token issuance mechanism and proposes a sustainable, incentive-based, community-centered new model for on-chain issuance.

Rumi Labs is a Web3 platform that rewards users for watching media content through a "watch-to-earn" mechanism. The platform utilizes AI to analyze content and build a decentralized knowledge network, allowing users to contribute content to the media knowledge base while watching videos and earn rewards.

3. Industry News Updates

1. Major Industry Events This Week

Gochujangcoin (GOCHU) launched a limited-time airdrop event on May 30, offering rewards to users who complete specified transactions on certain platforms. During the event, eligible users have the chance to receive GOCHU airdrops and platform points, with a total airdrop amount exceeding 4.2 billion coins. This initiative aims to enhance user participation and expand GOCHU's market influence.

On May 30, Backpack issued badge airdrops to platinum users as a thank you for their long-term support. The project team stated that the badges are a pre-benefit for the upcoming points system, which will carry more future rights within the Backpack ecosystem. Before the official launch of Season 2, Backpack introduced the "Season Special: Month of Benefits" series of activities, creating surprise side quests through multiple reward mechanisms. The first module, the Daily Trading Competition, has already started, allowing participants to share a daily prize pool of $50,000 to $100,000.

On May 29, the Assisterr project announced that Binance Alpha would be the first platform to launch Assisterr AI (ASRR), with trading opening on May 30 at a specific time to be determined. Eligible users can use Binance Alpha points to claim airdrops on the Alpha event page, with related activity pages and rules also going live on May 30.

On May 29, the Reddio (RDO) project announced that users holding 193 or more Binance Alpha points could participate in the exclusive token generation event (TGE) subscription activity for RDO. This subscription is exclusively open through Binance Wallet from 16:00 to 18:00 Beijing time on May 29, 2025.

On May 28, Sophon announced that it had opened airdrop claims for early contributors, with a claim period of 60 days. On the same day, Binance stated that eligible users with at least 195 Alpha points could claim 1,250 SOPH airdrop tokens starting at 20:05 that evening on the Alpha event page. Claiming will consume 15 points and must be confirmed within 24 hours, or it will be considered forfeited.

On May 27, the PFVS project launched an airdrop reward activity, distributing 875 PFVS tokens as rewards to users who performed well in the Binance Alpha event. Eligible users must hold at least 204 Alpha points and consume 15 points to complete the claim on the activity page. This airdrop aims to incentivize early supporters of the community, with a claim validity period of 24 hours; otherwise, it will be considered forfeited.

2. Upcoming Major Events Next Week

The LayerEdge project officially launched on the Binance Alpha platform on June 2, allowing users to claim airdrop rewards using Alpha points through the Binance Alpha event page. This airdrop aims to reward community supporters and promote LayerEdge's innovative verification layer technology, which aggregates and verifies zero-knowledge proofs, enhancing data settlement and verification efficiency for PoS chains and rollup chains, while achieving seamless connectivity with the Bitcoin network.

OpenSea announced on May 30 that the fully upgraded OpenSea2 (OS2) platform is now open to the public, supporting trading of tokens from 19 blockchains, marking a strategic shift from the NFT market to a broader crypto market. At the same time, the platform launched a new rewards system called "Voyages," where users can earn XP points by completing on-chain transactions and other activities. In the future, SEA tokens will be distributed through a token generation event (TGE), allowing users to exchange accumulated XP points for the token, further enriching the community incentive mechanism.

The Katana network, incubated by Polygon Labs and GSR, officially launched at the end of May and was deployed through the Conduit platform. The Katana Foundation announced an airdrop of KAT tokens for POL stakers on the Ethereum mainnet, with the total airdrop amount accounting for approximately 15% of the total supply. This airdrop plan is seen as a way to give back to the Polygon ecosystem, with specific timing and details to be announced later. Access to the Katana mainnet will officially open in late June.

ZK network developer Lagrange Labs will open registration for the LA token airdrop, which will close on June 2. This airdrop accounts for 10% of the total LA supply and is open to users who have participated in the Turing Roulette game and completed identity and uniqueness verification. The LA token will serve as a core asset for paying ZK proof fees and staking purposes in the future, promoting the establishment of a ZK economic ecosystem based on EigenLayer, making it one of the noteworthy airdrop opportunities recently.

3. Important Financing Events Last Week

Conduit completed a $37 million Series A financing round, co-led by Paradigm and Haun Ventures, with participation from other well-known institutions including Coinbase Ventures, Bankless Ventures, Robot Ventures, and several angel investors. Conduit provides customizable blockchain infrastructure services, particularly excelling in Rollup technology. It allows developers to quickly deploy OP Stack-based Rollups, significantly enhancing application performance to reach 100 times that of the Ethereum mainnet. (May 28, 2025)

Bitcoin investment firm Twenty One Capital announced an additional $100 million in financing through convertible senior secured notes, bringing the total financing amount to $685 million in preparation for a SPAC merger with Nasdaq-listed Cantor Equity Partners. The company is backed by iFinex (the parent company of Bitfinex) and Tether Holdings, with SoftBank as a minority shareholder, and Strike CEO Jack Mallers will lead the merged company. Twenty One aims to "accelerate Bitcoin adoption and education" and has invested $458 million in Bitcoin, committed to building an institutional Bitcoin asset management platform. (May 29, 2025)

The crypto AI project FreysaAI, developed on the Base blockchain, has completed $30 million in financing through its associated entity Eternis AI, with investors including Coinbase Ventures and Selini Capital. The project aims to create "personal AI digital twins." Selini Capital confirmed its participation in Freysa's token round financing, involving its native FAI token, but did not disclose specific financing details. (May 29, 2025)

4. Reference Links

Oncade: https://www.oncade.xyz/

Donut: https://donutbrowser.ai/

Rumi Labs: http://rumilabs.io/

Conduit: https://www.conduit.financial/

Twenty One Capital: https://xxi.money/

Eternis AI: https://www.eternis.ai/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。