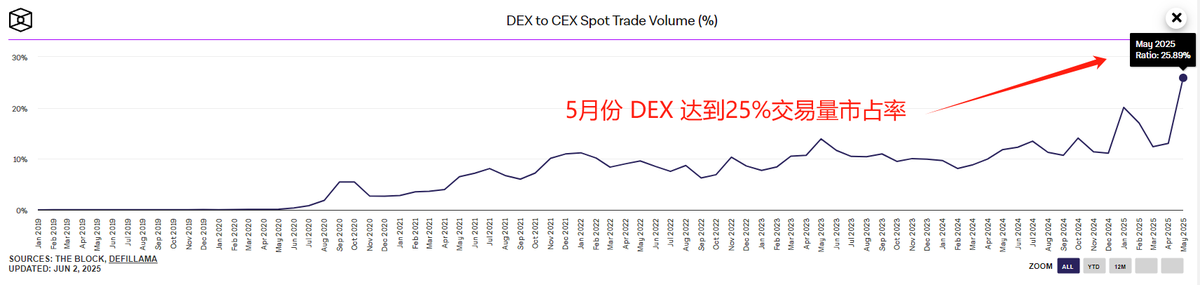

⚡️Another key signal: In May, the DEX market share broke 25% for the first time, a historic high——

CEX is not dead, but liquidity and users are beginning to structurally flow away. According to this projection, DEX may surpass CEX by 2028 and dominate the market by 2030.

This prediction may be somewhat optimistic, but the trend direction is correct. The truly important question is:

How can retail investors mine the next on-chain revolutionary like Hyperliquid?

Last time we discussed narrative and product structure, this time we will talk about how to dig deeper. I have summarized three core ideas——

1⃣ Look at whose liquidity is long-lasting?

Don't just look at the TVL leaderboard; you need to consider:

1) Trading depth: How many orders are on the protocol? Can large orders be absorbed? Can small orders be executed without issues?

Go to DEX aggregators (DefiLlama, Dexscreener) to check the trading volume and slippage of different pools, focusing on those with increased daily trading volume but without exaggerated token incentives.

2) Liquidity sustainability: Is it a temporary spike or can it stabilize?

Pay attention to whether the project can maintain order depth during high volatility market conditions (such as market fluctuations or hot topic switches). Many TVL surges are just illusions created by liquidity mining incentives.

Projects like Hyperliquid and Aevo accumulate trading flow through real market making and deep order absorption, not just by issuing tokens.

2⃣ Look at whose users are changing?

Don't just focus on how lively it is in TG or DC; you also need to analyze on-chain user behavior:

1) Analyze on-chain wallets:

Use tools like DeBank, Arkham, and Nansen to track the addresses of large holders in the protocol, see what funds are coming in, and whether there are professional arbitrageurs, quantitative teams, or large positions, rather than just small retail interactions.

2) Observe community sentiment:

Is there an increasing amount of discussion about trading experiences, arbitrage opportunities, and market-making profits in the community? Or is it just "when will there be an airdrop" and "when will tokens be issued"? Projects that can truly attract CEX users have community discussions and on-chain behaviors that are synchronously upgraded.

For example, Hyperliquid has transformed from retail users earning points to high-frequency traders focusing on trading volume, fee rebates, and following strategies. This upgrade in user profile is a typical signal of an on-chain revolutionary.

3⃣ Look at whose revenue model is genuinely profitable?

The most important and often overlooked step——

1) Look at the protocol fee versus incentive ratio

Visit the project’s official website, DefiLlama, or Token Terminal to clarify how much revenue the protocol itself generates, and whether it mainly comes from transaction fees. If the revenue drops to zero once token incentives stop, that’s a typical false prosperity.

2) Look at the flow of funds

Where does the project’s revenue go? Does it all return to LPs, stakers, and token holders, or is most of it consumed by the protocol itself?

Which protocol tokens can capture revenue without relying on subsidies?

Protocols like Uniswap, GMX, and Hyperliquid generate income through trading; trading is the fundamental basis for DEX to establish itself, and it is the lifeblood that determines survival. Tokens are merely tools for profit sharing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。