Original Title: "Four Major Changes in the Global Cryptocurrency Market After the South Korean Presidential Election"

Original Author: Ryan Yoon, Tiger Research

This report, written by Tiger Research, analyzes how the presidential election in South Korea on June 3 will trigger four major changes in the global cryptocurrency market.

Key Summary

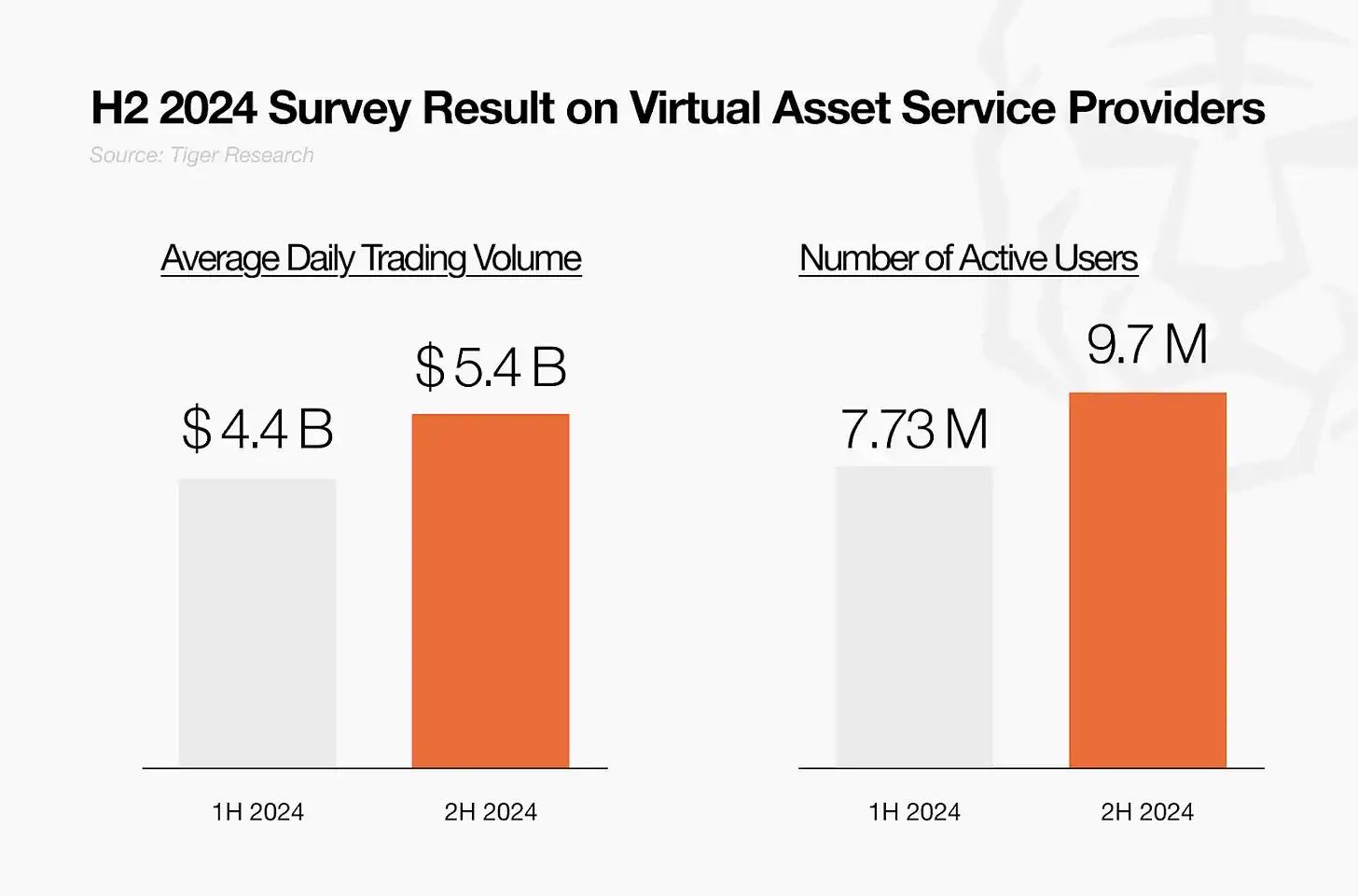

· South Korea as a Core Web3 Hub: With a daily trading volume of $5.4 billion and 9.7 million active users, South Korea has become the third-largest cryptocurrency market globally, after the United States and China. It serves as a key benchmark for global projects entering Asia.

· Tax Acceleration May Lead to Declining Trading Volume: Although the implementation of cryptocurrency taxes has been postponed until 2027, the new government is likely to push for it sooner. Drawing from international precedents, trading volume could decline by more than 20%.

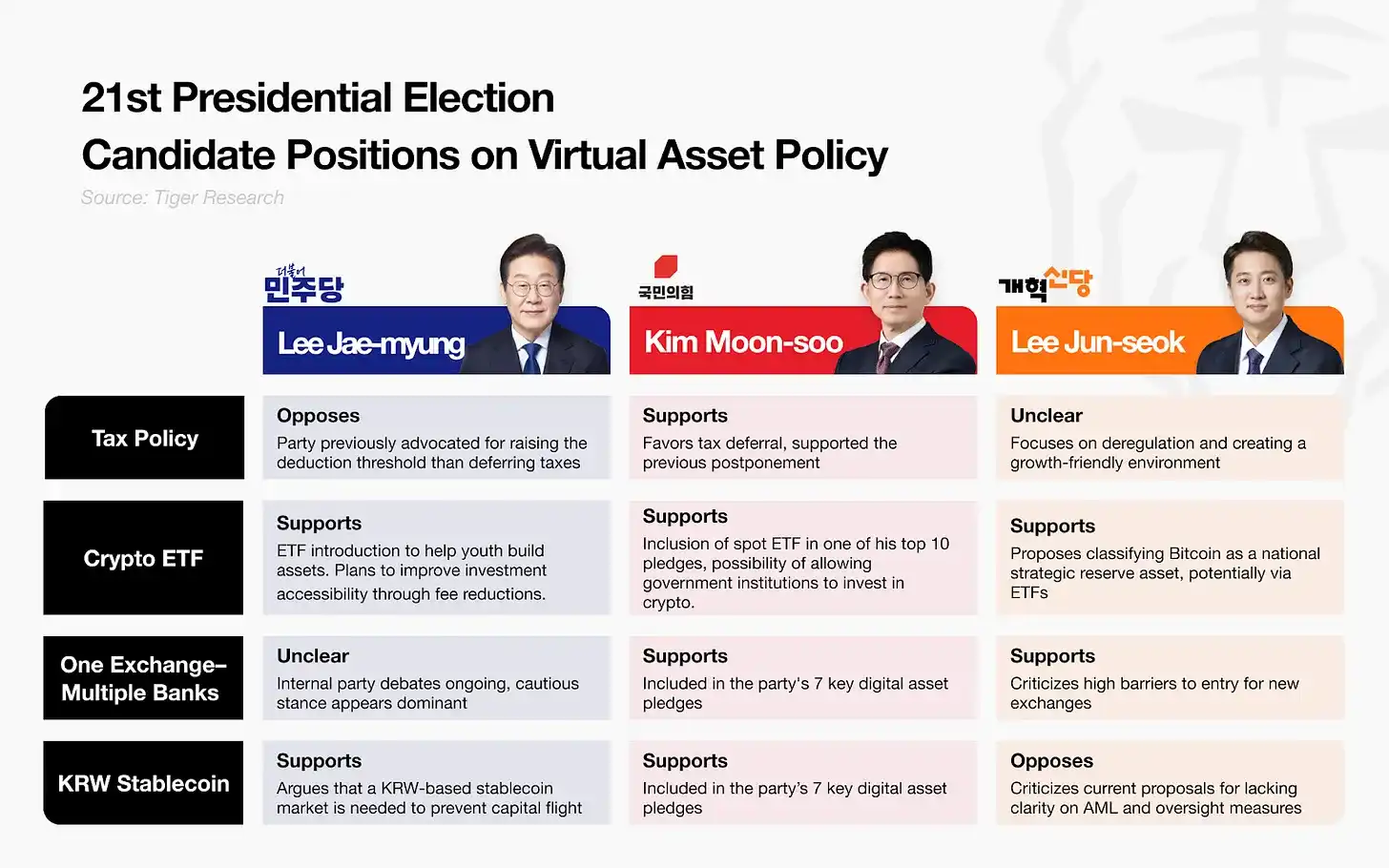

· High Likelihood of ETF Approval; Other Reforms May Face Delays: All major candidates support the introduction of a Bitcoin spot ETF, increasing the likelihood of its early passage. In contrast, regulatory reforms surrounding the Korean won stablecoin and the "one trading platform, one bank" policy are expected to be longer-term agenda items.

1. Is South Korea's June Presidential Election Only Local?

South Korea is set to hold its presidential election on June 3. While this appears to be a local political event, its impact has transcended borders due to the country's influence on the global cryptocurrency market.

Source: Tiger Research

South Korea is widely regarded as the third key market for global Web3 projects, following the United States and China. This status is not merely a result of marketing strategies. According to a report from the Financial Services Commission in 2024, South Korea's daily cryptocurrency trading volume reaches 7.3 trillion won, with over 20 million registered accounts and 9.7 million active users.

Investor behavior further solidifies this position. South Korean users consistently show strong interest in altcoins beyond Bitcoin and Ethereum. On-chain activity is also very active, making South Korea a valuable indicator for measuring the acceptance of new projects in the global market.

For many global projects, establishing a business in South Korea has become a strategic entry point into the broader Asian market. This makes the upcoming election particularly significant, as key campaign issues now include cryptocurrency taxation, regulation of the Korean won stablecoin, and approval of cryptocurrency ETFs.

These developments are not limited to domestic stakeholders. Global investors and project operators must also pay attention to the election results. There is potential for both tightening and loosening of regulations, and projects with a large South Korean user base may be particularly sensitive to the policy direction set by the next government.

2. What Changes Will Occur After the South Korean Presidential Election?

Source: Tiger Research

2.1. End of Cryptocurrency Tax Delay Policy

According to the Financial Services Commission's roadmap for corporate participation in the cryptocurrency market, corporate entities are gradually being granted access to the cryptocurrency market. This gradual opening of the market inevitably requires a corresponding comprehensive reform of the tax framework. Currently, the taxation of virtual assets in South Korea has been postponed until 2027. The original plan was to impose a 20% tax on annual gains exceeding approximately $1,850 starting January 2025. However, this implementation has been delayed by two years.

An increasingly contentious point is that, despite individuals and companies currently generating income from cryptocurrency trading, they are all benefiting from the tax delay policy. According to the Financial Services Commission's roadmap, from the second half of 2025, listed companies and registered professional investment firms will be allowed to invest in virtual assets through corporate accounts.

Given this shift, the delay policy for individuals and companies is unlikely to be extended again. The government may seek legislative amendments to abolish the current delay policy and implement taxation sooner. Political positions on the tax delay issue have historically diverged among parties. The Democratic Party initially advocated for raising the tax exemption threshold rather than delaying taxation, although it ultimately supported the delay policy. Depending on the election results, the policy may shift towards increasing the deduction limit rather than maintaining the delay policy.

If taxation is implemented, trading volume on domestic platforms is likely to see a significant decline—consistent with international precedents. In 2022, India imposed a 30% tax on cryptocurrency gains and introduced a 1% withholding tax on all transactions. This led to a decline in trading volume of 10% to 70% on major platforms like WazirX and CoinDCX. Similarly, after high tax rates were introduced in 2023, Indonesia's trading volume fell by about 60% year-on-year. Although the proposed tax rate in South Korea is less aggressive, these examples suggest that trading volume on local platforms could decline by more than 20%, with funds potentially shifting to offshore platforms.

2.2. Introduction of Cryptocurrency ETFs

Source: Tiger Research

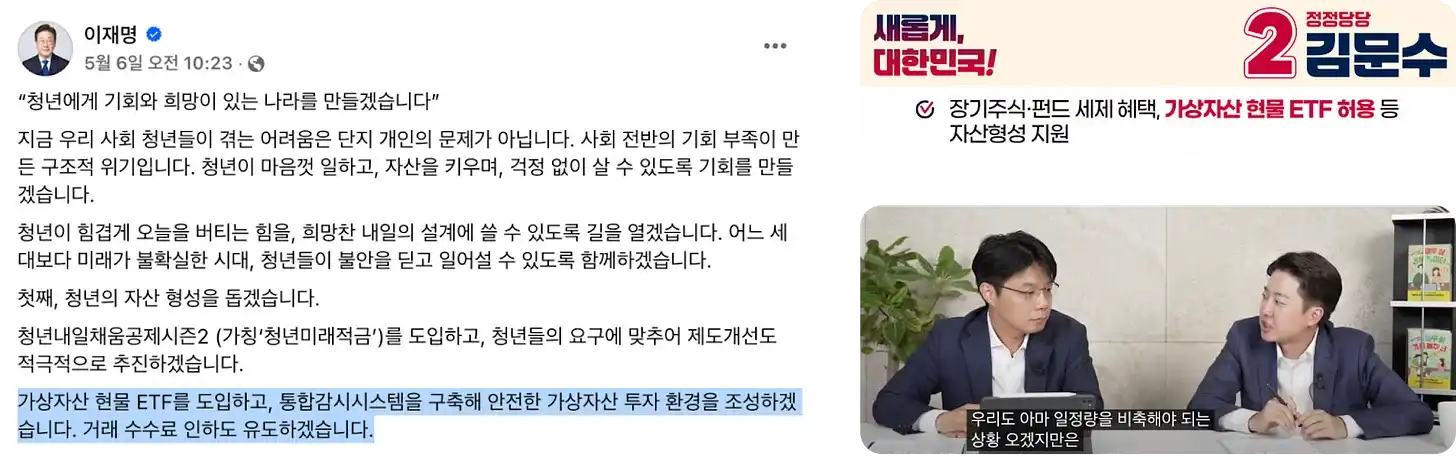

· Lee Jae-myung (Democratic Party): On May 6, Lee Jae-myung announced his support for spot cryptocurrency ETFs via Facebook as part of his broader initiative to support youth asset formation. He also proposed lowering investment costs to improve accessibility.

· Kim Woo-sik (People Power Party): On April 27, he expressed an open attitude towards allowing public institutions to invest in the cryptocurrency market. His ten core policy commitments include introducing spot cryptocurrency ETFs under the banner of "expanding middle-class wealth."

· Lee Jun-suk (Reform Party): On May 20, Lee Jun-suk proposed that the government should hold Bitcoin as a national strategic reserve through tools like ETFs via his YouTube channel.

The introduction of spot cryptocurrency ETFs is the only policy proposal that has reached bipartisan consensus among leading candidates, making it one of the most likely outcomes to be realized in the short term. Policy discussions are expected to commence earnestly shortly after the election concludes. If spot ETFs are introduced, they will naturally compete on fees with existing trading platforms that facilitate Bitcoin spot trading. This will promote healthier market dynamics and improve overall service quality. For investors, especially those with smaller portfolio sizes, lower fees can reduce the barrier to entry and enhance accessibility.

In the long run, the launch of spot ETFs could serve as a catalyst for further financial innovation. It may pave the way for new products that integrate cryptocurrencies with traditional finance, such as derivatives, index funds, and other hybrid investment tools.

2.3. Reevaluation of the "One Trading Platform, One Bank" Model

To manage anti-money laundering (AML) risks in the cryptocurrency sector, South Korea has maintained an implicit "one trading platform, one bank" principle. Under this model, each licensed cryptocurrency trading platform is only allowed to partner with one commercial bank to issue real-name verified deposit accounts. For example, Upbit only collaborates with K-Bank, while Bithumb is linked to KB Kookmin Bank. This framework contrasts with jurisdictions like the United States, where platforms like Coinbase offer integration with multiple financial services, including Apple Pay, Google Pay, and various banking institutions.

During a policy discussion meeting with members of the People Power Party, Jeong Jin-wan, president of Woori Bank, raised this issue, sparking a heated debate about abolishing the "one trading platform, one bank" principle. He argued that the current structure poses systemic risks, limits consumer choice, and imposes unnecessary restrictions on corporate clients. Jeong called for a shift to a "one trading platform, multiple banks" model.

As the presidential campaign unfolds, political parties are beginning to take positions. On April 28, the People Power Party included the abolition of the "one trading platform, one bank" rule in its "seven major digital asset commitments." The Democratic Party also seems to be internally reviewing the matter. However, a cautious attitude has emerged within the Democratic Party since then, and it remains unclear whether this issue will be reflected in formal campaign commitments. Financial regulatory agencies are also maintaining a cautious stance, indicating that any changes may require long-term deliberation.

While regulatory caution is necessary, maintaining the current model based on concerns about market concentration and anti-money laundering risks may need to be reevaluated. The argument that this rule prevents market monopolies is becoming increasingly unconvincing, as Upbit and Bithumb already control about 97% of the domestic market. Allowing multiple banks to collaborate could enhance competition by enabling trading platforms to serve a broader user base. This could lead to lower fees and more innovative services for retail and institutional users.

Concerns about anti-money laundering risks also require more nuanced assessment. In fact, greater risks occur during the transfer of funds to offshore trading platforms. Since the implementation of the Travel Rule and improvements in compliance infrastructure, South Korea now operates under stricter international monitoring standards. In this context, the systemic risks associated with allowing multiple banking relationships seem exaggerated.

2.4. Korean Won Stablecoin

Historically, South Korea has prioritized the development of central bank digital currency (CBDC) over stablecoins. The Bank of Korea is currently conducting a pilot program called "Project Han-Gang" to test a CBDC-based payment and settlement system. However, as global trends shift towards stablecoins, domestic demand for a Korean won stablecoin is growing.

Source: 21st Presidential Debate: First Presidential Debate

Lee Jae-myung (Democratic Party):

· On May 8: In an economic YouTube interview, he stated that a Korean won-based stablecoin could prevent capital flight by creating a domestic alternative.

· On May 18: In a televised debate, he emphasized that the Korean won stablecoin would be backed by collateral reserves to ensure stability.

Lee Jun-suk (Reform Party):

· On May 18: He questioned the feasibility of Lee Jae-myung's proposal, citing a lack of clarity on anti-money laundering measures in stablecoin issuance.

Kim Woo-sik (People Power Party):

· On April 28: He included a regulatory framework for stablecoins in his "seven major digital asset commitments."

· In the first presidential debate on May 18, the topic of stablecoins entered mainstream political discourse through the exchange between Lee Jae-myung and Lee Jun-suk. While the discussion showed directional support, it also highlighted the lack of a detailed policy framework—especially regarding risk mitigation and compliance.

At this stage, proposals for a Korean won stablecoin remain visionary rather than operational. The likelihood of immediate implementation after the election is low. However, considering regional trends—especially in Singapore and Hong Kong, where authorities are actively developing stablecoins pegged to local currencies—South Korea may face increasing pressure to follow suit in order to maintain its competitiveness as a financial center.

Any meaningful progress will require a foundational legal and regulatory framework. Key issues include determining qualified issuers, ensuring collateral transparency, establishing anti-money laundering protocols, and defining the relationship between stablecoins and CBDC initiatives. Given the complexity of these issues, policy development is expected to proceed in a phased, medium- to long-term manner rather than rapidly changing after the election.

3. Gradual but Inevitable: Upcoming Changes

While the discussed policy shifts are significant for the industry, they are unlikely to be realized in the short term. Among the major presidential candidates, only Kim Woo-sik has included Web3-related measures in his ten campaign commitments. This indicates that, despite being relevant to the industry, Web3 issues are not prioritized in the current broader policy agenda. Therefore, regulatory changes are expected to progress gradually, with discussions potentially running parallel to more urgent policy matters. However, the trajectory is clear: transformation is inevitable.

As mentioned earlier, the eventual implementation of cryptocurrency taxation is unavoidable. Additionally, legislative discussions surrounding Security Token Offerings (STOs) are expected to resume. Investors and market participants should not underestimate these shifts. Stakeholders must begin preparing for a policy environment that will increasingly be regulated and compliant.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。