Original Title: "James Wynn: The Journey of a 'Crypto Gambler'"

Original Author: Bright, Foresight News

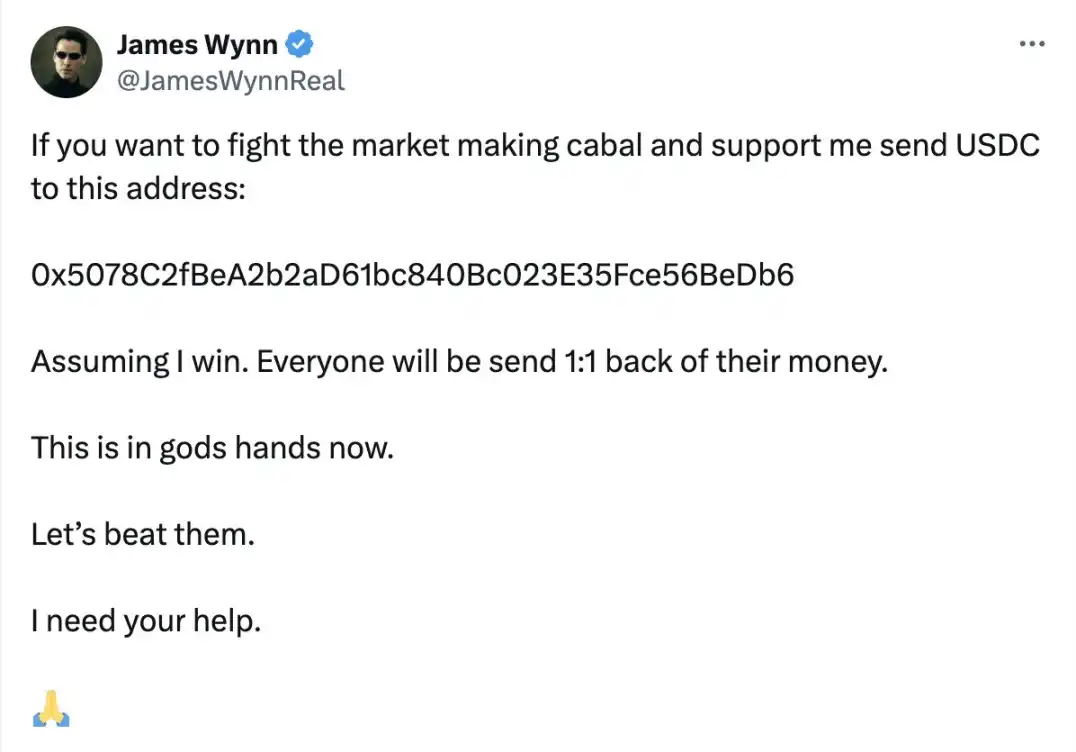

On June 2, whale James Wynn posted on social media, "If you want to fight against the market-making group and support me, please transfer USDC to a specific chain address. Assuming I win, everyone will get their money back at a 1:1 ratio. Let's defeat them. I need your help." Subsequently, James Wynn deposited the accumulated donation of 39,345.11 USDC into Hyperliquid, lowering the liquidation price.

This zero-cost fundraising tweet instantly sparked heated discussions. Has the most followed man in the crypto market started "begging"? In fact, James Wynn, who previously opened positions with high leverage exceeding $1 billion, has fallen from the pedestal of the "version child," losing about $100 million in the past week and incurring a net loss of about $17.5 million.

In response, BitMEX co-founder Arthur Hayes tweeted, "I’m starting to think this (referring to whale James Wynn's attempt at zero-cost fundraising) could become one of the most successful marketing campaigns for a trading platform in crypto history. HYPE will surely win. Moreover, this guy is likely hedging trades under another anonymous address, specifically to take advantage of Hyperliquid's next round of airdrops."

On June 3, after turning his total position of about $100 million in BTC from a loss to a profit, James Wynn quietly deleted the "begging" tweet he posted at 10 PM the previous day. Currently, his long position has made over $400,000 in profit. Last night, at the most critical moment, the price of Bitcoin was only $20 away from the liquidation price of James Wynn's long position, with an unrealized loss exceeding $1.35 million.

Position and Tweet Timeline

James Wynn expresses his thoughts on every contract he trades, so on HLP, every opening and closing, profit and loss of his publicly available address reflects the journey of James Wynn, the current "number one gambler in the market."

On May 30, after significant losses, James Wynn entered "sage mode."

After losing over $96 million in a week and an overall account loss of $14.03 million, he posted on social media, "Being a contract gambler is very interesting, and I have no regrets. Turning $4 million into $100 million and then back down to $13 million is incredibly thrilling. Most people are too afraid or lack the courage to make such trades. They can't do it, don't have the money to do it, and don't have the guts to publicly take on such risks. Maybe next time I'll try to make $1 billion; I will be back."

In response, crypto KOL scooter, who previously exposed the LIBRA token insider information, directly mocked, "James Wynn is a typical example, explaining why most scammers and ruggers eventually lose everything. They have never experienced the value of earning honestly and have never truly understood the effort required to make money. What comes easy goes easy." Well-known trader Eugene Ng Ah Sio also expressed a similar view on his personal TG channel, "When you use excessive leverage, easy come easy go."

On May 31, James Wynn aggregated $3.25 million through multiple addresses and went long on BTC and PEPE. After multiple rounds of liquidation and stop-losses, his actual position value (not nominal position value) was only $800,000. In response, James Wynn stated on social media, "I will come back; I love this game. Money is essentially a mindset. I am still richer than 99.9% of crypto Twitter users. I made a huge and well-thought-out bet, aiming to make billions of dollars. My passive income is more than most of you earn in a year."

On the same day, James Wynn also stated, "One hundred million dollars is not a lot of money. For those shackled by limited thinking, maybe it is. But for a free spirit, anything is possible; this amount is trivial. It's just $100 million, a drop in the ocean in the world of money. The ridiculous thing is how many people go their whole lives without even seeing or hearing this number. Free will is more important than a poverty mindset."

On June 1, James Wynn posted again, stating he would come back, passionately declaring: "Some of you act like gods, thinking you will cash out at $100 million. Have you ever thought that I never intended to cash out at $100 million? Why cash out? For me, it's either all win or nothing." Currently, James Wynn holds no positions, with total losses reaching $17.72 million.

Subsequently, James Wynn directly stated that multiple CEXs had unjustly banned his accounts, claiming the incident stemmed from his opposition to corruption and support for decentralization. He emphasized that he had never participated in selling pressure, his funds were clean, and he had long focused on on-chain meme coins and HyperLiquid trading, without accepting token promotion fees or participating in pump-and-dump schemes. James Wynn stated that if his accounts continued to be banned, he would consider collaborating with the Moonpig team to launch a new platform to counter centralized control: "I was born for war; my lawyer is ready, and I will publicly confront this."

On June 2, James Wynn, waving the banner of crypto freedom and transparency, announced on social media that he decided to suspend contract trading. But before the announcement could settle, the gambler doubled down. Within 4 hours, James Wynn posted a picture of his Bitcoin long position, directly targeting Wintermute. He tagged the official Wintermute account, stating, "I’m back."

However, as mentioned at the beginning of this article, James Wynn's long position had previously incurred an unrealized loss exceeding $1.35 million.

In response, James Wynn seemed a bit "high," exclaiming, "If you want to support this cause / fight against corruption, buy BTC now. As soon as I went long, I was instantly targeted. There must be some kind of conspiracy; I don’t know what it is. It can't just be because of my long position; maybe it's because I'm just a small fish playing in a big whale's game, or because I drew everyone's attention to HyperLiquid. Regardless, try to support by buying BTC!"

In the end, Lady Luck smiled upon him, and his long position turned profitable. James Wynn's gambling career continues.

However, as James Wynn has gone through ups and downs, who has become the biggest winner? The continuously rising price of HYPE may already explain everything. Previously named by James Wynn, Wintermute's founder wishful_cynic stated, "Overall, I think 'wynn' is just a very well-executed marketing campaign for HL (Hyperliquid), well done. He is excellent. His tweets are great." In fact, James Wynn mentions Hyperliquid in an average of every three tweets, continuously emphasizing decentralization, anti-corruption, and anti-manipulation, while vaguely referencing unverified "account bans" scandals of other centralized trading platforms. From a communication perspective, James Wynn has achieved the greatest success in the crypto market this year.

Whether James Wynn, who holds the banner of openness and transparency, is hedging his large positions with anonymous addresses, and whether Hyperliquid has a direct interest relationship with James Wynn, all of these black boxes remain unknown to us.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。