The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui talking about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smoke bombs!

In the past two days, the focus has been on explaining the mechanism of Ethereum. After communicating with everyone, I found that most coin friends are not optimistic about Ethereum's breakthrough situation. Especially regarding Ethereum's reform, the transition from PoW to PoS has led some users who believe they have a certain foundation to firmly believe that Ethereum cannot break through the historical high of 5000. Regarding this viewpoint, Lao Cui does not deny everyone's understanding but needs to remind everyone that with the recent popularity of articles, everyone should have their own opinions and not be influenced by others. Most users who have a consensus that it cannot break through are those who sold off Ethereum around 1000. Lao Cui will still discuss these two mechanisms with everyone, where will Ethereum ultimately be taken? First, let me explain the theories of both; Proof of Work (PoW): Solving mathematical problems through strong computational competition, the first node to complete the calculation obtains the bookkeeping rights, mainly used for Bitcoin and other early blockchains. However, this has obvious drawbacks; it requires powerful mining hardware, which means wasting a lot of electricity and energy resources, but it can effectively prevent DDoS and other network attacks. Proof of Stake (PoS): Selecting block nodes based on the amount of cryptocurrency held by participants, aiming to improve consensus efficiency and reduce energy consumption. PoS encourages currency holders to actively participate in network security maintenance.

The biggest difference in the comparison between the two is due to the mechanism issue; one has an absolute upper limit control, meaning Bitcoin's limit is only 21 million. The scarcity of quantity has created Bitcoin's current high position, while Ethereum, through reform, has abandoned the previous limit of 72,000 coins to allow more currency holders to participate in network maintenance. This is also the most extreme way for Ethereum to control its own costs. The lack of quantity limits has led to a loss of confidence among many investors, resulting in a selling mentality, which once brought Ethereum back to a low of 800. Compared to the two, Ethereum has more room for manipulation, gradually causing it to lose its attributes in the coin circle, which has both advantages and disadvantages. The issuance of Ethereum is generally maintained at around 0.5%-1% per year. Ethereum can be said to possess both cryptocurrency attributes and adaptability to traditional finance. For ordinary people, stability is worse, but for issuers and those in power, Ethereum is easier to control; perhaps the word "manipulation" is more appropriate. The most important thing in trading is to learn to think from different perspectives. Why does Trump hold a large amount of Ethereum instead of choosing Bitcoin? This is very important; it can be said that Ethereum provides Trump with greater operational space. Looking at Trump's gray industry theory, Ethereum is the optimal choice, first bringing the gray industry into the coin circle, and then completing the harvest through Ethereum's issuance capability. However, do not forget one point: if the sickle is ultimately to be swung down, there will definitely be a wave of attraction in the middle. How to get everyone to invest in Ethereum? Naturally, it requires driving the growth of Ethereum. The mid-line level of profit we are looking at is this wave of market, and when it ends, we must take our hands off!

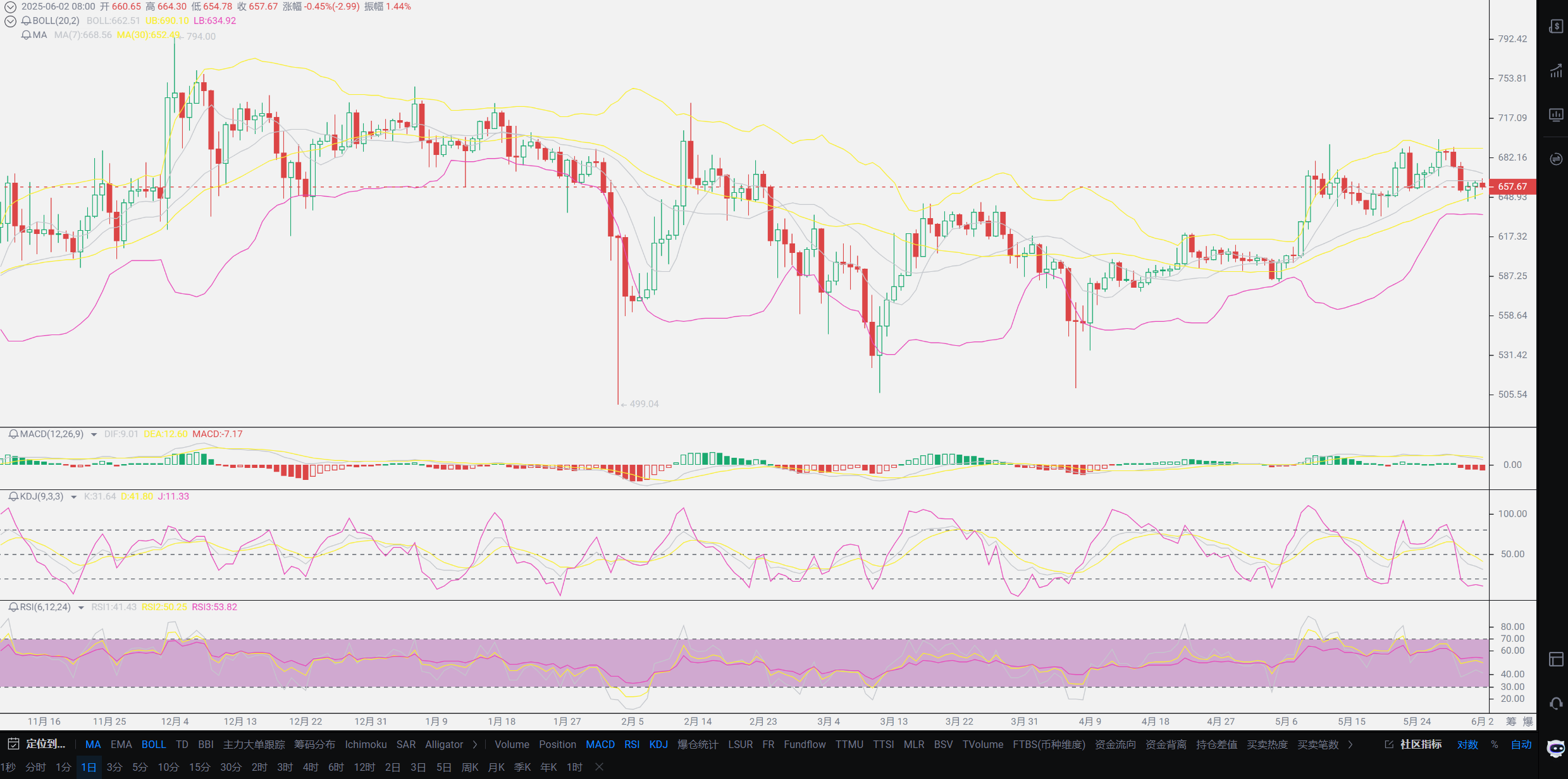

Regarding everyone's so-called high points, there is no need to set limits on any currency. Once limits are set, the ability to invest in the currency will be lost. The issuance mechanism of SOL is also like this, but its growth ability does not yield lower returns than any currency. When everyone sees that there is no limit on the total amount, they feel that the growth height of the currency is limited. We need to clarify one point: ninety percent of currencies will gradually be eliminated with the advancement of technology, and many currencies will not even wait for the total issuance to end before delisting. The ultimate goal of investment is to make a profit, and it is important to follow current events. When Ethereum was at 800, Lao Cui advised everyone to buy in, and everyone thought there would be lower points, completely ignoring the contract era created by Ethereum and the huge system support behind it. Even if the coin circle collapses, Ethereum will be the last currency to collapse. The arrival of a bull market will not rely solely on Bitcoin to hold on. The current Americans, before the stablecoin bill is passed, whether real or fake, must create the brilliance of the coin circle. Good data will make people believe in the theory of stablecoins, and only through the harvesting of the coin circle can these gray industry personnel be appeased. The harvesting of the coin circle is the most reasonable existence. Everyone can see clues from Trump's coin; the initial holders all signed a one to two-year non-sale guarantee agreement, creating the brilliance of the 79 high point, and the lowest point of 7.134 for harvesting still took nearly three months of layout. The sickle will not end the harvest in one go, including Trump's coin, which will break the high again and form a harvesting trend. The manipulable space of Ethereum is very large, and Trump is not so easy to give up this market.

In comparison between the two, it can be said that each has its own merits, and there is no mechanism that occupies an advantage. Ethereum abandoned the PoW mechanism to expand the system, not to limit the generation of high positions as you might think. This round of bull market can be said to be the largest opportunity in the coin circle so far. Everyone needs to clarify that currently only Ethereum and Bitcoin are listed currencies, so any future strategies regarding the coin circle will definitely prioritize these two. The significance of being listed already represents that the data is under the control of the Americans. With the promotion of stablecoins, the Ethereum chain is the most manipulable choice. According to the capital's consistent methods, breaking through the 5000 mark for Ethereum should not be too difficult, as long as Vitalik does not sell a large amount of coins, it is highly likely to push towards new highs. Currently, the stablecoins issued by JD are also compatible with the Ethereum chain. Everyone must have a keen sense; these bills, Hong Kong has always been at the forefront. When the situation is unclear, just focus on the head of the coin circle. As long as they are still bottoming out, everyone needs to keep in sync.

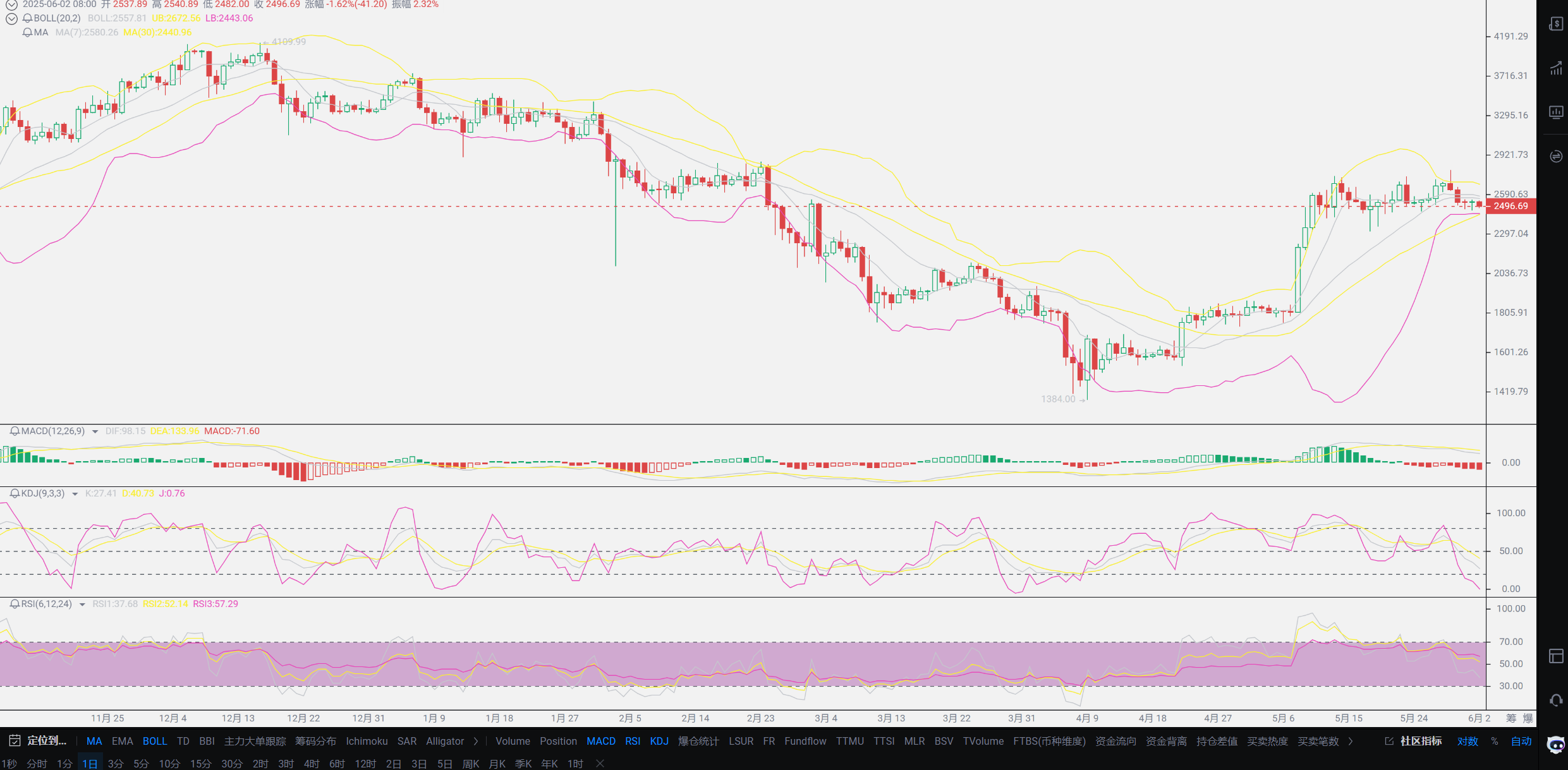

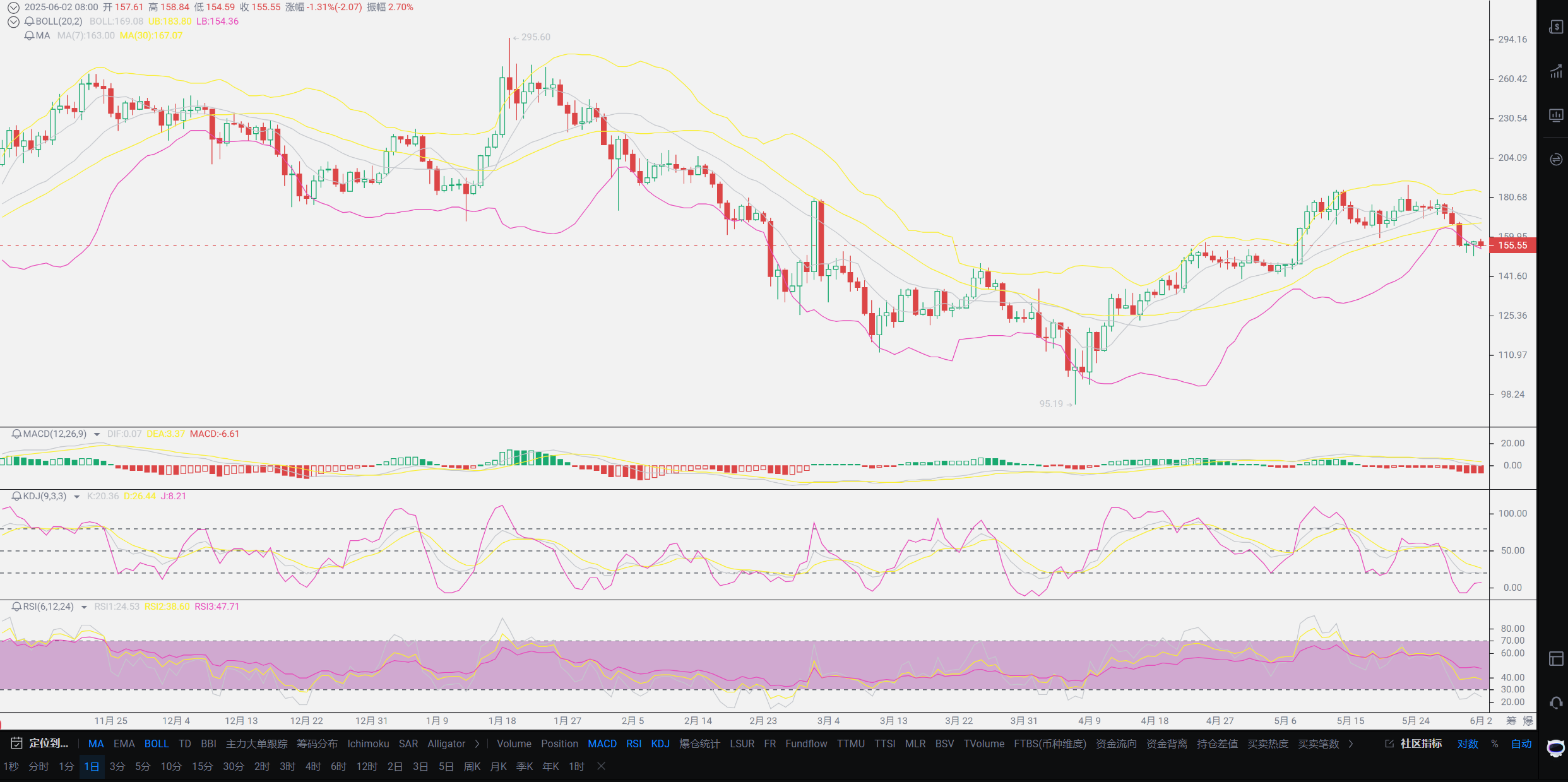

Lao Cui's summary: Recently, with the increase of newcomers, Lao Cui has been focusing more on conceptual explanations. As we enter June, Lao Cui has already explained the June trend in previous articles. As long as there is no interest rate cut in June, there will be a deep correction, but this does not mean that a bear market is coming. A phased strategic adjustment will ensure that the previous new lows will not be too deep. Those of you who are stuck in short positions can take this opportunity to clear the field quickly. Finally, I remind everyone that during the correction, try not to short, give up this opportunity, and wait for the rebound to come. After all, this year's trend is still bullish. Users who want to profit should follow the big trend. Those who did not keep in sync with Lao Cui in the last round can also choose to strengthen their positions during this correction. Lao Cui will also add some long positions during this correction and will notify everyone when entering. Regarding the prediction for Ethereum, there is a high probability of breaking through the previous new high, heading straight for the 5K mark within this year, and a new high will form around November to December. If the stablecoin bill is passed, it will be the timing for the bull market to start. The progress of this bill is basically nearing the end stage, and Lao Cui estimates that there will be news released in June to July, and results may come directly in July. If you mainly hold spot, just supplement on the downside; there is no need to sell. If you have no positions, just wait. For friends in contracts, as long as you avoid this wave of deep corrections in June, there should be no problem going long afterward. For specific positions, everyone can still ask Lao Cui, as the platform restrictions make it inconvenient to discuss points. At the end of the article, for those who need group chats, look for other analysts; Lao Cui does not have this business segment, so please do not waste each other's time. This also includes platform recruitment; first, Lao Cui is doing well in Hong Kong, so there is no intention to change jobs. Secondly, regarding company business, only regular platforms are accepted. Currently, it is all in cooperation with a certain security, and there is temporarily no possibility of accepting other platforms. Therefore, platform parties, please do not waste time on Lao Cui; I hope everyone can understand that looking for Lao Cui is not very meaningful!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five steps, seven steps, or even more than ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and the big trend, not focusing on one piece or one area, aiming for the final victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent troubles.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。