The homework these past few days has indeed been difficult to write. The first three days were all positive, with the US stock market rising while $BTC fell. Today, positive news and positive news are intertwined; the US stock market has shifted from falling back to rising, but Bitcoin has not yet returned to $105,000. As has been said recently, the rise is not due to strong buying power, but rather because there is little selling. Once negative news appears, it increases the selling pressure, and with no improvement in buying power, we see the current situation.

Today's positive news is that Trump's media group has officially signed a $2.32 billion agreement to establish Bitcoin reserves. The company behind the US president announced that it has completed private placements with 50 institutional investors. Additionally, the agreement was reached by selling over 55 million shares at an average price of $25.72 per share, along with senior secured notes maturing in 2028 with a principal amount of $1 billion.

On the negative side, the trade dispute between the US and China has escalated again. The tariff situation is already troublesome enough, and now sanctions surrounding chips and tech companies are also intensifying. The previously decent PCE data and the rare improvement in the University of Michigan data have been impacted, and we just hope nothing unexpected happens over the weekend.

Looking back at Bitcoin's data, today's turnover rate has significantly increased, mainly due to a more apparent battle between bulls and bears in the market. Especially with the continuous decline in $BTC prices over the past few days, some investors have become somewhat worried about the future. There are clear signs of a large number of loss-making investors exiting the market, reflecting an unfavorable expectation for short-term price trends.

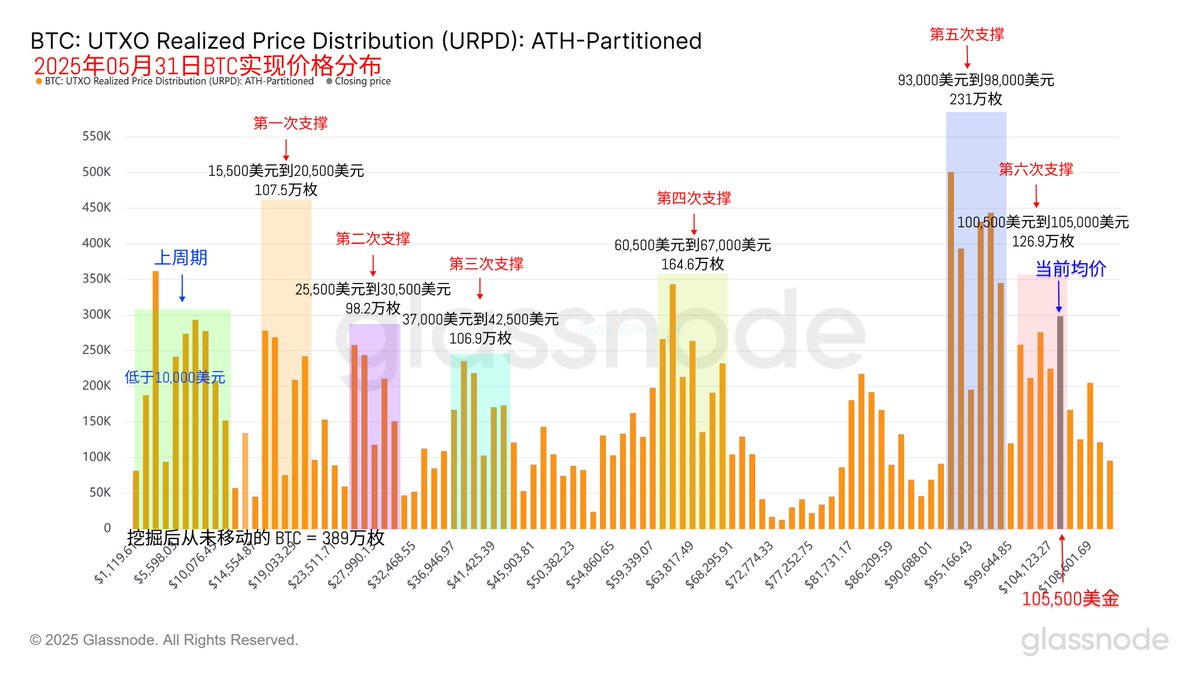

However, on the support side, there is still very good support between $93,000 and $98,000. Even with price fluctuations, investors in this range have not shown signs of large-scale exits. As long as this group of investors does not panic, the problem is not significant.

As for the US stock market, it has gradually shifted from falling back to rising before the close. The market is slowly digesting the negative information regarding US-China relations. We will have to see if any new situations arise over the weekend, and then wait for the US stock market to open next Monday to see if investor sentiment improves.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。