It is true that lending markets are very reliant on the oracles, but there are a lot of ways in which lending markets can safeguard users and the protocol itself.

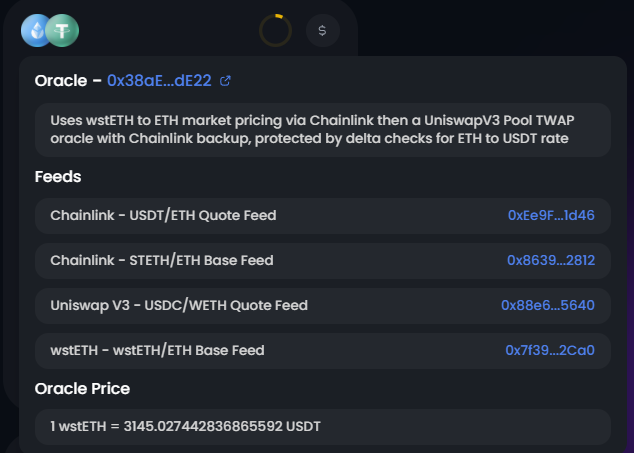

On @0xfluid, we probably have the most robust oracle framework. Every vault has its own set of oracles, which can include ChainLink oracles, Univ3 TWAP oracle, contract backing, rate limits on the collateral side and debt sides, etc, etc.

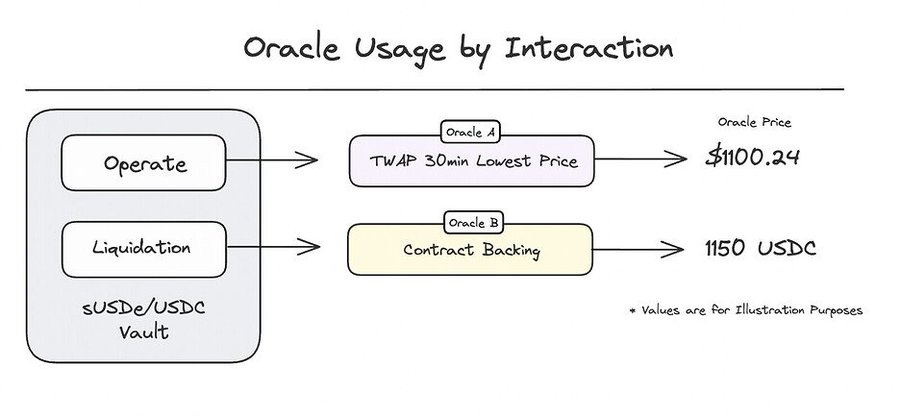

In addition, liquidations and borrowings in the vault also use different oracles. When a user is borrowing, the protocol will utilize the lowest possible pricing for the asset. For example, a 30-minute lowest moving average price for user interaction, while simultaneously using the most recent trusted market price (or contract backing) for liquidations to avoid liquidating users early and for the protocol to avoid taking any extra risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。