Original Title: "Binance Alpha Enters a Heated Competition, How to Participate with Better Strategies?"

Original Source: Shenchao TechFlow

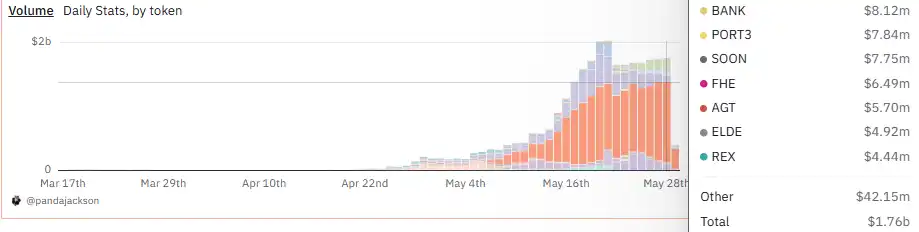

The point airdrop model of Binance Alpha has been online for a month, and the reputation of the Alpha activity "Basic Earnings Guaranteed" is gradually taking shape through relentless discussions in the market. The frequent "money-sprinkling" actions several times a week have gradually attracted those who were initially skeptical to participate, bringing in a batch of new users drawn by the earnings. As of May 29, the daily trading volume of Binance Alpha has reached $1.76 billion.

Data Source: Dune - Exclusive Accurate Data for Binance Alpha 2.0, Author: @pandajackson42

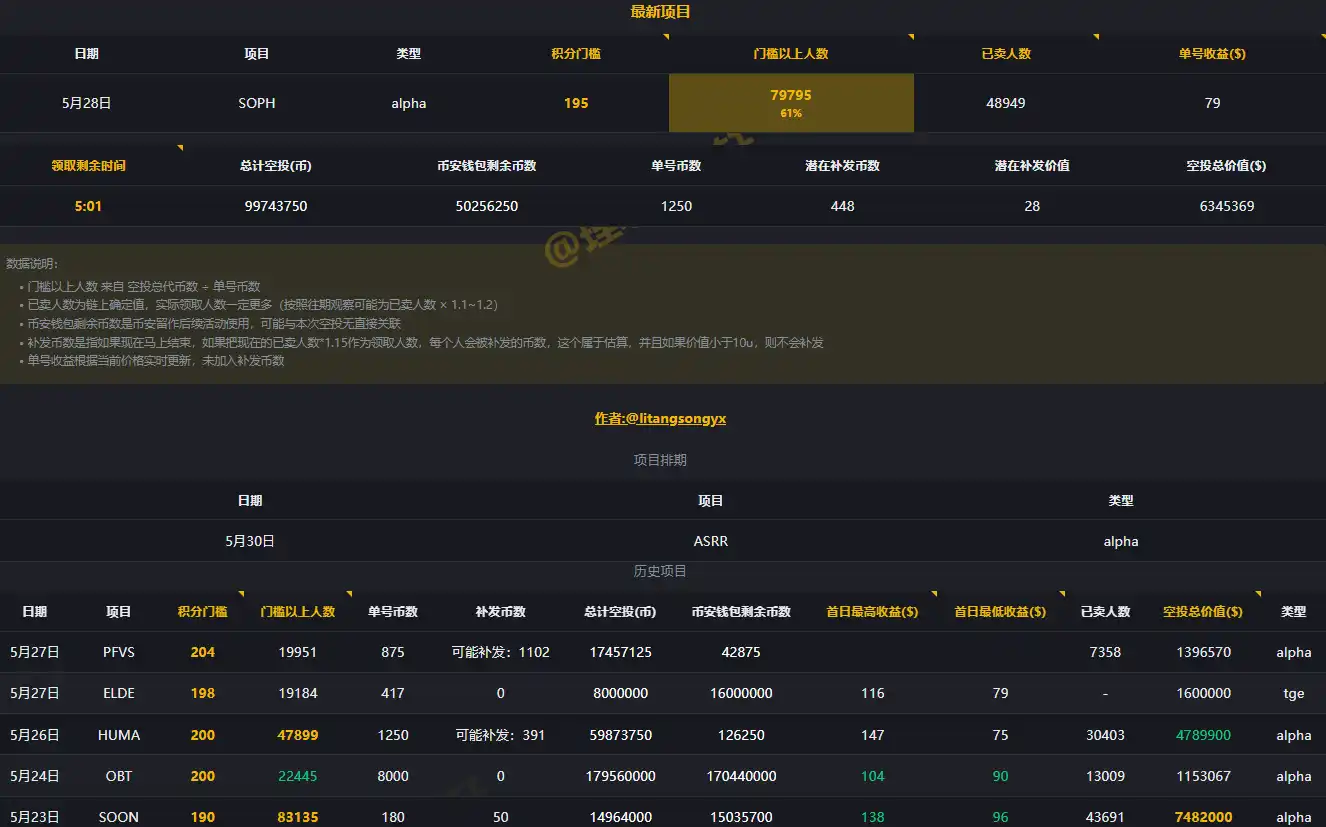

As the market's enthusiasm for participating in Binance Alpha continues to grow, Alpha points have also surged. According to statistics from Twitter user @litangsongyx, in the latest Alpha activity, the number of people with points ≥ 195 is close to 80,000, and the Alpha war is gradually entering a heated phase.

To do a good job, one must first sharpen their tools. In the current high-difficulty version environment, if you want to start participating or are already striving to participate, a suitable participation strategy is essential. Based on the current rules of the Binance Alpha activity and market participation, we have compiled a participation strategy that adapts to the current version for your reference.

Minimize Point Loss

Some people easily accumulate points daily, earning thousands of dollars a month, while others struggle to catch up and finally receive an airdrop, only to find that the airdrop earnings barely cover the point loss. Some even spend money and effort, ending up with losses instead of profits. This disparity is not only due to different entry times but also because everyone's control over trading losses varies greatly.

How to use the current rules to keep daily trading losses to a minimum? Please see the tips below ↓↓↓↓

1. Prioritize Trading BSC Assets: Currently, trading Alpha assets on the BSC chain can earn double points. Therefore, unless participating in specific coin Alpha trading competitions (such as Sonic or Sui chain assets), we should prioritize BSC assets when accumulating points. Compared to assets on other chains, BSC assets can earn more points for the same trading volume (loss), and this rule also attracts more liquidity into trading, resulting in relatively small trading slippage for BSC chain tokens.

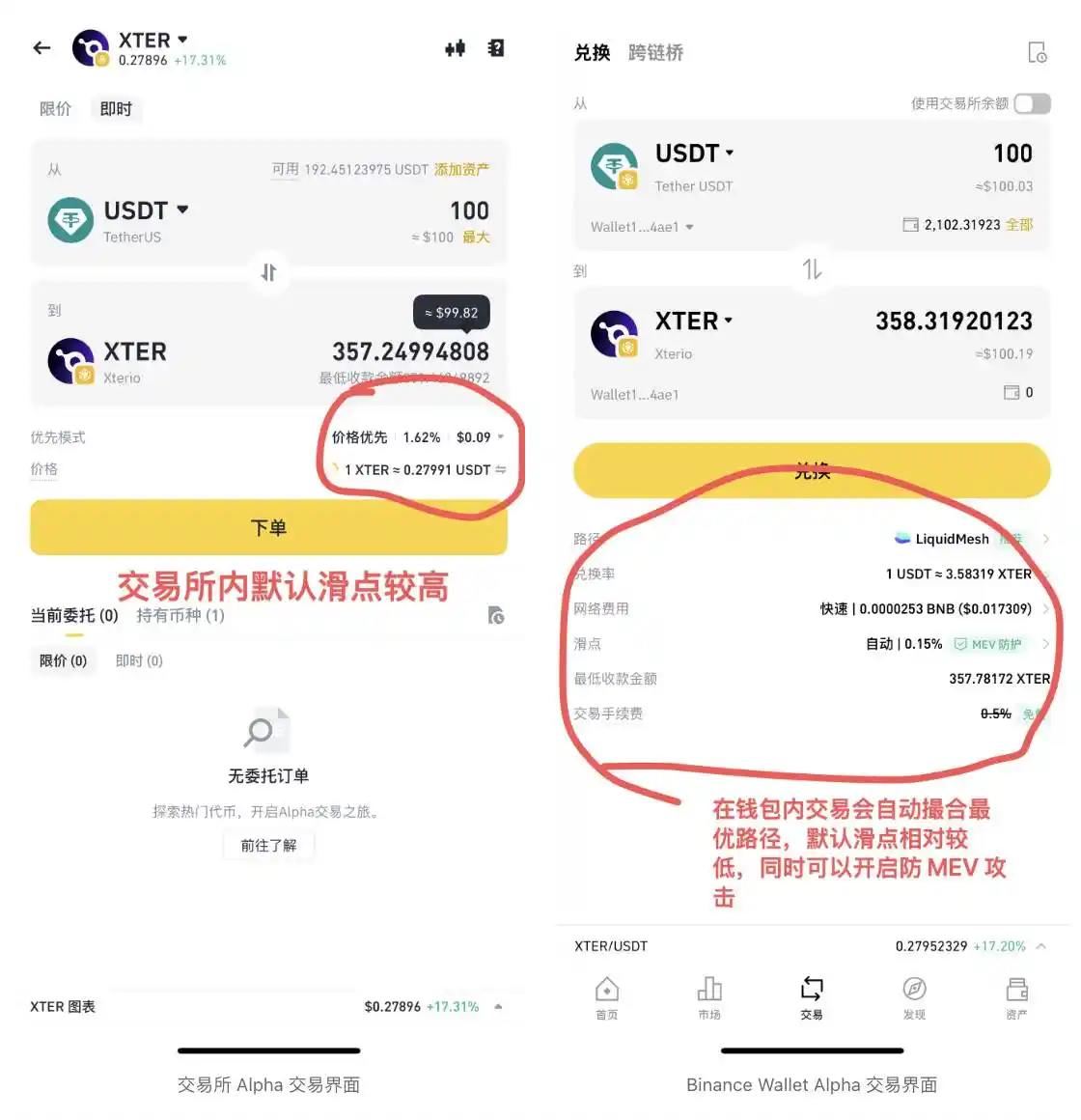

2. Manually Set Trading Slippage: Binance provides two ways for Alpha trading: "in-platform trading" and "wallet exchange." The Alpha trading tools within the platform optimize the trading process, making it easy for beginners, but the downside is that each trade requires manual adjustment of slippage and trading gas. If not careful, this can lead to higher losses; whereas trading within the Binance wallet, the system will match the optimal trading path, minimizing slippage, and users only need to set custom slippage once for a single coin, with the option to enable MEV protection.

3. Choose Different Trading Pairs: Assets on the BSC chain are not limited to USDT trading pairs; you can try BNB trading pairs or "Alpha asset/Alpha asset" trading pairs, which may yield different slippage surprises.

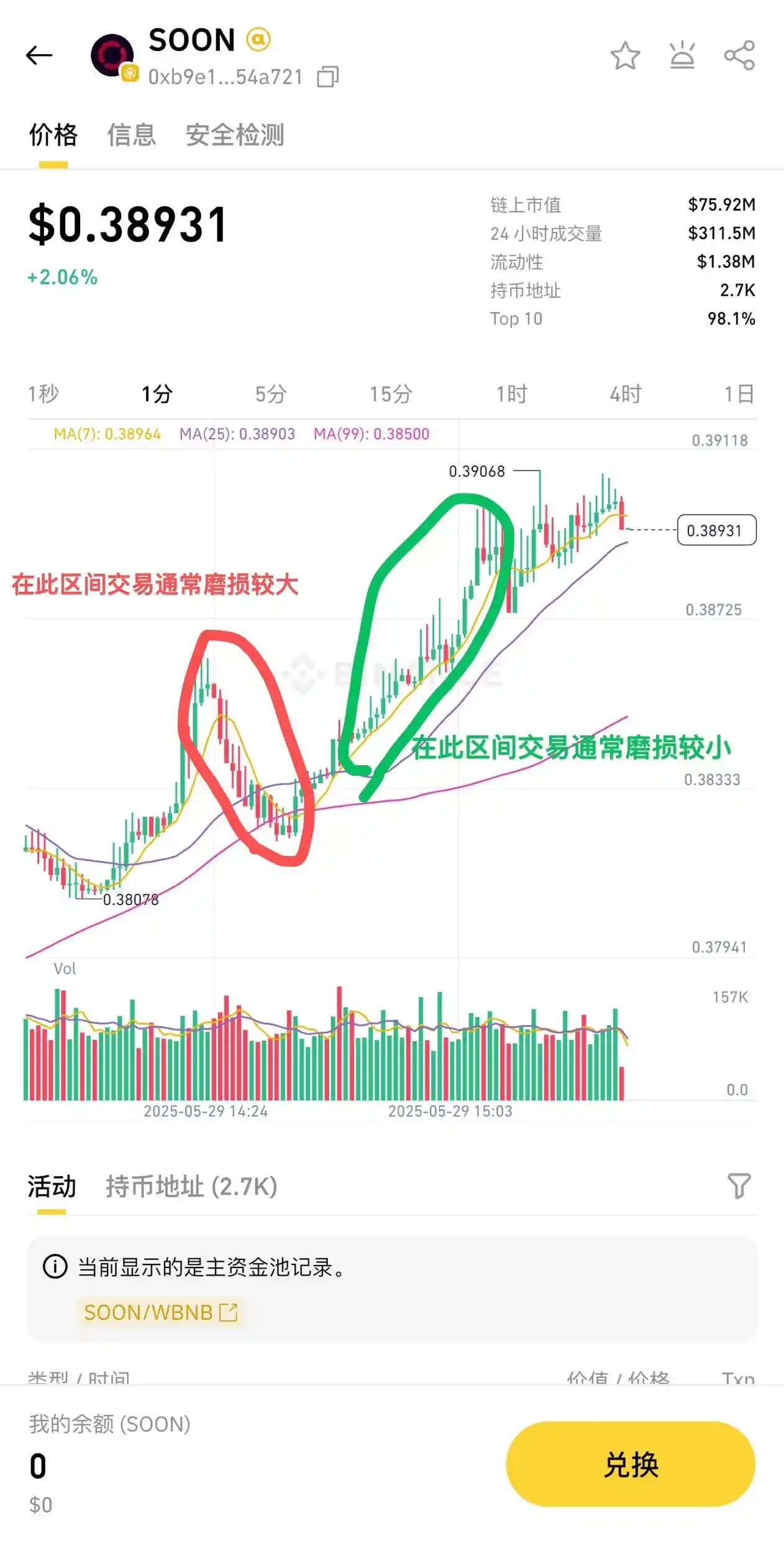

4. Try to Choose Coins in a Range-Bound or Upward Trend for Trading: Since the daily trading time for a single account is generally controlled within about ten minutes, when specifically choosing trading coins, in addition to observing the trading volume and liquidity depth, you should also monitor the specific price trends. Based on my tests, trading tokens that are in a small upward trend (1-5 minute level) can minimize losses (usually within 0.05% and sometimes even achieve 0 loss). PS: Small-level trends can be unpredictable, so this method requires observing while accumulating points, aiming to complete quickly to avoid losses from downturns.

How Many Points to Accumulate Daily?

It is known that the Alpha activity operates on a 15-day rolling point system, so each 15 days constitutes a point accumulation cycle. Under the current rules, how many points need to be earned daily within 15 days to achieve a reasonable return? Based on the recent 10 rounds of Alpha airdrop/TGE participation point thresholds, even for "sunshine-type" airdrops, the participation threshold has already risen to 190 points, indicating that participants need to earn at least 13 points daily. According to the point rules, for most users, to meet the 13-point threshold, they need at least "account balance ≥ $100 (1 point) + daily net purchase amount ≥ $4,096 (12 points)."

However, earning only 13 points daily is just enough to claim one airdrop/participate in one TGE per cycle. Given that the current single airdrop yield is around $100, accumulating points for 15 days to only claim one airdrop is clearly insufficient to cover daily effort and trading losses. Based on previous calculations of approximately 0.05% loss per trade, for most small fund users, within two point accumulation cycles (30 days), the following two strategies are relatively suitable in terms of balancing capital requirements and operation frequency:

Reserve $200 in the account, trade BSC chain tokens through BNB trading pairs, with a daily net purchase amount exceeding $8,192, earning 14 points (trading volume points) + 1 point (asset points), totaling 15 points daily, accumulating 225 points over 15 days, allowing for 4-6 airdrop claims on average over two point accumulation cycles.

Reserve $1,200 in the account, trade BSC chain tokens through BNB trading pairs, with a daily net purchase amount exceeding $16,384, earning 15 points (trading volume points) + 2 points (asset points), totaling 17 points daily, accumulating 255 points over 15 days, allowing for 8-10 airdrop claims on average over two point accumulation cycles.

If the deposit is ≥ $10,000, you can earn an additional point on top of the above trading volume, totaling 18 points daily, accumulating 270 points over 15 days, allowing for 10-12 airdrop claims on average over two point accumulation cycles.

How to Use Points Appropriately?

Not only should there be strategies for accumulating points, but there are also nuances in how to effectively utilize those points.

Rational Use of Mechanisms

The current frequency of Alpha activities is about 4-6 projects launched per week, with occasional instances where two projects can be participated in on the same day.

Since the deadline for claiming activity airdrops is 24 hours, based on the choice of "claiming airdrop on the project launch day" or "claiming airdrop the day after the project launch," a mechanism similar to a bug has emerged: Suppose currently (May 29), your points are 195, and today's activity participation threshold is 194. If you choose to claim the airdrop on May 29, under the same conditions, on May 30, your account points will be 195-15=180 points. If the participation threshold for the activity on May 30 is 190, then you cannot participate in the May 30 airdrop.

However, if you exploit this "bug" (i.e., claim the airdrop the day after the project launch), on May 30, you can claim the airdrops for both May 29 and May 30 with 195 points. If you do this, on May 31, your account points will be 195-30 (points consumed for 2 airdrops) = 165 points. This effectively allows you to claim an extra airdrop under the same conditions. If two Alpha activities are launched on May 30, you could even claim two extra airdrops under the same conditions.

Twitter user @litangsongyx has created a historical activity data dashboard for Alpha: https://litangdingzhen.me/, which details the specific distribution and claiming information for each Alpha project based on on-chain records, as well as predictions for potential token reissues based on the rules.

Participate in Subsidy Activities

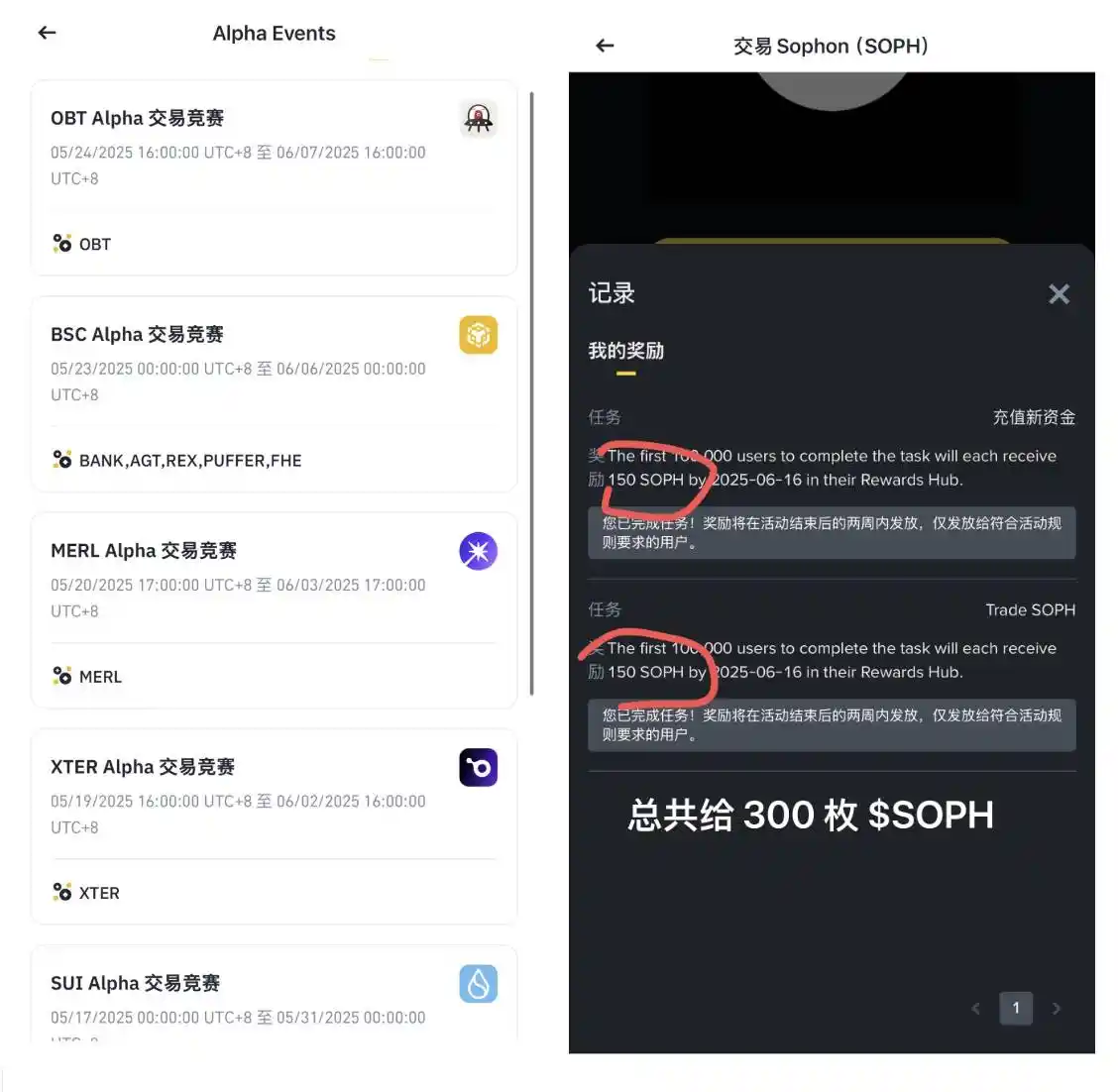

To promote enthusiasm for Alpha participation and support various projects launching Alpha, Binance has introduced trading competition activities. During specific times, achieving a certain ranking in trading volume for specific coins (different for each coin) can earn corresponding token rewards. Based on my tests, maintaining reasonable and moderate participation makes it not too difficult to qualify for ranking rewards. For example, in the $AIOT trading competition, I ultimately received 230 $AIOT (about $70), which can cover most of the trading losses incurred.

In addition to trading competitions, there will also be trading reward activities for individual coins, with relatively simple thresholds. For example, the $SOPH trading activity launched on May 28 can be completed in just a few minutes. The specific process is as follows: Enter "SOPH" in the Binance customer service window to find the activity registration entry → After successful registration, go to the BN wallet to buy $100 worth of $SOPH → Withdraw the $SOPH in the wallet to the trading platform (this step rewards 150 $SOPH) → Sell $SOPH on the trading platform (this step rewards 150 $SOPH). Completing the above operations can earn 300 $SOPH rewards after the activity ends, currently valued at around $20.

Market Changes Require Dynamic Strategy Adjustments

As of May 29, the average earnings from each Alpha activity in the current version range from $100 to $150, with participation point thresholds fluctuating between 190 and 205. As the number of participants in Alpha activities increases, the visible trend is that the participation threshold will continue to rise, and the rewards for each activity may decrease accordingly. As individual users, while diligently accumulating points, it is also important to adjust specific participation strategies accordingly, paying attention to the balance between capital loss, time and effort expenditure, and expected returns.

While the benefits are precious, it is crucial to be aware of potential systemic/non-systemic risks while actively participating. DYOR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。