Original Title: Coinbase Will Have to Acquire Circle – The Only Question Is Price

Original Author: Ryan Y Yi

Original Translation: Deep Tide TechFlow

Background

I have been deeply involved in the crypto industry for many years, having worked at the early-stage fund CoinFund and at Coinbase, helping to expand its venture capital strategy. All analyses in this article are based on publicly available data, including Circle's S-1 filing (April 2025) and Coinbase's public financial documents. There is no insider information; this is merely an analysis that anyone can conduct, though most people have not done so.

Analysis of USDC Supply Structure

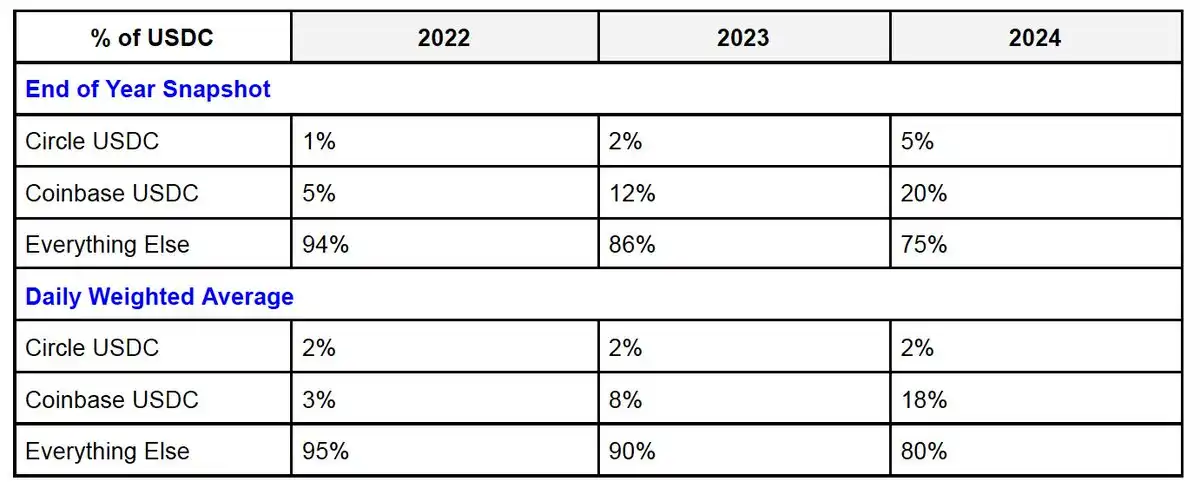

The total supply of USDC can be divided into three parts: USDC held by Coinbase, USDC held by Circle, and USDC held by other platforms. According to Circle's S-1 filing, "platform USDC" refers to "the proportion of stablecoins held in a custodian product or managed wallet service." Specifically:

· Coinbase: Includes USDC held by Coinbase Prime and the exchange.

· Circle: Includes USDC held by Circle Mint.

· Other platforms: USDC held by decentralized platforms such as Uniswap, Morpho, Phantom, etc.

Coinbase's share of the total USDC supply is rapidly increasing, reaching about 23% in the first quarter of 2025. In contrast, Circle's share remains stable. This trend reflects Coinbase's stronger influence in the consumer, developer, and institutional markets.

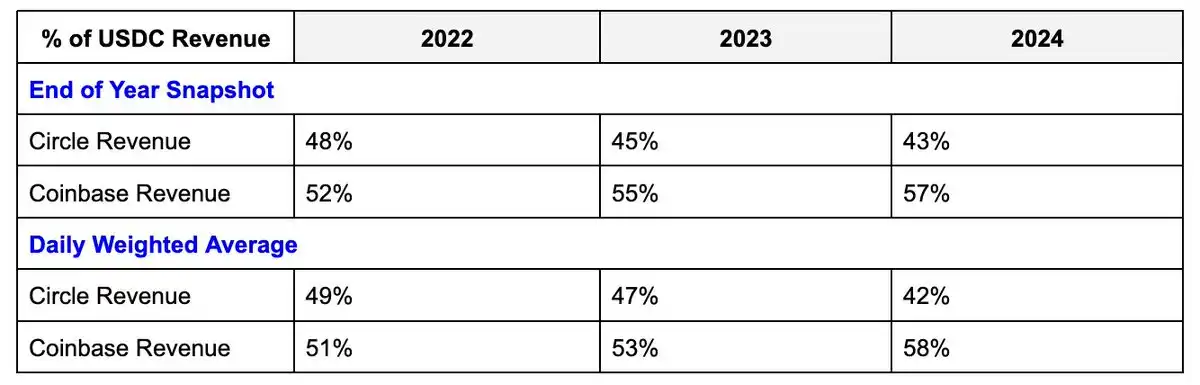

USDC Revenue Distribution

For USDC on the platform, Circle and Coinbase each retain 100% of the reserve income. For USDC off the platform (i.e., the "other platforms" portion), the two share the income 50/50. However, there is a key point: Circle benefits more from the off-platform USDC pool. Although the amount of USDC on Coinbase's platform is four times that of Circle, its income advantage is only about 1.3 times that of Circle. Some rough calculations based on the 50-50 split of the "other portion" yield the following income distribution results:

Circle: Betting on Market Size Rather Than Control

Circle's motivation is clear: to drive the overall circulation of USDC, even if these USDC are not stored on its own platform. For Circle, the ideal scenario is for USDC to become the preferred dollar stablecoin, a result that is inherently defensive and competitive. As the underlying protocol provider for USDC, Circle has advantages in the following areas:

· Publishing and maintaining USDC smart contracts on over 19 blockchains.

· Controlling the native bridging of the Cross-Chain Transfer Protocol (CCTP) and the minting/burning process.

· Although the profitability of USDC on the platform is higher, its growth is not significant. In high-risk business development, Circle's scale often does not match that of Coinbase. However, if USDC ultimately becomes the No. 1 dollar stablecoin, Circle will still be a winner. This is a game focused on total addressable market (TAM) rather than profit margin competition.

· The potential market size for USDC could be large enough that these details become less important—most of Circle's revenue growth is expected to come from the "other platforms" portion (which is not a bad outcome). This motivation aligns with Circle's capabilities, as Circle controls the governance, infrastructure, and technology roadmap of USDC.

Coinbase: Must Fully Control USDC

Macro Perspective

USDC is Coinbase's second-largest source of revenue, accounting for about 15% of revenue in the first quarter of 2025, surpassing staking income. It is also one of Coinbase's most stable and scalable infrastructure revenue sources. As USDC expands globally, its potential returns are asymmetric. In the future, USDC will become the core of Coinbase's business and build its competitive moat. Although Coinbase's primary revenue source remains trading volume from centralized exchanges (CEX), which will continue to grow with the market, the revenue model for USDC is more stable and will steadily increase with the overall development of the crypto economy.

USDC will rank among the top three dollar stablecoins and become a technology-driven solution for exporting dollars globally. Leaders in fintech and traditional finance have already recognized this, which is why they are taking action. However, USDC, with its early market advantage and support from the crypto economy, has the ability to survive and grow in competition. From an infrastructure and regulatory perspective, fully controlling USDC is a highly valuable narrative.

Micro Perspective: Coinbase's Profitability Dilemma

Coinbase is the main driver of USDC growth but is constrained by structural limitations. USDC has now become Coinbase's second-largest source of revenue, second only to trading income and ahead of staking income. Therefore, every product decision at Coinbase needs to be weighed from the perspective of revenue and profit. The core issue is: while Coinbase has expanded the market size (TAM), it has not fully controlled the revenue. As the market size expands, it needs to share the profits with Circle—off-platform income is only split 50%.

Ironically, Coinbase is working hard to drive USDC ecosystem growth—attracting users, building infrastructure, and improving transaction speed—but is structurally limited in terms of revenue. Its consumer and developer products have been "diluted" from the start.

Coinbase's natural response is to convert market size into "Coinbase USDC," the fully profitable portion—such as balances stored in custodian products, allowing Coinbase to earn 100% of the reserve income. This strategy has been effective: the proportion of USDC on the Coinbase platform has increased fourfold over the past two years. However, this strategy only applies to custodian USDC, namely the exchange and Prime product line. The problem arises in the gray area of custody—growth occurs here, but revenue attribution becomes ambiguous.

For example:

· Coinbase Wallet: By definition, it is a non-custodial wallet, and although its smart wallet improves user experience and may even introduce a shared key model, it may still not meet the definition of "platform USDC" in the S-1 filing. If most users interact with on-chain products in this way in the future, a large amount of USDC held by consumers will fall into the ambiguous revenue attribution between Coinbase and Circle.

· Base (Coinbase's Layer 2 network): Its architecture is non-custodial, allowing users to exit independently to Ethereum L1, and Coinbase does not hold the keys. Any USDC on Base may not be counted as "Coinbase USDC" as defined in the S-1, even though Coinbase is actually the main entry point to Base.

· Core Conclusion: The growth of Coinbase's consumer and developer products has driven the use of USDC but has embedded a "dilution system." Unless Coinbase can control the protocol layer of USDC, it will always face uncertainty in revenue attribution. The only thorough solution is to directly acquire Circle and redefine the rules.

Core Benefits of Acquiring Circle

100% Revenue Attribution

After acquiring Circle, Coinbase will no longer be limited by legal disputes over custodial and non-custodial definitions. It can directly claim full ownership of all interest income generated by USDC—regardless of where USDC is stored, it will receive all interest income from approximately $60 billion in USDC reserves. The debate over custodial definitions will cease to exist, and Coinbase will fully control all interest earnings from USDC.

Control of Protocol

The smart contracts, multi-chain integration, and Cross-Chain Transfer Protocol (CCTP) of USDC will become internal assets of Coinbase. This means Coinbase will have complete control over the technical infrastructure of USDC.

Strategic Product Advantage

After the acquisition, Coinbase can natively monetize USDC in wallets, Base (Layer 2 network), and future on-chain user experiences without coordinating with third parties. USDC can serve as an abstract layer for future on-chain interactions, and this integration does not require third-party permission.

Regulatory Integration

As a leader in the crypto policy space, Coinbase can shape the regulatory rules for stablecoins from the top down by controlling USDC. Mastering the core technology and operational rights of stablecoins will give Coinbase greater leverage in regulatory negotiations.

Unknowns and Unresolved Issues

Growth Potential

Currently, the market capitalization of USDC is about $60 billion, but it is expected to reach a scale of $500 billion in the future, corresponding to approximately $20 billion in annual reserve income. This would make USDC a core driver for Coinbase to reach "Mag7" level (the income level of the world's top tech companies).

Regulatory Factors

The U.S. is advancing legislation on stablecoins (GENIUS legislation), which is good news for the top-line growth of stablecoins from a macro perspective, as it will deeply embed stablecoins into the existing financial system in the U.S. At the same time, stablecoins will become proxy tools for the global dominance of the dollar. However, this may also trigger traditional financial institutions (TradFi) and fintech companies (FinTech) to enter the market as issuers of stablecoins. Additionally, related regulations may restrict how platforms market their income or savings products. Acquiring Circle will give Coinbase the flexibility to adjust its direction and marketing strategy to respond to the changing regulatory environment.

Operational Challenges

USDC was initially designed as a consortium model, which may have been based on the legal and regulatory considerations at the time. Although these obstacles should be overcome within a single company framework, it is currently unclear where the specific red lines of these complex mechanisms lie. Deconstructing the existing legal structure may bring risks of edge cases, but for now, these risks do not seem insurmountable.

Price

Market outcomes can never be accurately predicted, but we can refer to some disclosed data:

· Circle is seeking to go public (IPO) with a valuation of $5 billion.

· Ripple's IPO valuation target is $10 billion.

· Coinbase's current market capitalization is approximately $70 billion.

· USDC currently accounts for about 15% of Coinbase's revenue, and if fully integrated, this proportion is expected to exceed 30%.

Personal Interpretation:

· Based on the above data, Circle is a natural acquisition target for Coinbase, and Coinbase is well aware of this.

· Circle hopes to have the market value it through an IPO (targeting $5 billion).

· Coinbase wants to observe how the market prices Circle.

Coinbase may have realized the following points:

· For the aforementioned reasons, Coinbase needs to fully control the entire stack of USDC business.

· Fully owning USDC could increase its annual revenue composition from the current 15% to between 15% and 30%.

· From a 1:1 revenue valuation perspective, the ownership of USDC could be priced between $10 billion and $20 billion.

Circle may also be well aware of this—they know that if the market values them high enough and USDC continues to grow, Coinbase will be more motivated to directly acquire Circle to eliminate the various cumbersome issues related to business, product, and governance with third-party partners, integrating it into Coinbase's system.

Final Conclusion

Coinbase should and is likely to acquire Circle. Although the current collaborative model is functioning well, the conflicts in platform, product, and governance are too significant to ignore in the long run. The market will price Circle, but both parties have a clear understanding of each other's value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。