In recent years, the landscape of virtual assets has rapidly expanded globally. Decentralized financial products have not only impacted the boundaries of traditional financial systems but have also posed challenges to existing financial regulatory frameworks. It is well known that virtual assets have two major characteristics: high price volatility and high leverage in trading. This has presented a series of unprecedented regulatory challenges for regulatory authorities and trading platforms: How to regulate cross-border capital flows? How to complete customer identity verification (KYC)? How to avoid systemic financial risks such as death spirals? … This series of questions expresses the fact that the regulation of virtual assets will inevitably become a comprehensive issue that requires cross-departmental and cross-national collaboration.

The importance of Hong Kong's regulatory policies on virtual assets is well recognized: on one hand, Hong Kong, as the world's third-largest global financial center, occupies a key position in the global financial system; on the other hand, Hong Kong carries a special system under China's "one country, two systems." Its regulatory policies must not only promote the global virtual asset financial market but also meet the central government's requirements for financial stability. Hong Kong must find a balance between linking international capital markets and ensuring financial security in the mainland. At the same time, Hong Kong is bound to be an important window and testing ground for China to explore the development of emerging financial markets. Therefore, Hong Kong's regulatory path for virtual assets is bound to be complex, a process of continuous reconciliation between globalization and localization, innovation and prudence.

Thus, in this article, Crypto Salad will systematically outline the regulatory policy framework for virtual assets in Hong Kong, hoping to help readers establish a more comprehensive and clear understanding.

2017-2021: From Risk Warning to Institutional Prototype

This period marks the "initial stage" of Hong Kong's virtual asset regulation, where the government primarily focused on risk warnings and gradually introduced pilot regulatory elements. During this time, the government's regulatory attitude gradually transitioned from a cautious wait-and-see approach to an orderly and standardized one. Specifically:

On September 5, 2017, the Hong Kong Securities and Futures Commission (SFC) issued a statement on initial coin offerings (ICOs), indicating that some ICOs may constitute "securities" under the Securities and Futures Ordinance and need to be regulated, laying the foundation for the classification of virtual assets.

On December 11, 2017, the SFC issued a circular to licensed corporations and registered institutions regarding Bitcoin futures contracts and cryptocurrency-related investment products, requiring financial institutions providing cryptocurrency-related products to comply with existing financial regulations.

The issuance of these two "initial" regulations reflects Hong Kong's conservative and cautious attitude towards virtual asset regulation at that time, but it has already begun to attempt to incorporate virtual assets into the existing legal regulatory framework through the classification method based on securities attributes.

On November 1, 2018, the SFC issued a statement on the regulatory framework for asset management companies, fund distributors, and trading platform operators targeting virtual assets, aiming to clarify the regulatory framework for virtual asset portfolio management and trading platform operations, proposing to include compliant virtual asset trading platform operators in the SFC's regulatory sandbox. In the conceptual regulatory framework proposed by the SFC, the core regulatory content includes provisions for professional investors, prohibitions on leverage and derivatives, restrictions on ICO trading (which can only be traded at least 12 months after issuance), and customer asset segregation.

On March 28, 2019, the SFC issued a statement on the issuance of security tokens, defining STOs and making preliminary provisions for intermediary responsibilities. This statement has been replaced and updated by a circular issued on November 2, 2023.

On November 6, 2019, the SFC issued a warning regarding virtual asset futures contracts and a position paper on regulating virtual asset trading platforms, warning investors to be aware of the risks associated with purchasing virtual asset futures contracts, and in the position paper, proposed a licensing system, reiterating that platforms must self-certify compliance with strict standards and voluntarily apply for licenses to be included in the SFC's regulatory sandbox. In this document, the SFC also proposed token admission review rules and plans to establish a committee to assess the compliance of tokens.

In November 2020, the Financial Services and the Treasury Bureau launched a consultation on the amendment of the Anti-Money Laundering Ordinance, planning to include virtual asset service providers (VASPs) in the licensing system.

In May 2021, the Financial Services and the Treasury Bureau published a summary of the above consultation, officially confirming the introduction of a licensing system for VASPs, requiring those engaged in related businesses to apply for licenses and comply with anti-money laundering regulations.

Hong Kong gradually shifted from risk warnings to specific behavioral regulations, beginning to define the responsibilities of participants in the virtual asset market. At this time, regulatory authorities had recognized that virtual assets would become an important component of the financial market, and their attitude slowly began to shift towards positive management. However, for the participants in the ecosystem, the principle remained "voluntary participation." The government introduced the prototype of a licensing mechanism, where platforms that chose to accept regulation needed to proactively apply for licenses and self-certify compliance with standards.

Notably, the "regulatory sandbox" mechanism also entered the public's view, being used in the regulation of virtual asset trading platforms. The concept of a sandbox was first proposed and practiced in the UK, allowing emerging fintech companies or projects to test products, services, or other business models in a specific, controlled environment without fully meeting all existing regulatory requirements. As traditional regulatory models inevitably lag behind technological development, the sandbox mechanism can provide relatively free and abundant soil for some promising innovative projects to grow. The significance of the sandbox lies in its nature of being more inclusive and practical, as it differs from traditional one-way government regulation, resembling a collaborative approach where regulators and the market "cross the river by feeling the stones," fully testing in a small area.

At this point, Hong Kong's regulation of virtual assets had reached a threshold of maturity and institutionalization, with the regulatory focus shifting from merely classifying products to constructing a complete compliance ecosystem. Considering the global trends during this period, even in the United States and the European Union, the virtual asset market was still in its early stages, and excessive regulatory intervention could stifle technological innovation and industry exploration.

Additionally, during this period, mainland China maintained a high-pressure stance on crypto assets: in 2017, seven ministries in China issued a notice on preventing risks from token issuance financing, completely halting ICOs and closing related trading platforms; after 2018, the mainland intensified efforts to crack down on "disguised trading" and "over-the-counter trading"; in September 2021, ten departments jointly issued a notice on further preventing and addressing the risks of virtual currency trading speculation, classifying all virtual currency-related activities (trading, redemption, intermediaries, advertising, etc.) as illegal financial activities.

In the context of "polarized" regulatory directions, Hong Kong chose a third regulatory strategy: neither aggressively allowing nor implementing a blanket ban. As a financial special zone under the "one country, two systems" framework, Hong Kong had no urgent need to establish an independent path in related policies. Moreover, at that time, there was no unified regulatory consensus internationally, and Hong Kong neither had the conditions to take the lead nor the necessity to do so.

2022: A Key Turning Point in Policy Transformation

By 2022, this lukewarm regulatory style underwent a significant shift, transitioning from a previously cautious and limited regulatory approach to active and proactive policy support.

2022 officially became a watershed year for Hong Kong's virtual asset regulatory policy: On October 31, 2022, the Financial Services and the Treasury Bureau released the first policy declaration regarding the development of virtual assets in Hong Kong, clearly stating that Hong Kong would "actively promote" the development of the virtual asset ecosystem. This policy declaration not only indicated the implementation of a licensing system for VASPs but also proposed support for tokenization, green bonds, NFTs, and other emerging scenarios, marking a shift in regulatory thinking from "risk-oriented" to "opportunity-oriented," establishing a strategic direction for subsequent institutional reforms.

This declaration signifies a substantial change in the Hong Kong government's attitude towards virtual asset regulation. Crypto Salad believes that this shift did not occur in a vacuum; considering the international situation at the time, the underlying motivations can be roughly summarized into two points:

1. Intensified international competition, necessitating Hong Kong to maintain its status as a financial center. At that time, although the global virtual asset market experienced fluctuations, emerging fields such as Web3, NFTs, and the metaverse were accelerating their development, with major global financial centers ramping up their virtual asset strategies. Hong Kong, as an international financial center, had already fallen behind competitors like the United States and Singapore. Especially after Singapore introduced the Payment Services Act in 2020, it attracted a large number of Web3 companies and projects to settle there, prompting Hong Kong to urgently adjust its policies to compete for industry resources, or risk missing the window for global digital financial development.

2. From a market perspective, the development of virtual assets has generated multiple demands, with Hong Kong playing a key connecting role. Hong Kong itself needs a breakthrough and transformation opportunity in a new financial industry to strengthen its status as an international financial center; the mainland hopes to have a "testing ground" to explore the digital economy under compliance; and pioneering practitioners are eager to find a "regulated and orderly" landing place in Hong Kong to achieve legal compliance for assets, businesses, and identities; trading platforms desire institutional protection and legitimacy within a legal framework. These demands gradually converged around 2022, providing realistic conditions for a significant relaxation of Hong Kong's virtual asset policies.

In summary, this transformation is not only about accommodating innovative financial markets but also represents Hong Kong's proactive strategic choice to maintain its status as a financial center in a complex international environment.

2023-Present: Rapid Iteration, Deepening, and Transformation of Regulatory Policies

Since 2023, Hong Kong's virtual asset regulation has officially entered the "operational implementation" phase. The previous experimental model has gradually been replaced by a complete and mandatory legal and licensing system, with government policies formally evolving from "policy declarations" to "regulatory execution," gradually becoming complete and institutionalized.

In February 2023, the Hong Kong SAR government issued its first tokenized green bond. This bond is custodied by Bank of China (Hong Kong) and HSBC, and cash tokens are managed through the Monetary Authority's Central Moneymarkets Unit (CMU).

In June 2023, the SFC officially implemented the "Guidelines for Virtual Asset Trading Platforms," launching the VASP licensing system, with only two platforms—OSL and HashKey—successfully approved during the transition period.

In the same month, the "Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance" officially came into effect, marking that virtual asset trading platforms (VATPs) must operate with a license. Regulatory requirements cover aspects such as capital adequacy, cold wallet custody, KYC/AML, market manipulation prevention, and investor suitability assessment. With the introduction of the "Guidelines for Virtual Asset Trading Platforms," Hong Kong has completely shifted from "optional regulation" to "mandatory licensing," establishing clear market entry thresholds and operational norms. Additionally, restrictions on investors have been relaxed from "professional investors" to retail investors, provided that platforms meet additional protection requirements such as investor suitability assessments, risk disclosures, and cold wallet custody.

In August 2023, HashKey became the first licensed exchange in Hong Kong to open to retail investors, marking that retail investors can participate in virtual asset trading in compliance with regulations. The first offerings included Bitcoin (BTC) and Ethereum (ETH), signaling the start of compliance in the retail market.

The series of legislative measures in 2023 marks the official entry of Hong Kong's virtual asset licensing system into the operational phase, transitioning the regulation of platforms from "voluntary acceptance" to "mandatory requirements." At the same time, HashKey, as the first platform to be licensed during the transition period, has set industry standards. Meanwhile, the effectiveness of anti-money laundering legislation formally incorporates virtual asset trading platforms into the same anti-money laundering regulatory framework as traditional financial institutions, solidifying the legal foundation of the licensing system.

In November 2023, the SFC issued a circular regarding intermediaries engaging in tokenized securities-related activities, reiterating that although tokenized securities are issued using blockchain technology, they are essentially traditional securities and must comply with existing securities regulations. Intermediaries must conduct due diligence, ensure product suitability, and notify the SFC in advance when distributing, trading, or managing such assets.

In December 2023, the Monetary Authority and the SFC jointly released an updated circular on intermediaries' virtual asset-related activities, which for the first time clarified that virtual asset spot and futures ETFs are available for compliant sale. The release of this circular represents an extension of regulatory requirements from trading platforms to intermediary institutions (such as brokers, banks, and financial advisors), marking the beginning of virtual asset regulation covering the entire financial distribution chain, forming a complete regulatory loop. The circular also allows intermediaries to sell virtual asset-related ETFs for the first time, paving the way for the future launch of spot and futures ETF products.

In the same month, the SFC issued a circular regarding SFC-recognized funds investing in virtual assets, indicating that the SFC considers the relevant regulations that must be met when allowing funds for public offering, where the net asset value (NAV) involving virtual assets (VA) exceeds 10%.

In January 2024, GF Securities (Hong Kong) successfully issued the first tokenized securities applicable under Hong Kong law.

In March 2024, the Monetary Authority launched the "Ensemble Project," aimed at exploring the integration of tokenized assets with wholesale central bank digital currencies (wCBDC), testing atomic settlement mechanisms in scenarios including green bonds, carbon credits, real estate, and supply chain finance. The Ensemble sandbox focuses on exploring application scenarios for tokenization technology, with several RWA projects already successfully implemented.

In July 2024, the Monetary Authority initiated a stablecoin regulatory sandbox program, allowing institutions to test stablecoin issuance and application models in a controlled environment. The first participants include JD Technology, Circle, and Standard Chartered Bank. Among them, JD launched the "JD-HKD" stablecoin pegged to the Hong Kong dollar, exploring its application in payment settlement and supply chain management. This marks Hong Kong's pioneering exploration of the localization, practicality, and compliance of stablecoins globally.

In August 2024, Longshine Technology collaborated with Ant Group to launch a charging pile revenue rights RWA project.

In September 2024, GCL-Poly Energy Holdings collaborated with Ant Group to launch a photovoltaic power station revenue rights RWA project.

In February 2025, Financial Secretary Paul Chan announced the release of the second "Virtual Asset Policy Declaration," planning to integrate traditional finance with blockchain technology and promote over-the-counter trading and custody service systems.

In February 2025, Huaxia Fund (Hong Kong) announced that its Huaxia Hong Kong Dollar Digital Currency Fund has been approved by the SFC, becoming the first tokenized fund for retail investors in the Asia-Pacific region, expected to officially list on February 28.

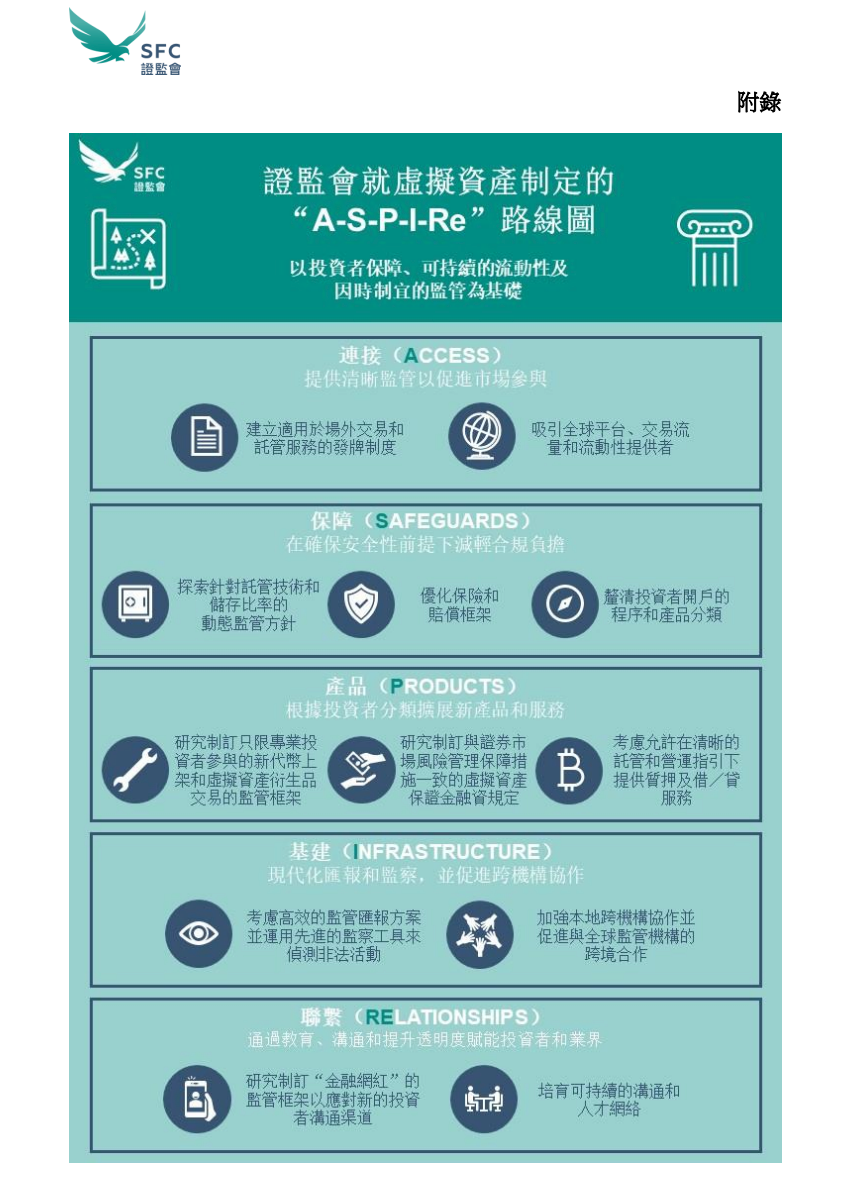

In March 2025, the number of licensed exchanges increased to 10, with 8 more under review, significantly enhancing regulatory efficiency and market confidence. During the same period, the SFC released the "A-S-P-I-Re" regulatory roadmap to deepen market development through five pillars: connection, protection, products, infrastructure, and engagement.

In the same month, Xunying Group successfully implemented the world's first battery swap physical asset RWA project.

Analysis and Overview of Hong Kong's Regulatory System

Through the above overview of the regulatory policies of developed countries regarding virtual assets, as well as the analysis of Hong Kong's regulatory path, Crypto Salad believes that Hong Kong has not simply copied the regulatory frameworks of Europe and the United States but has formed its own governance logic based on international rules.

Hong Kong's regulation of virtual assets has always adopted a "patchwork regulation" strategy based on the existing legal framework, meaning that it regulates digital assets through the issuance of guidelines or circulars rather than learning from the EU and starting from scratch to create a new specialized code. Considering Hong Kong's identity as an international financial center, we can make some judgments about the logic behind the regulatory strategy:

The Hong Kong government believes that virtual assets are essentially no different from traditional financial assets and can even be viewed as an extension of traditional financial assets. Therefore, the most important aspect of regulating virtual assets is to firmly uphold the three lines of defense: financial compliance, anti-money laundering, and investor protection, which can be managed within the existing financial regulatory system. As a resource-scarce but institutionally mature international city, Hong Kong's economic structure is highly dependent on the financial industry, with its GDP, employment, and international influence closely linked to the stability, transparency, and efficiency of the financial system. The rise of virtual assets presents both an opportunity and a challenge for Hong Kong. Objectively speaking, Hong Kong's "patchwork" regulation is the most efficient and adaptable regulatory approach in this field.

From regulatory authorities to financial practitioners, there is a strong familiarity with risk control and regulatory operations in sectors such as securities, banking, and asset management. Although virtual assets differ in technical form, they are functionally similar to financialized assets—they can be valued, traded, have markets, and carry risks, making them suitable for inclusion under familiar regulatory frameworks. Therefore, Hong Kong's regulation seems to lean towards treating them as extensions of financial assets. This not only reduces regulatory coordination costs but also builds a bridge between financial institutions and emerging technology companies, allowing for a better integration of institutional transformation and industrial development.

The views expressed in this article are solely those of the author and do not constitute legal advice or opinions on specific matters.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。