Core Points

– Cryptocurrency is taxable—and there is no way to avoid it. From BTC/USDT trades to staking rewards from XT Earn, every transaction could constitute a taxable event.

– Mainstream tools like Koinly, CoinLedger, and CoinTracking can help users simplify the tax reporting process for spot, contract, and DeFi activities.

– The choice of software depends on your location and investment strategy—there is no "one-size-fits-all" solution, but Koinly and CoinLedger can cover the tax needs of most countries worldwide.

– Most platforms offer a free version, but if you trade frequently or use multiple platforms, it is advisable to consider upgrading to a paid version for full support.

As Bitcoin (BTC) gradually enters the mainstream, cryptocurrency traders are facing an increasingly pressing issue: taxes. By 2025, regulatory agencies in various countries and regions around the world are strengthening their oversight of digital assets. Whether you are engaging in BTC/USDT spot trading, positioning in Bitcoin contracts, or earning staking rewards through XT Earn, you may need to report taxes—failing to report any transaction could lead to significant consequences.

The good news is that there are now many excellent Bitcoin tax software options available to help you automate the tax reporting process, ensure compliance, and even legally reduce your tax burden through smart cost basis calculations. This guide will systematically outline the best Bitcoin tax software to use in 2025, evaluating them based on functionality, country coverage, pricing plans, and whether they can integrate with mainstream trading platforms and wallets.

Table of Contents

Why You Must Use Bitcoin Tax Software in 2025

Core Features to Look for When Choosing Bitcoin Tax Software

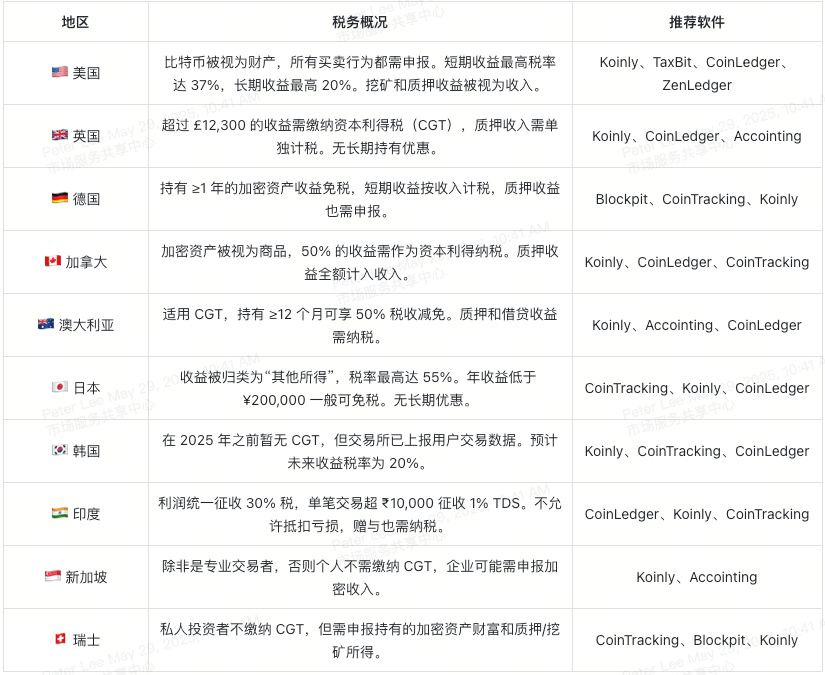

Recommended Bitcoin Tax Software by Country

Comparison Overview: Which Software is Right for You?

Why You Must Use Bitcoin Tax Software in 2025

Today's Bitcoin trading is no longer just about "making money," but about compliance. The days of the tax authorities turning a blind eye to crypto assets are long gone. Now, whether it's the IRS in the United States, HMRC in the UK, ATO in Australia, or CRA in Canada, you are required to report everything—from the most basic BTC spot trades to complex DeFi staking rewards, all must be included in tax considerations.

The situation becomes more complicated because crypto assets are inherently difficult to track. You might be buying and selling BTC on three different exchanges, earning rewards on XT Earn, and occasionally dabbling in NFTs. Trying to manually organize these transaction records? It's too painful, not only prone to errors but also carries high risks.

This is where Bitcoin tax software can be extremely useful. It can automatically import your transaction data, calculate gains and losses, convert to local currency, and generate reports that comply with local tax reporting standards. Not only does it make compliance easy, but it also significantly reduces mental burden.

Core Features to Look for When Choosing Bitcoin Tax Software

Not all cryptocurrency tax software is the same. Leading platforms in 2025 generally have the following features:

– Exchange & Wallet Integration: Can sync your transaction records, supporting platforms like Coinbase, Binance, XT.COM, Kraken, MetaMask, Ledger, etc.

– Trading Strategy Identification: Whether it's BTC spot trading, BTC perpetual contracts, or Bitcoin staking, the software can automatically categorize and apply the correct tax treatment.

– Income Tracking: Taxable income from staking platforms like XT Earn can be automatically included in your income reports.

– Local Tax Compliance: Supports exporting files in official formats that comply with IRS 8949 (USA), CGT summary (UK/Australia), CRA forms (Canada), etc.

– Multi-Currency Conversion: Can convert all transaction amounts to your local currency (such as USD, GBP, CAD, JPY, etc.) based on historical BTC prices.

– Audit Support: Can export complete gain and loss calculations and raw data, making it easier for accountants or tax reviews.

– Free & Paid Plans: Most platforms offer free trials or basic versions, with advanced features generally starting from $49 per year, billed based on transaction volume.

Recommended Bitcoin Tax Software by Country

United States

Tax Overview: The IRS views Bitcoin (BTC) as property. Any form of disposal (such as buying or selling) must be reported. Short-term capital gains are taxed at a maximum rate of 37%, while long-term gains are taxed at 20%. Mining and staking (such as rewards from XT Earn) must be reported as income.

Recommended Software:

– Koinly – Supports exporting IRS 8949 forms, strong DeFi support

– TaxBit – Enterprise-level solution that can automatically fill out IRS forms

– CoinLedger – Seamless integration with platforms like TurboTax, suitable for individuals

– ZenLedger – Provides audit records and tracks crypto donations

United Kingdom

Tax Overview: Bitcoin is taxed as a capital asset, and any annual gains exceeding £12,300 are subject to CGT. Staking rewards are considered income, with no long-term holding benefits.

Recommended Software:

– Koinly – Supports HMRC format reports, clear merging logic

– CoinLedger – Automatically matches wallet transfers, compatible with UK tax regulations

– Accointing – Simple interface, supports exporting HMRC-specific forms

Germany

Tax Overview: Holding for over a year is tax-free, while short-term gains are taxed as income. Staking rewards must also be reported. The 10-year tax exemption rule has been abolished since 2023.

Recommended Software:

– Blockpit – Developed locally in Germany, supports KrZFA format

– CoinTracking – Most commonly used by German users, detailed reports

– Koinly – Customizable holding period settings, flexible to meet German tax requirements

Canada

Tax Overview: Cryptocurrency is treated as a commodity, with 50% of profits subject to capital gains tax. Staking income must be reported in full. Corporate traders must report the full amount.

Recommended Software:

– Koinly – Can generate CRA format reports, supports automatic conversion to CAD

– CoinLedger – Can distinguish between capital gains and income

– CoinTracking – Powerful exchange rate conversion and analysis features

Australia

Tax Overview: All disposal actions must report CGT, with a 50% discount available for holdings of 12 months or more. Staking and lending income are taxable.

Recommended Software:

– Koinly – Can generate ATO format CGT reports

– Accointing – Automatically tracks XT Earn earnings, supports AUD

– CoinLedger – Supports dual reporting of income and capital gains

Japan

Tax Overview: Crypto earnings are considered "miscellaneous income," with a maximum tax rate of 55%. Annual earnings below ¥200,000 are tax-exempt, with no long-term holding benefits.

Recommended Software:

– CoinTracking – Supports JPY conversion and FIFO/LIFO strategies

– Koinly – Adapts to Japanese tax regulations

– CoinLedger – Simplifies reporting processes, supports local exchanges

South Korea

Tax Overview: There is currently no CGT before 2025, but regulators have obtained user data from exchanges. Future earnings are expected to be taxed at 20%.

Recommended Software:

- – Koinly, CoinTracking, CoinLedger – All support Korean exchanges like Bithumb and Upbit

India

Tax Overview: A flat 30% income tax is applied to profits, with a 1% TDS on any single transaction exceeding ₹10,000. Losses cannot be deducted, and gifts are also taxable.

Recommended Software:

– CoinLedger – Provides India-specific tax classifications

– Koinly – Supports INR and TDS tracking

– CoinTracking – Preferred by advanced users, strong in detail handling

Singapore

Tax Overview: Ordinary individuals are not subject to CGT, but professional traders or businesses may need to pay taxes on crypto earnings.

Recommended Software:

- – Koinly, Accointing – Support tracking GST and exporting SGD reports

Switzerland

Tax Overview: Private investors are exempt from CGT but must report crypto assets as wealth tax and report staking/mining income.

Recommended Software:

- – CoinTracking, Blockpit, Koinly – Provide comprehensive wealth and income tracking features

Feature Matrix: How to Choose the Best Bitcoin Tax Tool for You

As crypto trading becomes increasingly complex—from BTC spot, BTC contracts to staking platforms like XT Earn—choosing the right Bitcoin tax software can save you a lot of time and effectively avoid high costs from misreporting. Below is a comparative analysis of several mainstream software options, each with its advantages:

Koinly

– Supports over 800 exchanges and wallets, including XT.COM, Binance, Coinbase, and MetaMask

– Accurately tracks BTC spot, contract, and staking earnings

– Automatically categorizes rewards from platforms like XT Earn as taxable income

– Supports generating localized tax reports for over 100 countries (e.g., IRS 8949, UK CGT, ATO CGT)

– Offers various cost basis calculation methods (FIFO, LIFO, HIFO, etc.)

– Very suitable for multinational traders, DeFi users, and professional tax professionals with audit needs

Image Credit: Koinly Homepage

CoinLedger

– Quick setup, intuitive interface, suitable for beginners and intermediate users

– Fully supports BTC/USDT spot and contract trading

– Can automatically integrate staking and airdrop income from XT Earn and other platforms

– Can export reports suitable for the IRS and is compatible with tax platforms like TurboTax/TaxAct

– Covers major tax systems in the USA, UK, Canada, Australia, and India

– Very suitable for individual traders who prioritize efficiency, simple processes, and compliance

Image Credit: CoinLedger Homepage

CoinTracking

– Features advanced data analysis tools integrated with over 300 platforms

– Fully tracks gains and losses from BTC spot, leveraged, and contract trading

– Manual support for staking income (earnings from XT Earn need to be entered manually)

– Provides historical data charts, customizable tax logic, and audit exports

– Highly favored by high-frequency traders and institutional users

– Very suitable for advanced users who need detailed control and multi-year data management

Image Credit: CoinTracking Homepage

Accointing

– User-friendly interface, backed by Glassnode data

– Supports BTC spot, perpetual contracts, and staking activities

– Can automatically track DeFi activities, partially supports staking earnings from XT Earn

– Can export tax reports suitable for regions in the UK, US, Canada, and Europe, supports CSV format

– Accointing is more suitable for beginner to intermediate users in Europe and the US

Blockpit

– Designed specifically for European users, with built-in local tax law logic (e.g., Germany, Austria)

– Supports BTC spot, contracts, staking, NFTs, and DeFi protocols

– Provides KPMG-certified tax forms and complete audit tracking features

– Although support for XT Earn is limited, it excels in EU compliance and KrZFA format support

– Very suitable for professional users and businesses in the EU

Image Credit: Blockpit Homepage

Final Thoughts

Whether you are trading BTC/USD on centralized exchanges (CEX), earning staking rewards through XT Earn, or positioning in the Bitcoin contract market, you cannot escape one reality: crypto taxes are real and becoming increasingly stringent.

Choosing the right Bitcoin tax software can determine whether you file your taxes easily or get "invited for tea" by tax authorities. Tools like Koinly, CoinLedger, and TaxBit can automatically sync your transaction data, calculate taxable events, and generate standard tax reports, making it easy whether you hand them to a professional accountant or submit them yourself.

Are you ready to simplify your crypto taxes for 2025? Choose a tool that suits you, connect your accounts, and let the system handle the rest.

Frequently Asked Questions: What You Might Want to Know About Bitcoin Tax Software

If I only trade BTC/USDT, do I still need tax software?

Yes. Most countries stipulate that every transaction (even just spot trading) is a taxable event. Using software can help you accurately record and report.

Do BTC staking earnings (like XT Earn) need to be taxed?

Typically considered "ordinary income," they are included in taxable income when received. Tools like Koinly and CoinLedger can automatically identify and categorize this type of income.

Can tax software support multiple wallets and trading platforms?

Absolutely. Most mainstream tools support over 300 platforms, including Binance, XT.COM, MetaMask, Ledger, and more.

Are there free versions of Bitcoin tax software?

Yes. Koinly, CoinLedger, and others offer free accounts (usually applicable for up to 100 transactions), with advanced versions starting from around $49/year.

Which tool is best for me?

– Koinly: Global support, most comprehensive features

– CoinLedger: Especially suitable for U.S. users

– CoinTracking: Powerful analysis features

– Accointing: User-friendly interface, suitable for beginners

– Blockpit: Focused on the EU market

– TaxBit: Aimed at enterprise-level users

Can tax software help me reduce my tax burden?

Yes. For example, through cost basis algorithms, loss offsets, and anomaly detection, it allows you to file taxes more intelligently, not just faster.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。