On May 28, according to Circle's IPO filing, Circle acquired RWA issuer Hashnote for $9.9 million in cash and approximately 2.9 million shares of fully vested common stock (totaling about $99.8 million) in January 2025. Hashnote, which was launched with a $5 million investment from Cumberland Labs, is the issuer of U.S. Yield Coin (USYC) and has issued USYC tokens worth $1.3 billion, making it the largest tokenized U.S. Treasury product in the market.

This acquisition information undoubtedly adds to Circle's valuation.

About a month ago, Circle announced the launch of its initial public offering (IPO) plan, but the process was forced to be delayed due to changes in the external policy environment. During this period, Circle simultaneously engaged in in-depth negotiations with potential buyers, including Coinbase and Ripple, regarding acquisition matters. However, an agreement could not be reached due to differences in valuation amounts. Circle is not in a hurry to sell; its strategic intent is clear: on one hand, it hopes to validate and achieve a higher company valuation through the pricing of a public market IPO; on the other hand, it is also pressuring potential acquirers to further increase their offers. Essentially, Circle is engaged in a shrewd "price comparison" game aimed at maximizing benefits for its shareholders.

Failed Sale, Turning to IPO

This is not Circle's first attempt to go public. At the end of 2022, it tried to go public through a merger with a SPAC (Special Purpose Acquisition Company) at a valuation of $9 billion, but the merger was ultimately terminated due to the SEC's failure to timely approve the prospectus, resulting in a loss of over $44 million. Subsequently, Circle adjusted its strategy and gradually moved closer to financial centers. Last year, it relocated its headquarters from Boston to One World Trade Center in New York, further integrating into the global financial core.

At this stage, the timeline of Circle's acquisition and IPO application is as follows:

On April 2, Circle submitted its S-1 filing to the SEC, officially launching the IPO process, with plans to list on the New York Stock Exchange;

On April 5, possibly influenced by Trump tariffs, Circle announced it would delay the IPO process;

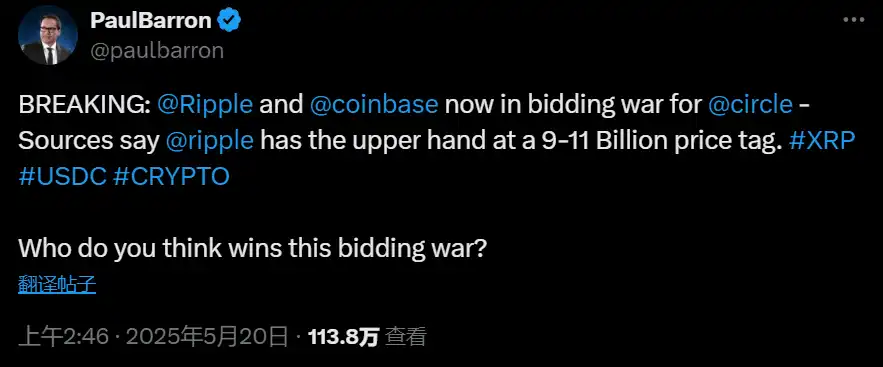

On May 1, Bloomberg reported that insiders revealed Ripple had proposed to acquire competitor stablecoin provider Circle for $4 billion to $5 billion, but this offer was deemed too low and rejected.

On May 20, The Block reported that stablecoin issuer Circle was seeking buyers, with a valuation of at least $5 billion. It is understood that the ongoing sales negotiations involve its long-term partner Coinbase as well as Ripple, which has recently become a competitor in the stablecoin space. This San Francisco-based startup is pushing for this acquisition while seeking to go public.

On May 27, pymnts reported that stablecoin issuer Circle denied media reports about ongoing sale negotiations, stating it is still advancing its IPO plan submitted in April. A Circle spokesperson stated, "Circle is not seeking a sale. Our long-term goals remain unchanged."

On May 27, stablecoin USDC issuer Circle submitted a listing application to the New York Stock Exchange. It plans to issue 24 million Class A shares, of which 9.6 million shares are from the company and 14.4 million shares are from shareholders. The expected share price is between $24 and $26, with the trading code CRCL.

According to the S-1 prospectus, JPMorgan Chase and Citigroup will act as lead underwriters, and the market expects Circle's valuation to reach $5 billion, nearly halving from the $9 billion market value proposed during its 2022 IPO application. Therefore, Circle has been seeking acquisition negotiations with Coinbase and Ripple, hoping to achieve a sale at a higher valuation.

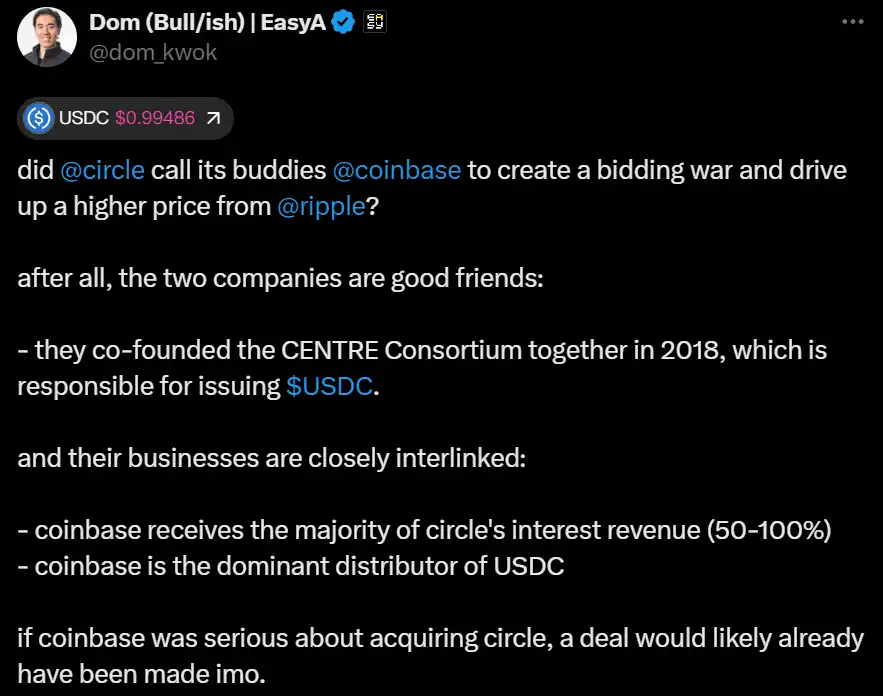

Coinbase has a long-term partnership with Circle, co-founding the Centre Consortium to manage USDC in 2018. Although it was later dissolved, both parties maintained a revenue-sharing agreement. In 2024, Coinbase earned $909 million from interest income generated from USDC reserves, reflecting its financial dependence on Circle. Recently, Ripple, which has become a competitor in the stablecoin space, has also shown interest in Circle.

This series of actions by Circle has sparked widespread discussion in the community. Although Ripple's proposed valuation of $4 billion to $5 billion in April 2025 was rejected by Circle as too low, reports indicate that Ripple's informal discussions with Coinbase had offers ranging from $9 billion to $11 billion.

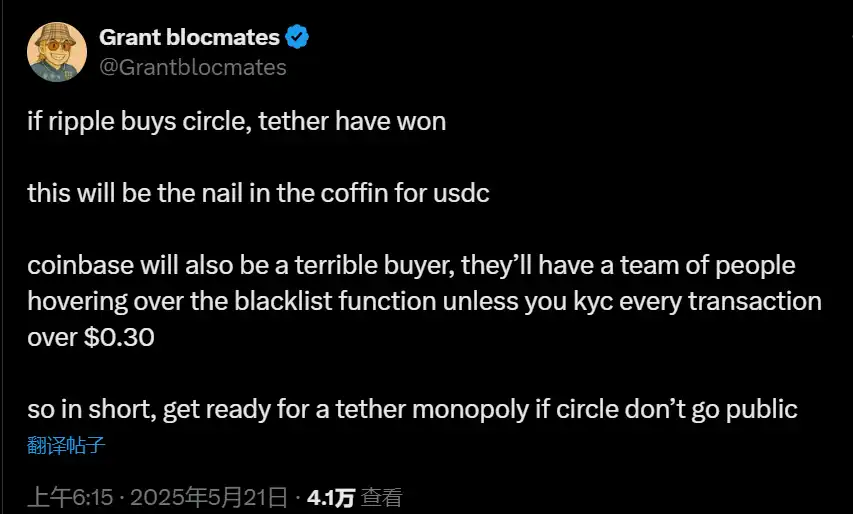

At the same time, due to intense market competition, some believe that if Ripple acquires Circle, it could negatively impact USDC, potentially allowing Tether (USDT) to capture more market share.

Others speculate whether Circle is leveraging the competition between Coinbase and Ripple to drive up prices, based on their historical relationship in co-founding the Centre Consortium in 2018.

Former Coinbase member and current vectordao member @yiryan also shared his views on X, suggesting that Coinbase should acquire Circle and is likely to do so. USDC is Coinbase's second-largest source of revenue, but due to its partnership with Circle, revenue allocation is limited. Circle controls the protocol layer, focusing on expanding overall market value, while Coinbase aims to fully capture USDC, achieving revenue consolidation and protocol control. If Coinbase acquires Circle, it could gain complete revenue, product synergy, and regulatory advantages. In the long run, the acquisition is a reasonable and necessary strategic choice, with the key being the price.

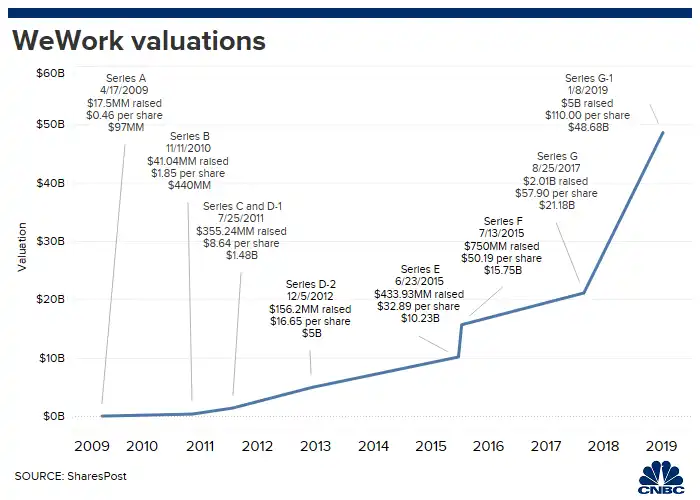

If Ripple or Coinbase ultimately offers a valuation exceeding $5 billion, Circle may also withdraw its IPO application, opting for a sale based on the better offer from the two "parallel bids." The office space startup WeWork is a case in point.

Parallel Pricing, Is Circle Aiming for Maximum Benefit?

In 2010, co-founders Adam Neumann and Miguel McKelvey opened the first WeWork in New York City's SoHo district, allowing anyone from freelancers to large enterprises to rent office space and desks.

In August 2019, WeWork publicly submitted its IPO application, but its documents revealed massive losses. According to media reports, it generated $1.8 billion in revenue in 2018 but lost $1.9 billion; in the first half of 2019, it generated $1.5 billion in revenue but lost $690 million. After board members and investors scrutinized its leadership (including self-dealing allegations) and financial issues, Neumann resigned as CEO. Previously, WeWork had delayed its IPO the week before and lowered its expected valuation from $47 billion to $10 billion. Due to its severe financial problems, the market value post-IPO was likely to plummet rapidly, making a direct acquisition by a major shareholder seem more cost-effective than a direct listing.

A month later, WeWork submitted a request to federal regulators to withdraw its IPO plan. After the IPO cancellation, SoftBank injected an additional $8 billion investment and took over WeWork in October 2019.

When WeWork received investments from SoftBank of $3 billion in November 2018 and $2 billion in January 2019, its valuation soared from $20 billion to $47 billion. In other words, SoftBank's investment increased WeWork's valuation by $27 billion compared to before. Even the initial $20 billion valuation in 2018 was set by SoftBank, which invested $4.4 billion in the G round of financing in 2017 through its $100 billion Vision Fund. SoftBank CEO Masayoshi Son stated after WeWork's IPO withdrawal that his investment in the company was "foolish" and that WeWork's valuation was only $2.9 billion.

For WeWork, the IPO represented placing the company under more authoritative, standardized, and detailed scrutiny, allowing for a reasonable pricing of its true value, thereby revealing long-hidden valuation and governance issues, which facilitated SoftBank's takeover.

SoftBank's decision reflects the sunk cost fallacy. The sunk cost fallacy forces investors to continue investing in a losing project because they have already invested time, energy, or money into it. SoftBank's continued investment decisions in WeWork were more based on avoiding the acknowledgment of failure rather than recognizing WeWork's future potential; the additional $8 billion investment did not resolve WeWork's fundamental issues. Furthermore, Son referred to the WeWork investment as "a lifelong stain" at the 2023 shareholder meeting but still chose to continue support, reflecting possible psychological influences.

Circle's prospectus also implies many issues.

First, there are excessively high executive salaries, with the CEO's total compensation exceeding $12 million, the CFO's total compensation at $5.2 million, and other executives such as the Chief Strategy Officer, President and Chief Legal Officer, Chief Product and Technology Officer, etc., earning annual salaries between $4 million and $5 million.

Secondly, Circle's business model relies on net interest margins, and it already faces many competitors in the market. Its main competitor, Tether (USDT), leads with a market capitalization of over $140 billion, while PayPal launched its own stablecoin in 2023, and banking giants like JPMorgan Chase are also exploring the blockchain space. In the prospectus, Circle explicitly listed these competitors, candidly stating that the market environment is complex. This is also reflected in the financial data, with Circle's profitability declining in 2024, with net income and adjusted EBITDA decreasing by 42% and 28%, respectively.

Finally, Circle largely relies on Coinbase as a distribution channel, with most of its net interest income going to Coinbase. Coinbase earned $908 million from USDC-related activities in 2024, accounting for about 13.8% of its total revenue. Therefore, if investors want to own a leader, a better choice would be to buy Coinbase directly.

Thus, considering various factors, the IPO valuation ultimately landed at $5 billion. As for whether Circle ultimately chooses to continue advancing the IPO process or be acquired, it may depend on which party, the buyer or the market, shows greater sincerity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。