Although the U.S. stock futures have risen nicely due to the positive impact of NVIDIA's earnings report and the halt of Trump's tariffs, with Nasdaq futures up 2% and S&P futures up over 1.6%, the reaction of $BTC has not been very friendly. After breaking through 108,500 in the morning, it started to decline, leading some to question whether it is no longer following the U.S. stock market.

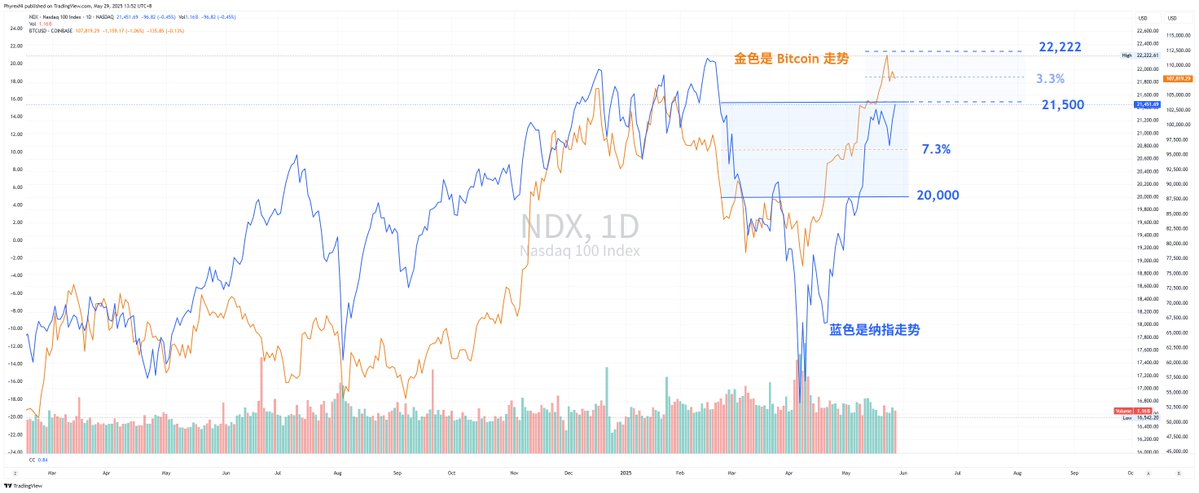

In fact, from a broader perspective, the trends of Bitcoin and the U.S. stock market are still highly correlated. Recently, BTC's leading performance has been quite good. Compared to the U.S. stock market, it not only returned to the historical high before the tariffs but also broke through the historical new high, leading the U.S. stock market in terms of the extent of the increase.

Even now, the U.S. stock market has just returned to the level before the tariffs on February 25, so relative to BTC, there is more room for the U.S. stock market. Therefore, the current situation of BTC is also normal, and it is currently the main trading time in Asia. We also analyzed that the main trading time for BTC starts at 21:00 every weekday.

So I still believe that the rise of the U.S. stock market will be beneficial for Bitcoin, as long as there are no unexpected issues. If the U.S. stock market can continue to rise at the opening today, BTC should not perform too poorly.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。