Original | Odaily Planet Daily (@OdailyChina)

Author | jk

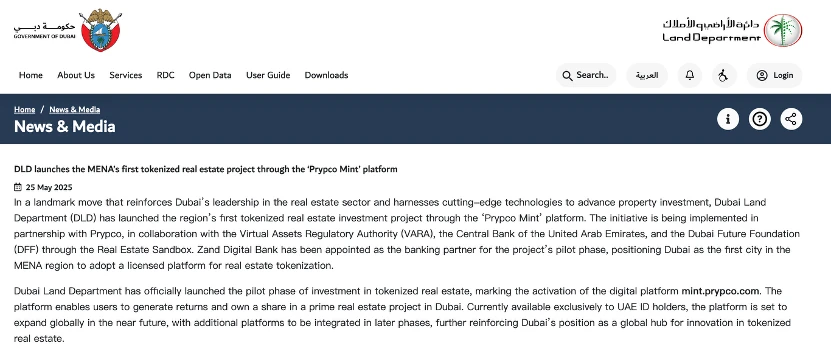

On May 26, 2025, the Dubai Land Department (DLD) officially launched the Middle East's first real estate tokenization platform "Prypco Mint" in collaboration with real estate fintech company Prypco and blockchain infrastructure provider Ctrl Alt. The platform successfully completed the full financing of the first real-world asset (RWA) apartment on the XRP Ledger chain, in just one day. This platform is an important part of the UAE government's blockchain strategy, aiming to have about 7% of transactions in Dubai's real estate market on-chain by 2033. The expected total asset scale at that time will reach $16 billion.

On May 26, 2025, the Dubai Land Department (DLD) officially launched the Middle East's first real estate tokenization platform "Prypco Mint" in collaboration with real estate fintech company Prypco and blockchain infrastructure provider Ctrl Alt. The platform successfully completed the full financing of the first real-world asset (RWA) apartment on the XRP Ledger chain, in just one day. This platform is an important part of the UAE government's blockchain strategy, aiming to have about 7% of transactions in Dubai's real estate market on-chain by 2033. The expected total asset scale at that time will reach $16 billion.

Previously, most RWA real estate projects either remained independent without official endorsement, essentially relying entirely on the credit of a single company, and due to the relatively short history of the Web3 industry and users' evident lack of trust in projects, there has been no so-called "well-known" RWA real estate project. This time, Dubai's operation may fill this gap.

Why Dubai?

Another reason many RWA projects have not gained traction is that the tokenized properties are not located in any real estate hotspots. In the global real estate industry, Dubai is undoubtedly a hotspot city; the booming real estate investment here has attracted a large amount of foreign capital. When you search "Dubai" on social media, you are likely to see it automatically complete with the word "real estate."

Why is Dubai famous? It's simple, the potential for appreciation and extremely high rental yield.

In recent years, Dubai's real estate market has continued to heat up. According to a report by CBRE, residential prices in Dubai rose by an average of 18% in 2024, with a 20% increase in the first quarter of 2025. During the same period, property transaction volumes also hit a new high, reaching 45,474 in the first quarter of 2025, a year-on-year increase of 22%. This growth trend is attributed to the UAE government's "Golden Visa" policy, which is equivalent to receiving a five or ten-year residency when buying a property, attracting a large number of high-net-worth individuals to invest in real estate. Additionally, Dubai's geographical advantages, stable political environment, and diversified economic structure provide a solid foundation for the continued growth of the real estate market.

In terms of investment returns, Dubai's real estate market performs exceptionally well. Data shows that Dubai's rental yield ratio is about 1:132, with 90% of the foreign population leading to rental returns of 8% to 9%, far exceeding the 2% to 3% in cities like Shanghai. This high rental yield allows investors to recover costs in a relatively short time, typically achieving a return on investment within 10 to 12 years. Furthermore, the UAE government exempts all personal income tax and capital gains tax, which further enhances investment attractiveness.

This is not an advertisement, but the real situation of the Middle East real estate market over the past decade.

Of course, Dubai's market has seen significant appreciation over the past decade, leading to many claims that this year may be the peak of Dubai's real estate market, citing various data such as high construction areas and slowing population inflow. However, based on past data, Dubai's real estate investment is indeed very hot.

So what asset sold out in one day?

The business model of RWA real estate is quite simple: it tokenizes the ownership of a property, where token holders own a portion of the property, and the appreciation income and rental income generated by the property are distributed to all property rights holders according to their token holdings. This way, even if holders do not have the ability to purchase the entire property directly, they can still include real estate in their investment portfolio, and the liquidity for exit is significantly better.

Perhaps to create a sense of urgency, Prypco Mint only offered one apartment for tokenization on its opening day.

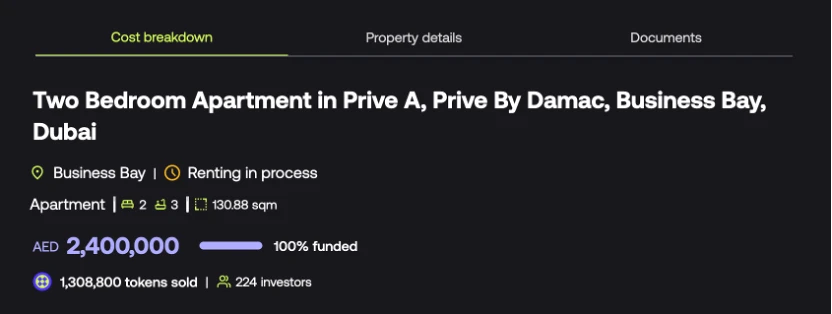

This completed financing real estate tokenization project is located in Dubai's core area, Business Bay, and is a two-bedroom unit in the residential complex Prive by Damac, built by the well-known developer Damac. The building area is approximately 130.88 square meters, with a layout of two bedrooms and three bathrooms. The project features full lake view perspectives and is equipped with hotel-style service facilities.

Details of the first tokenized property, source: Prypco official website

Within one day, this property achieved 100% financing on Prypco Mint, with a total price of 2.4 million dirhams (approximately 5.8 million RMB), issuing a total of 1,308,800 tokens, with 224 investors participating. Perhaps as a benefit for early investors, this price is significantly lower than the official market valuation: according to the Dubai Land Department's valuation, the unit's market value is 2.89 million dirhams, making the platform's actual purchase price about 16.96% lower, providing investors with an unrealized profit potential of approximately 20.42%.

In terms of returns, the expected annual rental income for this unit is 175,000 dirhams, corresponding to a net rental yield of 5.17% in the first year. Combined with capital appreciation expectations, the annualized total return for this apartment is estimated to reach as high as 14.77%. As of now, the realized net return is 5.31%, and the property has entered the leasing process.

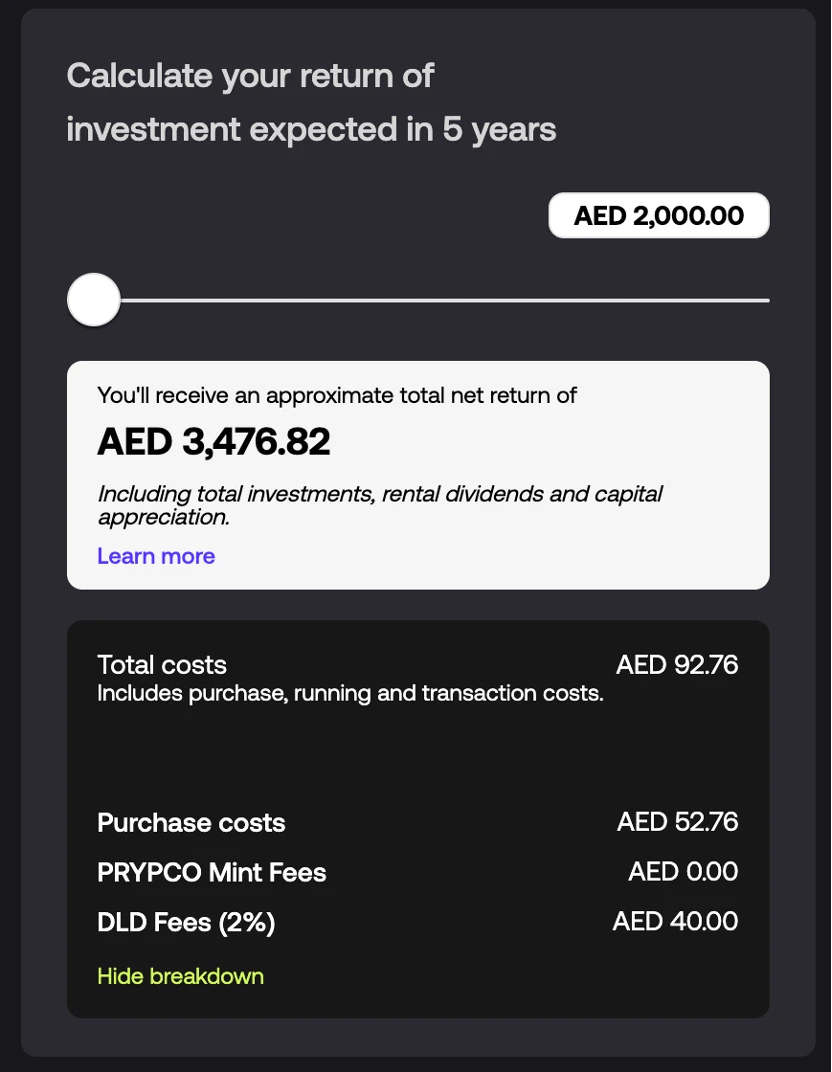

On the official website, it can be seen that the minimum investment threshold can be as low as 2,000 dirhams (approximately 4,000 RMB), with an estimated value of about 3,476.82 dirhams in five years, achieving a total return of 73.84% over five years. It is important to note that this is an estimate provided by the official website and does not represent actual returns.

In terms of transaction fees, the platform itself does not charge any tokenization fees; investors only need to pay official fees. However, this should also be considered a benefit for early investors, and it is highly likely that this will not continue in the future. The entire property ownership has been completed on-chain through Ctrl Alt's technical architecture on the XRP Ledger, with ownership information synchronized in real-time with the Dubai Land Department's government database.

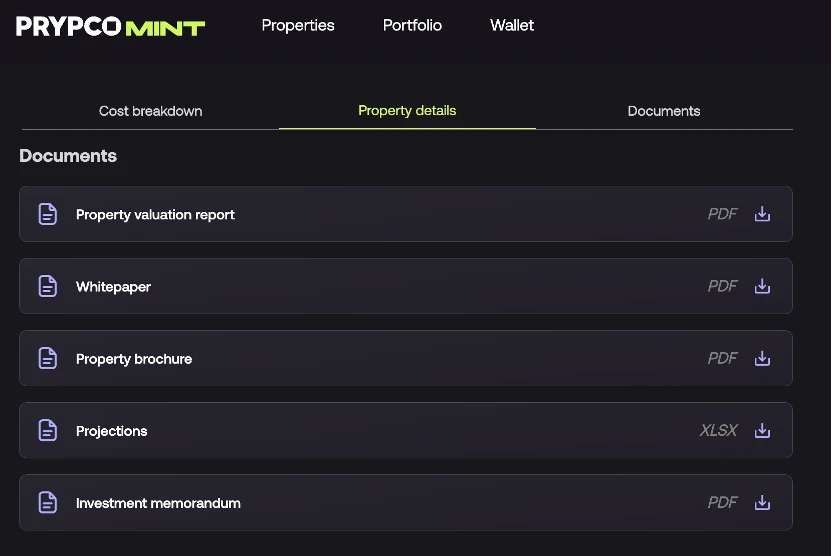

The official website has all kinds of reports available. Source: Prypco official website

Can it be purchased? Is it good for XRP?

Unfortunately, if you are not a resident of the UAE, you cannot purchase it, and the sale of this one unit has already ended, but this does not mean it won't open in the future.

From a compliance perspective, this tokenization project is currently only open to holders of UAE identification cards. This means that only those who work/study in Dubai or are already holders of a Golden Visa due to purchasing property in the UAE are eligible, and only dirham payments are accepted, meaning a local bank account is required. The regulatory framework is composed of the UAE Central Bank, the Dubai Virtual Assets Regulatory Authority (VARA), and the Dubai Future Foundation. The project's financial partner is Zand Digital Bank.

Official press release from the Dubai government, source: Dubai government official website

Strictly speaking, this is not the RWA project of your dreams. An ideal RWA project should meet the following criteria:

Different investors can invest in a property, with ownership clearly defined by the number of tokens;

Payments can be made directly through on-chain assets;

Token prices should track property price gains or declines;

Rental dividends should be distributed periodically based on token holdings;

And it should be possible to sell all or part of the tokens at any time.

Currently, Prypco Mint's attempt has only completed "the tokenization of ownership of one property, achieving distribution and dividends for different investors" for points 1, 3, and 4, but payments must be made in fiat currency, and the exit mechanism is still unclear, very similar to holding property through a company or trust and trading company shares or trust ownership on a stock exchange.

Even so, this is already a significant step for RWA. This apartment is one of the first real estate projects to achieve asset tokenization in the Dubai government's plan and is part of the city's $16 billion tokenization strategy, which is based on the official estimate that by 2033, about 7% of Dubai's real estate transaction total will be tokenized.

Therefore, it is expected that the short-term benefits for XRP will not be particularly significant, as it is merely the ownership information of the property and tokens being put on-chain, without opening on-chain public sales. However, if it opens in the future, the gas demand generated by tokenized real estate worth $16 billion will undoubtedly be very high, and this may currently be a low point for value capture. But all of this depends on the continuous output of the RWA platform, which may truly create a new wave of Dubai real estate driven by "more dispersed retail investors."

P.S. Thinking from another angle, this operation… with all property information on-chain, real and transparent purchase prices, and the potential for future on-chain asset public sales and the ability to sell ownership tokens at any time… isn't this the vision that decentralized finance once claimed, a dimensional reduction attack on financial intermediaries? Could this represent the complete decline of the Dubai real estate agency industry? Let's wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。