Today's homework is a bit difficult to write. Although it seems that the price of $BTC started to decline as soon as the U.S. stock market opened, in reality, there were no significant negative news today. Instead, some positive news from the traditional world emerged.

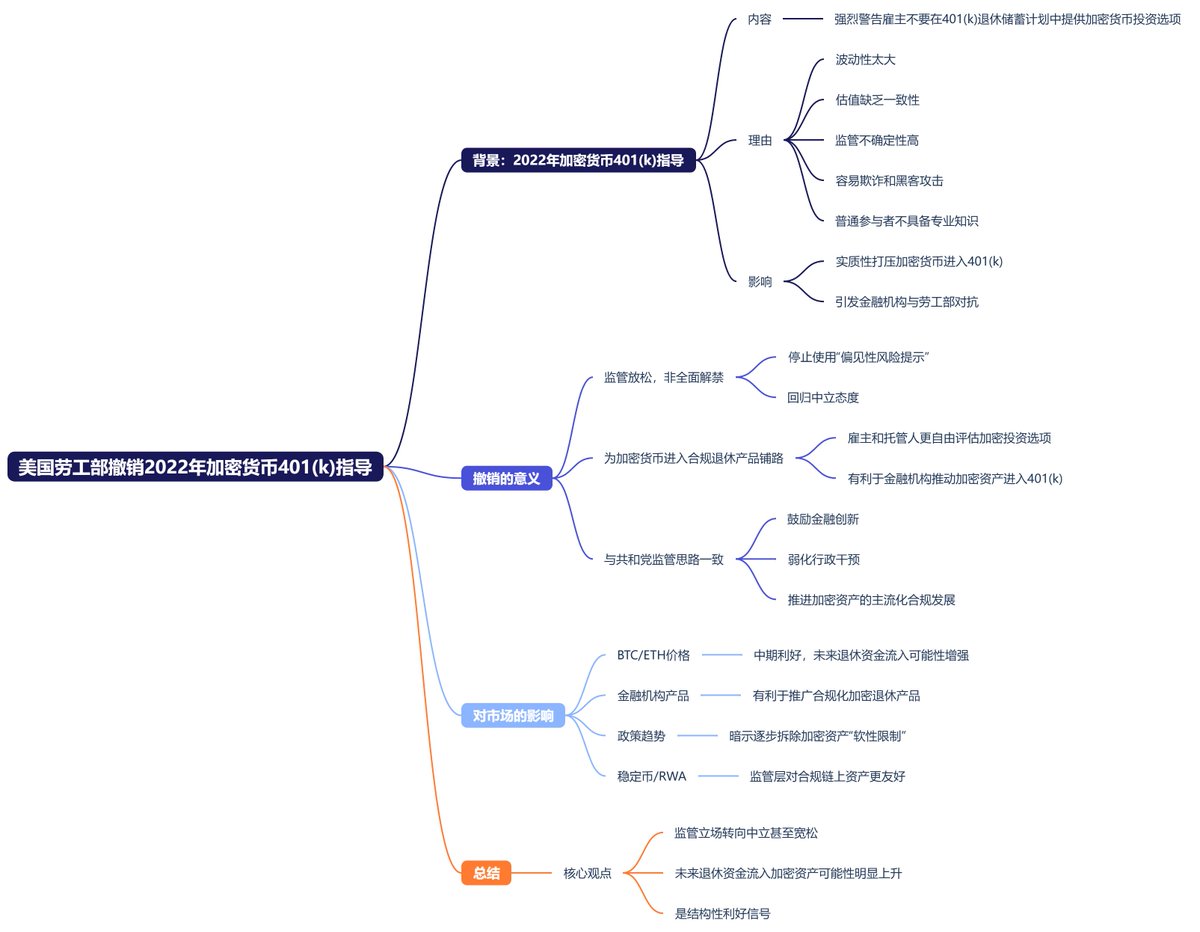

The U.S. Department of Labor recently revoked the guidance issued in 2022 that prohibited 401(k) retirement accounts from allocating to crypto assets, indicating a shift in regulatory stance towards neutrality. This old guidance had explicitly warned employers against allowing employees to invest retirement funds in cryptocurrencies, citing high volatility, uncertain valuations, and significant regulatory risks, which was almost equivalent to a de facto ban.

The revocation does not equate to encouraging crypto assets into 401(k) plans, but it opens up policy space for institutions like BlackRock and Fidelity to push for the inclusion of products like Bitcoin in retirement accounts. Coupled with the current overall lenient financial regulatory attitude of the Republican government, this is seen by the market as a structural positive.

Currently, I am not sure if the reason I haven't seen much discussion in the Chinese-speaking community is due to Twitter, but the related content has already generated a significant amount of discussion in the English-speaking community. In simple terms, the political impact on retirement funds purchasing cryptocurrencies, including BTC, has diminished.

This should be one of the benefits brought to the cryptocurrency industry by the Trump administration. Although it did not boost the price of BTC today, it is indeed a positive sign for more funds entering Bitcoin.

Additionally, Vice President Vance spoke at the BTC Consensus Conference today, emphasizing that Bitcoin will become an important strategic asset for the United States and does not see BTC as a competitor to the U.S. dollar. Essentially, this has a positive impact on cryptocurrencies, and there are no signs of negative trends in the macro market, which is likely still following the natural adjustments of the U.S. stock market.

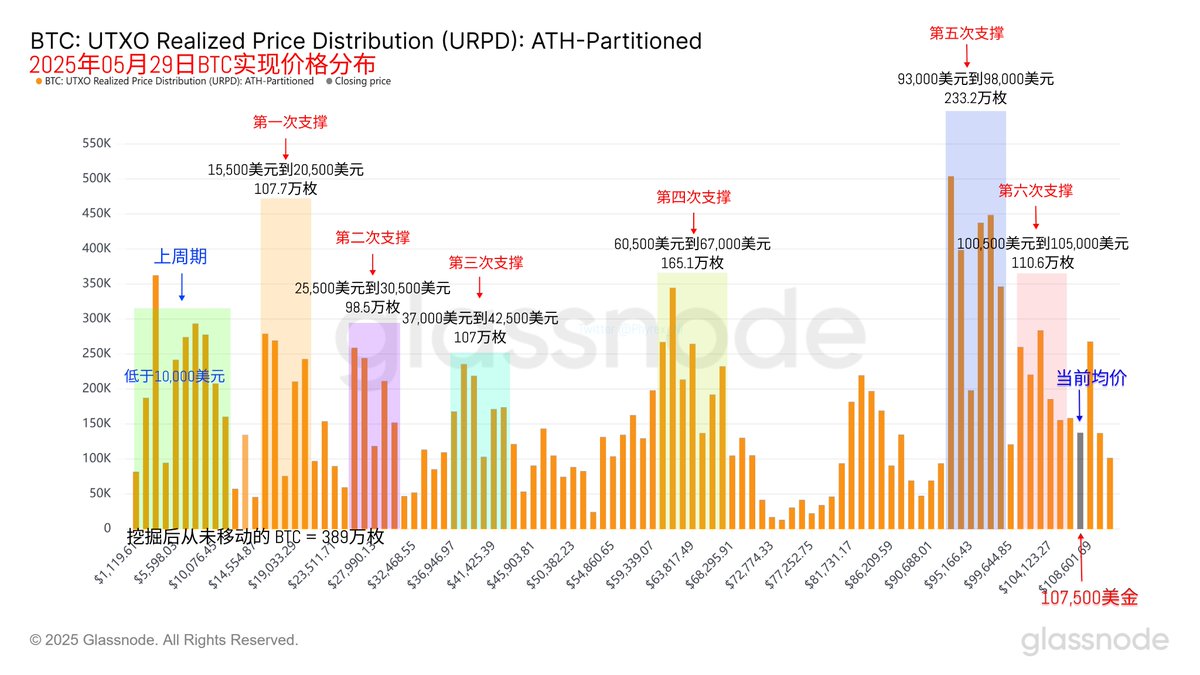

From the turnover data, today's turnover rate has slightly decreased, but it may be because short-term investors, who are sensitive to price, have increased their trading activity. The proportion of selling by loss-making investors has amplified in today's turnover, while earlier investors remain in a wait-and-see attitude.

From the support data, the reduced price has not changed the current support structure. The range between $93,000 and $98,000 remains the strongest support, while the stability of chips above $100,000 is still relatively good, and there are currently no signs of panic.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。