Trump Media & Technology Group announced it has raised $2.5 billion to create a Bitcoin treasury as part of its corporate reserves. Just as this news broke, U.S. publicly traded company SharpLink Gaming, Inc. (NASDAQ: SBET) also announced a bold strategic transformation plan on May 27, through a $425 million private placement to purchase ETH as the company's primary treasury reserve asset, making it a "MicroStrategy for ETH."

Who is SharpLink Gaming?

Last Tuesday, SharpLink Gaming was still a sports betting marketing company with a market capitalization of about $2 million and a stock price hovering around $2.91. Despite being listed on NASDAQ, it was in a difficult position. Just weeks ago, it had conducted a reverse stock split to maintain its stock price above NASDAQ's minimum requirement of $1, while its shareholder equity also failed to meet NASDAQ's minimum standard of $2.5 million. To restore compliance, SharpLink announced a secondary offering at a price of $2.94 per share, raising $4.5 million, and revealed that part of the funds might be used to "support the treasury management strategy under consideration" to purchase cryptocurrencies.

As a smaller, relatively single-business public company, SharpLink possesses a rare and valuable resource—a "shell of a U.S. listed company." In the market environment of 2025, this "shell resource" has become an ideal vehicle for entrepreneurs in the crypto space to achieve arbitrage. For investment institutions holding crypto assets, acquiring a small public company and transforming it into a "crypto treasury company" is undoubtedly a low-cost shortcut to obtaining high valuations.

SharpLink's $425 million private placement is a reflection of this logic. The announcement indicated that the company issued approximately 69.1 million shares of common stock at a price of $6.15 per share (with management team members at $6.72), and the funds raised will primarily be used to purchase Ethereum, making it the core asset of the company's treasury. The transaction was led by blockchain technology company Consensys, with participation from well-known crypto venture capital firms such as ParaFi Capital, Electric Capital, Pantera Capital, Galaxy Digital, as well as personal investments from SharpLink CEO Rob Phythian and CFO Robert DeLucia. The transaction is expected to be completed on May 29, and Ethereum co-founder and Consensys CEO Joseph Lubin will join SharpLink's board of directors after the transaction is completed.

"Guardians of E," keep up the pace

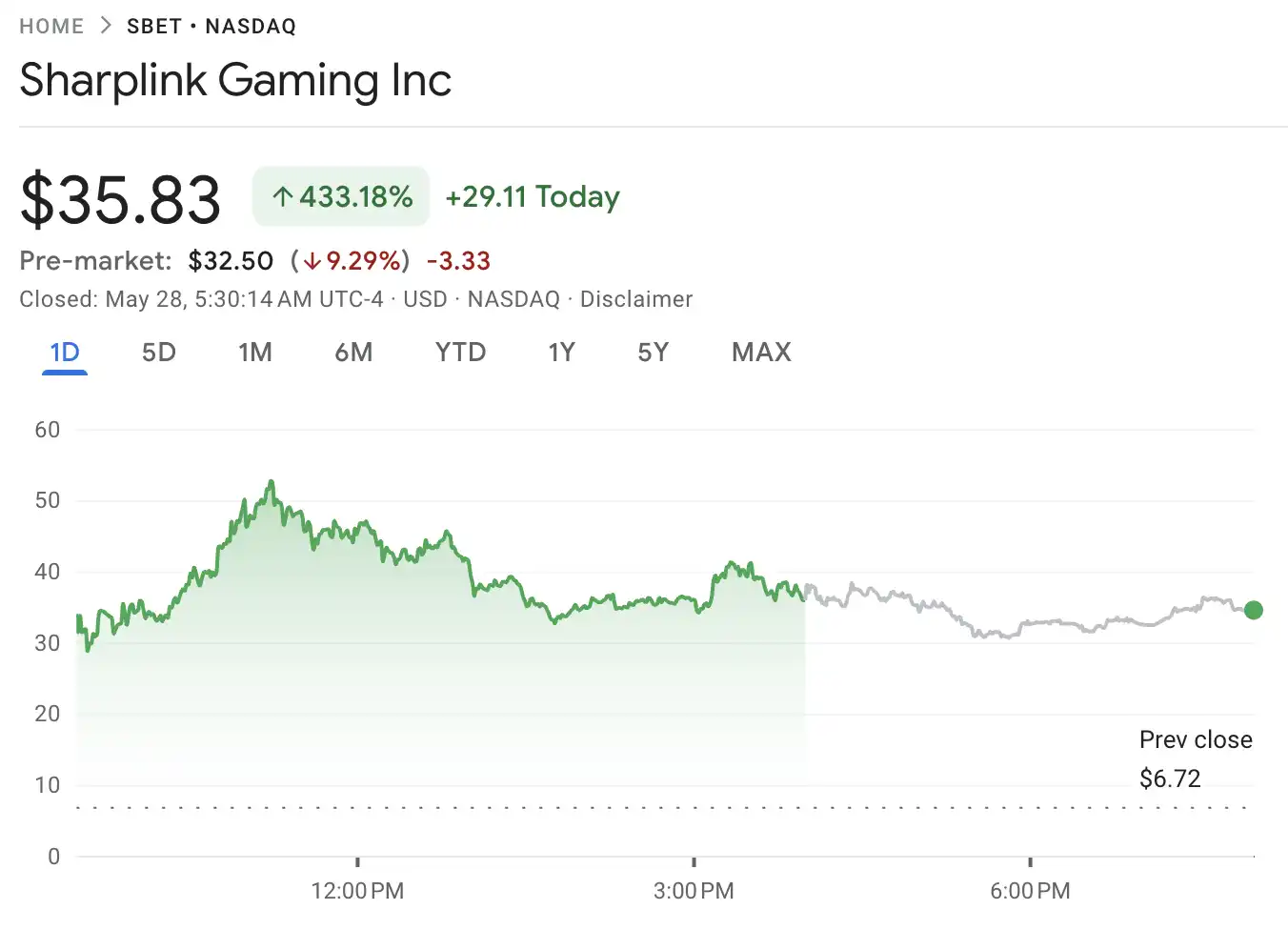

SharpLink's strategy quickly ignited enthusiasm in the capital markets. On the day the announcement was made, the stock price soared from the previous trading day's $6.72 to an intraday high of $53.45, ultimately closing at $44.74, a gain of over 650%. As of 1:30 PM on May 28, the stock price stabilized around $35, bringing the market capitalization to $2.5 billion. In other words, SharpLink created an approximate $2.5 billion book valuation through its $425 million financing, making it a textbook case of the "crypto treasury company" model.

It is worth noting that SharpLink currently does not hold any Ethereum; the investors are providing dollars rather than ETH. This means that SharpLink's strategy is not to "pack" existing crypto assets into the public company but to leverage the high premium of the U.S. stock market for crypto assets to implement a public arbitrage operation. As market commentary pointed out: "If the U.S. stock market is willing to buy $1 of ETH for $6, any investor holding hundreds of millions of dollars in cash can easily achieve over 5 times book profit by purchasing cryptocurrencies and packing them into a public company shell."

The Ethereum market was also boosted. After the announcement, the ETH price rose 4% within 24 hours, reaching $2,639, with a cumulative increase of 50% over the past month. Although Ethereum has fallen 31% over the past 12 months, SharpLink's actions have injected new narrative momentum into the market, with analysts suggesting that this could drive mainstream adoption of Ethereum as a "digital reserve asset."

Collaboration with Consensys further strengthens this strategy. The involvement of Ethereum co-founder Lubin not only brings technical expertise to SharpLink but also provides strong endorsement for its positioning within the Ethereum ecosystem. Lubin stated, "This is an exciting moment, and I am thrilled to work with the SharpLink team to bring the opportunities of Ethereum to the public market." His participation indicates that SharpLink's strategy may not be limited to financial asset allocation but could also involve deep integration of blockchain technology into its core business, such as using smart contracts to optimize payment settlements or data transparency in the betting industry.

"Crypto treasury companies" enter an arbitrage game

SharpLink may be a microcosm of the full-scale explosion of the "crypto treasury company" model this year. Since 2020, MicroStrategy has accumulated a total of $64 billion in BTC through large-scale purchases, becoming the pioneer of this model. Its success has inspired many companies to follow suit, including Semler Scientific and Metaplanet, which have both invested in Bitcoin, while Upexi and DeFi Development Corp. have chosen Solana, and Canadian company Spirit aims to become the "MicroStrategy of Dogecoin."

Related reading: "Public companies kick off a $500 million 'buy-buy-buy' model, SOL becomes the next BTC for micro-strategies"

Bloomberg's chief financial writer Matt Levine pointed out that SharpLink's case vividly illustrates the "temptation" and challenges of the "crypto treasury company" model. From an opportunity perspective, this model leverages the valuation premium of the U.S. stock market for crypto assets, providing a path for small public companies to rapidly increase their market value. SharpLink's market capitalization jumped from $2 million to $2.5 billion, exemplifying this arbitrage logic. However, the realization of book profits faces challenges.

Due to the lock-up period typically associated with private placements, 97% of the shares held by investors like Consensys will be difficult to sell in the short term. SharpLink's average daily trading volume over the past year has been only about 75,000 shares, meaning it could take over three years to liquidate all shares. More importantly, once a large-scale sell-off occurs, the stock price could collapse rapidly, making it difficult to realize the $2.5 billion valuation on paper. This is a typical dilemma of the "crypto treasury company" model: while the paper wealth is tempting, how to "cash in" remains a challenge.

Similar scenarios are not unfamiliar in the crypto industry. During the FTX collapse in 2022, SBF created hundreds of billions of dollars in paper valuation through self-created tokens, but when market confidence collapsed, these tokens quickly went to zero. Although SharpLink's case occurs in the U.S. stock market, it essentially continues the "wealth story of the crypto circle": creating hype through high valuations but struggling to convert it into real cash.

Another noteworthy case is the "arbitrage" incident involving Mango Markets in 2022. Trader Avi Eisenberg manipulated the price of the MNGO token to borrow over $100 million in crypto assets from the platform, sparking intense debate about "code is law." Although Eisenberg was ultimately convicted on other charges, his case revealed the conflict between crypto markets and traditional finance regarding regulatory and ethical boundaries. SharpLink's investors may also need to be wary of similar risks: while high valuations bring prestige and resources, if they cannot be effectively monetized, it may just be a "showy magic trick."

Related reading: "The stock market flows into 'Bitcoin fentanyl'"

SharpLink Gaming's Ethereum treasury strategy is another example of the rise of the "crypto treasury company" model. Through $425 million in fundraising and the addition of Joseph Lubin, SharpLink not only achieved a leap in market capitalization but also injected new momentum into the mainstream adoption of the Ethereum ecosystem. However, behind the high valuation lies the challenge of monetization, and SharpLink's future needs to find a balance on both technical and financial levels. As the transaction is completed on May 29, the market will closely watch how it utilizes the Ethereum ecosystem to write the next chapter of its transformation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。