Original Title: New State of the Network: The After-Effects of Ethereum's Pectra Upgrade

Original Author: Tanay Ved, Coin Metrics

Original Translation: Shan Ouba, Jinse Finance

Key Points:

Ethereum's Pectra upgrade officially launched on May 7, which includes raising the maximum effective balance for validators from 32 ETH to 2048 ETH (EIP-7251) and doubling the blob space to support Layer-2 scaling (EIP-7691). Currently, over 11,000 validators have completed the merge, reducing the number of active validators by about 16,000 while maintaining the overall staked ETH amount, resulting in an average stake of approximately 32.4 ETH per validator. The number of blobs published to Ethereum increased from about 21,000 to approximately 28,000; however, the demand for Rollup usage remains below the new target of 6 blobs per block. As costs decrease, the number of transactions on Layer-2 continues to grow, with total blob transaction fees nearly at zero. If fees rise, reliance on increased demand for blobs from Rollup will be necessary.

Introduction

Ethereum's Pectra hard fork successfully launched on May 7, bringing a series of improvements in validator operations and staking flexibility, enhanced user experience (UX) through smart accounts, and increased capacity to support Layer-2 scaling. This upgrade includes the implementation of 11 EIPs and marks another milestone in Ethereum's roadmap following the launch of the Beacon Chain, The Merge, Shapella, and Dencun.

This article analyzes the initial impacts of the Pectra launch, focusing on how the increase in Ethereum's maximum effective balance and the doubling of blob space affect the staking mechanism and Layer-2 ecosystem. Additionally, we track and analyze key on-chain metrics related to these changes.

Staking and Validators

One of the main goals of the Pectra upgrade is to optimize the validator operation process and enhance flexibility in participating in the PoS system. An important improvement is EIP-7251, which raises the maximum effective staking balance for validators from 32 ETH to 2048 ETH, potentially having a profound impact on the network's economic structure. This move means that stakers can now "top up" existing validators or consolidate multiple validators into one to more efficiently earn compound rewards.

Increase in Maximum Effective Balance (EIP-7251)

To understand the practical impact of this change, we can look at the specific process of validator consolidation:

- Update the withdrawal credential to type 0x02, indicating that the validator supports the merge operation;

- Select the source validator (the one to be merged) and the target validator (to receive the staking balance);

- Submit the merge request. Once submitted, the source validator will enter the exit queue (which is also used for voluntary exits and other merge operations), as the number of validators that can exit each epoch is limited;

- When the source validator reaches a withdrawable slot, it will exit the active validator set, and its effective balance will be transferred to the target validator, completing the merge.

This mechanism enhances the capital efficiency of the PoS system, allowing large stakers to participate in network maintenance with fewer validator nodes while also reducing hardware and operational costs.

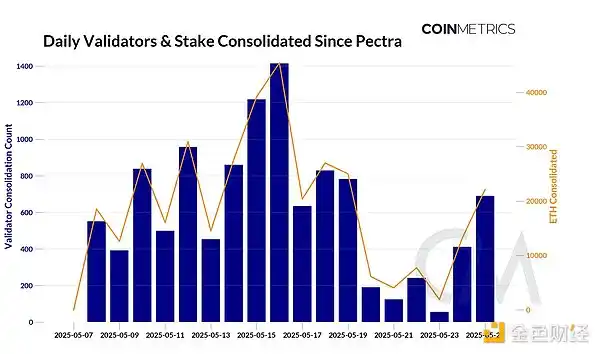

The above image shows the number of validators that have successfully completed the merge (entered the active validator set) and the total amount of ETH merged. Since the launch of the Pectra hard fork on May 7, as of May 25, 11,150 validators have completed the merge, totaling 359,146 ETH merged.

Impact on Validators and Staking Economics

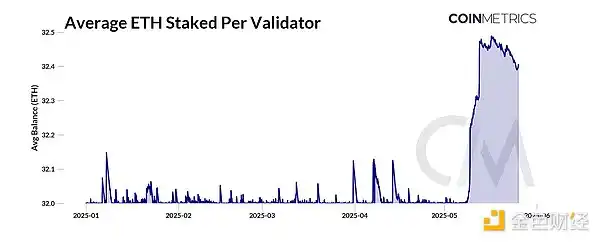

Due to the effects of merging and exiting, the total number of active validators has net decreased by 16,344 since the Pectra upgrade. This change may also be driven by EIP-7002, which simplifies and accelerates the validator exit process. Since then, the number of active validators has begun to decouple from the total staked ETH, as more and more stakes are concentrated in a few high-balance validators. The benefits of this concentration are not only reflected in the improved capital efficiency for stakers but also help alleviate network load and peer-to-peer communication pressure—issues that can become bottlenecks when the number of validators is large.

Currently, the average stake per validator has slightly increased from about 32 ETH to approximately 32.4 ETH, but the effective staking balance of most validators remains below 128 ETH. As more node operators consolidate their stakes to improve returns, we can expect this average to continue rising, while the distribution structure of validator stakes will also change.

Blob Expansion and Layer-2 Development

Doubling Blob Throughput (EIP-7691)

Another core goal of the Pectra upgrade is to further support Layer-2 scalability by doubling the throughput of blobs. Blobs are a low-cost data availability solution introduced in the Dencun upgrade and are a key component of Ethereum's scaling roadmap.

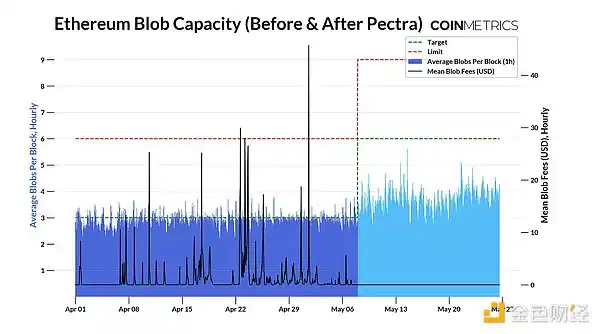

EIP-7691 introduced in Pectra raises the target number of blobs per block from 3 to 6 (green line) and increases the upper limit from 6 to 9 (red line), substantially increasing the supply of blob space. This means that Layer-2 will have greater transaction capacity and lower data availability costs.

After the upgrade, the number of blobs uploaded daily by Rollup increased from about 21,300 to approximately 28,000 (an average of 4 blobs per block), and the blob space used increased from about 2.7 GB before the upgrade to about 3.4 GB. From hourly frequency data, the average number of blobs per block is gradually approaching the new target value of 6, indicating that the demand for Layer-2 transactions is growing.

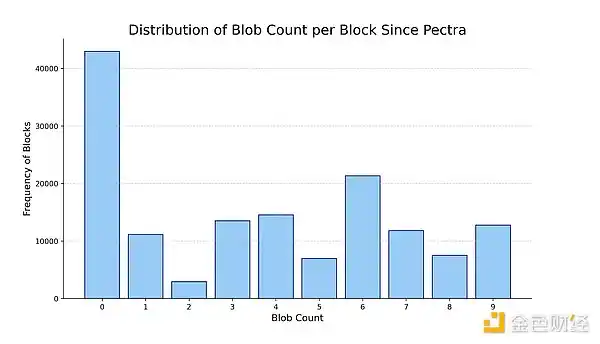

However, since the usage rate has not yet reached the target, blob transaction fees are currently at extremely low levels. Data on blob distribution since the launch of Pectra shows that over 40,000 blocks did not contain any blobs, while about 52,000 blocks contained 6 or more blobs, indicating more room for growth.

When the number of blobs submitted per block exceeds the target (usually occurring during demand peaks or network congestion), the blob fee market will be triggered, raising the fees for blobs (which also means Layer-2 costs will increase). Additionally, EIP-7623 was also launched in Pectra, which combats non-optimized data storage methods by increasing the cost of calldata, further encouraging Rollup to use blob space as a more economical data availability solution.

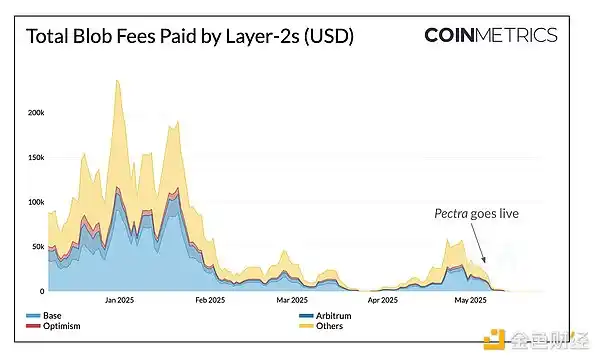

Impact on Layer-2

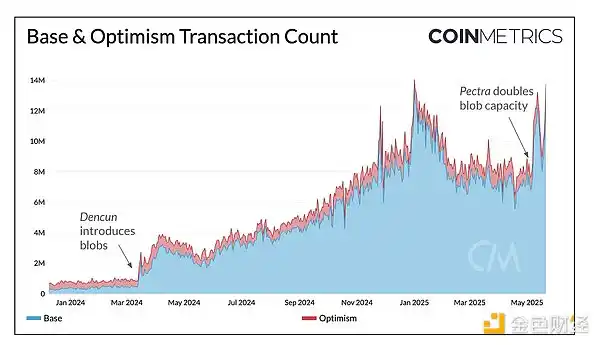

The increase in blob supply directly affects the costs for Rollup. The average blob fee has further decreased, making it more predictable, and is nearly free for Rollup projects like Base, Arbitrum, and Optimism. Consequently, the total blob fees paid by Layer-2 have dropped to $0.00001 (approximately 4 gwei). Lower costs mean that Layer-2 has a higher profit margin and can handle more transactions on its chain.

Layer-2 projects like Base and Optimism have seen an increase in throughput, with the number of transactions surging from 8 million to 14 million after the Pectra upgrade. This trend is similar to the situation when blobs were first introduced in the Dencun upgrade in March 2024. If Ethereum hopes to derive more value from blob fees, Rollup needs to gradually increase its usage of blobs and push towards the new block limit (6 blobs per block).

Conclusion

Pectra is an important step for Ethereum towards becoming a globally universal settlement layer, reflecting the ongoing evolution of the protocol. Although it may not be as eye-catching as previous upgrades, this feature-rich hard fork introduces greater flexibility and efficiency to the staking ecosystem, making it more forward-looking and suitable for institutional participation, while laying a critical foundation for scalability and improved user experience (UX).

While early data shows that the integration of validators is underway and the usage rate of blobs in Layer-2 is rising, many anticipated economic changes and scaling effects will still take time to gradually manifest. Pectra may not have attracted much attention, but it is quietly paving the way for the next phase of adoption and growth for Ethereum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。