I really like two types of listed companies. One type is those in the new consumption sector, providing products or services to consumers (B2C), such as the previously mentioned Pop Mart and Amer Sports (the parent company of Arc'teryx). The other type is the military-industrial series that has emerged in recent years due to geopolitical conflicts, which belong to the B2B category. This includes companies like Chengfei Group, which was affected by the recent India-Pakistan conflict, and Rheinmetall, which saw a surge due to the Russia-Ukraine conflict, as well as Palantir, which operates in a military-industrial + AI composite model (this was also highlighted in our early tweets, founded by PayPal co-founder Peter Thiel).

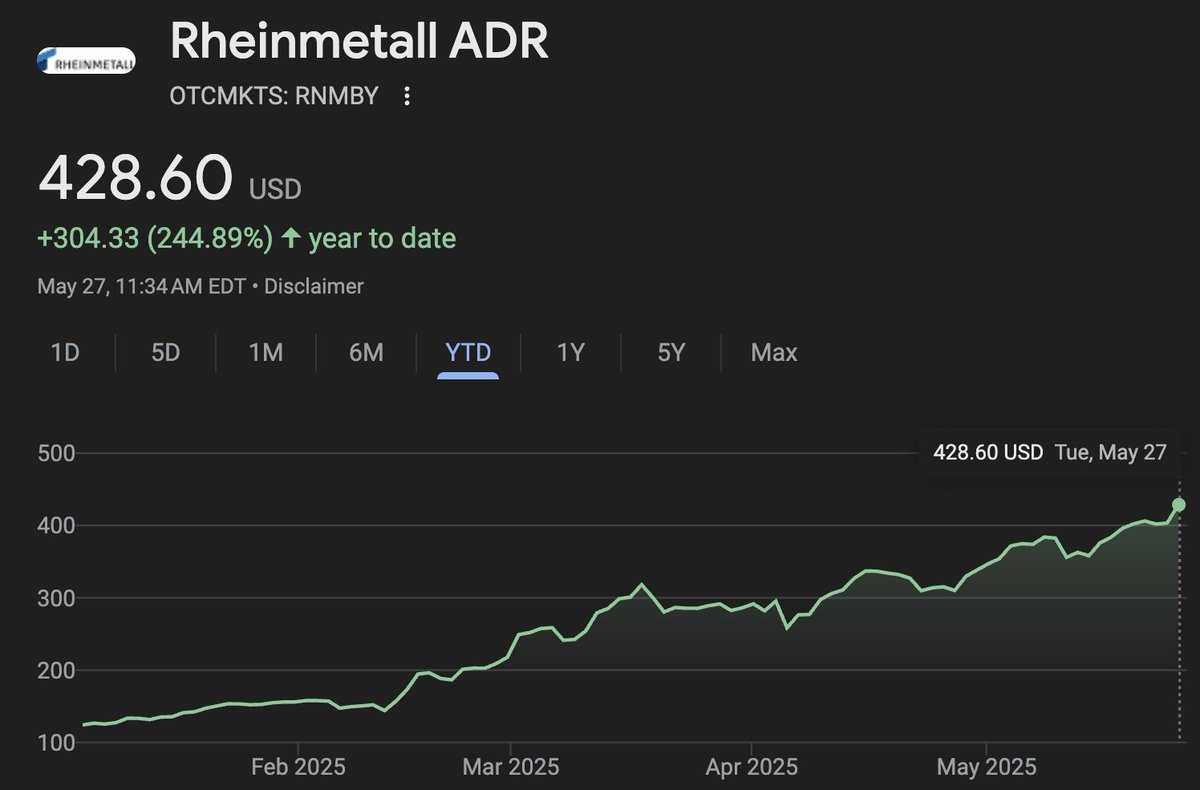

Today, let's talk about the German company Rheinmetall AG. This company has performed exceptionally well this year, with a growth rate of 244%, surpassing most stocks. The impressive performance of the military-industrial sector globally deserves attention.

Rheinmetall AG (Rheinmetall, FRA: RHM) is a multinational industrial group headquartered in Germany, with its core business spanning two major sectors: defense and automotive technology.

1️⃣ Main Business

Rheinmetall's current business is mainly divided into two sectors:

- Defense – accounting for over 70% of revenue

• Products and services:

• Main battle tanks (such as the Leopard 2 tank's fire control and turret systems)

• Armored vehicles, infantry fighting vehicles (such as Boxer, Lynx)

• Artillery and ammunition systems (such as 155mm shells, turret systems)

• Air defense systems, drone countermeasures

• Electronic warfare and sensor systems

• Customers: primarily the German Ministry of Defense, NATO member countries, Australia, Hungary, Norway, Middle Eastern countries, etc.

- Automotive and Industrial Technology (Automotive & Sensors) – accounting for about 25%-30% of revenue

• Originally a traditional automotive parts supplier (pistons, thermal management systems, emission control, etc.), now transitioning to electric vehicles.

• Focus areas include thermal management, electric drive systems, and electronic sensor technology.

• Major customers include European OEM manufacturers such as BMW, Volkswagen, and Daimler.

2️⃣ Future Growth Expectations and Driving Factors

✅ Significant increase in European military spending

• Germany established a €100 billion "Defense Special Fund" starting in 2022, a significant portion of which flows into Rheinmetall projects.

• Multiple NATO member countries have committed to increasing defense spending to over 2% of GDP.

• Germany and other European countries need to replace a large amount of Cold War-era equipment, creating a sustained demand over the next decade.

✅ Ukraine conflict + new geopolitical security landscape

• Rheinmetall provides a large amount of ammunition and systems to Ukraine and is establishing local factories there.

• Deepening cooperation with Middle Eastern and Asian countries (such as India and the UAE).

✅ Electrification transformation of civilian business

• Although the short-term contribution is not as significant as defense, its thermal management and electronic solutions have potential in the electric vehicle era.

• Gradually divesting low-profit traditional businesses to improve the profitability quality of the industrial sector.

✅ Technological leadership and vertical integration

• Rheinmetall's Leopard 2 tank, developed in cooperation with KMW, will also lead the next-generation main battle tank (MGCS) project jointly developed by Germany and France in the future.

• High technological barriers in turret systems and ammunition, with few asymmetric alternatives.

3️⃣ Investment Value Assessment

🎯 Advantages

Strong certainty of medium to long-term growth: Defense spending is largely unaffected by economic cycles.

High order visibility: Sufficient order reserves for 2025-2030.

Extremely high strategic position in the European defense industry chain.

Reasonable valuation (expected PE of 13-15 times in 2025, PEG <1), slightly lower than U.S. defense giants like Lockheed Martin or Raytheon.

⚠️ Risks

Policy and public opinion fluctuation risks: Green parties in Germany have long reservations about arms exports.

Reliance on government contracts, with long cash flow cycles.

The automotive business is still in a transition period, which may temporarily lower overall ROE and profit margins.

Arms exports may face international political restrictions or sudden halts.

Overall, the significant investment by major countries in defense has become a relatively certain and typical phenomenon. Both Rheinmetall and U.S. stock #PLTR continue to reach new highs. Additionally, one can also pay attention to Lockheed Martin (#LMT), which is a manufacturer of F35 and F22 fighter jets, and Northrop Grumman (#NOC), which produces the B21 bomber and Global Hawk drones. Domestic companies are even more familiar to everyone, such as Chengfei and others, but they tend to rise and fall quickly, lacking sustainability. That’s all for today’s global stock observations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。