Original Title: "Cold Thoughts Under Frenzy: From On-Chain to Macro Changes, How to Perceive the Cycles and Destiny of the Crypto Wave? | WTR 5.26"

Original Source: WTR Research Institute

Weekly Review

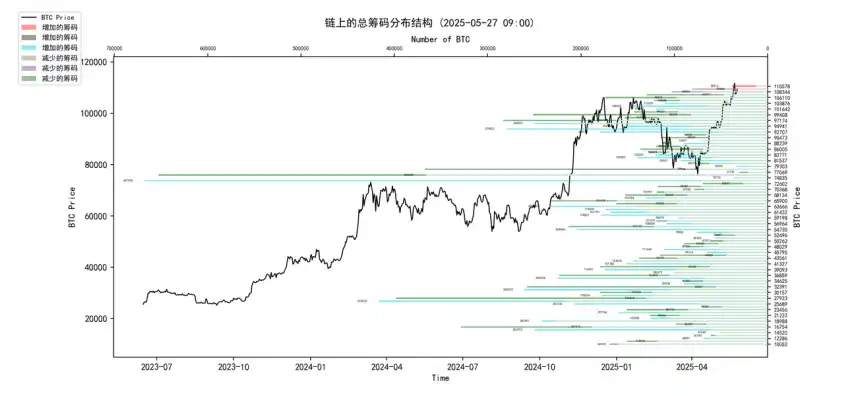

From May 19 to May 26 this week, the highest price of the ice sugar orange was around $111,980, and the lowest was close to $102,000, with a fluctuation range of about 9.78%. Observing the chip distribution chart, there is a large amount of chip transactions around $99,000, which will provide certain support or pressure.

• Analysis:

60,000-68,000 approximately 1.22 million coins;

76,000-89,000 approximately 1.25 million coins;

90,000-100,000 approximately 1.43 million coins;

• The probability of not breaking below 95,000~100,000 in the short term is 80%;

Important News

Economic News

1. Core Event: The Repeated Uncertainty of Trump's Tariff Policy

◦ Content: Trump has been oscillating between "50% tariff" and "90-day negotiation window extended to July 9" regarding the EU tariff policy. The fourth round of tariff negotiations between Japan and the U.S. is scheduled for the 30th.

2. Federal Reserve Monetary Policy Expectations and Official Statements

◦ There are differences in interest rate cut expectations:

▪ Goolsbee: There may still be rate cuts in the next 10-16 months (dovish).

▪ Bostic: Need to wait 3-6 months to observe uncertainties (neutral).

▪ Williams: Cannot fully clarify in June or July (cautious).

▪ Morgan Stanley: The Federal Reserve will not cut rates this year, starting in March 2026 (hawkish, with significant divergence from mainstream market expectations).

◦ Key Data: Friday's PCE data is an important basis for the Federal Reserve's monetary strategy.

3. Other Macro Indicators and Asset Prices

◦ U.S. stock index futures rose (Nasdaq futures up 1.5%, S&P 500 index up 1.2%).

◦ The U.S. dollar index fell by 0.1%.

◦ Citigroup raised the gold price target to $3,500 per ounce (due to expectations of tariff escalation).

◦ The U.S. Treasury stated that the sovereign wealth fund plan is on hold.

Crypto Ecosystem News

1. Bitcoin (BTC) Market Performance and Driving Factors

◦ BTC price rebounded to $110,000 (after the easing of Trump's tariff policy).

◦ Coindesk analysts: The new historical high of BTC is mainly driven by institutions, the retail meme craze has faded, and market sentiment has shifted towards more sustainable behavior, potentially paving the way for the long term.

◦ Analyst Eugene Ng Ah Sio: BTC maintains a clear upward trend, and if sustained, there are opportunities in the altcoin market.

◦ Interpretation:

▪ Institution-led "ongoing narrative": The success of ETFs is one of the core driving forces of this BTC bull market, which is a typical "ongoing narrative."

2. ETF Fund Flows (Core "Ongoing Narrative")

◦ Last week, U.S. BTC spot ETFs saw inflows of $2.75 billion, and ETH spot ETFs saw inflows of about $250 million (the highest since early February).

◦ Cumulative net inflows into U.S. BTC spot ETFs reached $44.499 billion, setting a new historical high.

◦ BlackRock's IBIT has seen no net outflows for 30 consecutive days, with net assets exceeding $71 billion.

3. Enterprises and Institutions Increasing BTC Holdings (Strengthening Institutional Narrative)

◦ Bitwise data: The BTC purchase volume by enterprises in the U.S. and elsewhere has exceeded three times the new supply of BTC within 2025.

◦ Semler Scientific increased its holdings by 455 BTC.

◦ Strategy increased its holdings by 4,020 BTC last week.

4. Regulatory Dynamics and Industry Conferences (Key Variables Affecting "Expectation Narrative")

◦ SEC's Hester Peirce supports providing clearer guidelines for the jurisdiction of securities law for PoS/DPoS activities, seen as positive information for U.S. institutional participation in staking.

◦ Bitcoin 2025 Conference (May 27-29), with participation from the White House cryptocurrency and AI director, U.S. senators, and expected Vice President Pence.

◦ Analysis:

▪ The clarity of regulation's "expectation narrative": Peirce's statement is very important, indicating that the regulatory environment may develop towards a clearer and more friendly direction, which is crucial for the long-term healthy development of the industry, especially in emerging areas like staking.

Long-term Insights: Used to observe our long-term situation; bull market/bear market/structural changes/neutral state

Mid-term Exploration: Used to analyze what stage we are currently in, how long this stage will last, and what situations we will face

Short-term Observation: Used to analyze short-term market conditions; and the likelihood of certain directions and events occurring under certain premises

Long-term Insights

• Non-liquid long-term whales

• Total on-chain selling pressure

• BTC's U.S. ETF

• Holding structure of long-term participants of different durations

• Large inflows and outflows from trading platforms

• Cost lines of short-term and long-term holders

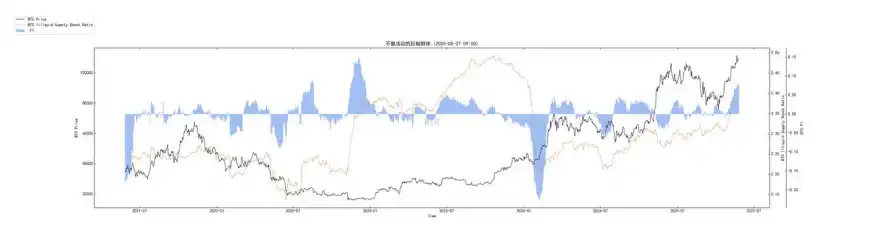

(The following image shows non-liquid long-term whales)

• Since the end of 2023, there has been a continuous upward trend, indicating that these entities are continuously accumulating.

• The overall trend shows that long-term holders and whales have strong conviction, continuously withdrawing BTC from the liquid market, which constitutes strong supply-side support. The long-term bullish structure remains unchanged, but the newly added accumulation momentum may weaken marginally in the short term.

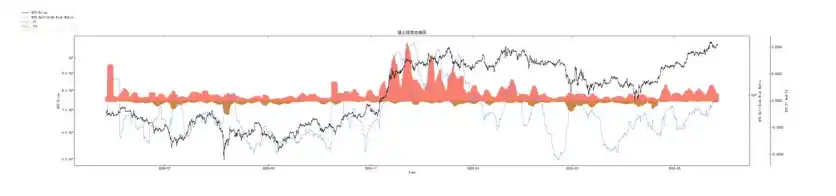

(The following image shows total on-chain selling pressure)

Recently, the market's "total selling pressure" has been slightly rising. There is a small amount of inflow, but the normal rotation of trading activity, rather than panic selling. From the perspective of "potential selling pressure," there have been no worrying signs of large-scale chips concentrating on trading platforms recently, and the market's selling willingness is low.

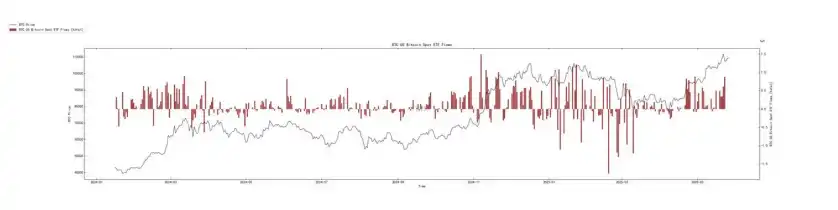

(The following image shows BTC's U.S. ETF)

Recently, the inflow of ETF funds has indeed seen a significant decline compared to previous peaks, even approaching the zero axis or showing slight net outflows on certain trading days. Currently:

• The "ongoing narrative" is facing challenges: The slowdown in ETF fund inflows is a direct test of one of the core driving forces of this bull market.

• The current ETF flow is a key window to observe institutional attitudes and new sources of funds, and its continued weakness will exert pressure on market confidence.

• The buying power driven by ETFs is marginally weakening, which is a significant change the current market is facing.

The market needs to find new demand growth points or wait for ETF demand to recover under new conditions.

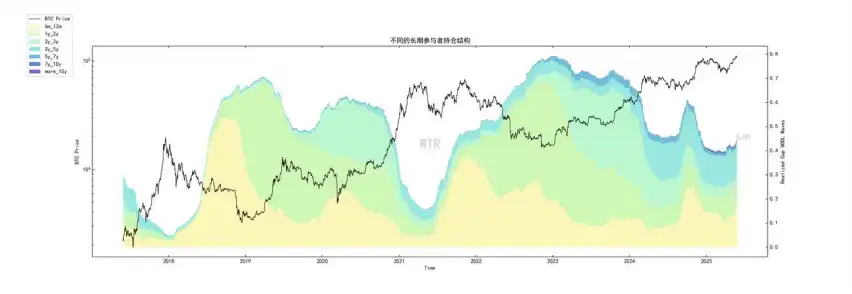

(The following image shows the holding structure of long-term participants of different durations)

The proportion of holders with a long-term holding period of over 6 months (green to purple area overlap) has recently slightly risen to 0.449. Analysis: The increase in the proportion of long-term holders (often considered "smart money" or steadfast investors) and its maintenance at high levels is a sign of a healthy market structure, reducing short-term speculative selling pressure.

• Synergy with Figure 1: This aligns with the increasing trend of non-liquid supply in Figure 1, collectively depicting the shift of chips from short-term traders to long-term holders, and from abundant liquidity to supply scarcity. The microstructure of the market remains solid, with a significant "ballast" effect formed by long-term holders.

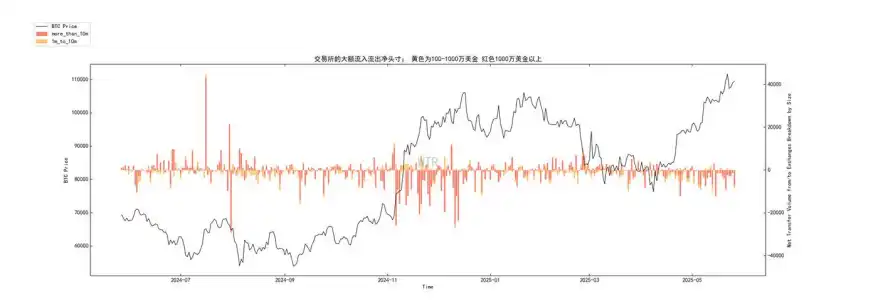

(The following image shows large inflows and outflows from trading platforms)

Representing net outflows from large transfers (yellow $1-10 million, red over $10 million). Recently, although not as continuous and fierce as in some previous phases, the overall net outflow remains the dominant trend, with no large-scale net inflows occurring. Despite the slowdown in ETF flow, large amounts of capital continue to net outflow from trading platforms, indicating that there are still large holders or institutions accumulating BTC and engaging in self-custody, or trading through the OTC market before exiting. The potential selling pressure from trading platforms continues to decrease, and the accumulation behavior of large holders is ongoing, although its intensity may fluctuate with market conditions.

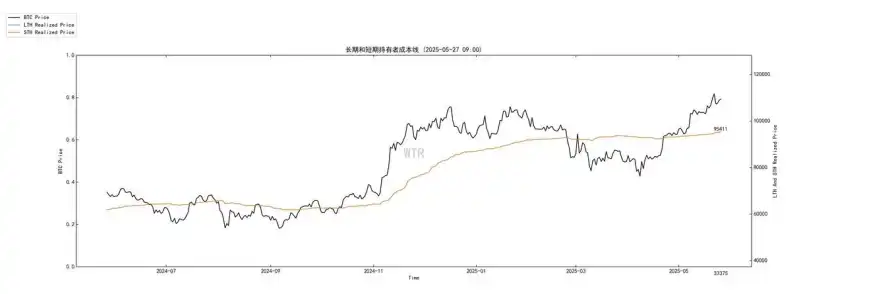

(The following image shows cost lines of short-term and long-term holders)

The cost line for short-term investors (orange) is currently at $95,411. The current price (around $109,000) is still significantly above this cost line.

• As long as the price remains above the average cost of short-term holders, the risk of large-scale panic selling in the short term is low, as most short-term participants are in profit. Key support level: $95,411 is an important psychological and technical support area. If the price retraces to this level and gains effective support, it will strengthen market confidence; if it breaks below, it may trigger stop-loss orders, increasing short-term downward pressure.

• The game point for new and old funds: This price level is also a key area for new entering funds and short-term funds seeking to take profits.

• The short-term market structure is still healthy, but close attention should be paid to the effectiveness of the $95,411 support.

Overall Analysis:

Fundamentals: Supply-side continues to tighten, and long-term holders have strong conviction. Although the short-term accumulation momentum is marginally slowing, non-liquid supply continues to increase, the proportion of long-term holders remains stable and slightly rises at high levels, and large amounts of capital continue to net outflow from trading platforms, with large transfers towards trading platforms (potential selling pressure) being inactive. Together, these constitute strong supply-side support for the market, a core feature that distinguishes it from previous cycles.

Current Challenges: Weakening ETF Driving Force, Market Facing Demand Test (Figure 3). The significant decline in ETF fund inflows is the most direct challenge facing the current market. This indicates that the previously main source of incremental funds is losing strength, and the market needs new demand narratives or a recovery of existing demand to maintain upward momentum.

Short-term Market Sentiment and Key Water Level (Figure 6). The current price is above the short-term holder cost line ($95,411), providing a "safety cushion" for the market. This price level is a key watershed for assessing short-term market strength.

The Overlay Effect of Macroeconomic Uncertainty and Narrative Vacuum Period. Against the backdrop of weakening ETF inflows, macro-level uncertainties (Trump's tariffs, Federal Reserve policy fog) may amplify the negative impact on market sentiment. At the same time, as discussed in the following (news analysis and summary), new "expectation narratives" that can attract funds on a large scale (such as stablecoin channels, substantial regulatory breakthroughs) have not yet formed effective connections, and the market may be in a brief "narrative vacuum" or "narrative fatigue" period.

Pressure Under "Attention Competition." In the context of weakened self-driving forces and unclear macro environment, the crypto market (especially assets outside of BTC) may appear more passive in the "attention competition" with stronger narratives like AI.

Future Outlook:

Mid-Short Term:

Main Tone: Possible high-level fluctuations, critical period for directional choice. The market may undergo a period of consolidation within the current price range (for example, with $95,411 as the lower bound and previous highs as the upper bound). The choice of direction will depend on:

Can ETF flows recover? This is the most important observation indicator.

Can positive catalysts emerge from macro news? (Such as PCE data exceeding expectations, the Federal Reserve releasing dovish signals, easing trade frictions).

Can new industry narratives emerge and attract funds?

· Downside Risk: If ETF continues to see net outflows, and negative macro factors emerge, a price drop below the short-term holder cost line of $95,411 may trigger a deeper adjustment, and the market will retest lower long-term support.

· Upside Potential: If ETFs regain upward momentum, or other significant positive factors emerge, combined with the already tight supply side, prices still have the momentum to challenge and break new highs, but the process may be more tortuous than before.

• The expectation of a "summer boom" is facing a test: From market news, the market is waiting for a break in the calm this summer, hoping for another boom. However, under the current backdrop of weakened ETF flows, achieving this becomes more difficult and requires strong catalysts from the macro level or within the industry.

Mid-Long Term:

The foundation of a structural bull market remains, but the path relies more on fundamental realization. The supply structure dominated by long-term holders is the core logic for long-term optimism. However, the magnitude and sustainability of the future bull market will depend more on:

Can the crypto industry truly generate sustainable economic value and large-scale applications? (Whether expectation narratives like "stablecoin/trading platform channels" can materialize is key (with high difficulty)).

Can the regulatory environment develop towards a clearer and more friendly direction? This will determine whether institutional funds can flow in on a larger and more sustained scale.

Can BTC consolidate and expand its value positioning in competition with traditional assets and emerging technologies? Not just as "digital gold," but are there other widely recognized narratives? Differentiation will intensify: • In a more challenging market environment, only projects with core technology, strong ecosystems, and clear value propositions can stand out.

Mid-term Exploration:

• Liquidity supply

• Structural analysis at various price levels

• Futures liquidation structure

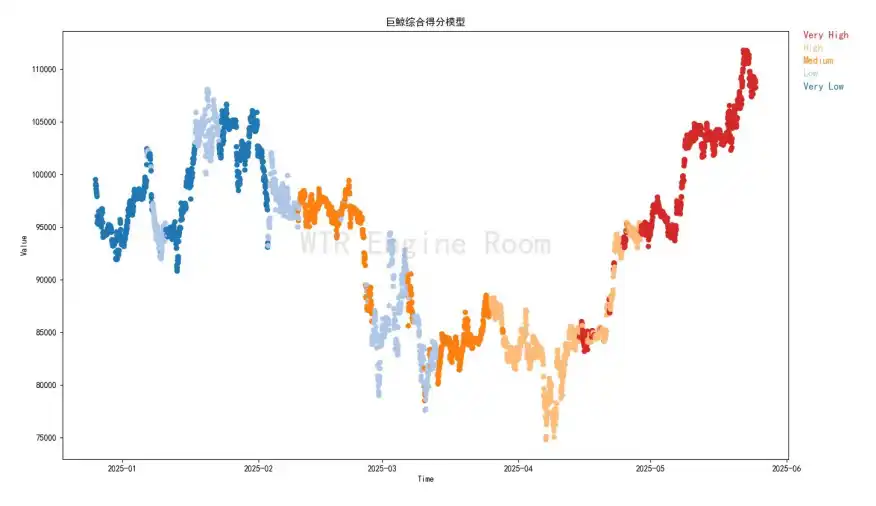

• WTR risk coefficient 1

• USDC purchasing power composite score

• Whale composite score

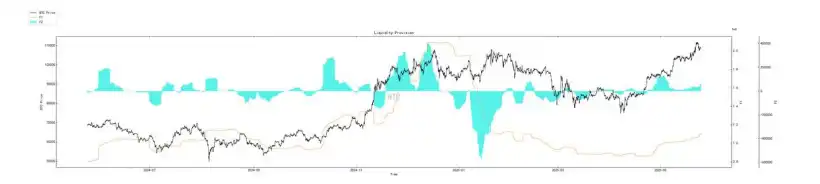

(The following image shows liquidity supply)

Liquidity supply remains in a significant growth state, indicating that the current market's changing factors have not been exposed to liquidity risks. Ample liquidity allows the market to maintain amplitude within the current pricing structure.

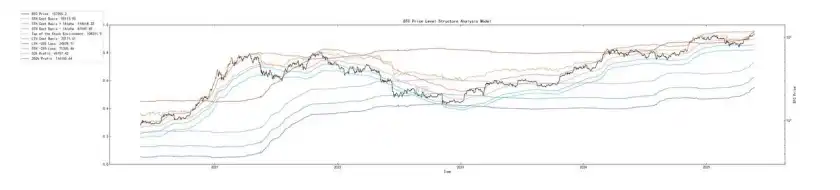

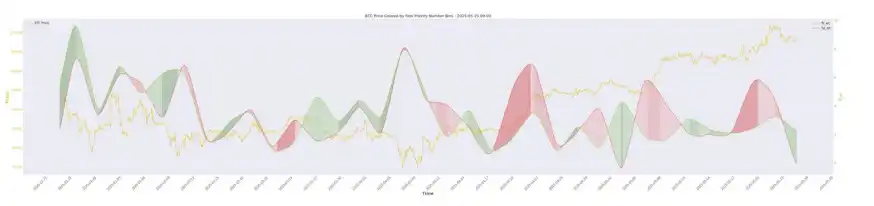

(The following image shows structural analysis at various price levels)

The current top price of the existing stock is around $108,000, while the short-term cost line is around $95,000. The current pricing may hover around these two price levels.

(The following image shows futures liquidation structure)

The current derivatives liquidation structure has switched from a short liquidation to a long liquidation structure. In the current environment, the risks faced by longs may be higher than those faced by shorts. After the previous short trend turned into a long trend, the market briefly underwent high-level consolidation. To ensure comprehensive observation, the risk factors of spot trading are taken into account.

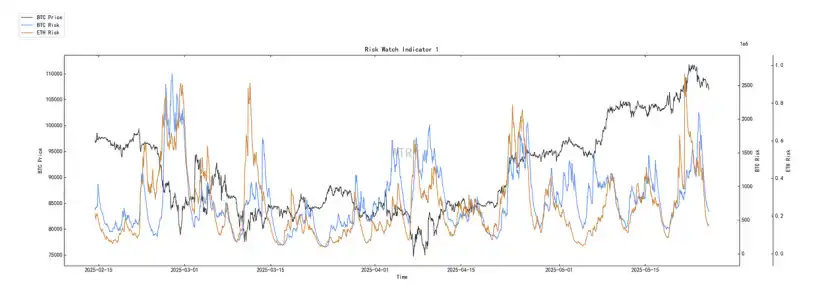

(The following image shows WTR risk coefficient 1)

WTR risk coefficient 1 indicates that BTC and ETH are not exposed to significant spot risks at present, and the preconditions for a substantial pullback have not yet formed.

(The following image shows USDC purchasing power composite score)

USDC purchasing power shows slight score fluctuations, currently maintaining a high score. There may still be liquidity support provided by USDC purchasing power in the market.

(The following image shows whale composite score)

Whale scores remain high and have not declined. The market may still lean towards a hovering tone.

Short-term Observation:

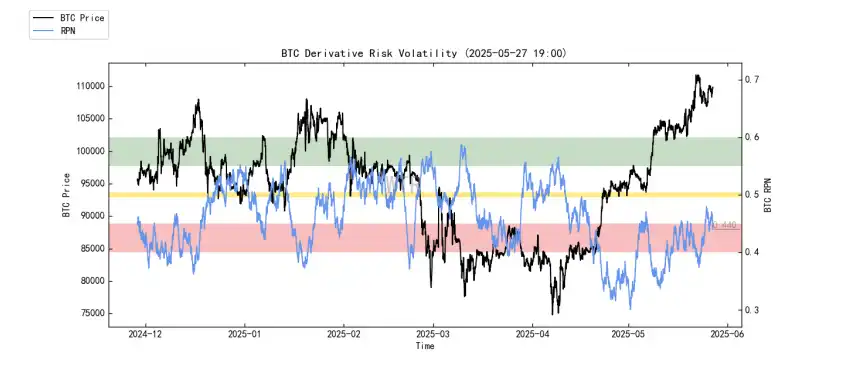

• Derivatives risk coefficient

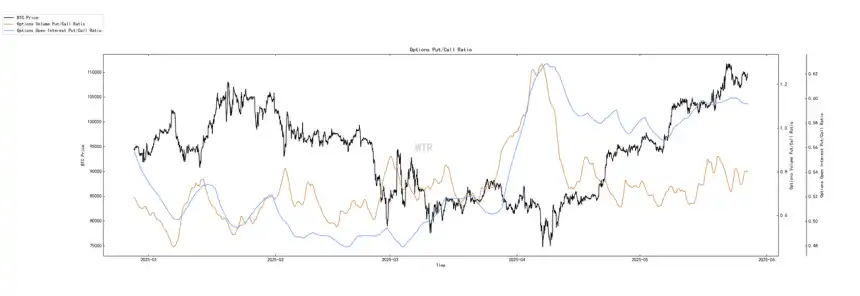

• Options intent transaction ratio

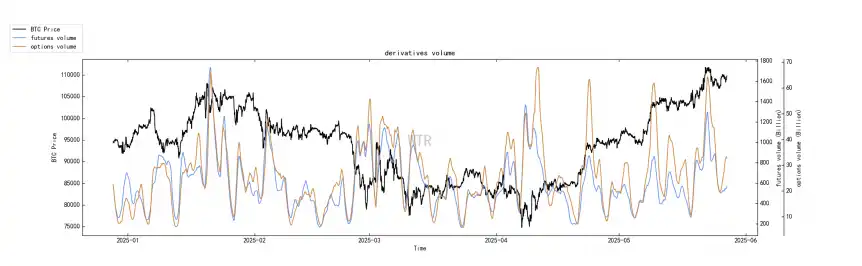

• Derivatives trading volume

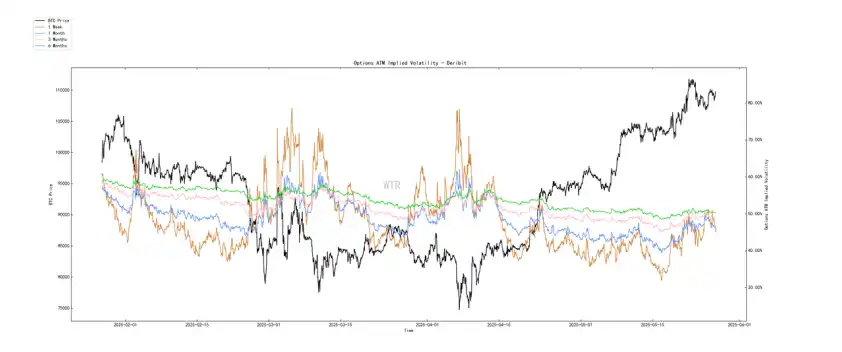

• Options implied volatility

• Profit and loss transfer volume

• New addresses and active addresses

• Ice Sugar Orange trading platform net headcount

• Pionex trading platform net headcount

• High-weight selling pressure

• Global purchasing power status

• Stablecoin trading platform net headcount

Derivatives Rating: Risk coefficient is in the red zone, derivatives risk is high.

(The following image shows derivatives risk coefficient)

The risk coefficient remains in the red zone, with currently low liquidation volumes for both longs and shorts. Consistent with last week's expectations, this week the derivatives market will experience significant volatility, leading to liquidations for derivatives participants.

(The following image shows options intent transaction ratio)

The ratio of put options is at a medium-high level, with trading volume at a medium level.

(The following image shows derivatives trading volume)

Derivatives trading volume is at a medium level.

(The following image shows options implied volatility)

Options implied volatility has only seen low amplitude fluctuations in the short term.

Sentiment State Rating: Neutral

(The following image shows profit and loss transfer volume)

Last week, it was mentioned that the market's positive sentiment (blue line) and price were in a state of divergence, and subsequently, market sentiment rose to a short-term high, breaking this divergence.

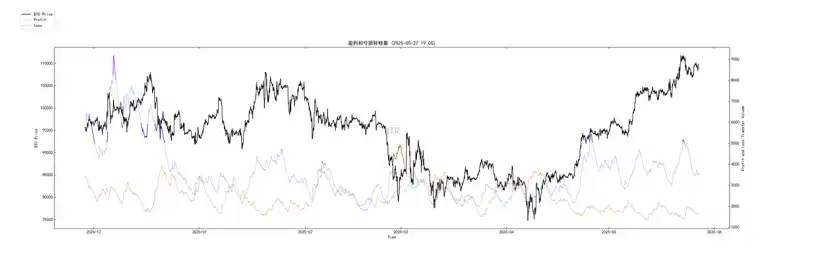

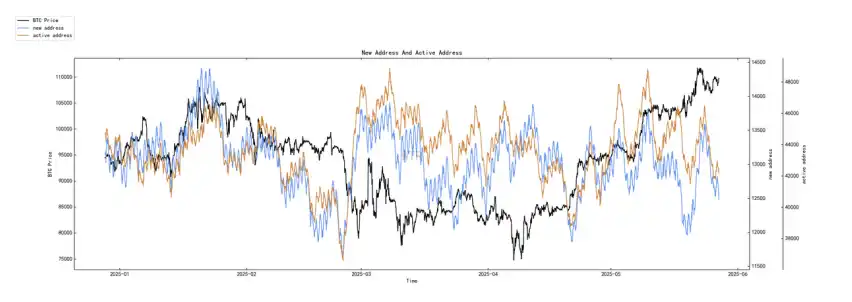

(The following image shows new addresses and active addresses)

New active addresses are at a low level. Spot and selling pressure structure rating: BTC and ETH are in a state of continuous large outflows.

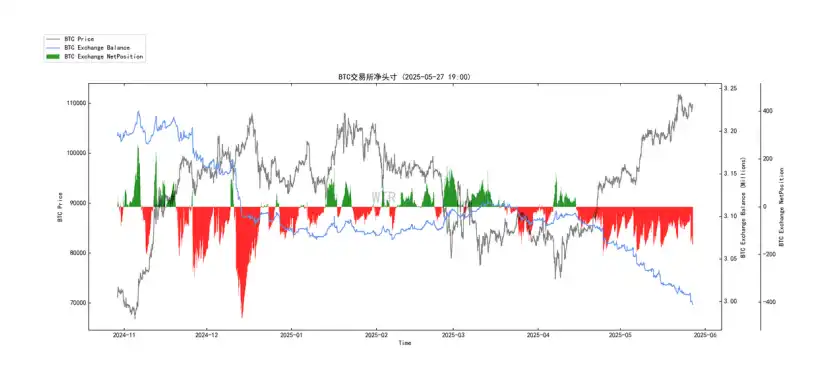

(The following image shows Ice Sugar Orange trading platform net headcount)

Currently, BTC is experiencing continuous large outflows.

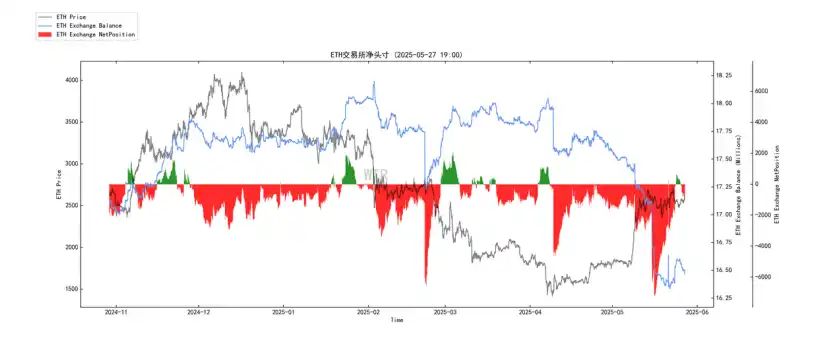

(The following image shows Pionex trading platform net headcount)

Currently, ETH is also experiencing continuous large outflows, with only a small amount of inflow.

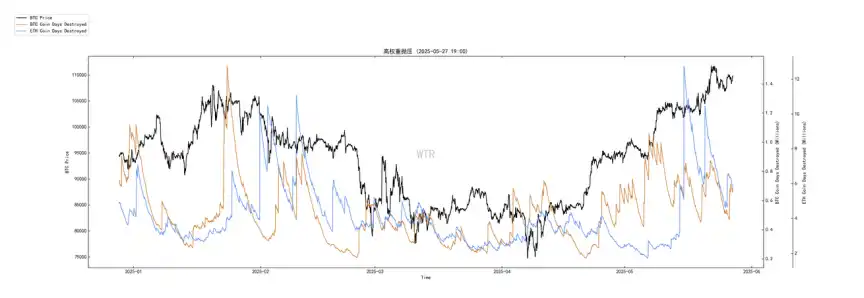

(The following image shows high-weight selling pressure)

ETH has significant high-weight selling pressure, but it has currently eased.

Purchasing Power Rating: Global purchasing power and stablecoin purchasing power remain stable compared to last week.

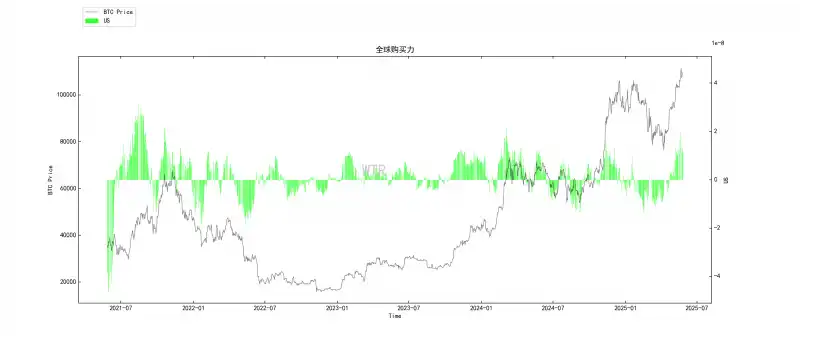

(The following image shows global purchasing power status)

Global purchasing power remains stable compared to last week.

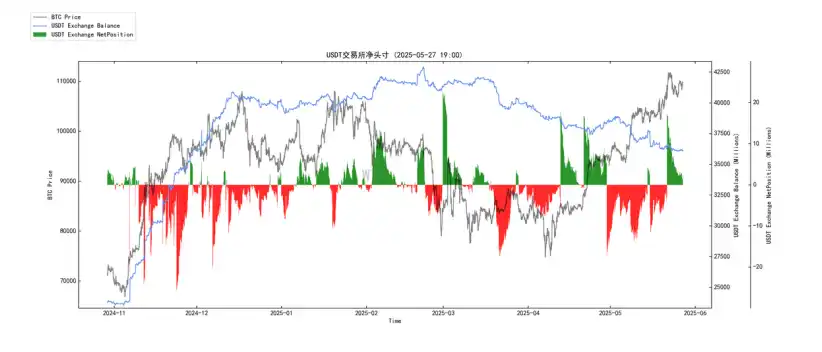

(The following image shows USDT trading platform net headcount)

Stablecoin purchasing power remains stable compared to last week.

This Week's Summary:

News Analysis and Summary:

- The Current Market's "Division" and "Dependence":

◦ Macroeconomic Aspect: The market is swaying amid the high uncertainty of Trump's trade policies and the ambiguous expectations of Federal Reserve monetary policy, with risk sentiment fluctuating sharply. As part of the risk asset class, the short-term trend of the crypto market is highly correlated with these macro factors.

◦ Internal Crypto: BTC relies on institutional fund inflows from ETFs and the "digital gold" narrative, demonstrating a certain level of resilience and "maturity" (QCP perspective), becoming the market's "stabilizing force." However, this strength is largely a short-term realization of the "ongoing narrative."

- The Sustainability of Core Driving Forces Needs to be Questioned:

◦ After the "Honeymoon Period" of BTC ETFs: After the initial institutional allocation is completed, whether subsequent fund inflows can continue will depend on BTC's ability to consistently prove its value in global asset allocation (compared to gold, stocks, etc.) and whether the macro liquidity environment is supportive.

◦ Pressure on the Realization of "Expectation Narratives": Whether it is the Federal Reserve's interest rate cuts, the clarification of the regulatory environment, or the large-scale implementation of crypto applications (such as "stablecoin/trading platform channels"), these driving "expectation narratives" for future growth face a long and uncertain realization path. The market's patience for these narratives is limited.

- Differentiation Under Narrative Rotation and Attention Competition:

◦ Internal Rotation: The rapid retreat of the meme craze indicates an acceleration of internal hot spot rotation within the market. If BTC can maintain its strength, some funds may flow into ETH (benefiting from ETF expectations and potential regulatory positives) and other altcoins with real progress. However, a broad market rally is difficult to achieve, and the "authenticity" of fundamentals and narratives will become more important.

◦ External Competition: The strong narrative of AI will continue to pose "attention" and "funding" competition for the crypto industry. The crypto industry needs to find paths to coexist with AI or demonstrate unique advantages; otherwise, it may face the risk of marginalization in the "positioning battle" of the tech wave.

Future: Seeking Structural Opportunities Amid Uncertainty, but Risks of "Expectation" Falling Short

Mid-Short Term:

• The market will continue to grapple between macro uncertainties (trade policies, Federal Reserve meetings) and internal crypto driving forces (ETF fund flows, regulatory signals).

• BTC is expected to maintain relative strength with institutional fund support, but overall market volatility remains high. PCE data and the Federal Reserve's statements before July will be key observation points. Whether the summer can "break the calm and bring the market another boom" depends on whether these uncertainties can develop positively.

Mid-Long Term:

• Optimistic Scenario: Improvement in macro liquidity (interest rate cuts), gradual clarification of the regulatory environment, continued attraction of funds by ETFs, and some crypto applications with real value (possibly including preliminary forms of "virtual world channels") begin to show results. The market may welcome a broader structural bull market, but differentiation will intensify.

• Pessimistic Scenario: Continued adverse macro environment (stagflation, escalating geopolitical conflicts), tightening regulation, slowing or even reversing ETF fund inflows, and the "expectation narratives" failing to materialize. The market may experience a prolonged period of adjustment and value reassessment. Other tech fields like AI continue to be strong, further diverting resources from the crypto market.

• Most Likely Scenario: Significant volatility, sometimes upward, but the process is tortuous. A few leading assets (like BTC, ETH) and truly valuable niche sectors will attract funding, while many projects lacking fundamental support will be eliminated. The market will pay more attention to the actual utility and sustainability of crypto rather than pure speculative trading.

On-Chain Long-Term Insights:

- The supply-side fundamentals of BTC remain very strong, which is an important source of market confidence.

- Of course, the recent weakening of ETF fund inflows is a warning signal that cannot be ignored, indicating that one of the main demand engines of the market is "cooling down."

- The current market is in a critical observation and directional choice period, where the macro environment, subsequent performance of ETFs, and the emergence of new industry narratives will jointly determine the next phase of the trend.

• Market Tone: There is a need to pay more attention to risks and maintain patience and caution regarding the realization of "expectation narratives." Frenzied sentiment may need to give way to more fundamental value considerations.

On-Chain Mid-Term Exploration:

- Liquidity continues to expand, temporarily suppressing short-term risks, and the current market remains stable in amplitude.

- The market is oscillating near the existing top of $108,000 and the short-term cost line of $95,000.

- The derivatives liquidation has shifted to a long-dominated structure, with short-term long pressure increasing.

- BTC and ETH spot risk indicators have not shown abnormalities, and conditions for a deep pullback are not yet sufficient.

- USDC purchasing power scores remain high, and liquidity support in the market is solid.

- Whale holding scores remain high, and the market maintains a consolidation structure.

• Market Tone: Hovering, vigilant. Ample liquidity supports market fluctuations, but the shift of derivatives to a long liquidation structure requires caution regarding potential changes triggered by this shift.

On-Chain Short-Term Observations:

- The risk coefficient is in the red zone, indicating high derivatives risk.

- New active addresses are at a low level.

- Market sentiment state rating: Neutral.

- The net headcount of BTC and ETH on trading platforms is in a state of continuous large outflows.

- Global purchasing power and stablecoin purchasing power remain stable compared to last week.

- The probability of not breaking below $95,000 to $100,000 in the short term is 80%.

• Market Tone: In the short term, there are few chips for profit-taking at the current price level, and purchasing power is sufficient to provide support. This week's expectations are basically consistent with last week, and there is still the possibility of further short squeezes, while the probability of a direct large pullback is low.

Risk Reminder: The above is all market discussion and exploration, and does not constitute directional opinions for investment; please approach with caution and guard against market black swan risks.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。