Preface: Investment carries risks, and operations should be conducted with caution.

Article review takes time, and there may be delays in publication. The article is for reference only, and you are welcome to read!

Article writing time: May 28, 11:29 AM Beijing Time

Market Information

- Brian Quintenz, the CFTC chairman nominee by Trump, disclosed $3.4 million in assets and his relationship with the crypto industry;

- Blockstream CEO: Trump's election as U.S. president has accelerated the government's acceptance of Bitcoin by "decades";

- The executive director of digital assets under President Trump stated that the U.S. is "becoming the world's Bitcoin superpower";

- Trump Media CEO: Bitcoin is the "ultimate tool for financial freedom," and the company will treat cryptocurrency as a key asset;

- Federal Reserve's Kashkari: I believe the argument against ignoring tariffs' impact on inflation is more persuasive;

- Thailand's finance minister: may consider linking cryptocurrency to certain services like purchasing goods and credit cards;

Market Review

Earlier, we mentioned that Bitcoin would reach a new high, with the peak at 111,959, breaking the previous high of 110,000, which was as expected. Our long position was set around 106,800, yielding at least a 3,000-point profit. Ethereum's rally point was at 2,734, which still hasn't broken the 2,750 resistance, but our previous long position at 2,550 also provided around 180 points of profit. Congratulations to those who followed this operation for a small gain. Currently, after breaking the new high, Bitcoin has not continued to rise and is in a high-level consolidation. In trading, we can maintain a consolidation trading strategy;

Market Analysis

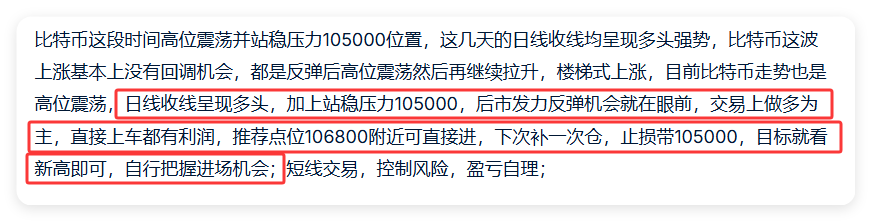

Bitcoin:

From the daily chart, Bitcoin has not continued to rise after breaking the previous high, and the pullback has not materialized. The overall trend has not broken down and remains in high-level consolidation. It is normal for the price to consolidate for a period after reaching a new high. The higher the price, the higher the cost of pushing up, requiring some time to absorb favorable conditions before funds can continue to push up. In trading, we can adopt a strategy of shorting at high points and going long at low points. If it breaks, we abandon the consolidation strategy. The lower boundary of the consolidation range is 107,500, and the upper boundary is 110,700. The current price is around 108,700, and we can set up around 108,000 with a stop loss at 106,500. The target is around 110,000. If it breaks 110,700, hold for a new high and seize the entry opportunity; for short-term trading, control risks and manage profits and losses independently;

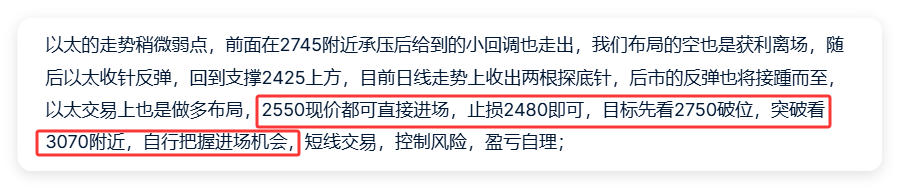

Ethereum:

From the daily chart, Ethereum is still operating within a consolidation range. The 200-day moving average has been a resistance several times without breaking. Now that Bitcoin has not continued to rise, Ethereum's rally is again under pressure. There is a significant chance that the market will continue to maintain a consolidation trend. In trading, we can first set up short positions near the upper pressure, recommending a setup around 2,650 with a stop loss at 2,730 and a target in the 2,550-2,510 range. After reaching this range, we can consider setting up long positions based on the closing situation. Seize the entry opportunity; for short-term trading, control risks and manage profits and losses independently;

In summary:

Both Bitcoin and Ethereum have room for pullbacks; wait for a pullback before setting up long positions.

The article is time-sensitive; pay attention to risks. The above is only personal advice and for reference!

Follow the WeChat public account "Crypto Lao Zhao" to discuss the market together;

If you don't like it, you must have a standard you like. All negativity is the opposite of positive perception. The matter itself is not important; what matters is what changes you can achieve through it and what impact it can have! Some prefer one-sided trends, some prefer consolidation, some excel in rising markets, while others are obsessed with falling markets. No one is absolutely right, and no one is absolutely wrong. If you don't like it, it doesn't meet your standards; what you can't do may be what others excel at.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。