Preface

In the early narrative of the Web3 industry, GameFi was the second independent narrative to achieve industry consensus, following DeFi. Early gaming public chains were not an independent concept; game distribution platforms dominated the development of blockchain games. Before 2020, the vast majority of Web3 games were implemented through Ethereum's smart contracts, facilitating the buying and selling of NFT equipment. Play-to-Earn was the primary demand for most players, often placing game experience in a secondary position.

In Web2 games, game performance drove the upgrade of personal gaming hardware. In 2017, the popularity of PUBG led gamers to upgrade their graphics cards to at least RTX1050, and in 2021, Cyberpunk 2077 prompted players to upgrade to RTX3060 or higher. In the Web3 gaming industry, the increase in active players forces game developers to consider enhancing public chain performance. The explosive popularity of Axie Infinity in the second half of 2021 led many players to invest time in Play-to-Earn, but due to Ethereum's parallel transaction bottleneck, players experienced poor NFT trading. As a result, the Sky Mavis team developed the Ronin sidechain, significantly improving player experience while gradually building its own gaming ecosystem.

Compared to the DeFi industry, where open-source project codes can be quickly cloned (such as PancakeSwap and UniSwap), products with depth in GameFi are difficult to replicate quickly. This is because the ecological chain of GameFi is longer, involving game studios, public chain selection, platform promotion, and player communities, with each link being crucial. DeFi products often innovate on existing product forms, making code reuse easier. Therefore, for general-purpose public chains, quickly establishing a DeFi ecosystem is almost a necessity, while building a GameFi ecosystem is optional. Game-specific public chains can compensate for the ecological resource deficiencies of general-purpose public chains, often initiated by industry veterans with certain game studio resources, focusing on player experience and the distribution of interests with studios and promotional channels.

1. Game Chain Chronology

2017-2019: Technical Validation and Concept Exploration

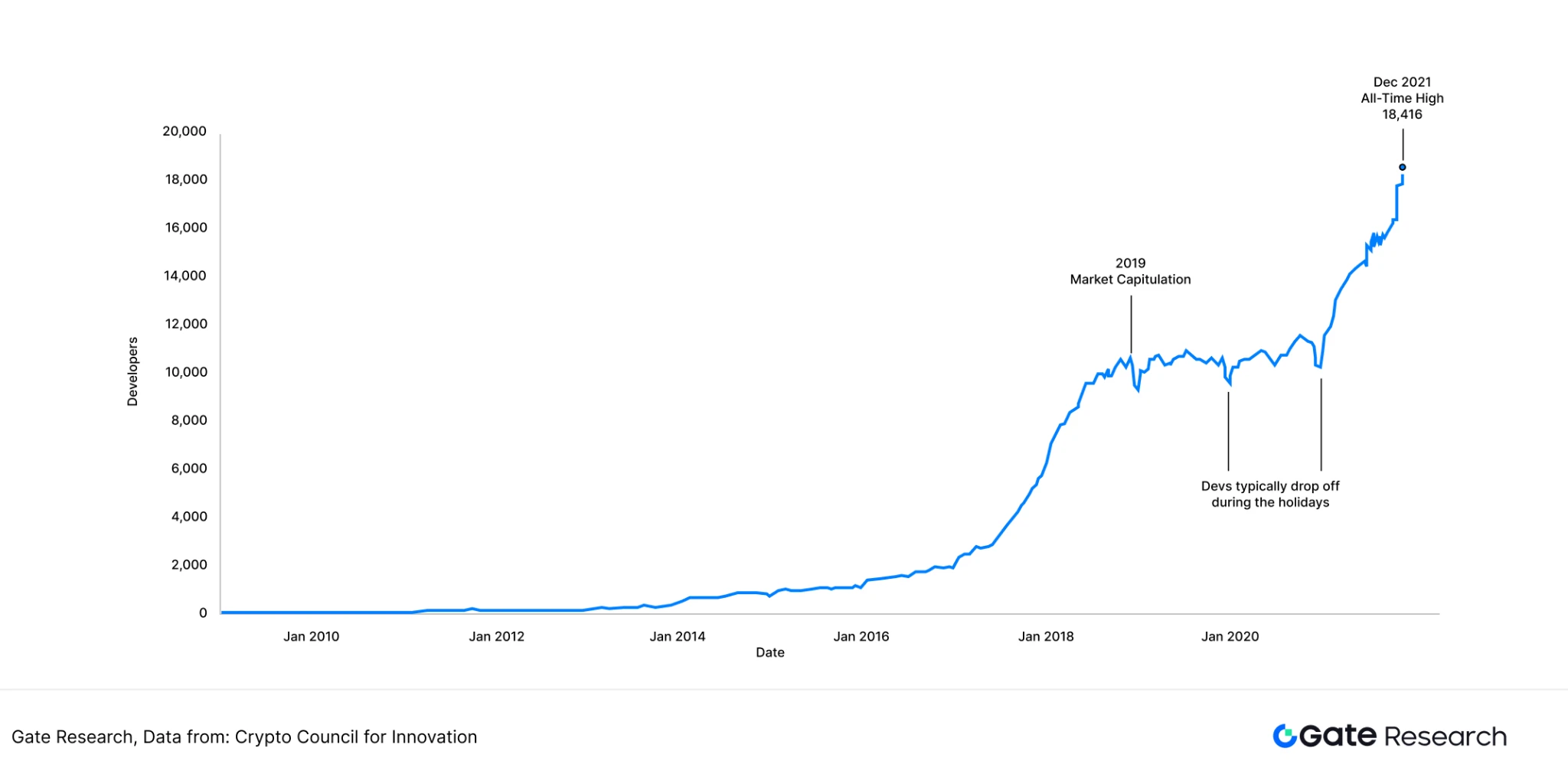

Before 2020, the crypto field was relatively barren at the application level, with many entrepreneurs having forward-thinking concepts but a small user base and few commercially viable applications. The Gamechain System, initiated in 2017 by veteran game developer Ling Lianwei, is the earliest dedicated gaming public chain found in my research. This public chain proposed a decentralized game asset circulation framework, pioneering the use of the NFT standard and DPoS consensus mechanism to provide a technical prototype for game asset rights confirmation. In 2018, the first game on the Gamechain System, Candy Shooter, was launched. However, due to its early establishment, Gamechain System was like a shooting star in the realm of dedicated gaming public chains; although it was the first to propose the concept, the number of active developers in the entire Web3 industry in 2017 was less than 4,000, and the developer community had not yet been built up.

The WAX public chain was also established in 2017, serving as a vertical public chain for games and NFTs, with its mainnet launching in June 2019, later than Gamechain System. The game-specific public chain ImmutableX was initiated in 2018, aiming to solve the NFT scalability issue.

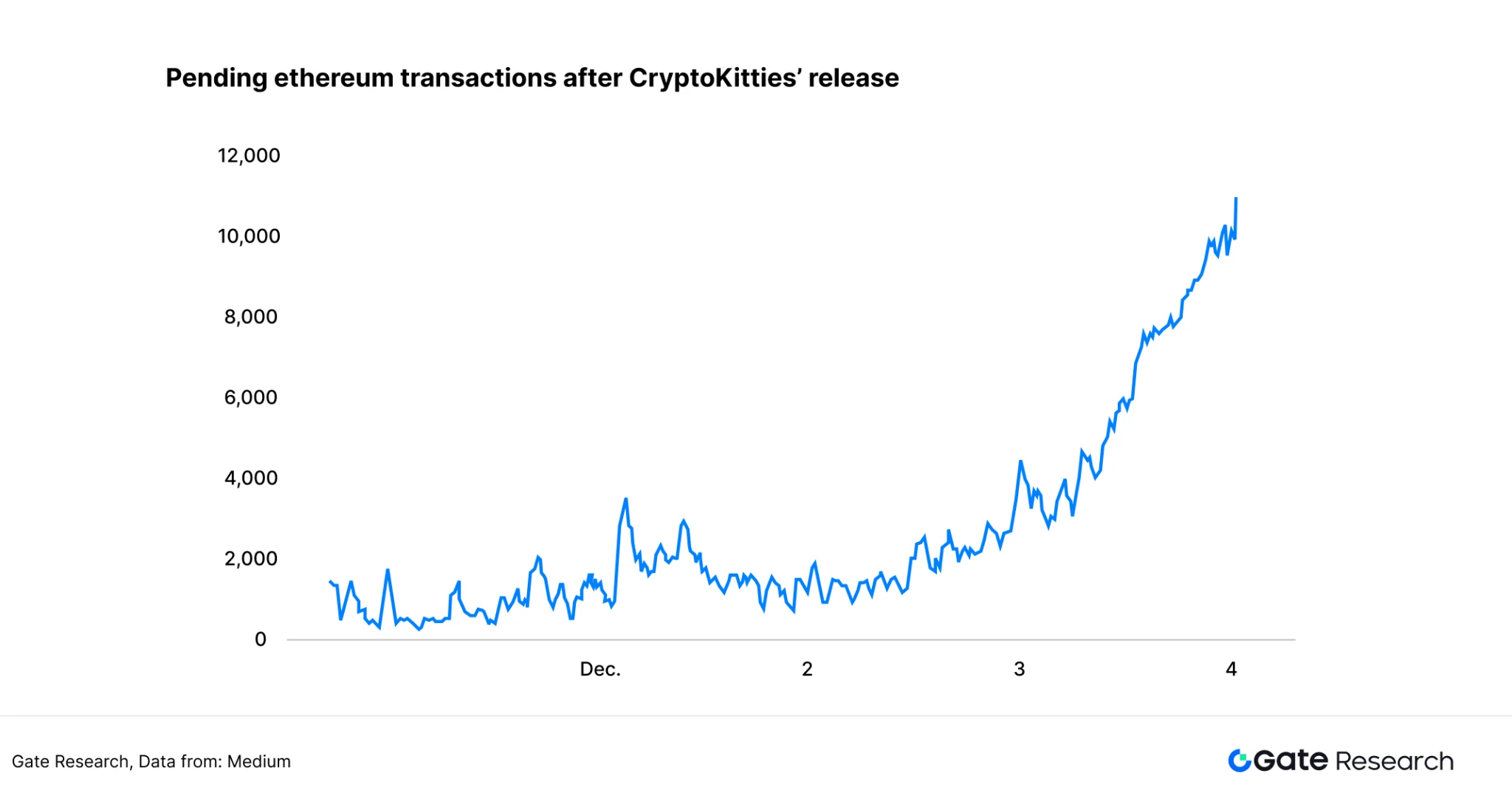

During this phase, the most breakout product in Web3 gaming was CryptoKitties, released in 2017. Developed by the Canadian studio Dapper Labs on the Ethereum smart contract, it is a cat-breeding game. In CryptoKitties, each cat is an independent NFT (the NFT concept had not yet been born in 2017, and CryptoKitties pets are widely regarded as the origin of the NFT concept). Players can purchase NFTs on third-party platforms, and two NFT cats can breed to produce new cat NFTs. After hatching high-quality cats, players can sell their NFTs for profit. The unexpected popularity of CryptoKitties caused the number of unconfirmed transactions in Ethereum's memory pool to soar to 12,000 at one point.

The later explosive Web3 game Axie Infinity was officially initiated in 2018. It is a card game developed by Sky Mavis that allows players to breed, raise, battle, and trade Axie creatures. It combines elements of Pokémon and CryptoKitties gameplay.

The period from 2017 to 2019 was the early stage of the blockchain gaming industry, characterized by relatively homogeneous Web3 games, where financial attributes far outweighed gaming attributes, and the lifecycle of games was short. The demand for dedicated Game Chains was not urgent, and the construction of the Web3 gaming industry chain required many years.

2020-2021: Formation of Technical Framework and Rise of Vertical Public Chains

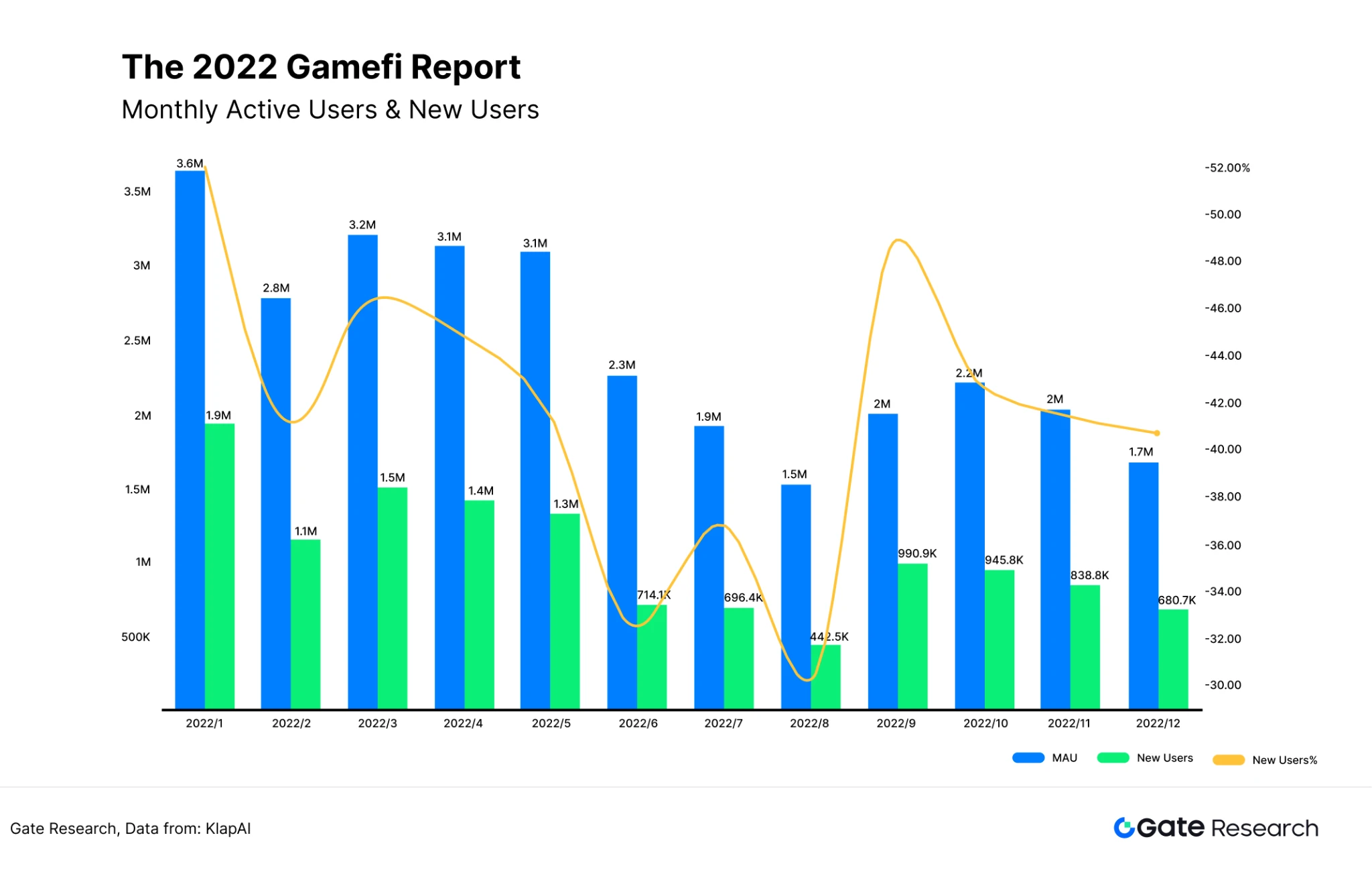

The years 2020 to 2021 marked the main phase of the popularization of blockchain games and the rise of vertical public chains. With the further popularization of the Play-to-Earn model, more game studios began developing blockchain games, leading to explosive user growth.

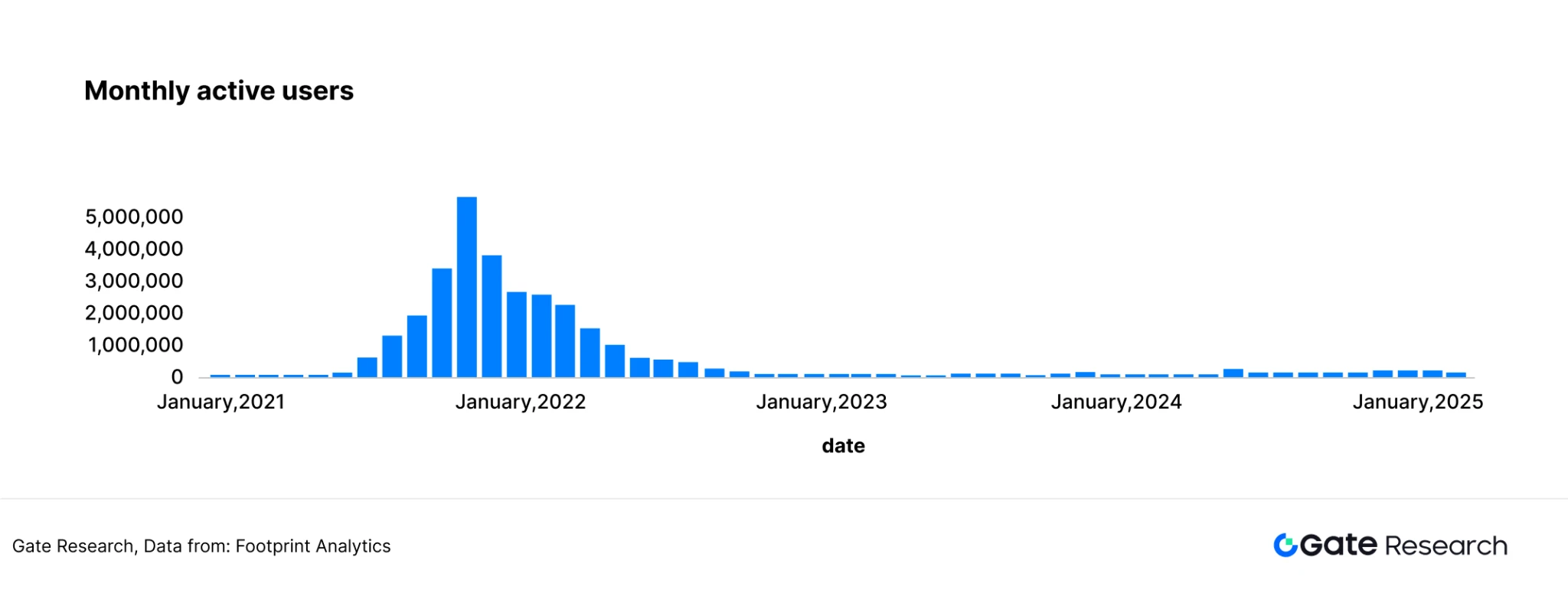

The breakthrough in economic models was the core driving force of this phase. In 2021, Axie Infinity sparked a craze in the Southeast Asian market with its dual-token mechanism (AXS governance token and SLP utility token), with its daily revenue surpassing that of traditional mobile games at one point. The incentives brought by the tokens created a positive growth flywheel. This model not only attracted millions of users but also formed Discord gold farming communities, shifting the user structure from speculators to real players. In November 2021, Axie Infinity reached its peak popularity, with 5.59 million monthly active players and a total transaction volume of 64.86 million. Although these figures still did not match those of classic Web2 online games like Dota, CSGO, and World of Warcraft, to this day, no Web3 game has come close to Axie Infinity's player numbers and transaction volume in 2021. As players and guilds continuously engaged in gold farming transactions, the performance bottleneck of the Ethereum mainnet began to show. To optimize the gaming experience for players, Sky Mavis developed the Ronin sidechain, significantly increasing the public chain's TPS and becoming a benchmark case for vertical public chains in terms of performance and scenario adaptation. The Ronin Network mainnet officially launched in February 2021.

At the same time, ImmutableX also made strides during this phase, completing the construction of its gaming ecosystem. It provided technical support for the subsequent development of AAA-level blockchain games. For example, the open-world RPG blockchain game Illuvium chose ImmutableX as its underlying architecture in the early development stage to achieve an efficient combination of complex game logic and on-chain assets.

Overall, the technological breakthroughs and model innovations of this phase laid two major foundations for the industry: first, vertical public chains represented by Ronin solved performance and scenario adaptation issues through customized architecture; second, vertical public chains represented by ImmutableX made strides in the field of AAA game masterpieces, which had previously seen little engagement from blockchain games, expanding the boundaries of blockchain gaming and laying the groundwork for ecological reconstruction and technological integration after 2022.

2022-2023: Market Adjustment and Ecological Reconstruction

Starting in 2022, the entire cryptocurrency industry entered a period of adjustment, with a significant decline in the total market value of cryptocurrencies severely impacting the Web3 gaming industry. The rapid decline of token assets (FT and NFT) led to many gold farming studios being unable to maintain a balance between income and expenditure. Games such as Axie Infinity, Big Time, and CryptoBlades experienced significant user loss during this phase. The destruction of the gaming ecosystem further transmitted to gaming public chains, causing their gas fee revenues to decline rapidly.

Based on data from the Big Blockchain Game List, over 30% of the blockchain games announced in 2023 have been reported as stopped or canceled. As of January 2024, this list includes 911 games, of which 334 are currently operational, and 577 are still in development. Since the launch of this plan in 2021, a total of 1,318 blockchain games have been recorded, with 407 now classified as stopped or abandoned.

On the positive side, after a capacity clearing, the landscape of Web3 gaming public chains has been thoroughly established, with ImmutableX, WAX, and Ronin gradually forming the first tier of dedicated gaming public chains. The construction of ecosystems has given vertical gaming public chains a strong moat, while general public chains require significant effort to rebuild their ecosystems, making gaming public chains an important paradigm in the GameFi field.

Games like Lumiterra, Dark Angel, and Sharpnel have also become some of the few highlights during the crypto bear market. These games share a common focus on player experience, with relatively well-developed game mechanics that do not quickly enter a death spiral.

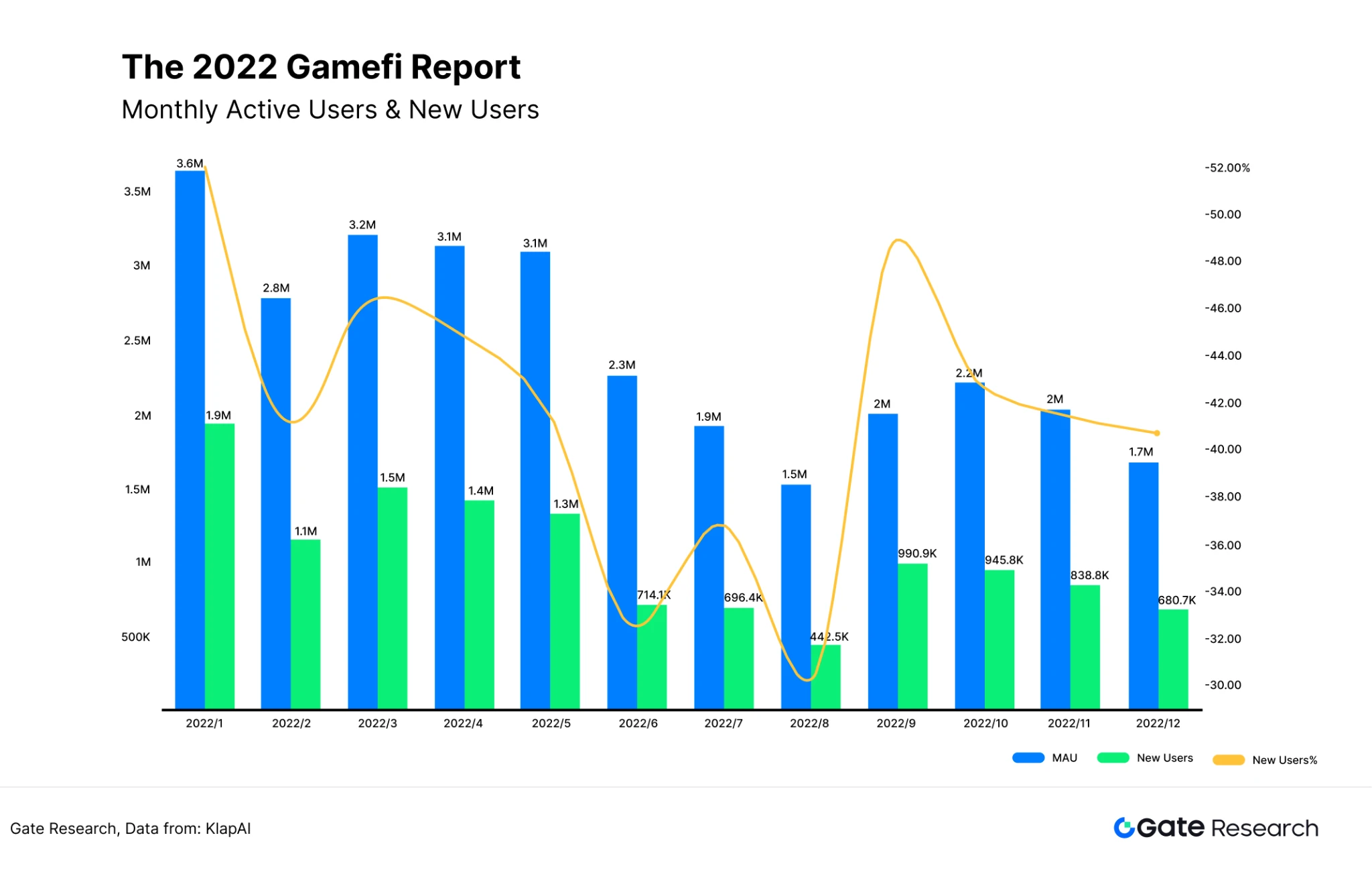

2024-2025: Ecological Competition and Technological Iteration

In the first quarter of 2025, gaming projects have not returned to the levels of active addresses and transaction volumes seen in the third quarter of 2021. From an overall external environment perspective, the Ethereum ecosystem's performance in 2024 is far behind that of the Solana ecosystem; Ethereum-based gaming projects are generally underperforming, while most previously popular blockchain games like Axie Infinity, Bigtime, and Lumiterra are executing transactions on Ethereum scaling public chains such as opBNB, Polygon, Ronin, and ImmutableX.

Among Ethereum's main competitors, Solana's gaming ecosystem is relatively weak, with fewer resources for game studios. At this time, a Solana Layer2 specifically designed for gaming, Sonic SVM, has launched. In the future, the Solana gaming ecosystem will compete directly with the Ethereum gaming ecosystem. Additionally, the TON public chain has emerged in the TAP to Earn mini-game category. Although this game type is also common on Ethereum, TON's gaming ecosystem has attracted a large number of game developers due to the Telegram App's over 1 billion monthly active users. By the third quarter of 2024, the number of games on the TON public chain had increased by over 320% year-on-year.

In terms of technology, an increasing number of dedicated gaming public chains are adopting zero-knowledge proof (ZK) technology, such as Immutable X's Validium solution, to improve transaction speed and reduce costs while enhancing security. Ronin Network has upgraded to a DPoS consensus mechanism, expanding the number of validating nodes from 9 to 22, significantly increasing decentralization and attracting multiple game studios to join, promoting its ecological revival. Furthermore, emerging public chains like Xai (Layer3 based on Arbitrum) and Oasys (Ethereum sidechain using Optimistic Rollup) are further lowering the entry barriers for players by optimizing gas fees and transaction speeds.

In gaming, the metaverse sandbox game World of Dypians, launched in November 2024, achieved 1 million UAW (unique wallet addresses) within two months of its launch, becoming the most popular GameFi project during this phase.

2. Game Chain Competitive Landscape

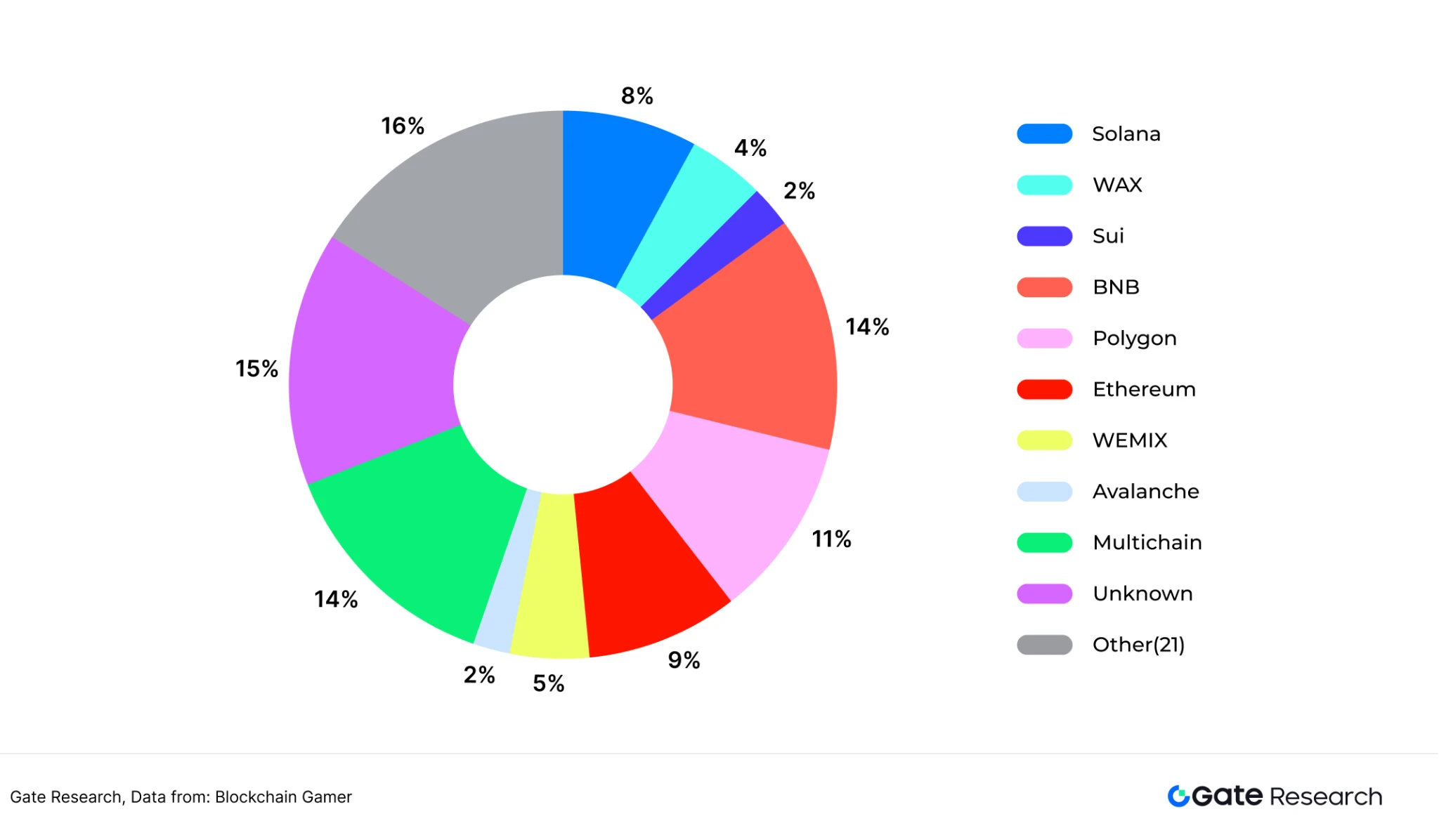

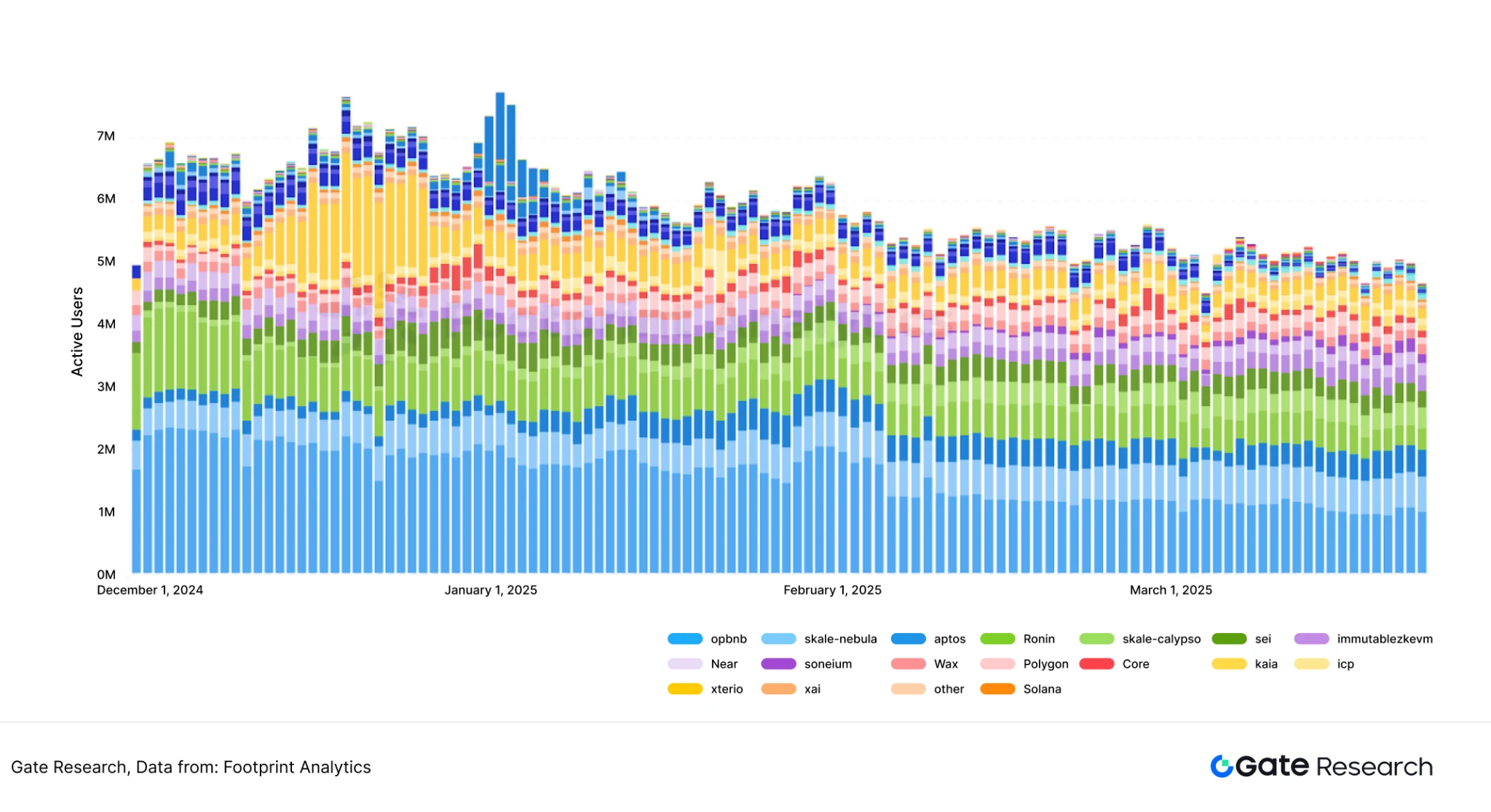

Currently, the main gaming public chains include WAX, Ronin, ImmutableX, and Immutablezkevm. This chapter will analyze the current competitive landscape of Game Chains from the perspectives of active addresses, transaction volume, and transaction amounts.

First, from the perspective of daily active addresses, Ronin public chain ranks first among dedicated gaming public chains, stabilizing at around 500,000 daily active addresses in March 2025. Immutablezkevm and WAX have active addresses fluctuating around 200,000. The gaming distribution platform Xterio, in collaboration with AltLayer, has created Xterio Chain, which has seen the most significant data fluctuations among dedicated gaming public chains recently. Due to Xterio launching a large-scale $XTER points reward campaign in December 2024, its active addresses exceeded 1.6 million at the end of December, but after the campaign ended, its active addresses dropped to around 100,000 by March 2025.

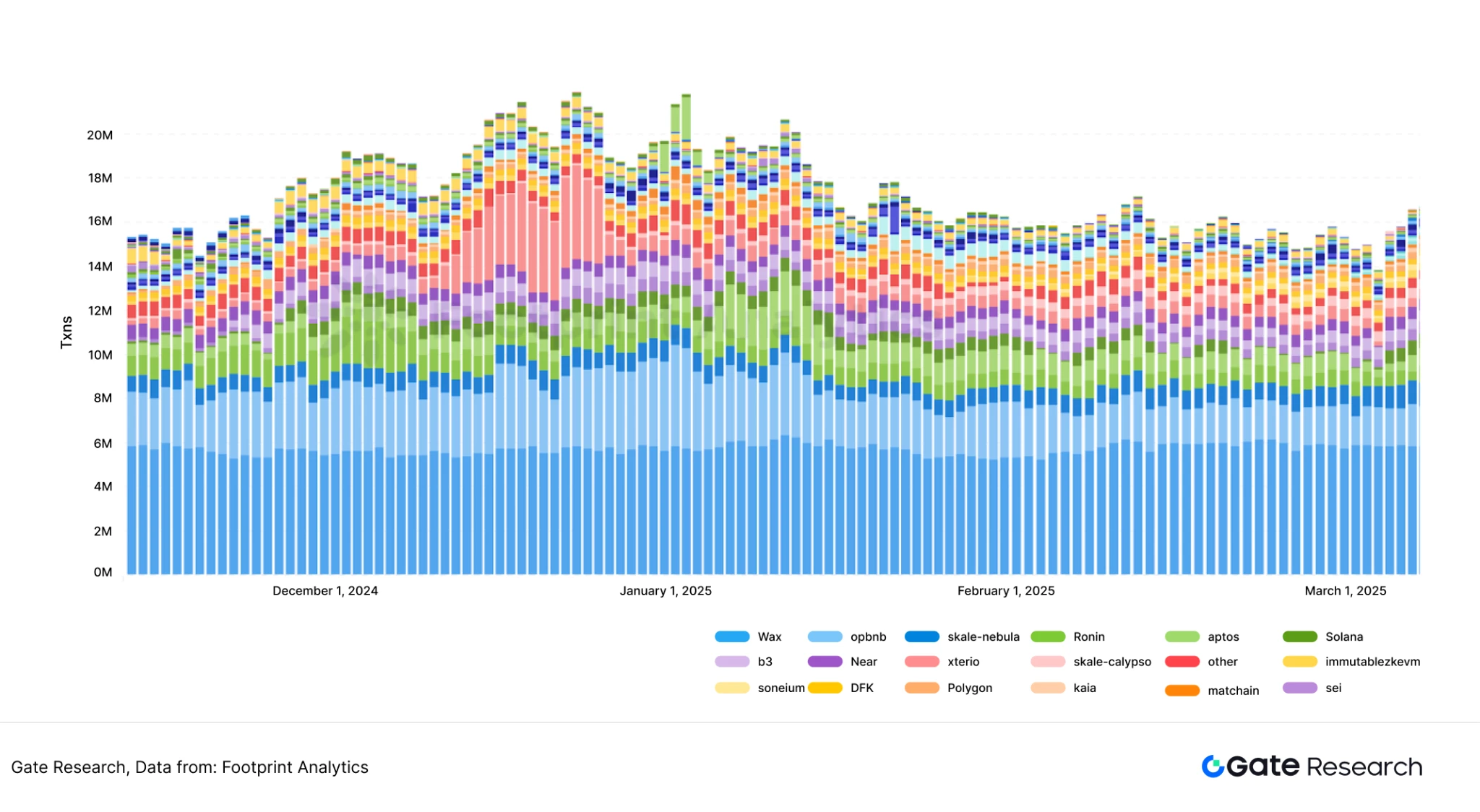

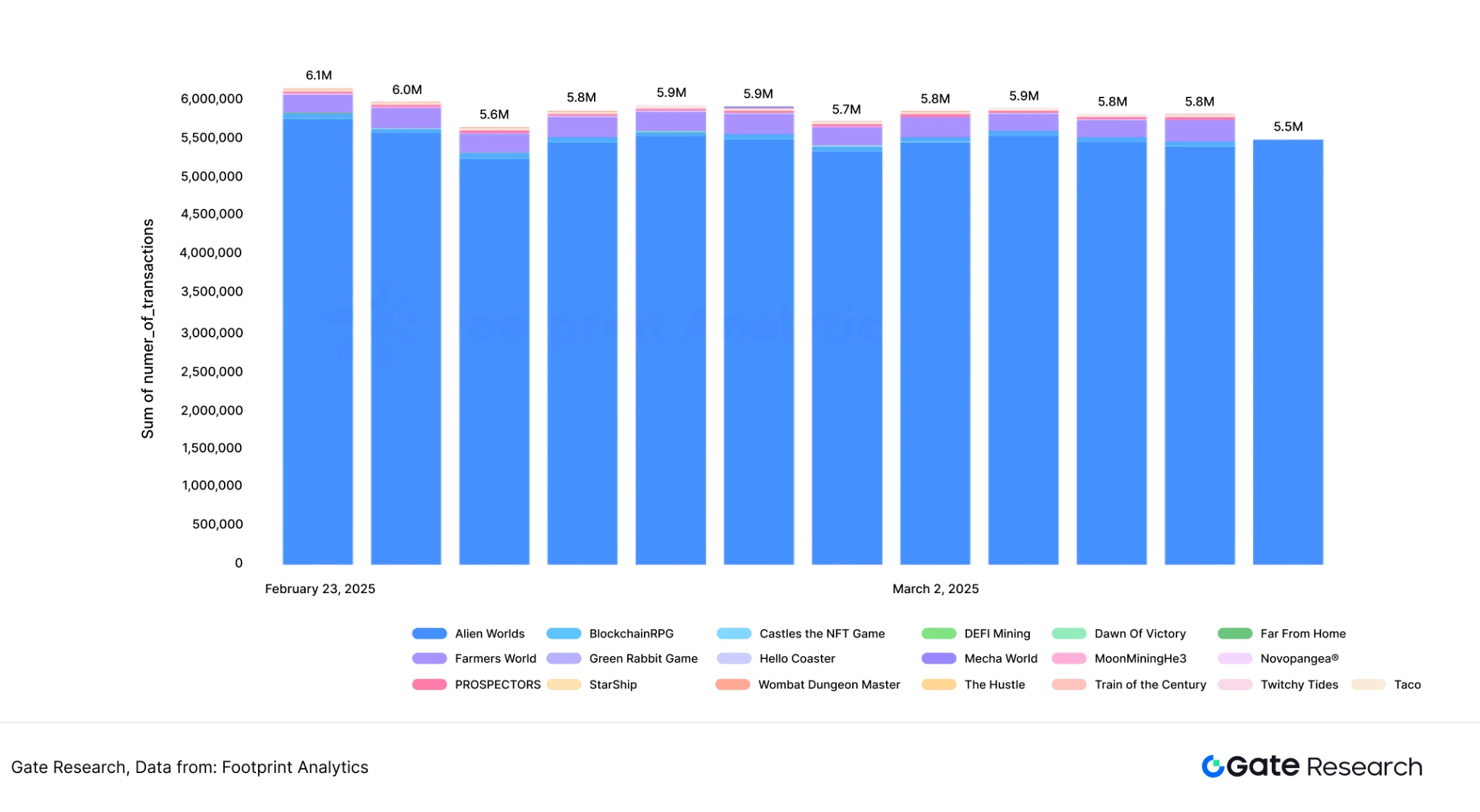

Secondly, in terms of transaction counts, WAX public chain has maintained the first position for the past three months (including other general public chains), with transaction counts stabilizing at 5 million per day. Ronin public chain follows, with transaction counts fluctuating significantly, currently around 500,000 daily transactions, peaking at over 2 million daily transactions in December 2024. Immutablezkevm's transaction counts are relatively low, maintaining around 200,000 daily transactions.

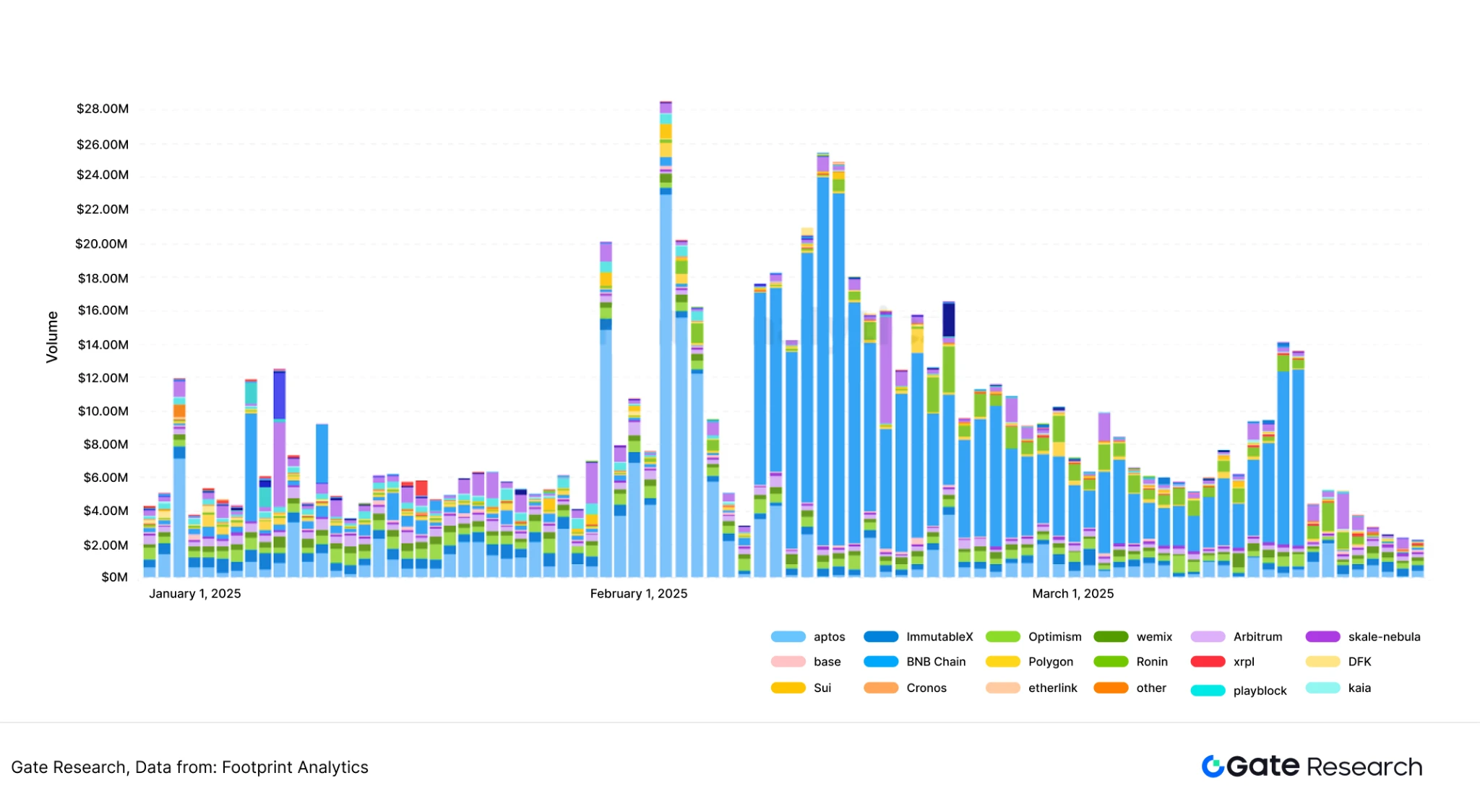

Finally, in terms of transaction amounts, Ronin is currently the gaming public chain with the highest transaction volume, stabilizing at $800,000 to $1.5 million daily. ImmutableX follows, with transaction amounts between $300,000 and $1 million. Although WAX public chain consistently leads in transaction counts, its average daily transaction amount struggles to exceed $100,000.

Overall, the current competition between gaming public chains and general public chains does not show a clear advantage. In terms of active addresses, Aptos and opBNB have significant advantages. In terms of transaction amounts, BNB and Aptos also far exceed several dedicated gaming public chains. The dominance of gaming public chains in the entire GameFi market still requires the emergence of more blockbuster exclusive games.

3. Game Chain Typical Cases

3.1 WAX

WAX was founded in 2017 by cryptocurrency pioneer William Quigley (founder of Tether) and is known as the "King of NFTs" for successfully facilitating NFT sales from many well-known partners, including Major League Baseball, Street Fighter, Atari, and more. WAX is based on EOS and follows its DPoS (Delegated Proof of Stake) consensus mechanism to support the high throughput required for gaming.

3.1.1 Core Mechanism of WAX Public Chain

The consensus mechanism of the WAX public chain is DPoS, which evolved from the mainstream PoS mechanism of current public chains. DPoS was first proposed by Dan Larimer (former CTO of the EOS public chain). In short, the difference between DPoS and PoS is that PoS nodes operate on a one-person-one-vote system (requiring 32 ETH to become a qualified node), while DPoS nodes operate on a "representative" system, which is an indirect election where token holders elect 21 guilds to confirm the block production of the blockchain. The advantages of DPoS include fast speed, with TPS exceeding 3,000; the downside is a lower degree of decentralization, making it easier for guilds to form oligopolies.

The WAX blockchain generates a block every 0.5 seconds, with only one WAX guild node authorized to produce blocks during each period. If a node fails to generate a block within the scheduled time, that period's block will be skipped. When one or more blocks are missing, the blockchain will experience a gap of 0.5 seconds or more. To prevent idleness, WAX implements a reward penalty mechanism for guild nodes with block production rates ≤50%. As an independent public chain, WAX does not have the independent Rollup layer and DA layer of modular public chains.

WAX achieves Byzantine Fault Tolerance (BFT) through a rule that strictly prohibits WAX guild nodes from signing two different blocks at the same block height or timestamp. The role of BFT is to prevent major failures and suppress the influence of malicious nodes. If any WAX guild node attempts to sign two blocks at the same height or timestamp, token holders will vote to expel it from the network. The final confirmation of a block is jointly signed by 15 guild nodes, and once confirmed, the block is immutable and permanently effective.

3.1.2 Economic Model of WAX Public Chain

WAXP is the governance token of the WAX public chain, and holders of WAXP can earn rewards through staking. The public chain reserves a fixed number of tokens daily as rewards to distribute to holders. Individual daily rewards = individual staking weight / total network staking weight × total daily rewards. Additionally, as a public chain that values co-governance, staking rewards are also linked to the number of votes cast by token holders. Individual staking weight = current number of staked WAX tokens × voting intensity. Voting intensity is a coefficient between 0 and 1; if a token holder participates in community proposal voting every week, their voting intensity is higher; conversely, it is lower.

The 21 guilds elected by token holders can earn WAX guild rewards by producing blocks. The reward amount is directly linked to the number of blocks produced by each guild. Additionally, standby guilds, as "backup operators," can also earn a corresponding proportion of rewards if they are randomly called upon and successfully process blocks.

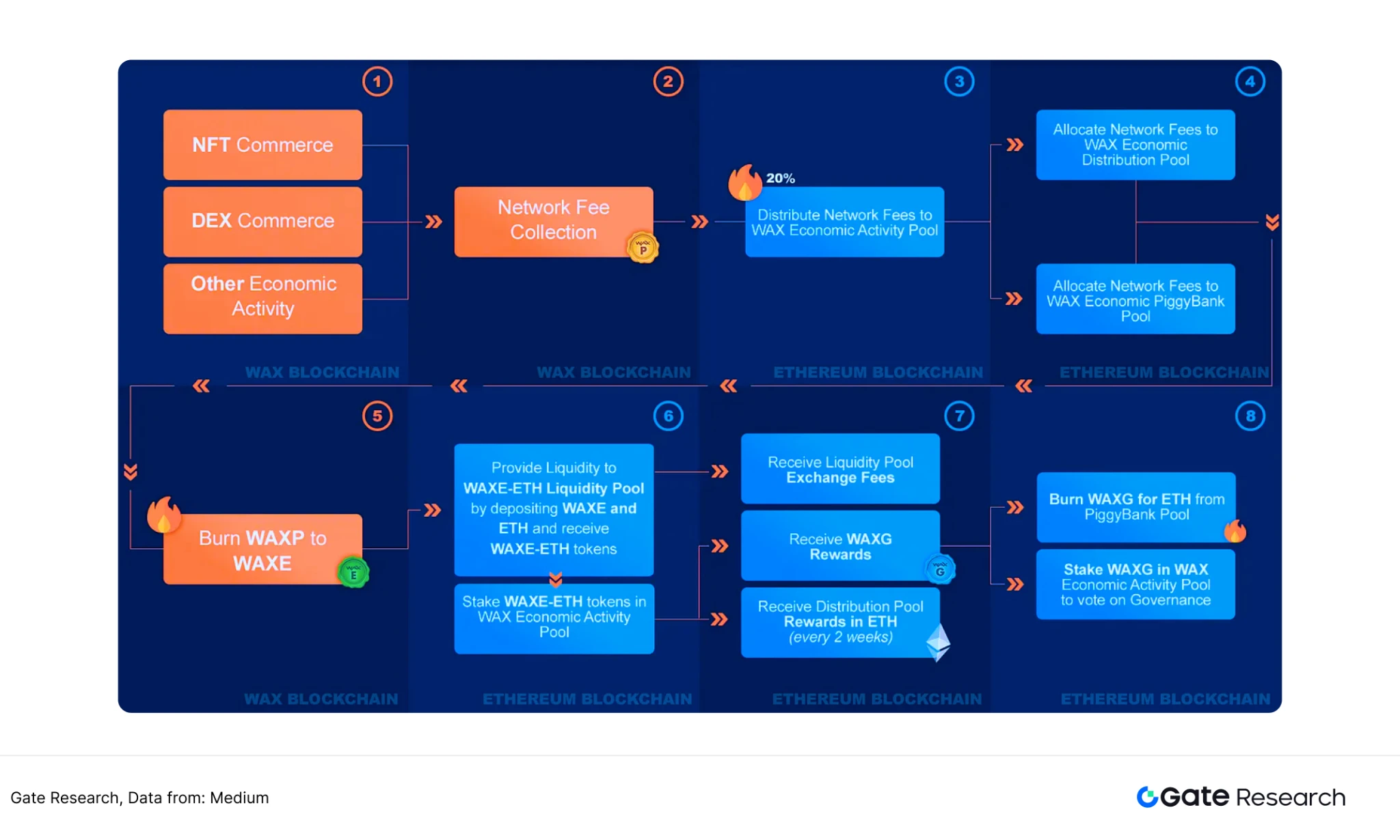

To better integrate with Ethereum, WAX has created three new types of tokens: WAXE, WAXE-ETH, and WAXG. WAXE is an ERC-20 token pegged to WAXP at a ratio of 1000:1 (the exchanged WAXP will be burned). In addition to being exchanged through WAXP, 80% of the on-chain NFT transaction fees are also rewarded in the form of WAXE, stored in the WAX Economic Activity Pool (WEAP). WAXE-ETH is the token obtained by liquidity providers (LPs) after injecting liquidity into the liquidity pool. WAXG is obtained by staking WAXE-ETH in WEAP, and these tokens grant holders additional governance rights and other benefits within the ecosystem. The WAXG mechanism further incentivizes user participation while deepening the connection between the WAX native chain and Ethereum-based DeFi activities.

3.1.3 WAX Public Chain Game Ecosystem

As one of the earliest established dedicated gaming public chains, WAX has seen over 5 years of ecological development, with more than 5,000 games on the WAX public chain, making it one of the public chains with the most gaming projects.

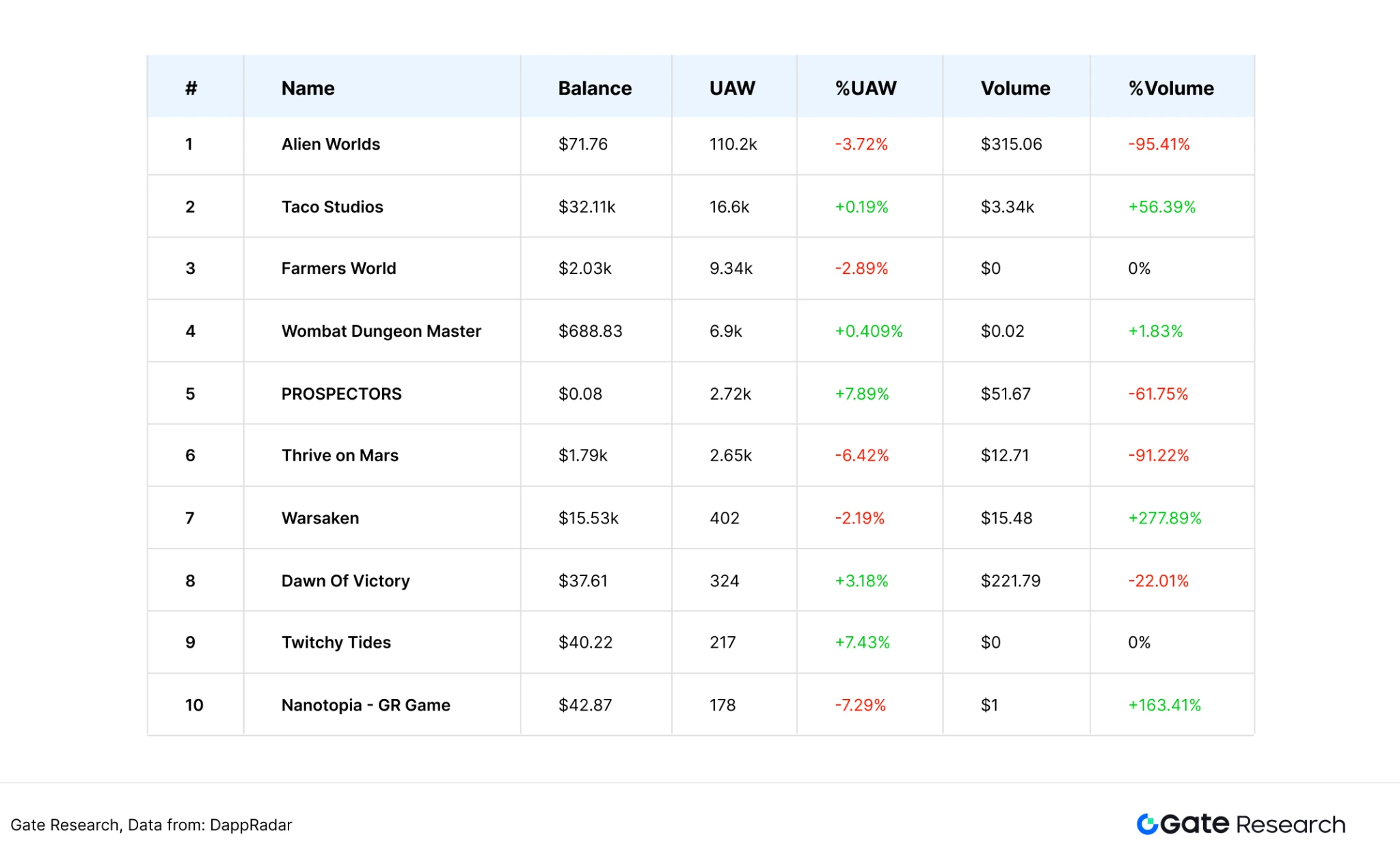

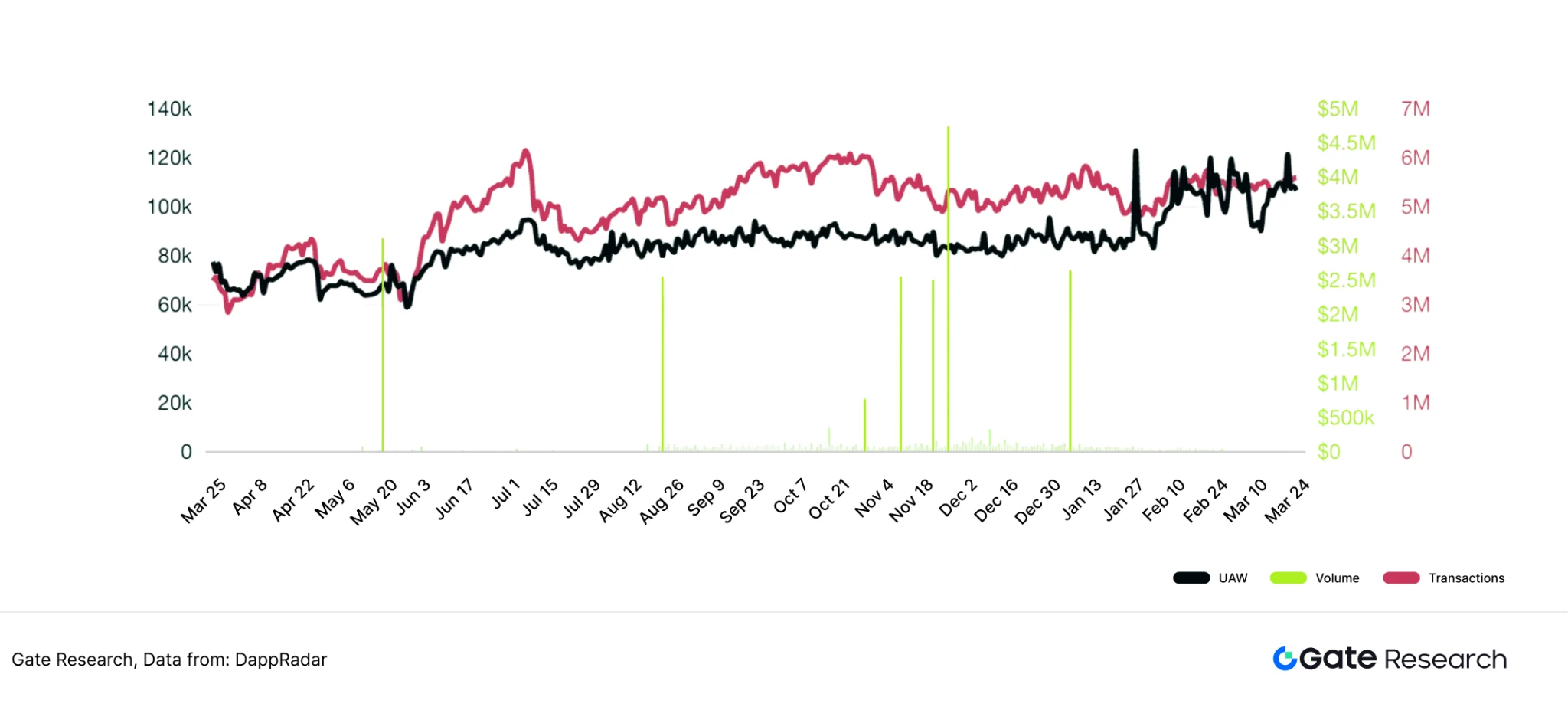

In the WAX public chain's game ecosystem, Alien Worlds leads in multiple data metrics, with over 110,000 UAW (unique active wallets) in the last 24 hours, while the second place, Taco Studios, has only 16,000 UAW in the same timeframe. Additionally, the daily transaction volume on this game chain exceeds 5 million, accounting for over 80% of the total transaction counts on the WAX public chain.

Alien Worlds is a space exploration game developed by Dacoco GmbH on the WAX public chain. Alien Worlds offers players land ownership, the ability to deploy tools, soldiers, and weapons, and to customize their own game characters. Since its launch at the end of 2022, the game's data has remained stable, closely tied to its mature gameplay. Land-building gameplay is currently a relatively successful model in the Play-to-Earn paradigm, where players purchase land NFTs and mine various resources to achieve considerable economic returns.

Besides Alien Worlds, other games on the WAX chain, such as TACO Studios, Farmers World, and Thrive on Mars, also follow land-building game mechanics, sharing similar underlying logic. This indicates that the main games on the WAX public chain are NFT-based games with strong financial attributes.

3.1.4 Overview of WAX Public Chain Strategy and Development

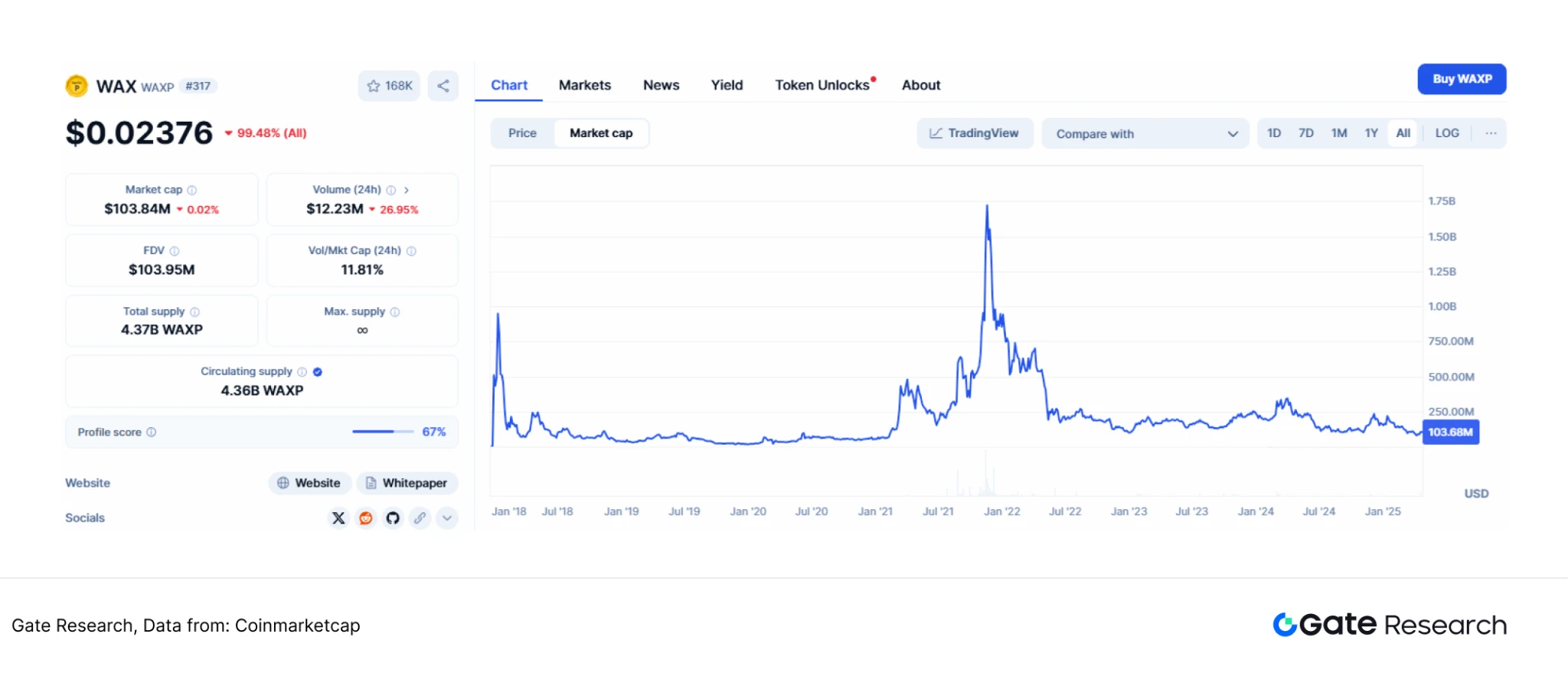

From the perspective of WAXP's market capitalization, the core team of the WAX public chain has not taken any actions regarding market cap management. WAXP's market cap has been declining since reaching $1.7 billion in November 2021, dropping to less than $100 million by March 2025 (the lowest point since March 2021). During the cryptocurrency bull market in 2024, its market cap still fell by over 32%, underperforming the market. If market cap is used as a criterion for judging project success, the strategic decisions of the WAX public chain over the past three years can be deemed a failure.

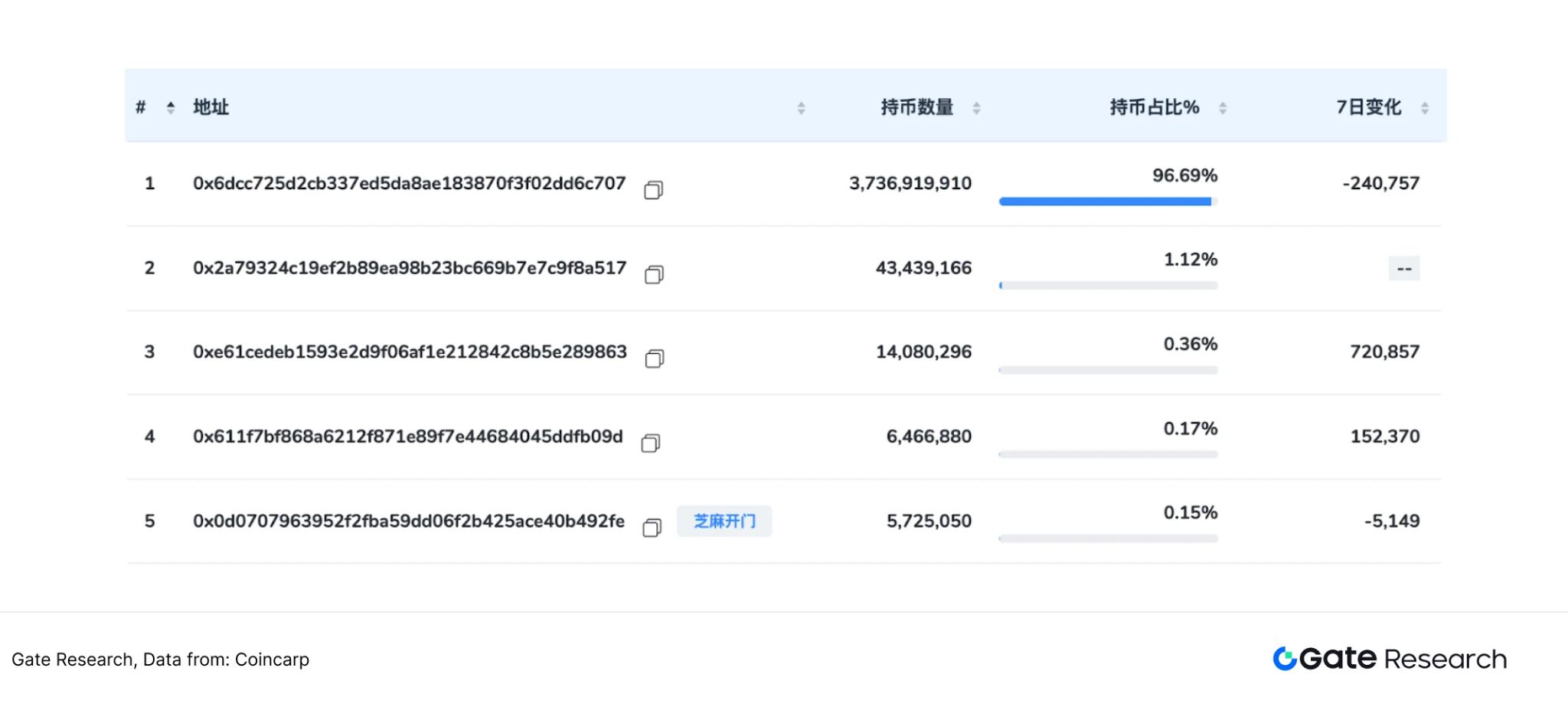

From the changes in WAXP holding addresses, data from Coincarp and Arkham both indicate a high degree of centralization for WAXP tokens. Over 96% of the tokens are held by the address 0x6dcc. Such a centralized holding distribution leads to the conclusion that the decline of WAXP is not due to the project team unlocking tokens and selling them; the core reason lies in the fact that the core team of the public chain has not regarded WAXP as a representation of the WAX public chain's value, neglecting market cap management.

In summary, WAX's current situation reflects the reality of many older application-oriented public chains (such as EOS, ICP, Conflux, etc.). After experiencing a significant drop, the token has fallen into a situation of declining trading volume and low price consolidation. There are not many new games emerging in the gaming ecosystem, with Alien Worlds and Farmers World being earlier projects that contribute the majority of trading volume on the WAX chain. The financial attributes of land-based NFTs are strong, but they do not have a high development threshold. The lack of new games has resulted in a lack of fresh blood in the ecosystem.

In terms of resource endowment, William Quigley, as one of the pioneers in the crypto industry, has significantly more resources than other public chains in issuing NFTs for classic IPs. Many brands, including DC, Marvel, and Street Fighter, have chosen to collaborate with WAX.

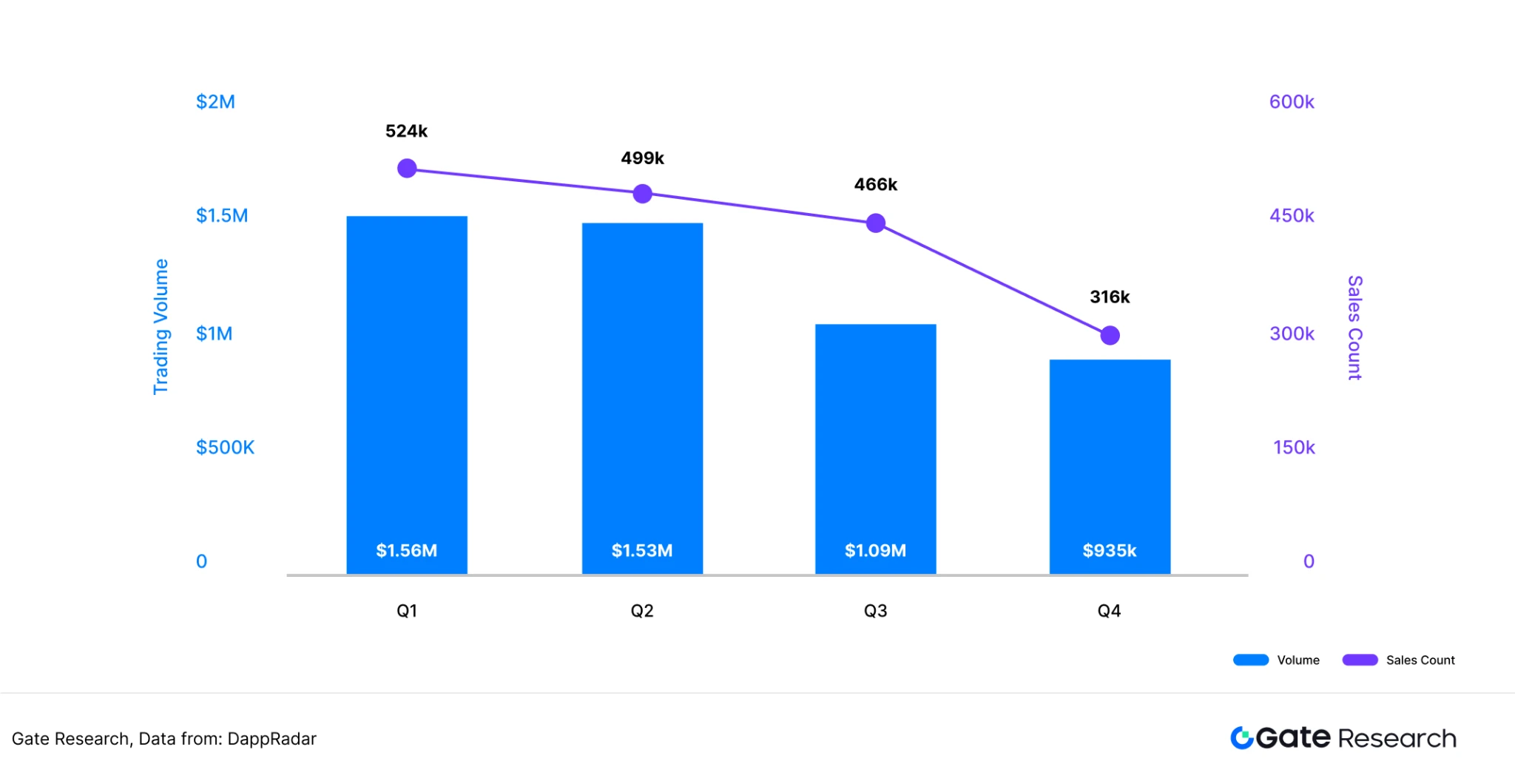

By the end of 2022, the total sales of NFTs on the WAX chain had exceeded $400 million, with the main distribution channel being the Atomic Hub platform under the WAX public chain. The Atomic Hub platform charges a 2% fee on NFT transactions. During the NFT boom from 2021 to 2022, the core team of the WAX public chain made substantial profits. Therefore, from an operational perspective, the team has shown clear signs of "lying flat" over the past three years, with NFT sales for the entire year of 2024 only amounting to $5 million.

3.2 Immutable

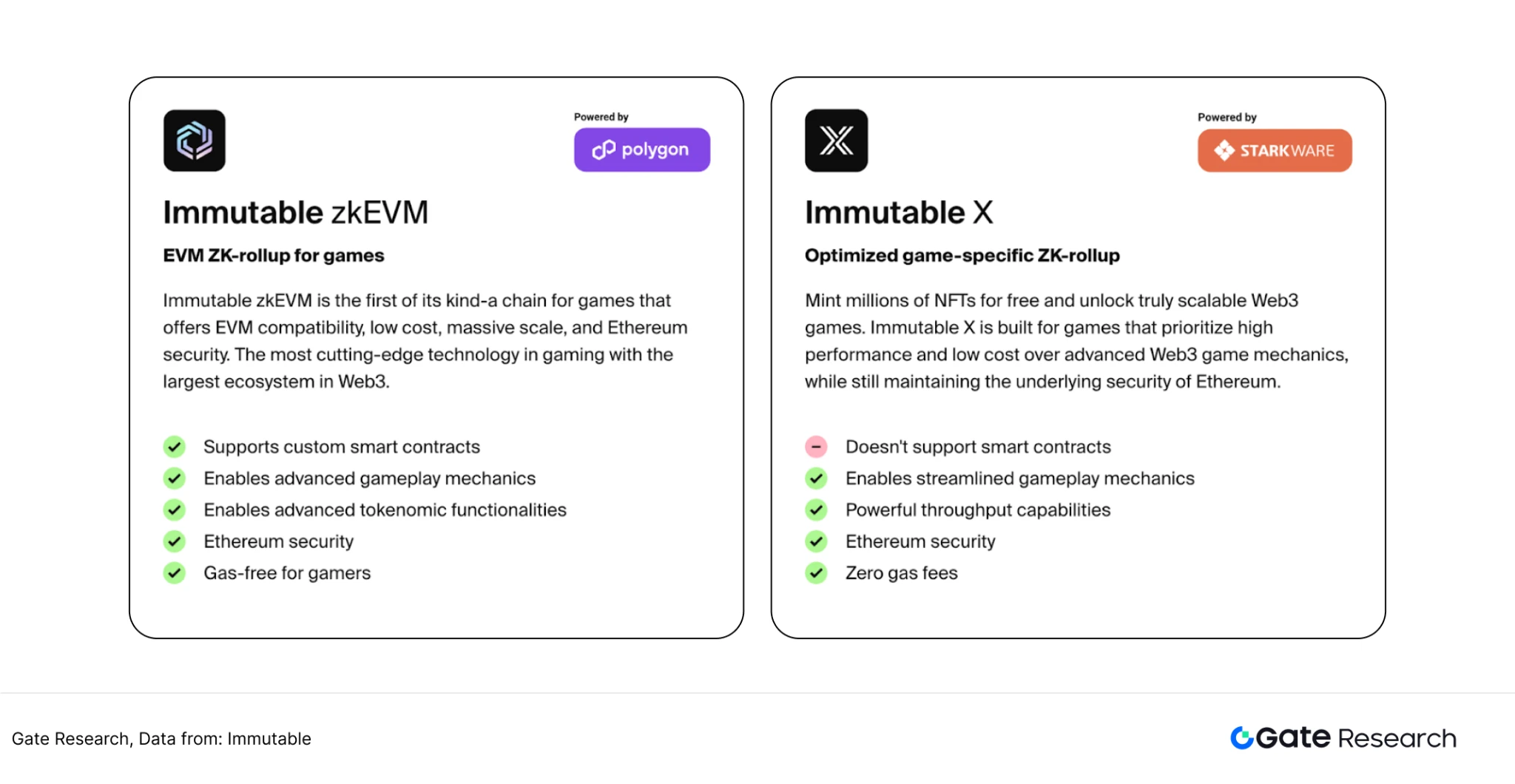

Immutable was officially founded in 2018 by brothers Robbie Ferguson (CEO) and James Ferguson (CTO), both of whom are seasoned professionals in the blockchain and gaming industries. ImmutableX Layer 2 (based on StarkEx) launched in 2021, focusing on high-performance scaling for NFTs and games. Immutable zkEVM (based on the Polygon technology stack) launched its mainnet in January 2024, further optimizing Ethereum compatibility and scalability.

3.2.1 Core Mechanisms of ImmutableX and Immutable zkEVM Public Chains

Both ImmutableX and Immutable zkEVM utilize ZK-Rollup packaging methods, with the former using the ZK-Stark proof system developed by Starkware to optimize the NFT trading experience, while the latter employs the ZK-SNARK proof system based on Polygon, fully supporting smart contracts. In terms of consensus mechanisms, both ImmutableX and Immutable zkEVM adopt the currently most widely used PoS mechanism.

● ImmutableX Consensus Mechanism

ImmutableX uses a Vault Merkle Tree to manage asset states, where each leaf node represents an asset vault, and non-leaf nodes are the hash values of child nodes. Its operational mechanism consists of two core components: first, an on-chain smart contract validator that ensures state security by storing root hashes and only allowing valid proof updates, currently adopting a time-lock upgrade design but ultimately planned to be immutable; second, the L2 proof logic written in Cairo language, responsible for verifying the legality of state transitions such as asset transfers. This dual verification architecture ensures both asset security and retains flexibility for system upgrades.

Immutable X employs STARK proof technology rather than the more common SNARK proof. STARK, as a new generation of zero-knowledge proof technology, addresses three core flaws of the SNARK scheme: the need for a trusted setup ceremony, lack of post-quantum security, and reliance on overly complex cryptographic implementations that are prone to errors. Although STARK proofs are larger in size and have higher on-chain publishing costs, the team believes this is a reasonable trade-off for stronger user security guarantees.

In terms of data availability (DA), Immutable X supports two modes: Rollup and Validium. In the Rollup mode, each batch of state changes is published to L1, adding a small linear cost to each transaction while retaining the security of L1; in the Validium mode, the Data Availability Committee (DAC) signs each batch of data, allowing users to successfully withdraw assets as long as there is one honest member in the committee. Currently, the DAC members include eight institutions, such as Immutable and StarkWare.

● Immutable zkEVM Consensus Mechanism

The Immutable zkEVM, developed in collaboration with Polygon, has a settlement layer and DA layer that are fundamentally the same as ImmutableX, with the difference being that the former uses a ZK-SNARK proof system that fully supports smart contracts and is compatible with Ethereum development toolchains (such as Hardhat and Truffle), reducing the migration costs for games.

3.2.2 Immutable Economic Model

Although ImmutableX and Immutable zkEVM are two different public chains, both have the governance token IMX, utilizing the same economic system. IMX is an ERC-20 token, with core functions including voting, staking, and payment.

In terms of payment, 20% of the Immutable protocol fees must be paid using IMX tokens. This fee can be paid directly with IMX or automatically converted by Immutable from the actual payment currency (such as ETH) into IMX on the open market. This means that users do not need to hold IMX tokens specifically to transact on the protocol.

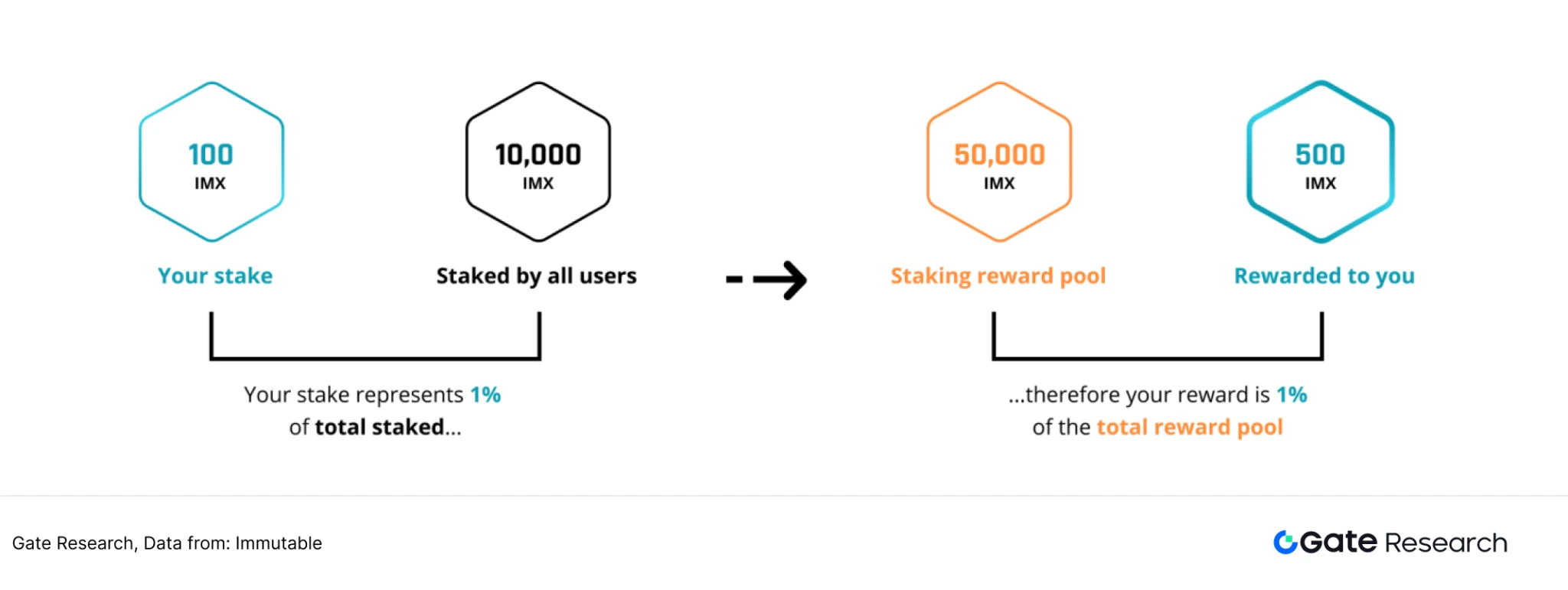

Regarding staking, the gas fees from transactions by gamers on both Immutable chains are placed into a reward pool, and holders who stake IMX tokens can earn IMX tokens from the gas fee reward pool. The reward amount for each user is proportional to the amount of IMX they staked in the current month relative to the total staked amount across the network. Similar to WAX's mechanism, Immutable requires stakers to participate in community governance; only those who have voted on governance proposals in the last 30 days can become qualified stakers. Additionally, Immutable requires stakers to complete a transaction within 30 days or hold an NFT to qualify as stakers. The author believes that the staking model of IMX provides a good deflationary mechanism for the entire system, as locked-up stakers can reduce market selling pressure, preventing the overall economic system from experiencing a high inflation rate.

In terms of community governance, token holders will be able to vote on token-related proposals through a decentralized governance mechanism. The scope of proposals includes: (1) token reserve allocation plans; (2) developer funding project votes; (3) daily reward mechanism activation; (4) token supply adjustments.

3.2.3 ImmutableX and Immutable zkEVM Game Ecosystem

● ImmutableX Game Ecosystem

The game types covered by ImmutableX are very diverse, including card games like Gods Unchained, pixel-style mini-games like Habbo X, and AAA titles like Illuvium. However, the UAW (unique active wallets) in the ImmutableX ecosystem is relatively low, with the highest UAW game being Gods Unchained, which has only 560 UAW in the last 24 hours, far less than the UAW of games in the WAX ecosystem. This phenomenon reflects that while ImmutableX games place more emphasis on player experience, their Play-to-Earn attributes are relatively weak, making them less attractive to gold farmers.

● Immutable zkEVM Game Ecosystem

The Immutable zkEVM, developed in collaboration with Polygon, allows games originally on Ethereum and Polygon chains to migrate to the Immutable ecosystem at a lower cost. Currently, the exclusive game Immortal Rising 2 on Immutable zkEVM has reached up to 103,000 UAW, ranking first among exclusive games. This game is an MMORPG mobile game that has significantly optimized the map and gameplay based on the first generation of Immortal Rising, achieving high popularity. Compared to the low activity of its twin chain ImmutableX, Immutable zkEVM has gradually found a balance between gaming experience and financial attributes.

3.2.4 Immutable Strategy and Development Overview

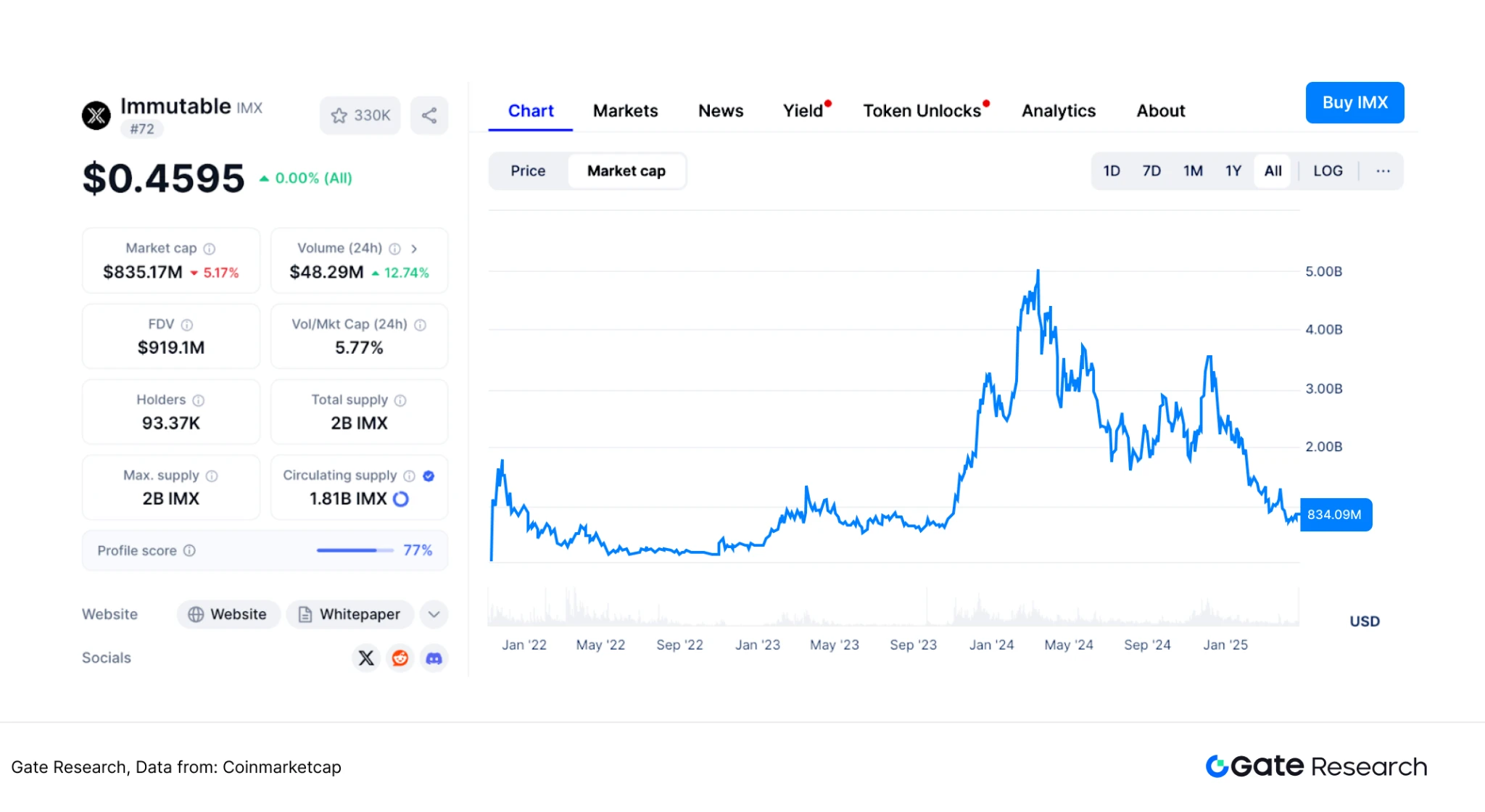

Since the launch of IMX on multiple exchanges at the end of 2021, its price and market capitalization have experienced a significant rollercoaster. With prior investments from several well-known VC funds, including Naspers Ventures, Digital Galaxy, and SBF, IMX was valued at $1 billion when it completed its Token Generation Event (TGE) in November 2021. By March 2024, the market capitalization of the IMX token surpassed $5 billion, reaching an all-time high. However, after that, the token's market capitalization declined overall, dropping to $800 million by March 2025.

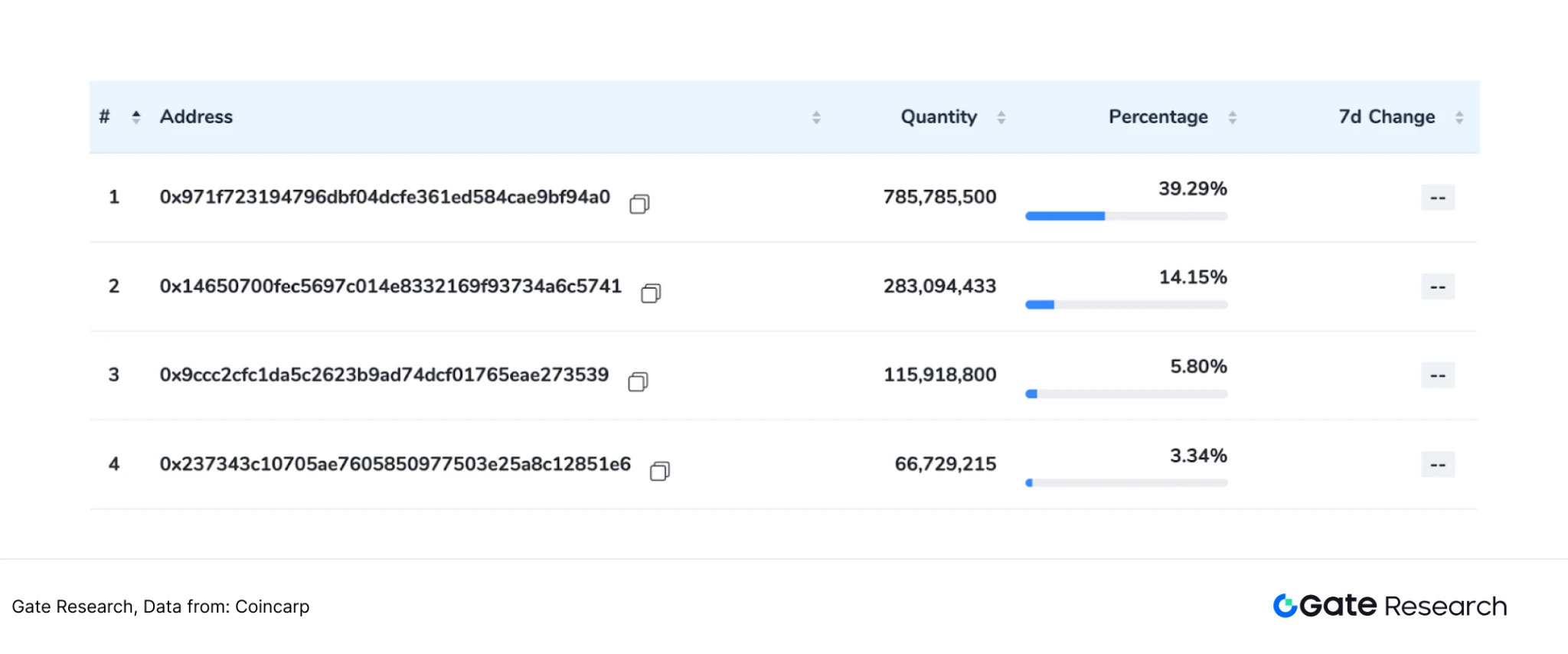

After completing the TGE, the project team's contract address has sold tokens for cash every time it reaches an unlocking time point. The IMX Foundation Treasury CA (0x237) has cashed out over 1 billion tokens, while the IMX Dev Treasury CA (0x9cC) has cashed out over 300 million tokens. However, to stabilize the token price, the other two contract addresses of IMX have cumulatively bought back 1.06 billion tokens during the selling period. As of March 2025, the four addresses collectively hold 1.25 billion tokens, accounting for 62.5% of the total issued tokens.

In terms of resource endowment, Immutable, as a star project, has already gained favor from capital and industry during its startup phase. Throughout the entire game development chain, Immutable has established strategic partnerships. In game development, top studios such as Mineloader, Ubisoft Innovation Lab, and Planetarium Labs have chosen to place their games on the Immutable public chain. To ensure real-time on-chain trading of items for gamers, Immutable has reached a strategic partnership with AWS, which can support 9,000 transactions per second. In terms of distribution platforms, several Immutable games have launched on the Epic distribution platform, and Immutable has also partnered with game retailer Gamestop. Additionally, to reach players, Immutable has collaborated with gaming guilds such as YGG and Merit Circle to encourage guild players to participate in games on the Immutable chain.

In summary, the Immutable project, led by seasoned gaming professionals the Ferguson brothers, consistently adheres to a development path of "high investment, high output." Although the current market capitalization of IMX is at a historical low, the pace of new game launches within the ecosystem remains stable, and the global partnership landscape continues to expand. In response to the pressure of declining active addresses (UAW) on the ImmutableX chain, the team quickly initiated deep technical integration with Polygon, achieving an upgrade in Ethereum compatibility through Immutable zkEVM and successfully migrating 15 games from the Polygon chain to expand the ecosystem. From the perspective of strategic execution, the team's agile response to market changes and the efficiency of implementing leading IP chain transformation solutions validate its pragmatic and efficient operational genes.

3.3 Ronin

As mentioned at the beginning of this article, Ronin is a highly representative public chain specialized for gaming. Unlike other public chains that first build underlying infrastructure and then develop gaming ecosystems, Ronin was created by the Axie Infinity team after encountering transaction bottlenecks on Ethereum, resulting in a high-performance public chain. The Ronin mainnet launched in 2021, and in addition to its core game Axie Infinity, Ronin has partnered with multiple game studios to expand its gaming ecosystem.

3.3.1 Ronin Public Chain Core Mechanism

In terms of consensus mechanism, Ronin adopts the DPoS mechanism used by EOS public chains like WAX, enhancing the speed at which nodes process transactions. For settlement, Ronin employs a modular approach using ZkEVM, improving performance while ensuring the security of transactions on the public chain.

3.3.1.1 Ronin Consensus Mechanism

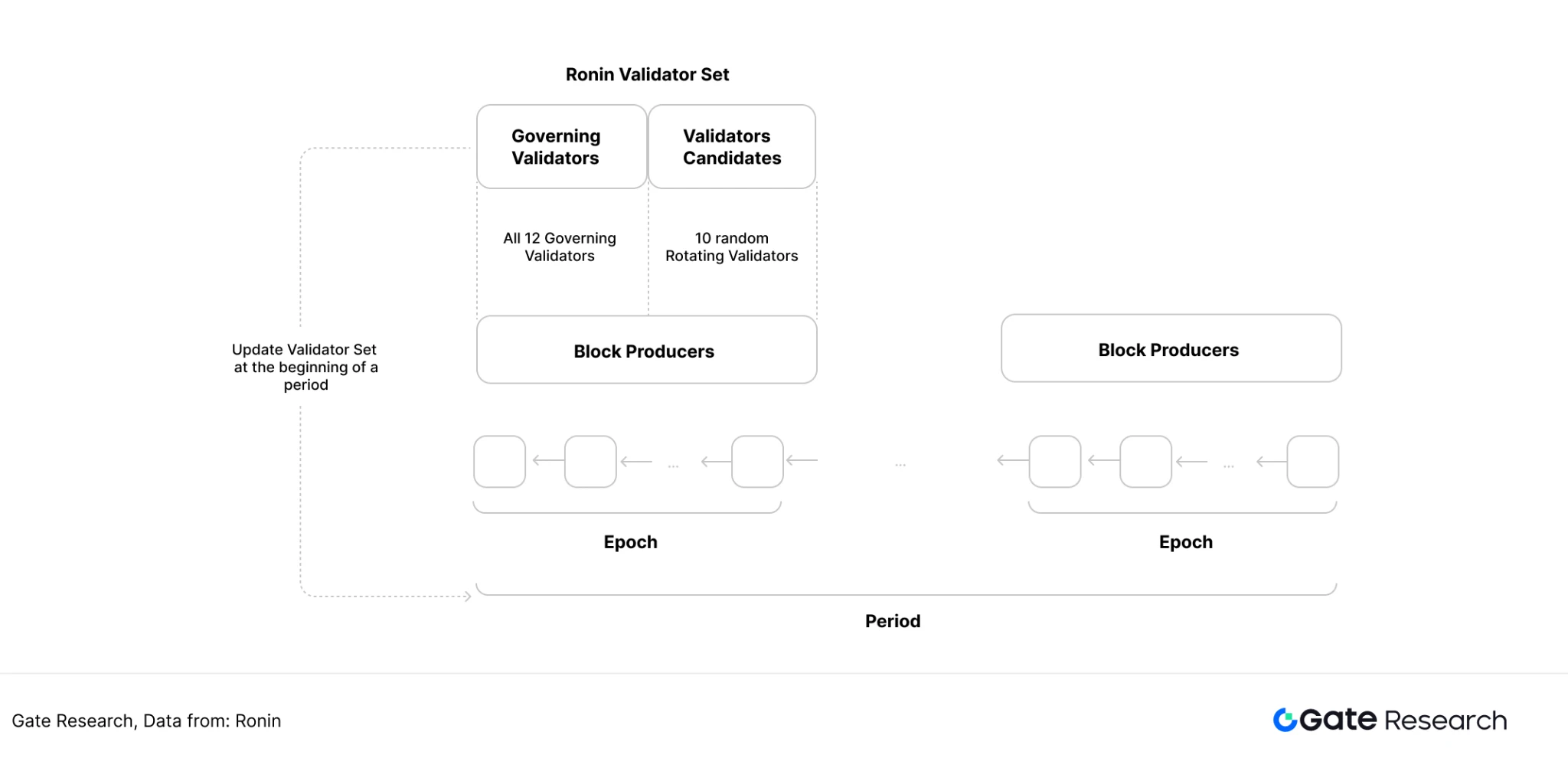

The DPoS mechanism of Ronin is divided into four core modules: governing validators, block production, final voting, and delegators. The governing validators are similar to the guilds in the WAX mechanism and are elected by the community.

● Governing Validators

The validator selection process through staking may introduce new attack risks. If an attacker controls more than 51% of the tokens, they can take over the entire blockchain. To prevent such attacks, the community-elected governing validators will assist in safeguarding against them. Besides governing validators, any token holder can register as a validator candidate.

● Block Production

Every cycle (approximately every 10 minutes), a random group of block producers is selected to produce blocks, with 12 blocks reserved for governing validators. The remaining 10 block slots are selected based on the staking amounts of validator candidates.

● Final Voting

All validators can participate in finality voting. The voting weight of a validator is proportional to their staking amount.

● Delegators

Delegators can delegate their staked assets to any validator of their choice, thereby increasing the chances of the validator being selected as a standard validator and gaining access to block production.

3.3.1.2 Ronin Settlement Mechanism

To enhance the scalability of the public chain, Ronin employs Zk Rollup, which packages transactions for quick settlement on the mainnet. The ZK prover is seamlessly integrated into the Ronin protocol, allowing validators to establish their own ZK-EVM. Validators can initiate the ZK-EVM by submitting transactions containing the necessary information for the new ZK-EVM chain. Once initiated, validators must maintain their state and cannot choose to exit the validator set.

3.3.1.3 Ronin Cross-Chain Bridge

As Ronin is an EVM-compatible public chain, it interacts with the Ethereum mainnet by creating cross-chain bridges. The Ronin Bridge suffered a hacker attack in March 2022, resulting in losses exceeding $600 million. To enhance the security of the cross-chain bridge, the bridge between Ronin and Ethereum is currently managed by 22 bridging operators to ensure safe and reliable cross-chain transactions. For each transaction, each bridging operator is responsible for verifying its validity and voting to approve or reject it. To ensure a high level of security and consensus, transactions can only be executed if at least 70% of the bridging operators approve them.

3.3.2 Ronin Public Chain Economic Model

RON is the governance token of the Ronin public chain, encompassing a series of functions including staking, payment, and governance:

● Staking

Users can stake RON in the delegated proof-of-stake consensus. Validators stake RON to run validator nodes and validate blocks to earn rewards. Users delegate RON to validators to further enhance economic security and receive a portion of the rewards.

● Governance

Holders can participate in network governance decisions in the future and influence the use of the Ronin treasury, which receives fees from decentralized applications (such as DEX and NFT markets).

● Payment

Games built on the Ronin public chain typically use RON as the payment currency for key revenue sources, such as purchasing game items, minting NFTs, and trading tokens.

● Exclusive Opportunities

Stakers and holders of RON have received airdrops, whitelist opportunities, and allocations for token sales of projects built on Ronin.

3.3.3 Ronin Public Chain Game Ecosystem

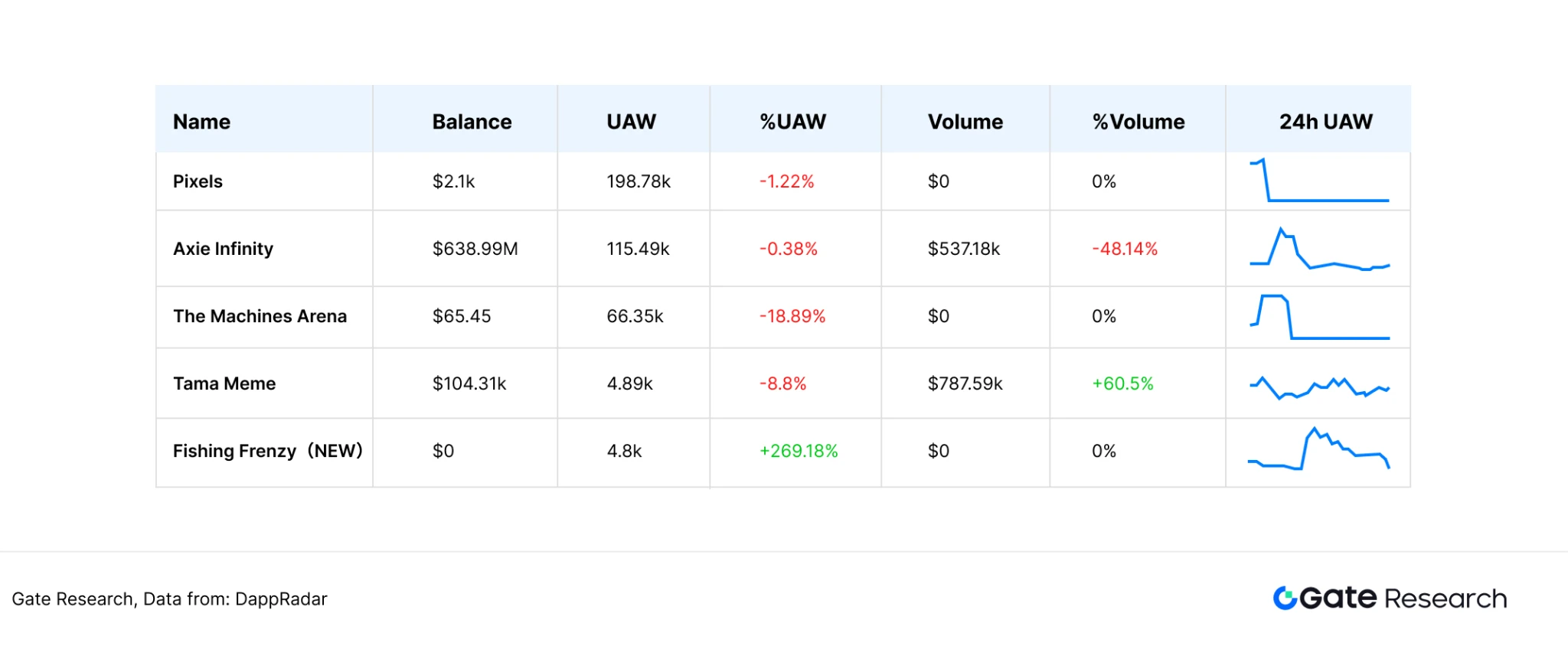

From a data perspective, Ronin currently has the most hit games among public chains, with multiple games including Pixel, Axie Infinity, and The Machines Arena each surpassing 50,000 UAW. In terms of game styles, the Ronin public chain's game ecosystem includes various types of games such as MMORPG, RTS, turn-based, and simulation management. The author believes that even compared to the strong gaming ecosystems of general public chains like BNB and Polygon, Ronin, with its multiple exclusive games featuring deep gameplay, is one of the best public chains for building a gaming ecosystem.

3.3.4 Ronin Strategy and Development Overview

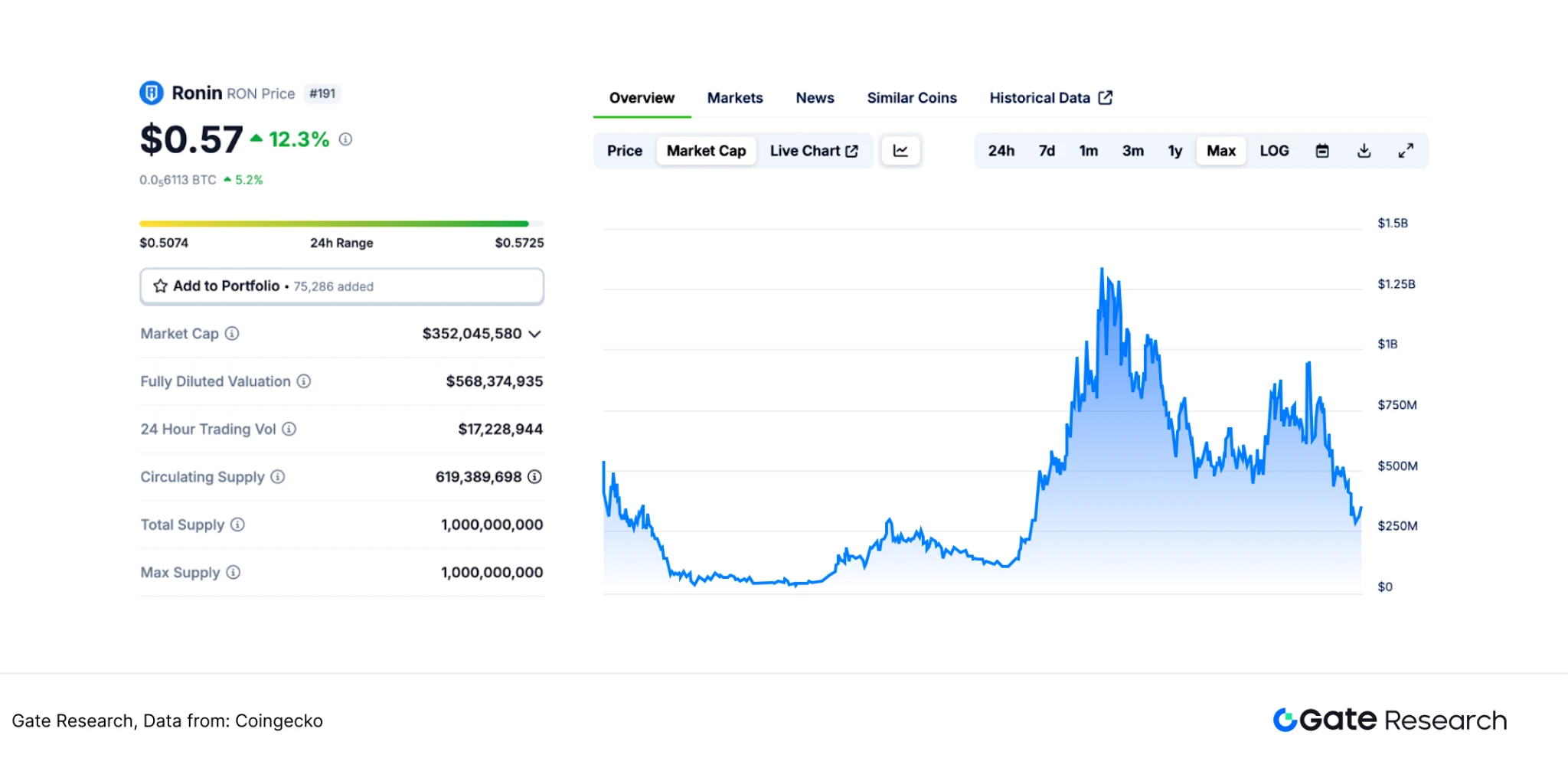

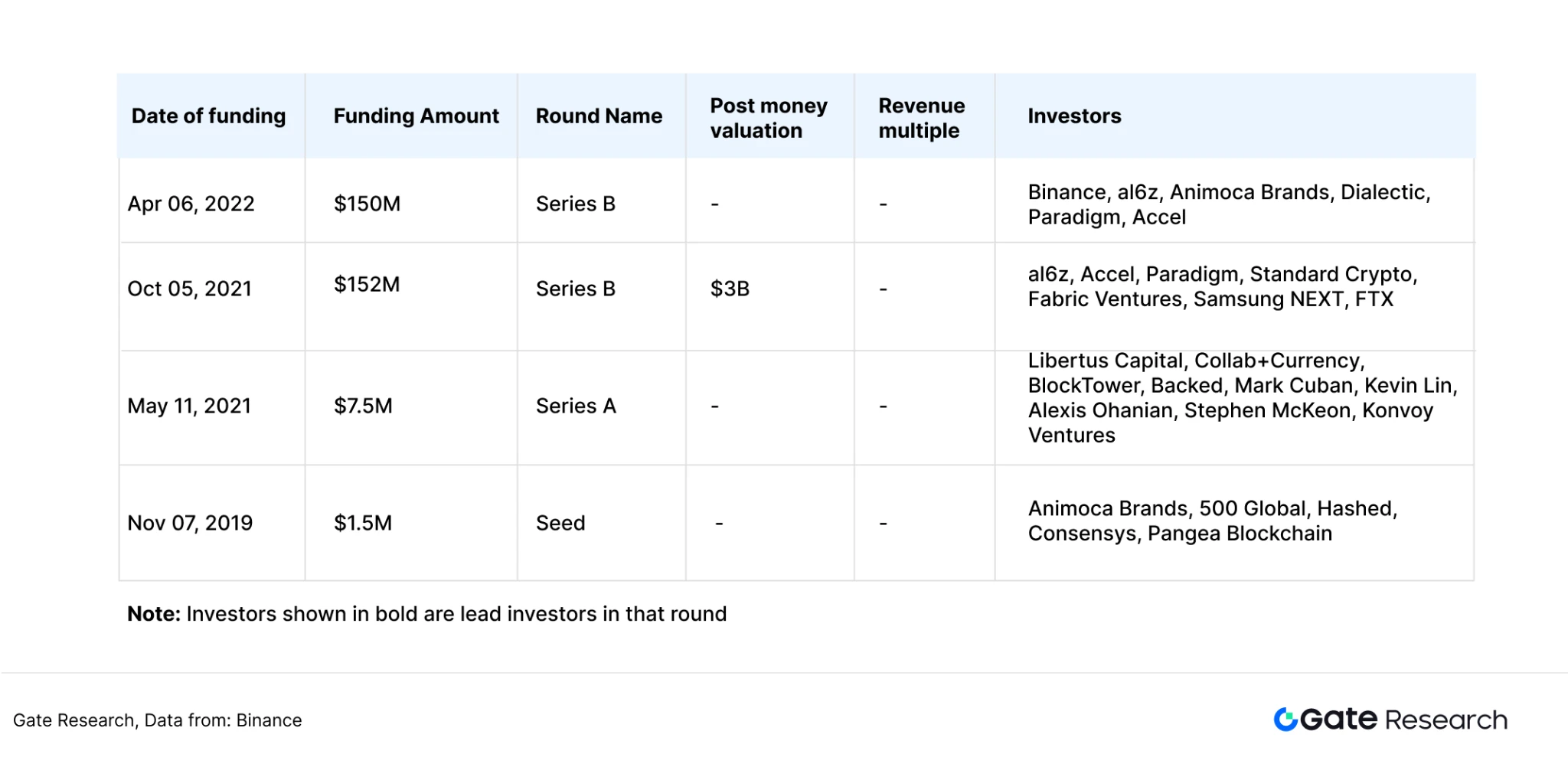

From the perspective of token market capitalization, RON has experienced two rapid growth phases in market capitalization since 2024, in March and December 2024, with its rise and fall cycles closely mirroring those of the broader cryptocurrency market. Unlike other vertically-focused gaming public chains that finance themselves primarily through the public chain, the Ronin team, Sky Mavis, finances itself as a game studio. After the success of Axie Infinity, Sky Mavis studio received investments from top funds such as a16z and Animoca Brands.

As Sky Mavis is a game studio with rich development experience, the Ronin Network itself has a wealth of exclusive game resources. In April 2024, the MOBA game The Machines Arena completed its public testing, consistently ranking third in UAW data within the Ronin ecosystem, only behind Axie and Pixel. The year 2024 marks a transition year for the Ronin game ecosystem, with The Machines Arena, Lumiterra, and Apeiron all launching on the Ronin chain this year, showing impressive data performance and maintaining the heat of the Ronin ecosystem. If WAX has rich IP resources for issuing NFTs and Immutable excels in integrating the entire game chain, Ronin specializes in game development itself. Continuously delivering high-quality exclusive game content is Ronin's core competitive advantage.

4. Conclusion

Gaming is a relatively emerging industry, with Web2 online games having only a history of about 50 years. From the development history of Web2 games, high-quality game studios have the opportunity to grow into monopolistic oligarchs in the industry (such as Blizzard Entertainment and Zynga), while internet companies with strong financial capabilities will also expand their businesses into the gaming sector, becoming leaders in the gaming industry (such as Tencent and NetEase). A similar situation exists in the Web3 space, where Sky Mavis, with its hit game Axie Infinity, has gradually evolved from a game studio into a giant in the Ronin gaming ecosystem; meanwhile, general public chains like Polygon and OpBNB, with their strong financial backing, have also released several influential games.

Game Chain has become a traffic entry point for competing for gaming resources, with multiple game distribution platforms, including Xterio, transforming to develop game-specific public chains. In the future, dedicated gaming public chains will occupy a larger share of the gaming market, with more complete infrastructure and more influential games becoming the core competitive advantages of dedicated gaming public chains.

Data Sources

Medium, https://medium.com/electric-capital/electric-capital-developer-report-2021-f37874efea6d

Footprint Analytics, https://www.footprint.network/@Vent/Axie-infinity

blockchaingamer, https://www.blockchaingamer.biz/features/29764/31-percent-blockchain-games-discontinued-canned/

Blockchaingamer, https://www.blockchaingamer.biz/news/34600/ton-320-percent-growth-q3-2024/

Footprint, https://www.footprint.network/chart/Daily-Tnx-Stacked-by-chain-Chain-stats-Duplicate-fp-52243

Medium, The King of NFT Public Chains - Can It Reproduce Past Glory - A Comprehensive Analysis of WAX

DappRadar, https://dappradar.com/narratives/gaming/games/chain/wax

Footprint, https://www.footprint.network/chart/Gaming-Transactions-on-Wax-Chain-by-Games-fp-33492

DappRadar, https://dappradar.com/dapp/alien-worlds/analytics?range-ha=1y

Coinmarketcap, https://coinmarketcap.com/currencies/wax/

Coincarp, https://www.coincarp.com/currencies/wax/

Dappradar, https://dappradar.com/blog/wax-dapp-ecosystem-q4-2024-report

Immutable Whitepaper, https://support.immutable.com/hc/en-us/articles/9405590951055-Immutable-Whitepaper

DappRadar, https://dappradar.com/rankings/protocol/immutablex?range=24h

DappRadar, https://dappradar.com/rankings/protocol/immutablezkevm

Coinmarketcap, https://coinmarketcap.com/currencies/immutable-x/

Coincarp, https://www.coincarp.com/currencies/immutablex/richlist/

Ronin Whitepaper, https://docs.roninchain.com/basics/white-paper

DappRadar, https://dappradar.com/chain/ronin

Coingecko, https://www.coingecko.com/en/coins/ronin

Binance, https://www.binance.com/ar/square/post/8351263239746

Gate Research Institute

Gate Research Institute is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risks. Users are advised to conduct independent research and fully understand the nature of the assets and products they are purchasing before making any investment decisions. Gate is not responsible for any losses or damages resulting from such investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。