Original Author: Yang Ge Gary

During the period around several Crypto conferences in North America in Q2 2025, the GENIUS Act (Guidance and Establishment of the U.S. Stablecoin National Innovation Act) was passed in the U.S. Senate on the 19th with a vote of 66 in favor and 32 against. Within less than a week, various financial and Crypto institutions rapidly iterated, and as a friend put it, the entire market became agitated.

The uniqueness of this act lies in its potential to significantly impact both the short-term and long-term financial economy globally, with many layers of implications that build upon each other, much like a major earthquake occurring close to the surface. If the GENIUS Act is successfully implemented, it will cleverly mitigate the impact of Crypto on the current financial economic status of the U.S. dollar and U.S. Treasury bonds, while also linking the growth of the dollar to the value and liquidity of the Crypto Market. Essentially, it is transforming the existing advantage of the dollar as a price anchor into a long-term advantage as a value anchor, truly deserving the name "Genius."

tl;dr

The fundamental reasons for the decline in traditional dollar control.

Recognizing the trade-offs and retreating for advancement in the trend of Crypto driving changes in the global monetary system.

3. The nominal and substantive purposes of the GENIUS Act

4. Insights from DeFi Restaking for the fiat currency world and the currency multiplier of shadow currencies

Gold, the dollar, and Crypto stablecoins.

Global market feedback and dramatic changes in financial transactions and assets after the act takes effect.

1. The fundamental reasons for the decline in traditional dollar control

The decline in the dollar's influence in the global economy has multiple dimensions. From a long-term perspective, the resource dividends from the Age of Exploration to World War II have been largely exhausted. In the short term, the effectiveness of economic policy regulation is gradually diminishing. However, the essential factors contributing to the current situation can be summarized in four points:

i) The rapid rise of the global economy and national powers has reduced the necessity of using the dollar as the sole currency for global trade and financial settlement. More countries and regions are establishing their own trade and currency settlement systems independent of the dollar.

ii) During the COVID-19 period (2020-2022), the U.S. excessively issued over 44% of the dollar supply, with M2 growing from $15.2 trillion to $21.9 trillion (Federal data), leading to an irreversible decline in dollar credit post-pandemic.

iii) The internal U.S. Federal system's methods for regulating monetary and fiscal policy have become rigid and entropic, with severe asymmetry in capital efficiency and wealth distribution, failing to adapt to the needs of digitalization and the new paradigm of AI-driven economic growth.

iv) The rapid rise of a decentralized Crypto financial system, compounded by the above environmental context, has destructively disrupted the traditional financial economic system based on national credit established since the Bretton Woods Agreement.

It is worth mentioning that veteran financial entrepreneurs like Ray Dalio and some politicians have exhibited dogmatic inertia in their understanding of the Thucydides Trap in the face of the above environment. Many have believed for the past decade that the Thucydides Trap still exists or is about to occur between China and the U.S., even using this topic as a basis for lobbying or investment strategies. In fact, the issues faced by China and the U.S. are entirely consistent and should be categorized under the same side of the Thucydides Trap, while the other side represents the Crypto financial system and the production relations of decentralized governance in the digital age. How to confront this inevitable trend of transformation is the transitional issue that the upgraded paradigm of the Thucydides Trap in the new era should address. Clearly, the GENIUS Act has grasped this point.

2. Recognizing the trade-offs and retreating for advancement in the trend of Crypto driving changes in the global monetary system

Based on the above, the decision of the GENIUS Act is essentially a trade-off, a retreat for advancement: it signifies that the Federal Reserve is beginning to accept the reality of the declining influence of the traditional dollar under the existing financial system, actively further delegating the issuance and settlement rights of the dollar (Note: Most of the offshore dollars in fiat currency also come from the Federal Reserve's off-balance-sheet offshore bank credit expansion, which belongs to shadow currency. The authenticity of issuance and settlement is controlled based on access systems and compliance networks, and is backed and filtered by sovereign-level central banks). In the face of the inevitable trend of Crypto financial development, it will take advantage of the situation, drawing on the advanced practices of DeFi Restaking combined with the experience of off-balance-sheet expansion of offshore dollars in foreign bank systems, by encouraging compliant institutions to issue stablecoins to form a new type of "on-chain offshore structure" known as "on-chain shadow currency," further amplifying the currency multiplier effect of circulating dollars.

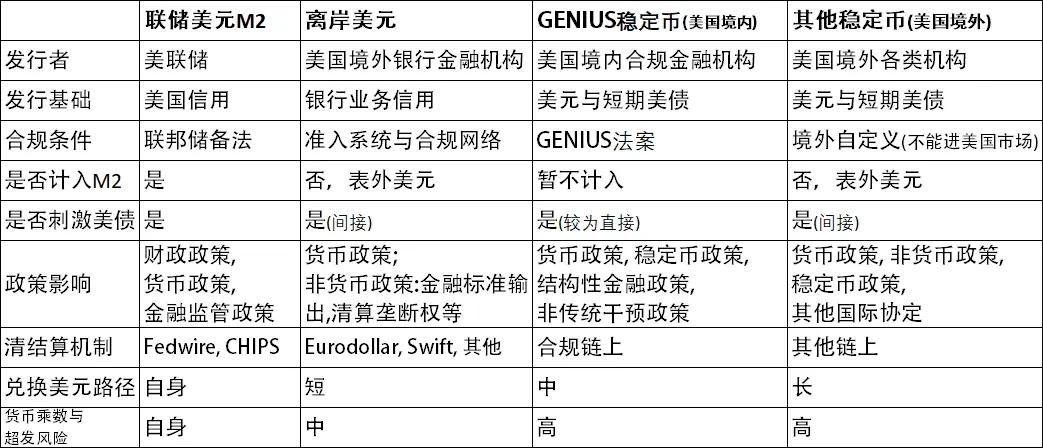

The following table compares the characteristics of different levels and types of dollars with various shadow currency dollars:

This decision and initiative of the GENIUS Act will significantly help the dollar to "re-anchor," not only restoring confidence among holders of U.S. Treasury bonds and dollar assets but also allowing off-balance-sheet dollars to rapidly expand by leveraging the growth of the Crypto Market, achieving a dual effect of risk mitigation and maximizing benefits.

3. The nominal and substantive purposes of the GENIUS Act

The nominal and substantive purposes of the GENIUS Act are clearly different. Simply put: internally, it is for compliance regulation; externally, it serves as a model for publicity. It provides a policy template for financial management departments in other countries and regions, using the U.S. market as an example to offer execution templates for financial institutions in other countries and regions, enabling faster use of dollar stablecoins anchored to fiat currency in the global Crypto Market.

In the short term, the internal goal is, of course, direct compliance management, ensuring stability during the rapid development of the Crypto Market impacting traditional financial markets, which is a routine operation of the U.S. financial legal system. In the long term, this has achieved an absolute effect of model publicity, maximizing the inherent advantages of the dollar as a price anchor in the traditional financial system, while cleverly addressing the pain point that there are no other stablecoin price anchors in the Crypto Market besides the dollar. It does this through a semi-compliant and semi-open approach—specifically mentioning in the act that foreign stablecoin issuers without approval from U.S. regulatory agencies are not allowed to operate in the U.S. market, which essentially suggests that they can operate in foreign markets, thereby stimulating and confirming the global reliance on and use of dollar stablecoins during the upgrade of Crypto Finance.

On May 21, the Hong Kong Legislative Council passed the stablecoin ordinance draft, and it is believed that the Japanese Financial Services Agency (JSA), the Monetary Authority of Singapore (MAS), and the Dubai Financial Services Authority (DFSA) will soon respond with corresponding policies. Due to the special importance of the stablecoin ecological niche, combined with the rapid iterative changes triggered by the GENIUS Act, this poses a significant challenge for countries and regions with preemptive legislative measures, making the balance of boundaries and looseness very important. Too loose could lead to market chaos and management difficulties, while too tight could quickly leave the Crypto Market behind, losing competitive advantages in the next phase of finance, payments, and asset management. Additionally, the quality of the legislation directly determines the degree of peg with dollar stablecoins in the next phase; if the peg is too deep, it could rapidly lose the financial market independence of its own stablecoins (Note: Due to the global high liquidity and high interactivity characteristics of the Crypto Market, the independence of other fiat stablecoins relative to dollar stablecoins may be more difficult to establish, and the peg may become more rigid). Furthermore, countries with reactive legislation will not fare better, facing the same dilemma of market chaos due to rapid paradigm shifts and the risk of losing competitiveness due to outdated practices.

4. Insights from DeFi Restaking for the fiat currency world and the currency multiplier of shadow currencies

A partner from an asset management firm told me last week that the next stage of global finance poses significant challenges, requiring a dual understanding and cross-comprehension of traditional finance and Crypto; otherwise, one will quickly be eliminated by the market. Indeed, in the past two cycles of DeFi development, the Crypto Market has independently evolved a set of digitized, protocol-based economic science systems, from protocol logic, tokenomics, and financial analysis methods and tools, to the complexity of business models that far exceeds that of the traditional financial system. Although Crypto DeFi differs from traditional finance, it still continuously requires the experience system of traditional finance for calibration and comparison during its development. The two learn from each other, rapidly develop, and continuously couple, forming a new financial system.

The introduction of the GENIUS Act bears a high degree of similarity to the Staking, Restaking, and LSD of DeFi in past cycles, or rather, it is another extension of the same methodology in the fiat currency world.

For example, in DeFi: using ETH to obtain rebase stETH through Lido, staking stETH on AAVE to receive 70% of its value in USDC, and then using the USDC to continue purchasing ETH in the market. The ideal model for this repeated operation is a geometric series with a ratio of q=0.7, ultimately yielding a currency multiplier of 3.3.

This process can soon be realized under the GENIUS Act based on fiat stablecoins: suppose a Japanese financial institution outside the U.S. issues USDJ by staking U.S. Treasury bonds under compliance conditions, obtaining JPY through off-ramp and converting it to USD, then purchasing U.S. Treasury bonds to form a cycle. In this repeated operation, there are several assumptions for the multiplier: one is the staking rate (which could be full, discounted, or over-collateralized), the second is the on/off-ramp and exchange friction, and the third is the market loss rate. After accounting for all these, a single cycle's geometric multiplier q can also be calculated, ultimately leading to a currency multiplier of 1/(1-q). This multiplier represents the ideal financial amplification currency multiplier that the GENIUS Act and subsequent stablecoin legislation in various countries regarding dollar and U.S. Treasury bond holdings may achieve.

Of course, this does not account for the excessive issuance by some informal institutions, as well as the further restaking of assets tokenized from stablecoins to obtain other types of shadow assets. The flexibility of stablecoins will far exceed that of the derivatives market in the fiat currency world, and the "stablecoin asset nesting" will undoubtedly bring unimaginable shocks to the traditional financial market.

5. Gold, the dollar, and Crypto stablecoins

In a previous article discussing the dramatic changes following Trump's election victory, I mentioned the faith replacement of the three generations of financial system anchors, which are: gold, the dollar, and Bitcoin, from a macro perspective. From a micro perspective, all three generations of finance require a daily settlement unit to hold in hand; previously it was a gold ingot, a dollar bill, and what will it be in the future?

The previous discussion highlighted the pain point in the Crypto Market where, apart from the U.S. dollar (stablecoin), there is no (native Crypto) currency or asset that can serve as a stablecoin price anchor. The reason is that pricing is very important. In real-world transactions, a product or service needs to have a relatively stable amount as a reference price; it cannot be that a cup of Americano was 0.000038 BTC yesterday and is 0.000032 BTC today. This would cause consumers and traders to lose their ability to judge value. The most important characteristic of a stablecoin is stability, which helps consumers and traders assess and understand value through pricing. Price fluctuations around a stable price act as a dynamic regulator, balancing purchasing power and economic development.

Why the U.S. dollar (stablecoin)?

First, the U.S. dollar has established relative universality in the fiat currency world. Second, it is difficult to create a better consensus definition. Of course, I have discussed this issue with a few friends: a world currency stablecoin. Suppose its issuance is based on a more reasonable pricing mechanism derived from the total historical GDP and annual GDP increments globally. Even if it has better economic and financial efficiency than the current dollar, it would still be challenging to gain consensus to replace the position of the dollar stablecoin in social development. This is similar to the invention of Esperanto 140 years ago; even with the greatest algorithmic optimization, it is hard to replace English's leading market share advantage worldwide. Many countries with native languages eventually chose English as their official language in later developments, such as India, Singapore, and the Philippines. Although they use English, their standards have long since become independent of British English norms, and it can be said that these "shadow Englishes" operate completely independently. The indirect influence control expanded by the decentralized issuance rights of the dollar stablecoin after the GENIUS Act is very similar to this example of English.

The introduction of the GENIUS Act has precisely aligned with the demand at this historical transition point, leveraging the irreplaceability of the dollar's existing advantage as a price anchor globally. By transforming this into a long-term advantage as a value anchor for the future Crypto Market through the form of dollar stablecoins, it is a clever innovative design that maximizes the use of historical advantages to leverage future advantages. Essentially, the proposal to issue dollar stablecoins by staking dollars and U.S. Treasury bonds is a bold attempt to upgrade and transform U.S. dollars and Treasury bonds into a second-order gold.

6. Global market feedback and dramatic changes in financial transactions and assets after the act takes effect

The implementation of the GENIUS Act will take some time, and the same goes for stablecoin legislation in other countries and regions. Some markets have begun to respond to short-term sentiments with preliminary feedback on asset prices.

In the short term, the introduction of the stablecoin legislation will trigger significant changes in financial institutions' assets, RWA, and Crypto assets, with opportunities coexisting alongside restructuring, chaos, and development expectations. The uncertainty of adjustments in traditional finance will further increase, leading to some asset price corrections, which is a normal phenomenon. Meanwhile, confidence in the re-anchoring of U.S. Treasury bonds will inversely enhance and support the current market. The advantages of open decision-making will lead to a second curve development of dollar assets augmenting Crypto growth, forming a second curve unique to dollar assets. The expectations gained from this will also offset some of the panic from short-term restructuring, creating a relatively complex superposition state environment.

From the perspective of the Crypto Market, this undoubtedly opens an excellent window for further asset management and financial innovation. RWAFi will have more landing channels and asset forms, benefiting long-term institutional projects like CICADA Finance that focus on Real Yield Asset Management, facilitating rapid transition and development in the DeFi, PayFi, and RWAFi industries.

Contact the Author

X: https://x.com/gary_yangge

E: gary_yangge@hotmail.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。