Original Title: The Exact Setup I’m Using to Make $1M+ from HyperEVM

Original Author: @PixOnChain, Member of Bubblemaps

Original Compiler: Rhythm Little Deep

Editor's Note: This article shares the author's detailed setup for earning over a million dollars in the HyperEVM ecosystem through capital efficiency and Delta-neutral strategies. The author studied 65 native protocols and recommends operations such as cross-chain transfers via HyperUnit, staking $HYPE, providing liquidity, and hedging to accumulate points across multiple protocols while earning over 19% annualized returns. Additional strategies include purchasing .hl domain names, NFTs, and stablecoin operations, with a focus on @hyperunit and @prjx_hl, believing that early participation can yield high airdrop returns.

Below is the original content (reorganized for readability):

Most people are still unaware of HyperEVM. I spent over 20 hours researching all 65 native protocols. If you operate correctly, I firmly believe you can secure six to seven-figure airdrops.

Here’s the complete guide:

Step 1: Acquire Funds On-Chain (Efficient Use of Capital)

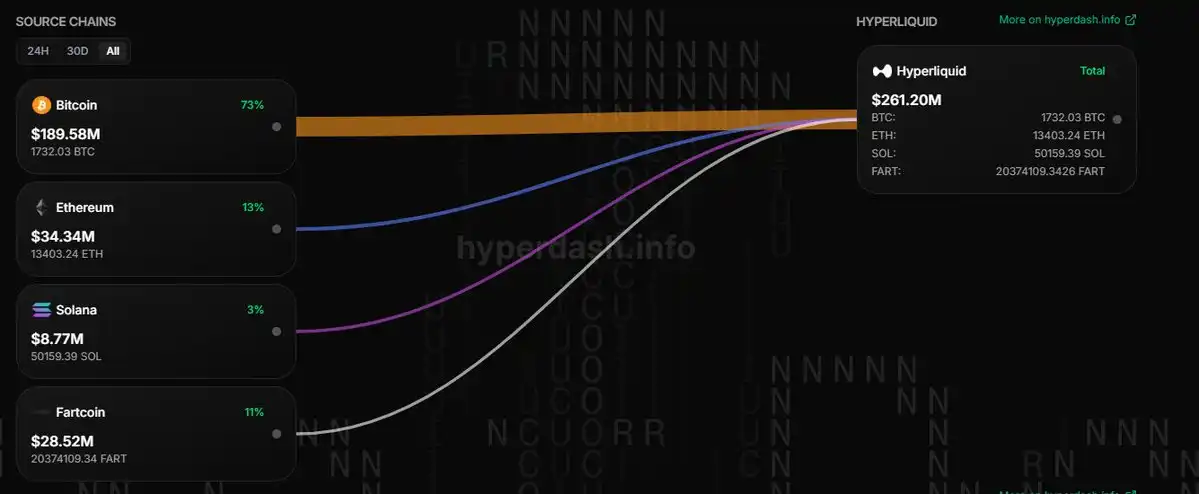

You need liquid funds on HyperEVM. But not all cross-chain bridges are the same.

The cross-chain bridges I use are as follows (all without tokens):

· @hyperunit

· @HyperSwapX bridge

· @HyBridgeHL

I primarily transfer assets via HyperUnit.

It first bridges to Hypercore (the trading layer of Hyperliquid).

From there, it only takes two steps to reach HyperEVM (details below).

Step 2: Yield Strategy (Delta Neutral, Low Risk)

I dislike impermanent loss. I pursue yield. Here’s my specific setup:

Cross-chain via HyperUnit

Exchange for $USDC, then spot buy $HYPE

Stake 20% of $HYPE to HypurrCollective x Nansen validators

Transfer the remaining portion to HyperEVM (Portfolio > Balances > Transfer to EVM)

Stake $HYPE as $stHYPE on @0xHyperBeat

Provide $stHYPE to @HypurrFi and borrow $HYPE

Exchange $HYPE for $stHYPE on @HyperSwapX

Provide $stHYPE to @hyperlendx

Hedge $HYPE exposure with 1x short (currently earning 35% annualized return through funding fees).

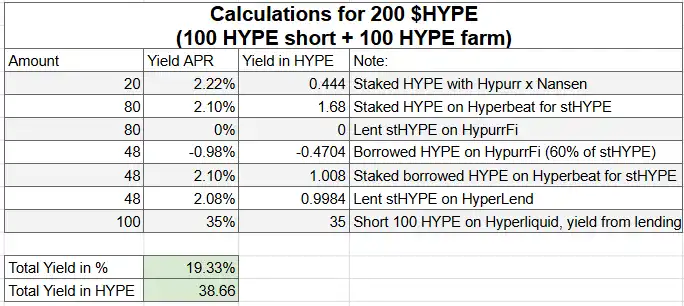

This setup forms a Delta-neutral position, allowing for passive income while accumulating points across multiple protocols. Here’s an example calculation of strategy yields based on current interest rates:

Step 3: Ways to Earn More Points

· Purchased several .hl domain names from @hlnames

· Acquired an @HypioHL NFT on @drip__trade

· Provided UBTC + UETH on @HypurrFi and @hyperlendx (hedging when funding fees are positive, approximately 11% annualized return+)

I also used stablecoins within the ecosystem:

· Used USDC in HLP (Hyperliquid → Vaults → Protocol Vaults)

· Lent USDT0 on @HypurrFi and @felixprotocol

· Provided USDT0/feUSD liquidity pair on @HyperSwapX (narrow range, excellent APY)

· Provided feUSD on @felixprotocol

This setup nearly covers every vertical in HyperEVM.

Step 4: Returns from This Setup

· Unit Points

· Hyperliquid Points

· Nansen Points

· Hyperbeat Points

· Drip Points

· Hypio Points

· Felix Points

· HypurrFi Points

· HyperSwap Points

· HyperLend Points

· HyperEVM Points

· HL Names Points

At the same time, my capital can earn over 19% annualized returns.

Some of these points systems are confirmed, while others are speculative. I’m all in.

Step 5: Hidden Strategies

Currently, most protocols on HyperEVM have only 5,000 to 10,000 users. This is comparable to the user base before the Jito airdrop.

If you’re reading this article, you likely belong to the top 1% of early participants.

However, there are several strategies that can yield higher asymmetric returns. I focus on the following two:

· @hyperunit

· @prjx_hl

Let’s start with Unit.

This may be the most underrated protocol in the entire HyperEVM ecosystem. It’s live, has no tokens, and is flying under the radar.

But if they achieve their goal—bringing real-world stocks on-chain—then launching a token? This could easily become a billion-dollar airdrop.

My speculation on the airdrop formula is:

Airdrop = (Holding Unit Assets × Holding Time) + (Cross-Chain Trading Volume × Coefficient)

So I cross-chain early, with significant cross-chain volume,

Then let the assets quietly sit in spot HL, liquidity pools, or lending markets.

Now, about Project X. It’s still a black box, but…

This team has been pushing its development since before the InfoFi wave was named, and they’ve airdropped a lot of $$$ to participants.

Yes, they already have some buzz during the pre-release, but I still think it’s early.

That’s exactly why I want to participate.

This is my setup.

Delta neutral, capital efficient. Accumulating unnoticed points while earning yields. Most people are waiting for the next big airdrop. I’m already prepared for it.

What if I’m wrong? I still have returns.

What if I’m right? You’ll see the results on-chain.

P.S. I have no affiliation with these protocols and have not received any compensation. Please DYOR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。